2.6 Million Towing, Storage, and Auction documents From 25 States Exposed In Data Breach

Cybersecurity Researcher, Jeremiah Fowler, discovered and reported to WebsitePlanet about a non-password-protected database that contained 2.6 million documents related to towing, storage, and auction records from 25 states. The records belonged to Dallas-based Traxero, a technology provider for the towing industry. The exposed records provided a behind-the-scenes view of costs, seizures, and sales of automobiles that have been towed.

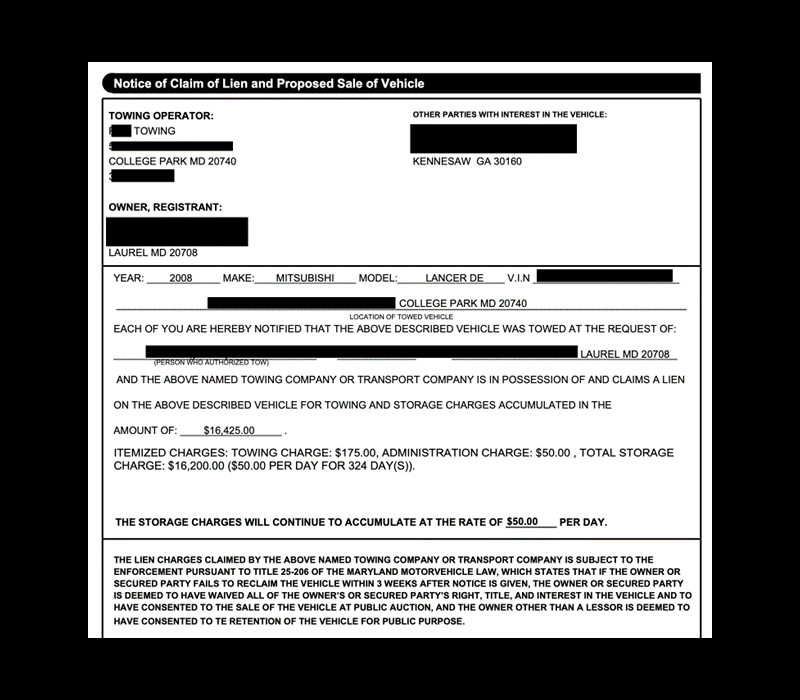

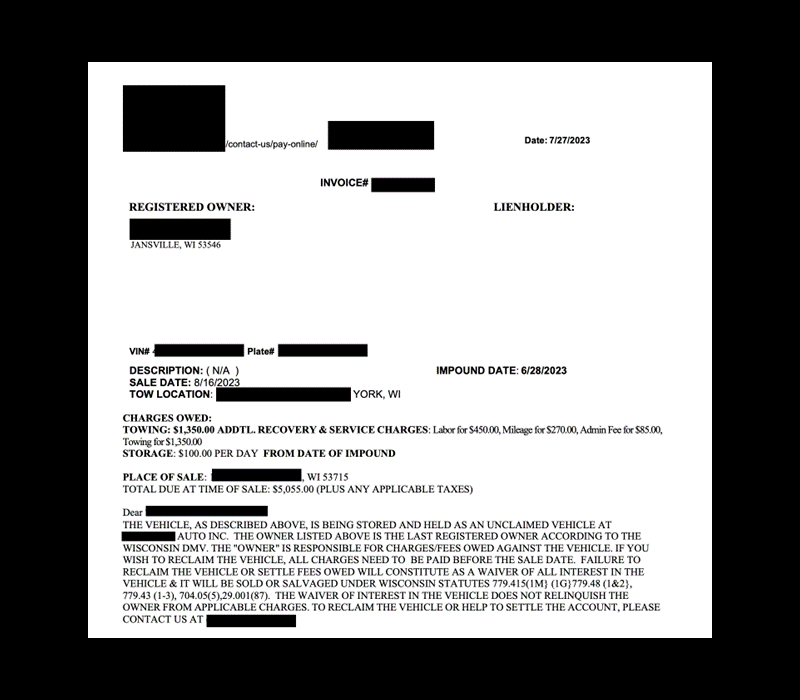

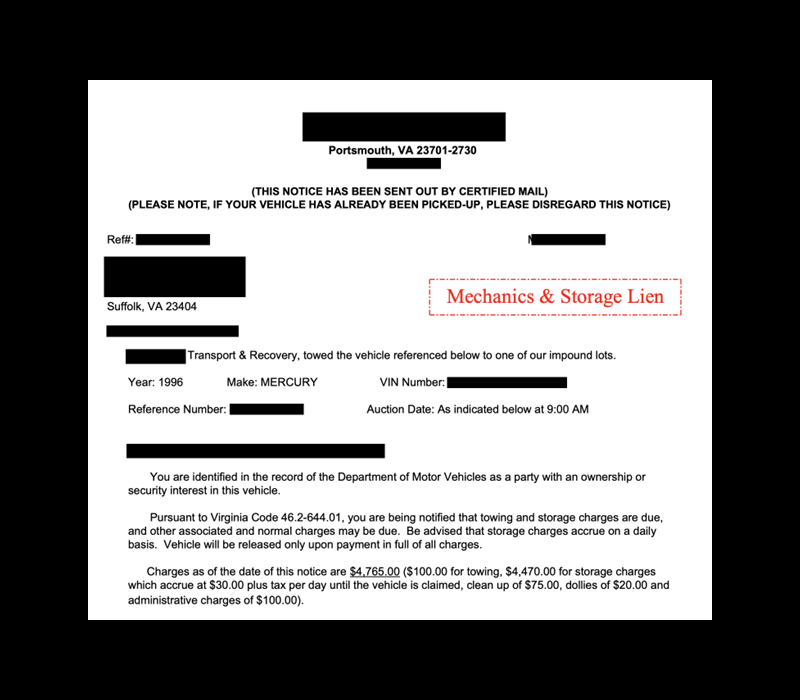

The publicly exposed database contained documents such as invoices, certified mail notices, liens, auction or sale dates, and internal application files. Upon further research, it was identified that the documents belonged to Traxero, a Texas-based technology company that provides digital dispatching, impound yard management, and auction software. I immediately sent a responsible disclosure notice to Traxero, and public access to the database was restricted the following day. It is not known how long the data was exposed or who else may have accessed the documents, only an internal cyber forensic audit could identify this information. Traxero acted fast and professionally to secure the database and replied thanking me for my notification.

“We have been working with various third parties to review and validate our actions. To clarify, we immediately secured the database containing the set of pdf and text files that you noted. The Dispatch Anywhere application was meant to be accessible for download to our customers’ desktops.”

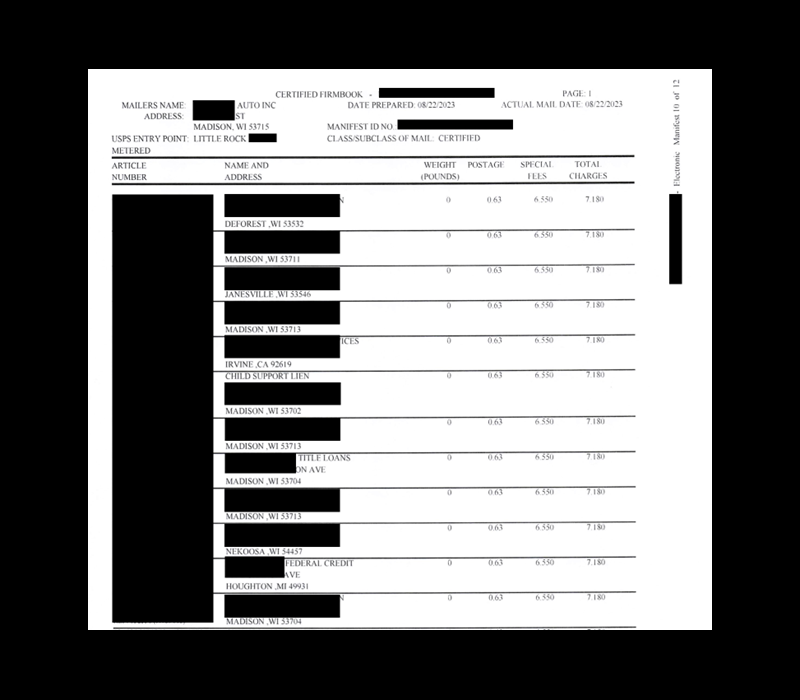

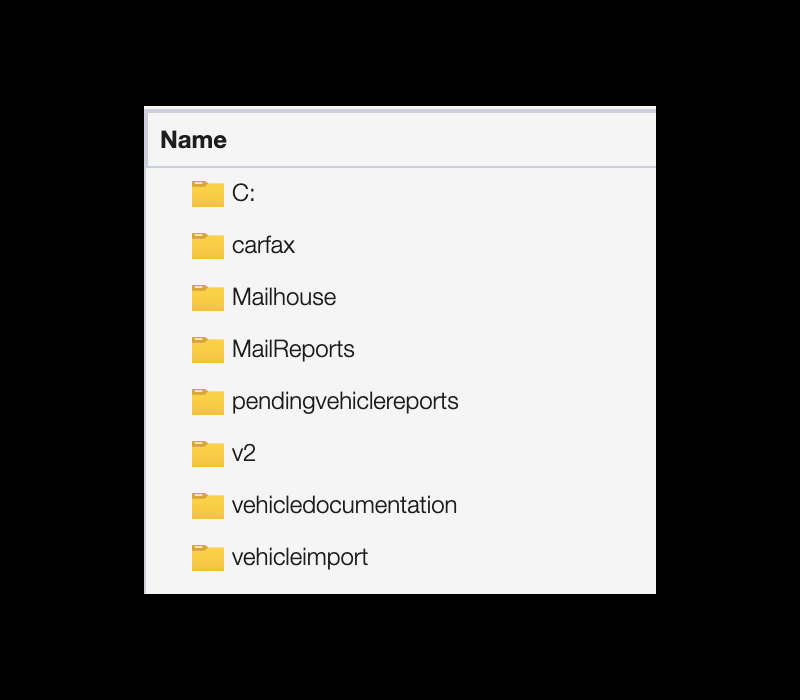

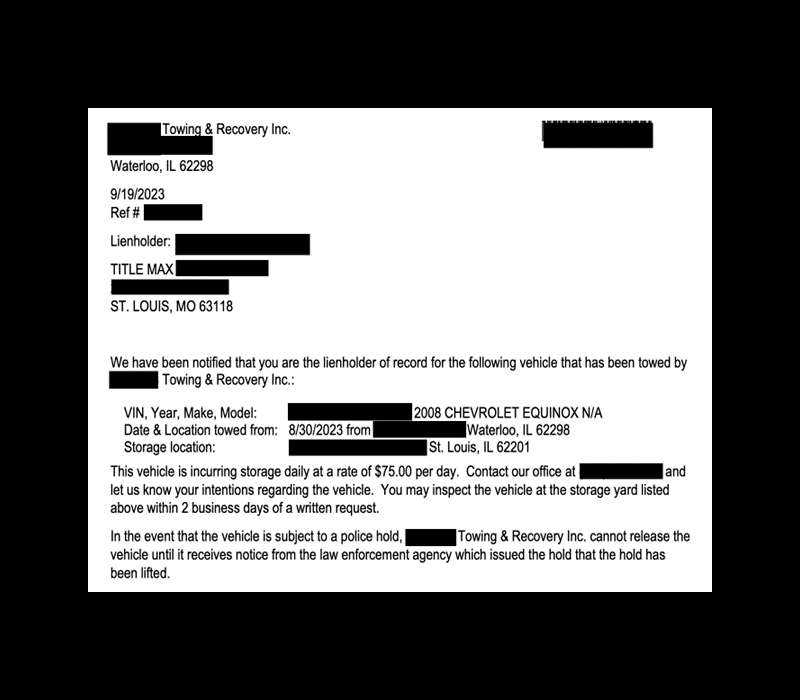

The database contained 2,634,753 records, organized in various folders, with a total size of 488 GB. For instance, a folder named “vehicle documentation” contained 816,700 documents with a total size of 180.62 GB. Another folder had 542,442 certified mail documents (as .PDF files) that totaled 248 GB, making it the largest folder in the database. Many of the exposed certified mail documents contained lists of multiple recipients. One single document included over 700+ final notices that the vehicles would be auctioned or destroyed by an individual towing company. These notices contained PII (such as names and addresses), vehicle data, amount owed, invoice or reference numbers, and more. Certified mail is a postal service that provides proof of mailing, with the sender receiving a mailing receipt and the recipient’s signature upon delivery.

I saw documents pertaining to towing companies in 25 states including: Alabama, Arkansas, California, Colorado, Delaware, Florida, Iowa, Illinois, Louisiana, Massachusetts, Maryland, Missouri, Mississippi, North Dakota, New Jersey, Nevada, New York, Ohio, South Carolina, Tennessee, Texas, Virginia, Washington, and Wisconsin.

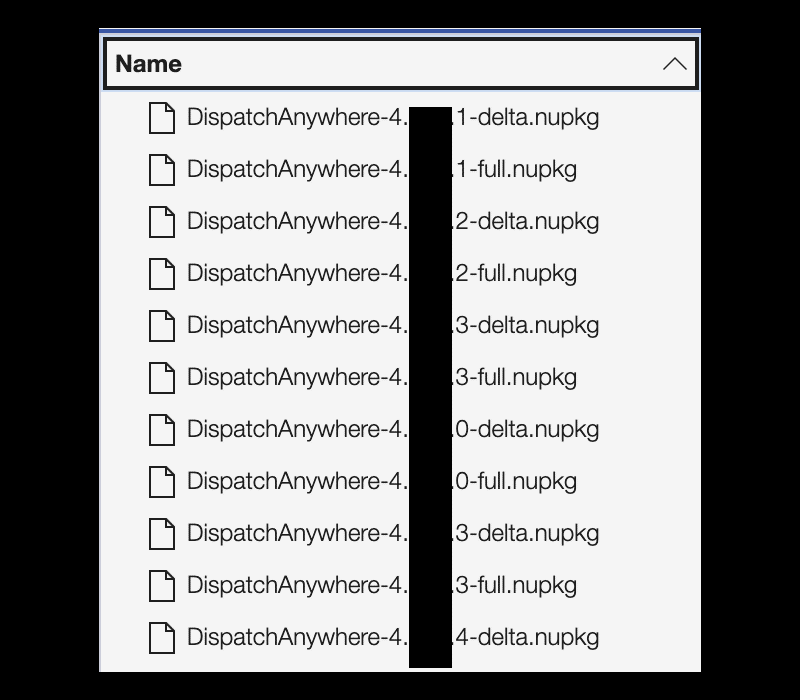

The database also contained multiple .nupkg files. The NuGet package file is used primarily in the Microsoft .NET ecosystem for packaging and distributing software libraries and components. There are potential risks associated with a .nupkg file data exposure, including a code or malware injection. Hypothetically, criminals could inject malware into the package, which could potentially lead to unauthorized access or data theft. Another potential risk is that the user’s system could also be compromised after installing manipulated code files. Although I did not analyze the exposed .nupkg files, they may sometimes contain additional information such as API keys, passwords, or configuration details that are embedded within the package’s code or metadata, leading to further potential risks. I am not saying that Traxero was at risk of a code injection or that the package files were manipulated or contained sensitive information. I am only providing a real-world hypothetical example for educational purposes of potential risks when there is a public exposure of internal package or development files.

Exposed invoices that contain PII of customers, VIN numbers, license plate numbers, and other details pose numerous potential risks — especially if they show a current outstanding debt. Hypothetically, criminals could contact the victim using internal details from the invoice, lien, or sale notice and offer the victim a discounted settlement. As an example, let’s say an individual owes thousands of dollars, and a criminal contacts them posing as a tow company employee. The criminal then offers a once-in-a-lifetime deal: to return their vehicle and settle the debt for much less than the outstanding amount as long as they make the payment now. The criminal would know dates, amount owed, personal details, invoice or account numbers and more. When provided with this information, the victim would have no reason to suspect the offer is not legitimate and could send money to the criminal or provide them with credit or banking information. I am not saying towing customers are imminently at risk of this type of fraud; I am only providing an example of a possible tactic that could be used.