| POS equipment | Stripe Reader S700, BBPOS WisePOS E, and Stripe Reader M2 are available to buy |

| Payment methods accepted | Over 100 payment methods, including debit and credit cards, ACH transfers, and more |

| Payout times | 2-7 business days as standard |

| Contract length | Pay as you go with no cancellation fees |

Stripe Is Adequate for Low-Volume Businesses but Could Do Better

Stripe is a decent credit card processor for low-volume e-commerce businesses. However, even though it offers checkout pages in 53+ languages, it’s not the best choice if you’re processing many international payments. Stripe Climate is a unique feature that allows you to contribute a % of your revenue to advanced carbon capture technologies and its flexible billing and subscription management tools.

However, Stripe operates as an aggregator, meaning it doesn’t offer individual merchant accounts and combines them under one umbrella. Because of this, Stripe can abruptly close high-risk accounts, making it a suboptimal choice for high-volume and international businesses. Most of Stripe’s negative reviews on TrustPilot quoted account closure and frozen assets, meaning more reliable payment processors are available.

In my extensive review, I found that Stripe accepts over 100 payment methods, including buy-now-pay-later in over 150 countries. Its pricing is straightforward on its standard plan at 2.9% + 30¢ per domestic card transaction. Still, you’ll have to contact its sales team for country-specific, interchange plus, multi-product, and volume discount pricing.

Read on to determine if Stripe is the right payment processor for your business’s needs.

Features and Ease of Use

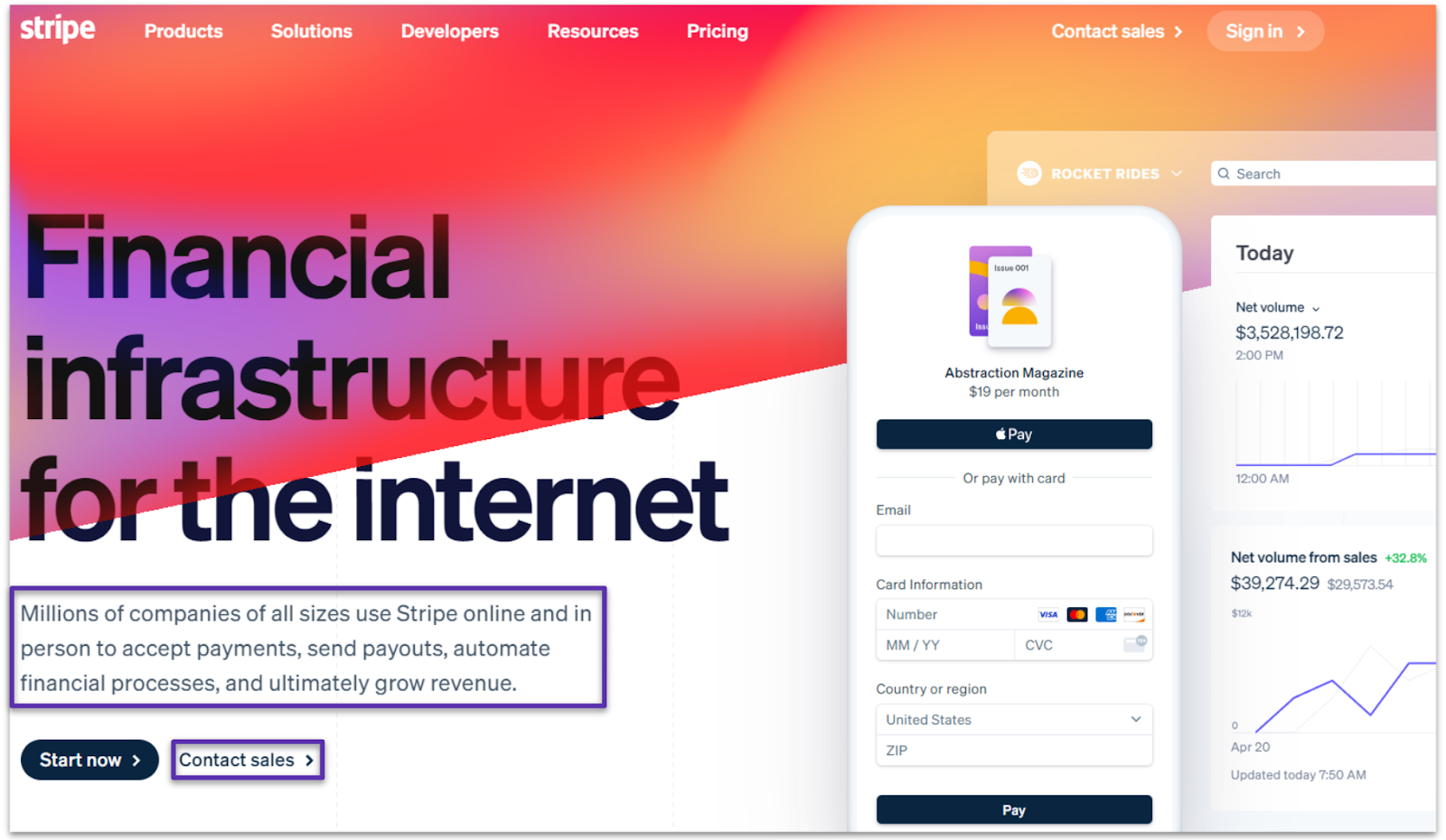

Stripe has excellent features and can be considered an all-in-one processor for your processing needs, offering global payments, revenue, finance automation, and banking-as-a-service solutions. Stripe also has Atlas, a unique feature for pre-startup businesses that you can get for $500. It’s an automated service to incorporate your company in Delaware and retrieve your tax ID from the IRS.

Stripe accepts over 100 payment methods, including buy-now-pay-later schemes like Klarna. It also allows you to use its prebuilt payment forms to get an optimized checkout in over 53 languages. Plus, you can apply for business funding of up to $25,000. However, this is very little, considering that you can get up to $500,000 in working capital from POS Pros without needing to pay a loan fee of $25,000 or putting aside 15% of your sales to repay it.

Regarding ease of use, Stripe integrates with several e-commerce platforms like BigCommerce, Salesforce, Xero, Wix, and Amazon Web Services. Using its app marketplace, you can download your favorite apps like QuickBooks and Sweep to manage your accounting or calculate your total CO2 emissions.

Pricing and Support

Stripe has two pricing plans: a standard plan with no setup fees, monthly fees, or hidden fees and a custom plan for high-volume businesses. You’ll pay 2.7% + 5¢ (in-person) per transaction on its standard plan for domestic cards when using a Stripe terminal. You can access its interchange plus, country-specific, volume, and multi-product discount plans by contacting its sales team for pricing tailored to your business’s needs.

Unfortunately, Stripe isn’t suitable for high-volume businesses or high-risk businesses processing international transactions due to many additional fees that can significantly impact your bottom line. For example, you’ll pay an extra 1.5% per transaction for international cards, 1% for currency conversion, 0.8% per ACH transfer, 80¢ for iDEAL, 0.5% for recurring payments, 0.4% for invoicing, 0.4% for chargeback protection, and $15 per dispute.

Stripe doesn’t offer any POS equipment for free and only has 3 card readers: the Stripe Reader S700 for $349, BBPOS Wise POS E for $249, and Stripe Reader M2 for $59. To use Tap to Pay on Android or iPhone without hardware, you’ll pay 2.9% + 30¢ (online) per transaction. In comparison, Payment Depot offers a free Dejavoo terminal and many other readers and processing hardware at discounted prices.

Stripe offers customers 24/7 phone, email, and live chat support. However, many customer reviews suggest you’ll wait long for a response – if you ever get one. Moreover, Stripe charges extra for support plans that give you access to a dedicated support team. If that’s not good enough, you can get a dedicated account manager for free if you open a merchant account with Leaders Merchant Services.

| Phone | ✔ (24/7) |

| ✔ (24/7) | |

| Live chat | ✔ (24/7) |

| Support ticket | ✘ (Only on its Growth, Premium, and Enterprise support plans that come at an additional cost) |

| Knowledge base | ✔ |

| Tutorials/videos | ✔ (Documentation + sample code in 8 languages) |

| Dedicated account manager | ✘ (Only on its Growth, Premium, and Enterprise support plans that come at an additional cost) |

| Other | Technical support team on Discord |

Compliance & Security

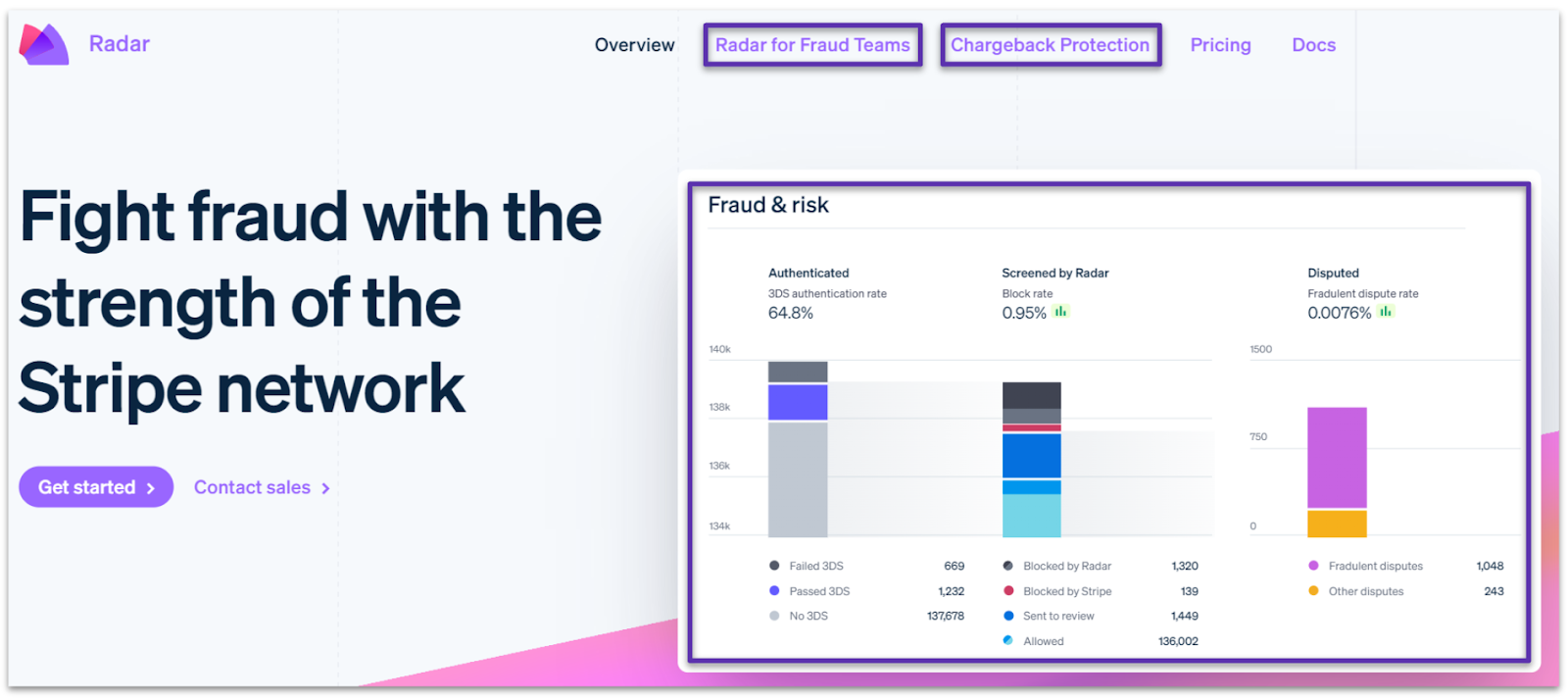

Stripe acts as a PCI advocate, advising you on how to reduce the burden of PCI compliance, notifying you when you need to change your PCI level, and providing a PCI packet for Level 1 merchants to reduce validation time. Plus, with Stripe Radar, you get built-in fraud and proxy detection. It also uses machine learning to authenticate IDs from over 100 countries and extract data from submitted documents.

Unfortunately, most of Stripe’s negative reviews pertain to its sensitive fraud detection. High-volume businesses can get their accounts frozen or closed without notice due to legitimate transactions being classified as fraudulent. If your business is susceptible to many chargebacks and fraudulent activity, I’d recommend Leaders Merchant Services due to its 98% approval rating for high-risk merchants.

| PCI DSS compliant | Level 1 |

| GDPR compliant | ✔ |

| HIPAA compliant | ✘ |

| Other payment card industry and privacy standard(s) | SOC 1, SOC 2, EMVCo Level 1 & 2, NIST Cybersecurity Framework, TLS 1.2, and HSTS |

| PCI compliance assistance for merchants | PCI Guide and PCI Packet for Level 1 merchants |

| Security features | End-to-end AES-256 encryption, tokenization, multi-factor authentication, and single sign-on |