| POS equipment |

|

| Payment methods accepted | Credit and debit cards, digital wallets, ACH, bank transfers |

| Payout times | Free same or next-day funding |

| Contract length | Monthly (no cancellation fees) or 3 years (early cancellation fees apply) |

| Customer support | 24/7 phone support, email and live chat |

| Security | Level 1 PCI-compliant, advanced fraud detection |

Cheap Processing With Freebies but Aggressive Marketing Might Be a Turn-Off

Sekure Payment Experts isn’t a typical payment processor. It employs Electronic Transactions Association (ETA) certified payment experts across the US and Canada to source the best credit card processing and POS equipment for your business.

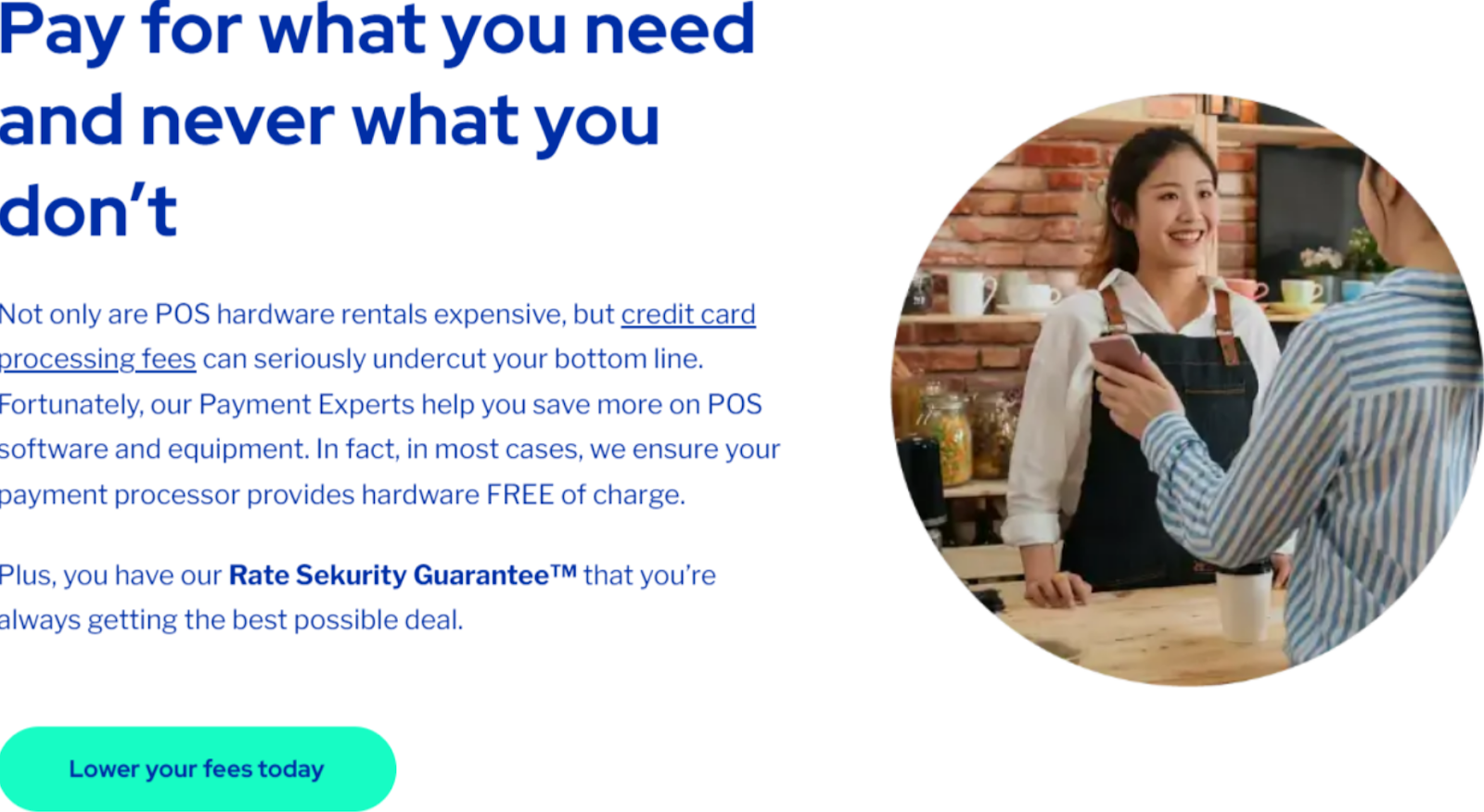

While it won’t reward you with a gift card like some processors, it does offer the Rate Sekurity Guarantee™. If it fails to match your current rates, Sekure may cover your current processor’s cancellation fees when you commit to a 3-year contract. Its interchange-plus rates and simplified flat rate pricing is available on month-to-month agreements and you can tailor these to suit your business model.

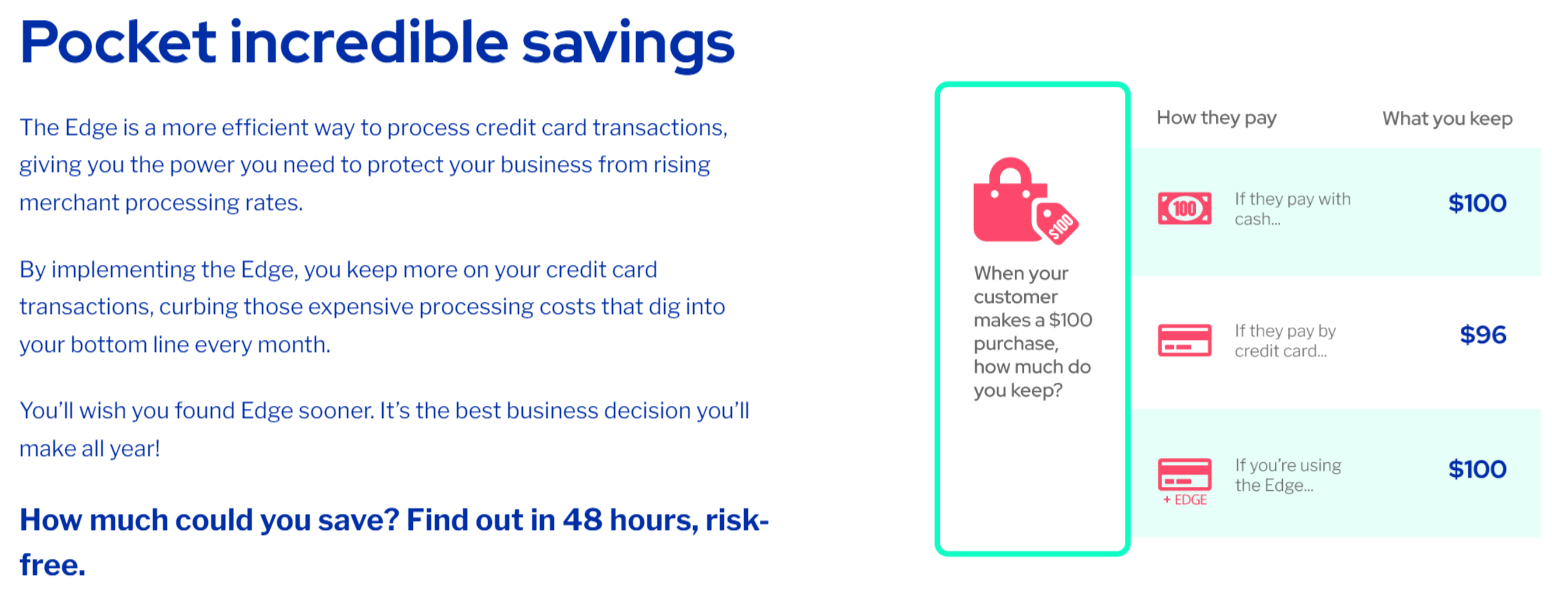

Sekure’s flat rate pricing is beneficial for new, low-volume businesses or high-risk merchants. You can also save up to 100% on your processing costs with Edge, its zero-cost processing program.

Due to its cost-effective approach and pricing models, Sekure is the most suitable for small businesses – although it’s open to working with larger businesses, too. If you’re new to payment processing or want to cut costs, you can take advantage of free equipment without monthly, annual, or PCI compliance fees. Sekure also offers free same or next-day funding, and setup can take as little as 48 hours.

Businesses will also find an e-commerce toolkit suited for small brick-and-mortar businesses venturing into online sales. It includes the essentials like a simple checkout with a “buy now” button and customizable hosted payment pages, as well as the option to send branded digital invoices via email. You can also use a free virtual terminal and a payment gateway at a discounted price.

My weeks-long dive into Sekure indicates that it’s a reliable processor, provided you carefully review your contract terms. Keep reading to see if it’s a fit for your business.