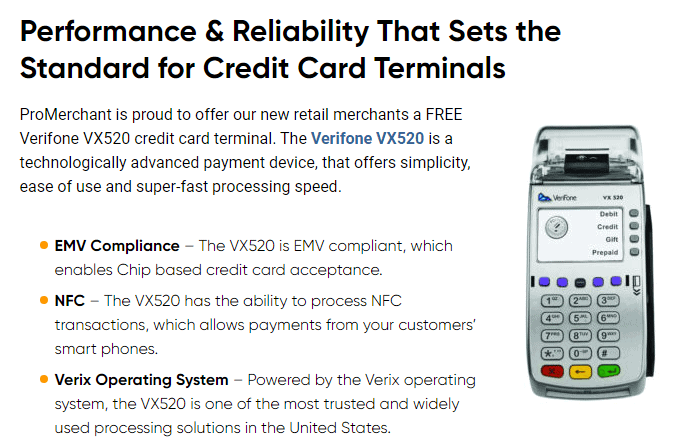

| POS equipment | Free Verifone, Payanywhere, PAX, or Ingenico terminal. Over 50 POS devices available to purchase, including 3 Clover devices |

| Payments methods accepted | Credit and debit cards, digital wallets, ACH, bank transfers |

| Payout times | Next day |

| Contract length | Monthly (no cancellation fees) |

| Customer support | 24/7 phone and email support |

| Security | PCI compliant, end-to-end encryption, tokenization, advanced fraud detection and prevention, payer verification |

Clear and Transparent Payment Processing

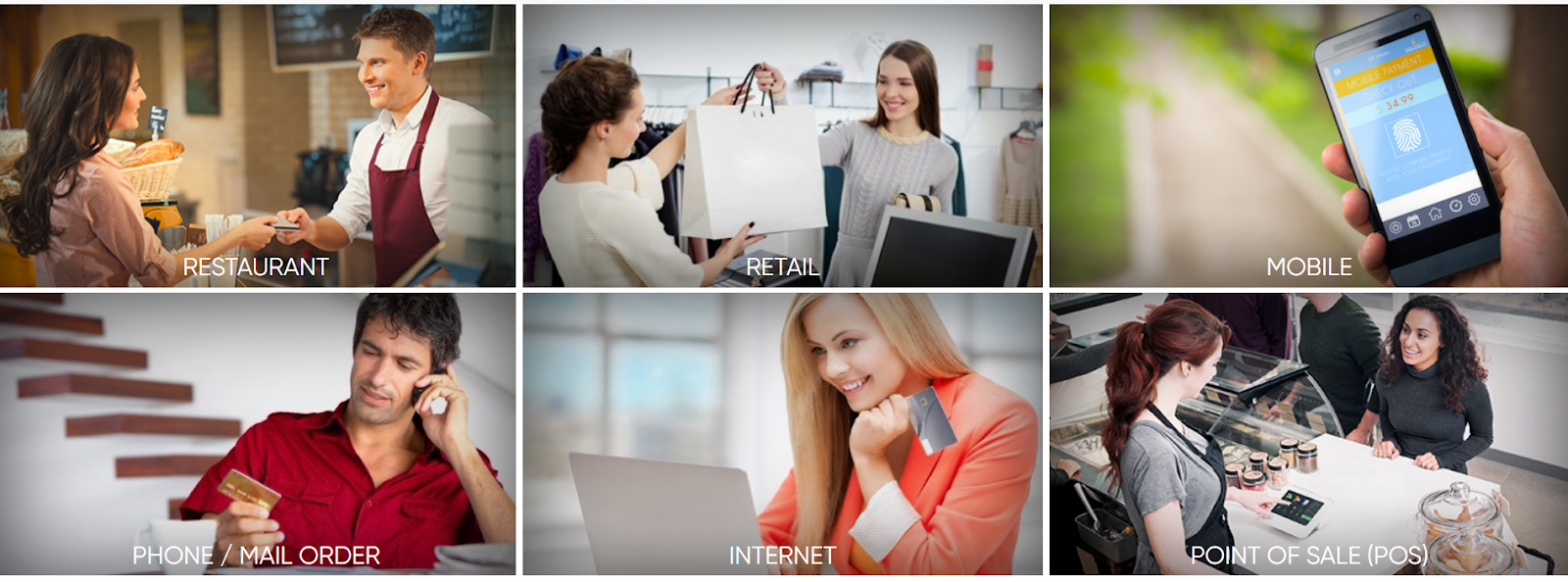

ProMerchant is one of the few payment processors on the market that will truly support almost any small business. In addition to the standard point-of-sale (POS) functionality you’d expect, this credit card processor also offers software for e-commerce and phone/mail order businesses.

Not only that, but ProMerchant is one of the few credit card processing companies that offer high-risk merchant accounts. These accounts come with additional fraud protections, providing a financial lifeline to businesses that may otherwise struggle to accept payments.

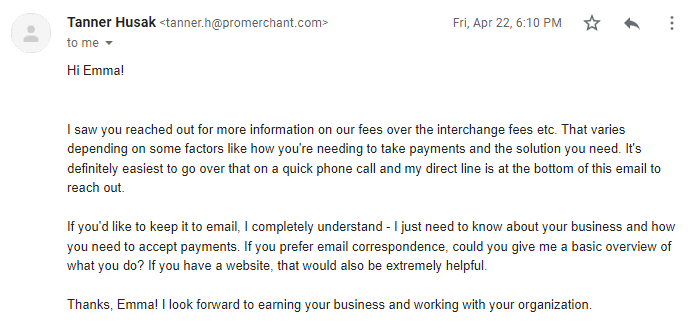

It’s not as feature-rich as some other processors like Stax, but what it lacks here it makes up for in customer support. ProMerchant’s customer service has a great reputation for being knowledgeable, attentive, and transparent. With account approval within 24 hours and 24/7 phone and email support, this company makes it easy to get paid as quickly as possible.

Promerchant’s standout feature, though, is the unique choice of payment models it gives you. You can pay primarily by transaction, with the cost borne by your business, or you can pay primarily by subscription, with per-transaction fees borne by customers.

I’ve spent a lot of time scouring customer reviews, talking to customer support, and investigating what this company has to offer. Keep on reading to decide if ProMerchant is right for you and your business.