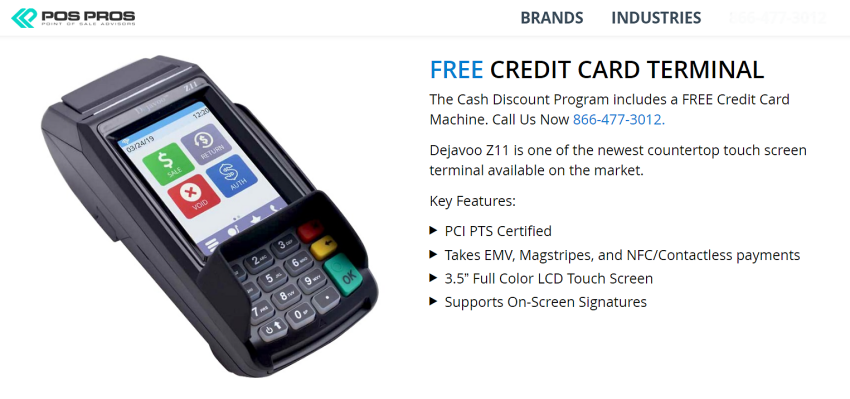

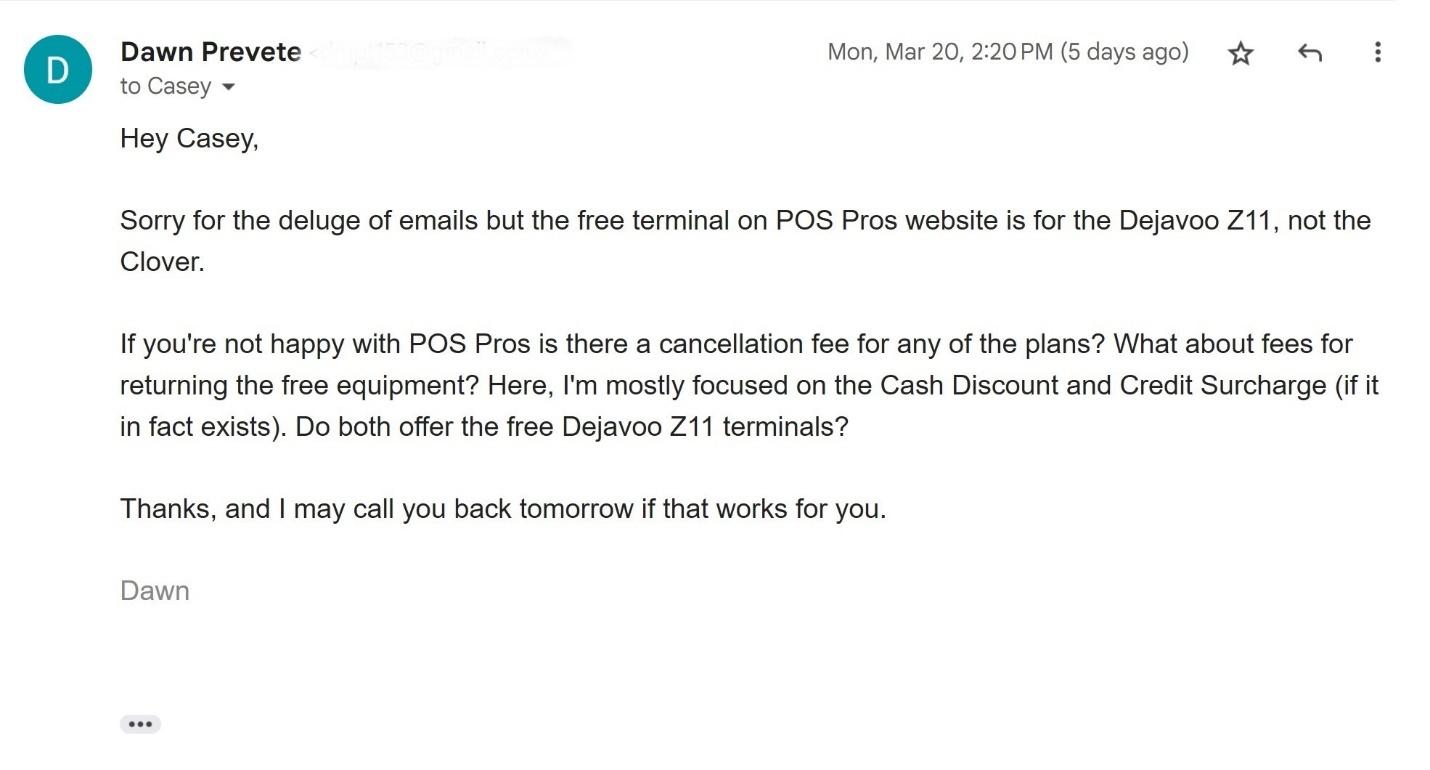

| POS equipment | Free Dejavoo Z11, Clover Mini, or Clover Flex terminals. Other POS terminals, systems, and accessories available for purchase |

| Payment methods accepted | Credit and debit cards, digital wallets, ACH, bank transfers |

| Payout times | Next day |

| Contract length | Monthly (no cancellation fees) |

| Customer support | 24/7 support and POS technical help desk with purchase of POS equipment and merchant account, sales support available Monday to Friday via phone and email from 6:00 AM – 9:00 PM (CT) |

| Security | Level 1 PCI compliant, tokenization, fraud prevention, and chargeback management |

Customized Payment Processing Solutions and Plans

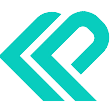

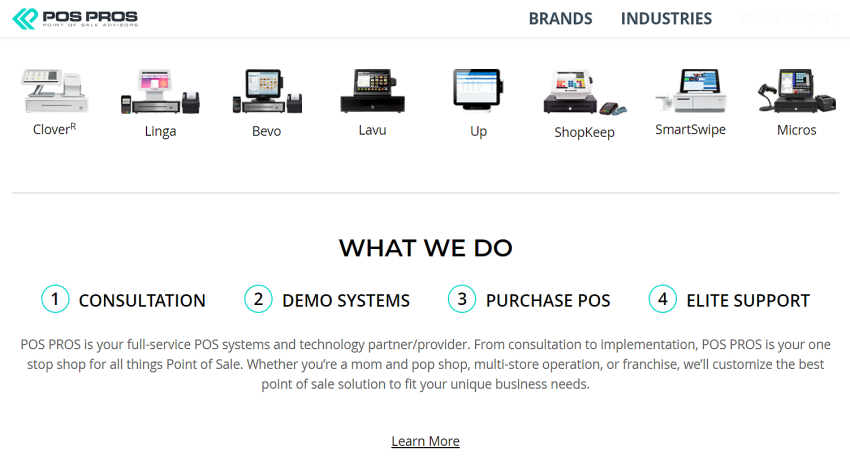

POS Pros is a payment processor with an innovative approach to point-of-sale (POS) solutions. Rather than pushing a one-size-fits-all terminal, POS Pros helps you choose the right POS system and plan for your business type, size, and processing needs.

The POS Pros business model recognizes that different types of businesses have different point-of-sale needs. Once you sign up, you’ll receive a free consultation with a POS Pros specialist who will recommend industry-specific point-of-sale equipment options.

A standout feature is free virtual system demos, which allow you to test the interface and features of these POS systems before you buy. If you’re a new business, this can help you avoid purchasing expensive POS equipment that doesn’t suit your needs.

While this needs-based approach to choosing the right POS system is at the heart of the POS Pros business model, it also offers card-not-present and e-commerce payment solutions through the Authorize.net virtual terminal and payment gateway.

POS Pros provides several pricing models: interchange-plus, tiered pricing, and cash discount. Monthly plan fees are affordable, and transaction fees for the interchange-plus and tiered pricing plans are competitive. All plans are also month-to-month with no cancellation fees.

While the POS Pros approach is ideal for new businesses, its promise to save you money on your current processing rates or pay you $500 makes it equally suitable for businesses looking to switch services. Established businesses with long-term contracts will also appreciate POS Pros’ promise to cover the cancellation fee.

After contacting support and researching merchant complaints, I can confirm POS Pros deserves a closer look. Keep reading to find out If it’s right for your business needs.