| POS equipment | Free SwipeSimple mobile reader (plus other free hardware depending on your plan). SwipeSimple Aries8, Pax E700 and 2 Pax 2 terminals, Clover Solo/Clover Duo systems and 1 Clover terminal available to purchase |

| Payments methods accepted | Credit and debit cards, digital wallets, ACH, bank transfers, cryptocurrency |

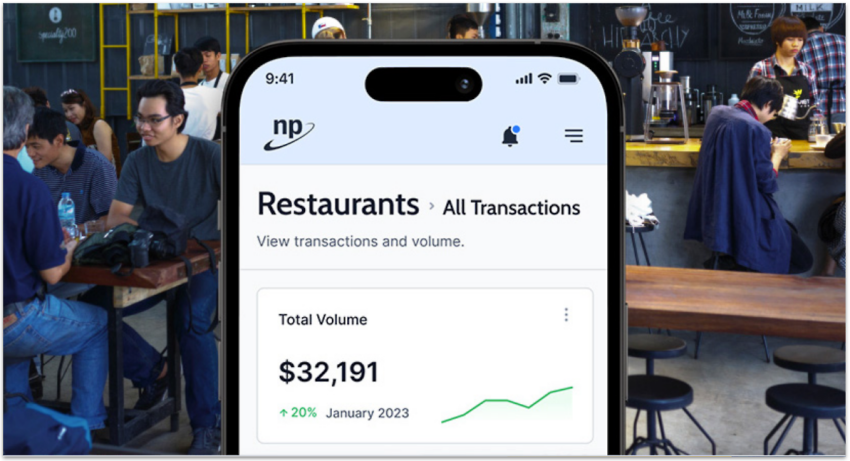

| Payout times | 48-72 hours as standard, faster funding available with a Premium plan and minimum processing volume of $30,000 monthly, optional same-day payout add-on |

| Contract length | Monthly or long term depending on plan and features ($495 – $595 cancellation fee for long term contracts*) |

| Customer support | 24/7 phone and email support, live chat available Monday to Friday |

| Security | PCI-compliant, regular security scans, end-to-end encryption, tokenization, payer verification |

* Cancellation fee may be waived if your Business closes or National Processing can’t beat your new rates.

National Processing’s Rates Are Competitive

National Processing offers several card processing solutions, as well as free hardware and gateway setup for all types of businesses. If you’re a small or new business that doesn’t currently have the resources to deal with technical issues, this service can be invaluable.

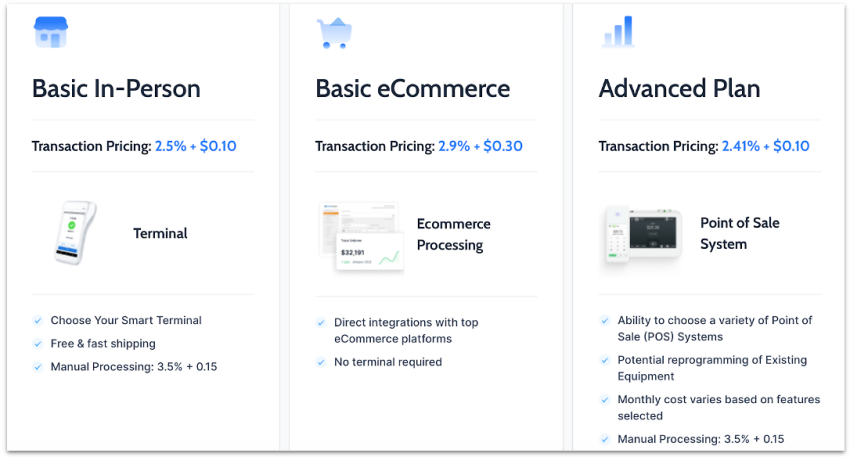

Although there’s no free plan, all of National Processing’s subscriptions are priced competitively. The flat transaction fees range from 2.4% + 0.10¢ (in-person transactions) (in-person) to 2.9% + 0.30¢ (online transactions) for online payments, which is cheaper than competitors with this pricing model, though these processors typically don’t charge monthly fees.

National Processing also offers a $500 meet-or-beat guarantee. So, if you’ve already got a good processing deal, it’s worth getting a quote from this processor for the chance of getting some extra cash.

After filling out your application, make sure you contact the sales team directly to receive your custom quote and get a better idea of what each subscription plan offers.

Just be aware that National Processing’s favorable rates are only available to low-risk merchants and those that process a minimum of $10,000 per month. If your processing volume is lower or you’re in a high-risk industry (e.g., gambling, CBD), National Processing might not be the best choice for you. Check out our list of the best credit card processors in 2025 for more options.