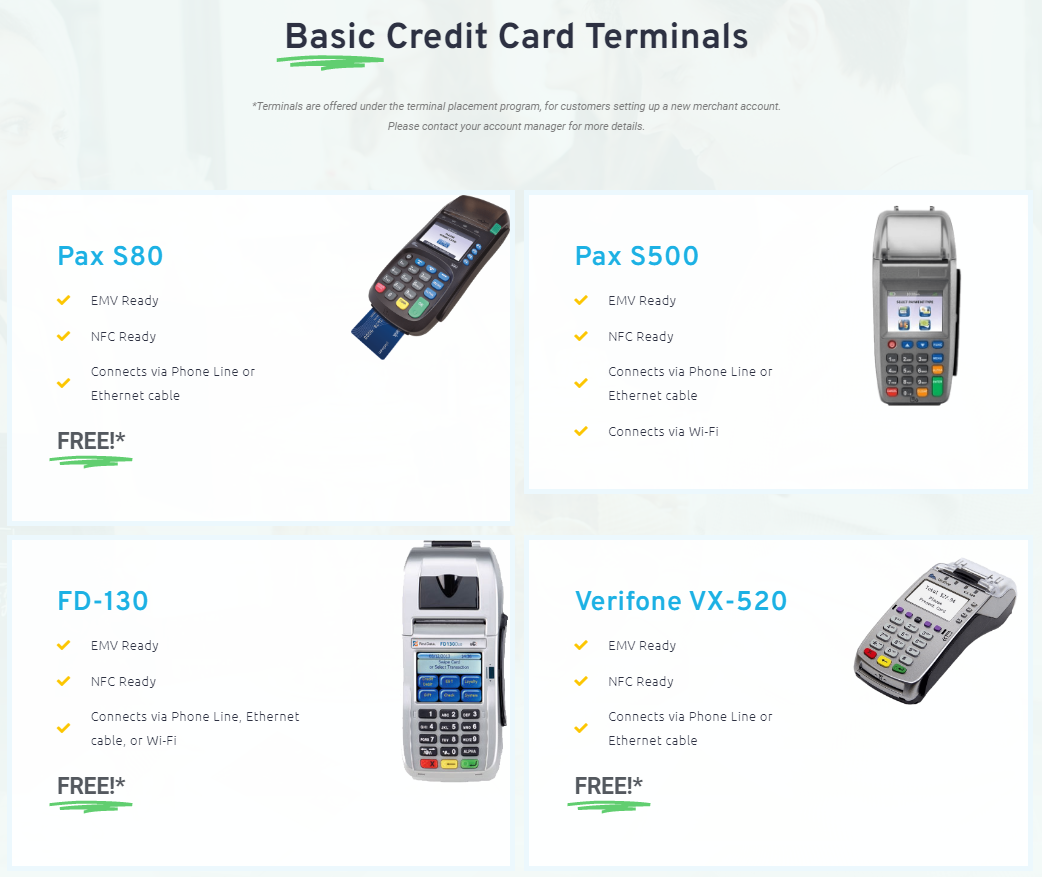

| POS equipment | 4 Clover devices, 4 terminals, and 3 mobile card readers available to purchase |

| Payment methods accepted | Credit and debit cards, digital wallets, ACH, bank transfers |

| Payout times | An average of 7-9 days |

| Contract length | Variable (cancellation fees apply) |

| Customer support | 24/7 phone and email |

| Security | PCI compliant, advanced fraud protection and detection features |

Don’t Worry About Having No Credit or Bad Credit – Merchant One Can Still Help

Merchant One is a US-only credit card processing company that promises a simplified and transparent processing service for small businesses. With a simple interchange-plus pricing structure, POS devices for every budget, and a payment gateway with a slew of e-commerce integrations, this processor is a good choice for almost any type of business.

Merchant One offers plenty of hardware and software options to meet almost all business needs.

If you’ve been turned away from other payment processors because you don’t have great credit, it’s worth giving Merchant One a try. It advertises a 98% approval rate and setup within 24 hours, making it ideal for new businesses. That said, its acceptance of less-than-stellar credit doesn’t necessarily mean it’ll accept businesses in high-risk industries.

Overall, Merchant One is a decent place to start for new businesses. It offers a respectable range of POS hardware to help you get set up, even if you only have a small budget to work with. It’s worth noting, though, that MechantOne no longer offers any free POS hardware, despite what it says on its site. You’ll need to set up a payment plan or purchase any devices outright.

If you’re here, then there’s a good chance you’ve seen that Merchant One has a lot of mixed reviews across Trustpilot, the Better Business Bureau, and other review aggregate websites. I’ve spent several days researching this credit card processor to see if it’s right for you and your business, so keep reading to see what I discovered.