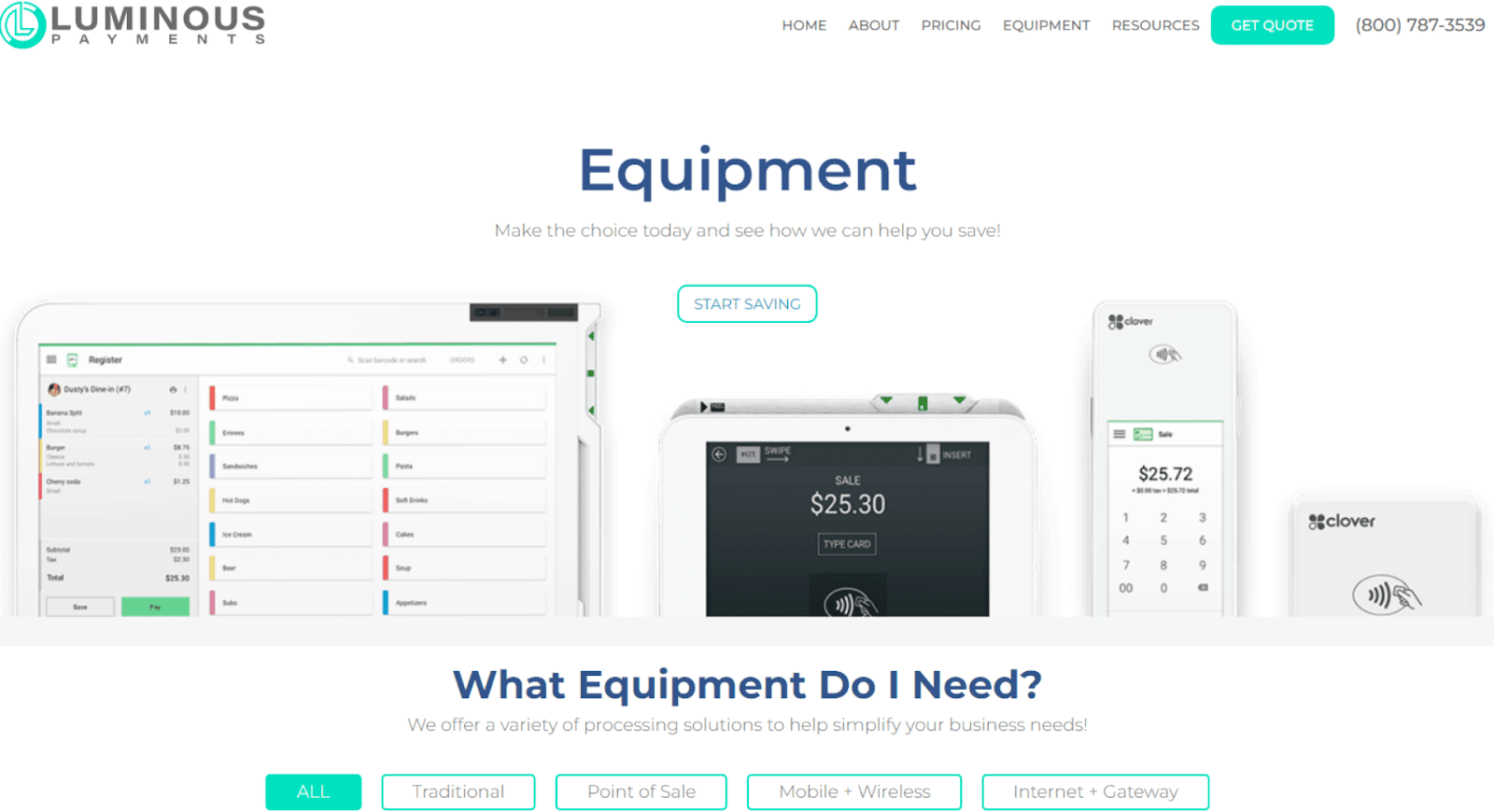

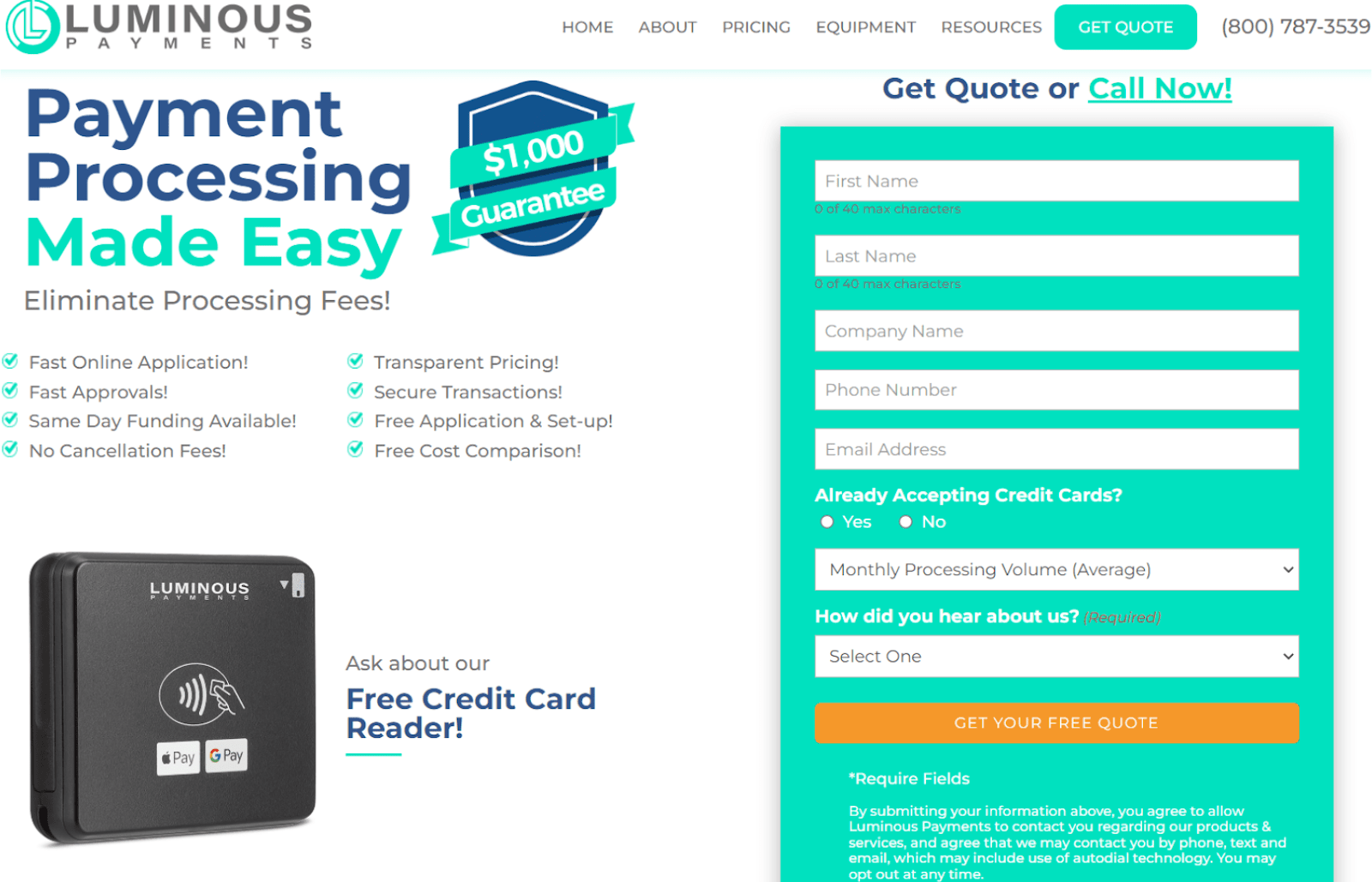

| POS equipment | Free mobile reader, 4 Clover devices, 2 terminals, 1 POS station and 1 mobile reader available to purchase |

| Payments methods accepted | Credit and debit cards, selected digital wallets, ACH, bank transfers |

| Payout times | 24 hours as standard, optional same-day payout add-on |

| Contract length | Variable (no cancellation fees) |

| Customer support | Phone or ticket support. Merchant support available 24/7, sales available Monday – Friday |

| Security | PCI-compliant, end-to-end encryption, tokenization, two-factor authentication, advanced fraud detection and prevention |

An Exciting New Processor for Small Businesses

Luminous Payments bills itself as a modern, merchant-friendly credit card processor for small and medium-sized businesses. On its website, Luminous promises to “empower local small businesses nationwide.” But with very little time in the field and little publicly available information about this processor online – both from merchants and Luminous itself – the question is, does it actually deliver?

After spending many hours researching this company and sifting through what public information is available, I can confidently say that Luminous really is a fantastic choice for brick-and-mortar businesses with a modest online presence. If you’re a small business looking for a reliable solution, you’re sure to appreciate the wide choice of pricing plans, easy-to-use service, and outstanding merchant support you’ll get with Luminous. On top of that, Luminous guarantees it can save you money – and if it can’t, you’ll get $1,000.

On the other hand, Luminous has neither the internal structure nor the broader offering of merchant services that many larger enterprises require, such as loan programs and proprietary software. The shortage of information about this processor available online might also be enough to deter some merchants, at least for now.

So, is Luminous Payments the right processor for you, or are you better off with a more established solution? Read on to find out.