Whether you’re just launching your store or scaling fast, your payment solution shouldn’t drain your profits with costly fees or complicate customer checkout. Stripe and Shopify are both great, but they specialize in different e-commerce needs.

After weeks of digging into both platforms – reviewing pricing, features, and what actual users have to say – one thing became clear: using Shopify with Shopify Payments is the better fit for most entrepreneurs. While Stripe excels in payment processing, Shopify’s all-in-one solution helps you save money, streamlines your business operations, and offers you all the tools you need to run a successful online business.

If you’re a tech-savvy business owner who’s big on customization and already has an affordable website outside of Shopify, Stripe is a decent option. But if you’re on the fence or curious about the nitty-gritty details, keep reading. I’ll show you how Shopify outpaces Stripe for most entrepreneurs and where Stripe has a one-up over Shopify.

Features

Shopify Has Everything You Need To Run a Successful Online Business

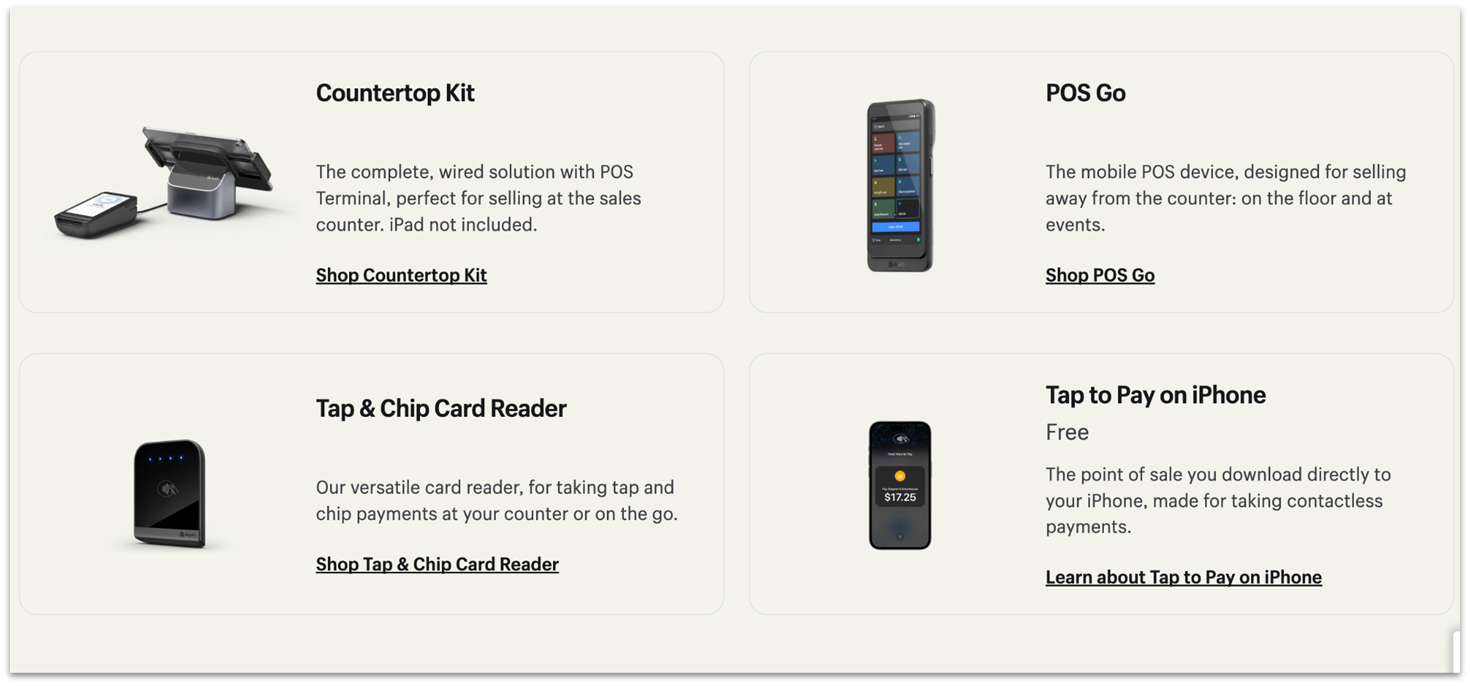

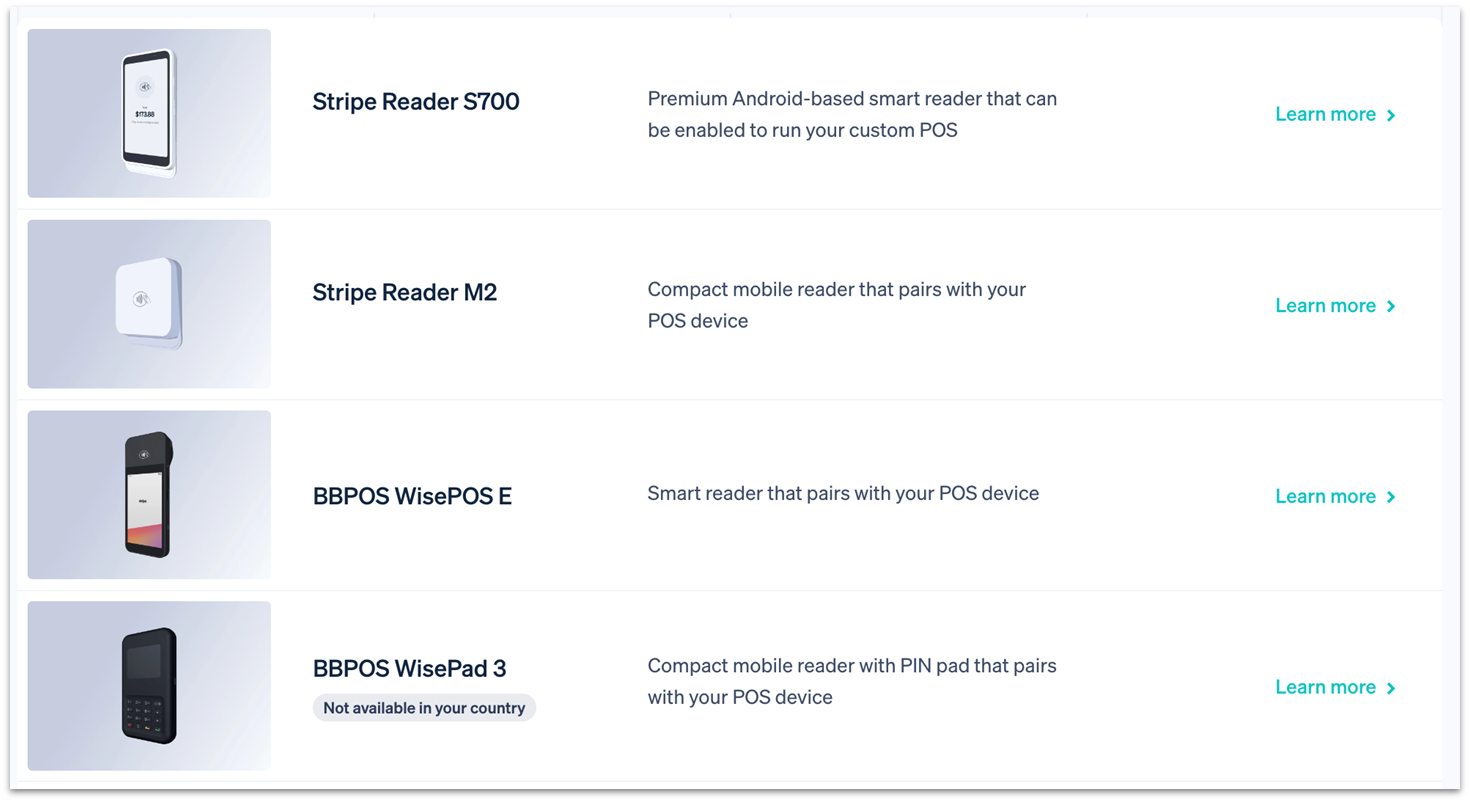

Stripe and Shopify provide a wide range of point-of-sale (POS) devices, making it easy to manage in-person transactions. Stripe offers four card readers and support for Tap to Pay on Android and iPhone devices, while Shopify provides more versatile options.

Shopify’s hardware lineup includes a countertop kit, a mobile POS device, a card reader, and Tap to Pay for iPhone. Since Shopify is a dedicated e-commerce platform, it only makes sense that it offers better e-commerce functionalities than Stripe.

Still, Stripe doesn’t fall short. It lets you embed a prebuilt payment form that optimizes checkout, supports multiple payment methods, and adapts to your customers’ language and devices. Also, its Adaptive Acceptance tool helps reduce payment declines, which can be a significant benefit if you’re facing customer churn issues. However, Stripe’s modular approach means that features like recurring payments and automatic tax calculations come at an extra cost.

On the other hand, Shopify gives you everything you need to run your online store. With built-in SEO and marketing tools, inventory management, automatic tax calculations, and support for recurring billing, Shopify covers more ground without additional fees. Also, its vast app marketplace integrates with every web and business service you can think of, allowing you to streamline your workflows and operations.

What’s more, Shopify provides valuable data insights for comparing with competitors, identifying your most loyal customers, and measuring your performance across marketing channels. In contrast, Stripe’s analytics focus primarily on payment data, leaving much of the business intelligence work to third-party integrations.

That said, Stripe outshines Shopify in terms of global payment flexibility. Stripe and Shopify Payments support credit cards, debit cards, digital wallets, ACH, and buy now, pay later (BNPL) payments. However, Stripe stands out by covering 50 countries, while Shopify Payments supports only 23.

Overall, Shopify stands out with its comprehensive approach to e-commerce and physical point-of-sale (POS) solutions. Stripe focuses more on payments and financial tools, which, in all fairness, is what it does best. Shopify, on the other hand, takes a holistic approach to help you manage your entire online business.

Ease of Use

Shopify’s Built-in Tools Give You an Advantage

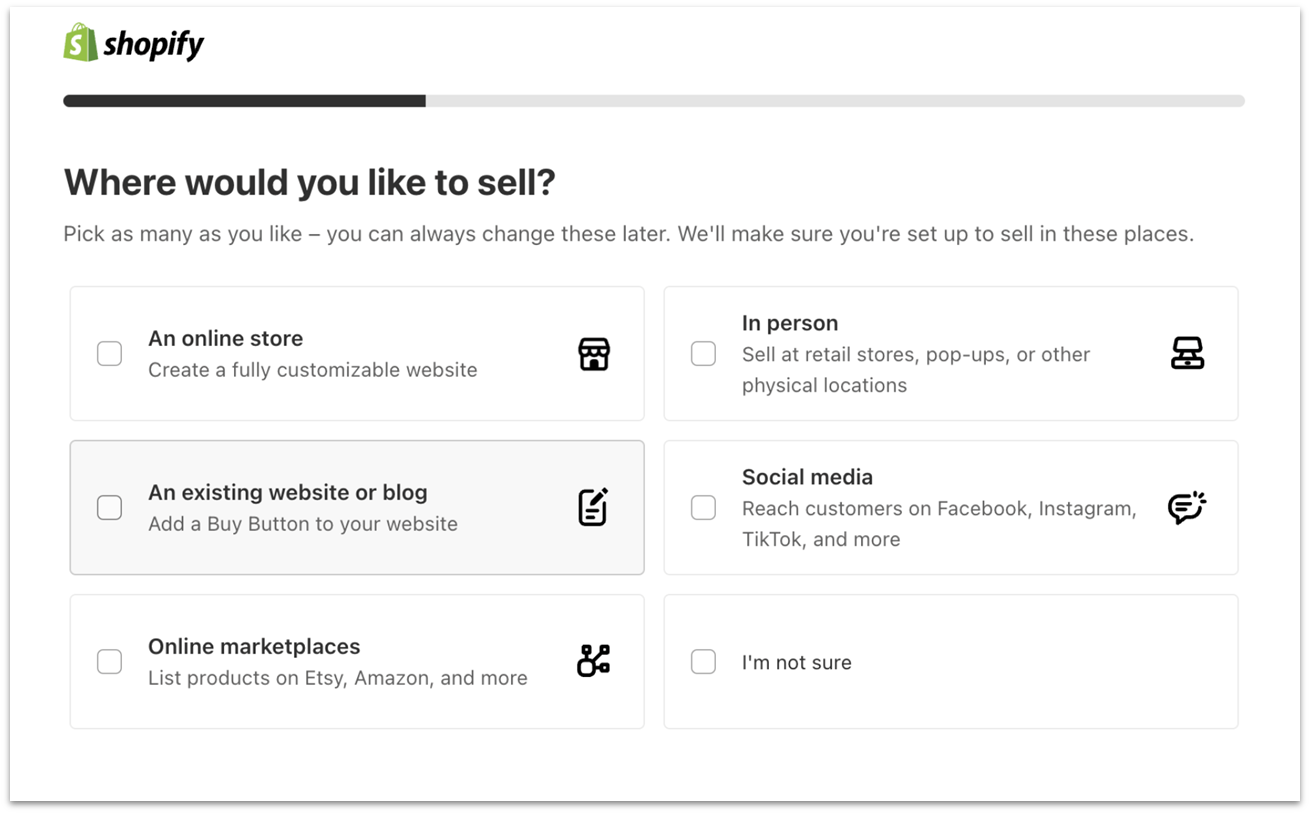

Shopify and Stripe provide a simple and user-friendly application process, allowing you to create an account without extensive vetting or complex technical documentation. Both platforms also offer helpful tutorials and articles to streamline the setup. However, unlike Stripe, Shopify takes a more personalized approach during sign-up, gathering information about your business to better tailor its services to your needs.

One thing to note is that many Stripe users have complained about unexpected account closures or having their payments put on hold. Plus, if you already have a website, signing up with Stripe would mean creating a new account for a different platform. Whereas with Shopify, once you set up your store, you can immediately accept payments through Shopify Payments, which is pre-integrated.

Both platforms offer strong integration capabilities with existing systems, but Shopify’s all-in-one nature makes it more accessible to beginners. Its backend features for inventory management, customer tracking, and order fulfillment are built into a single platform, reducing the need for multiple third-party services. Stripe, on the other hand, focuses solely on payments, which means it’s not a ready-to-go, all-included e-commerce platform.

Overall, Shopify is easier for the average entrepreneur due to its plug-and-play capabilities and simplified interface, while Stripe is better suited for tech-savvy business owners with an existing site and setup who fancy robust API integrations.

Compliance and Security

Stripe Has More Advanced Security Solutions

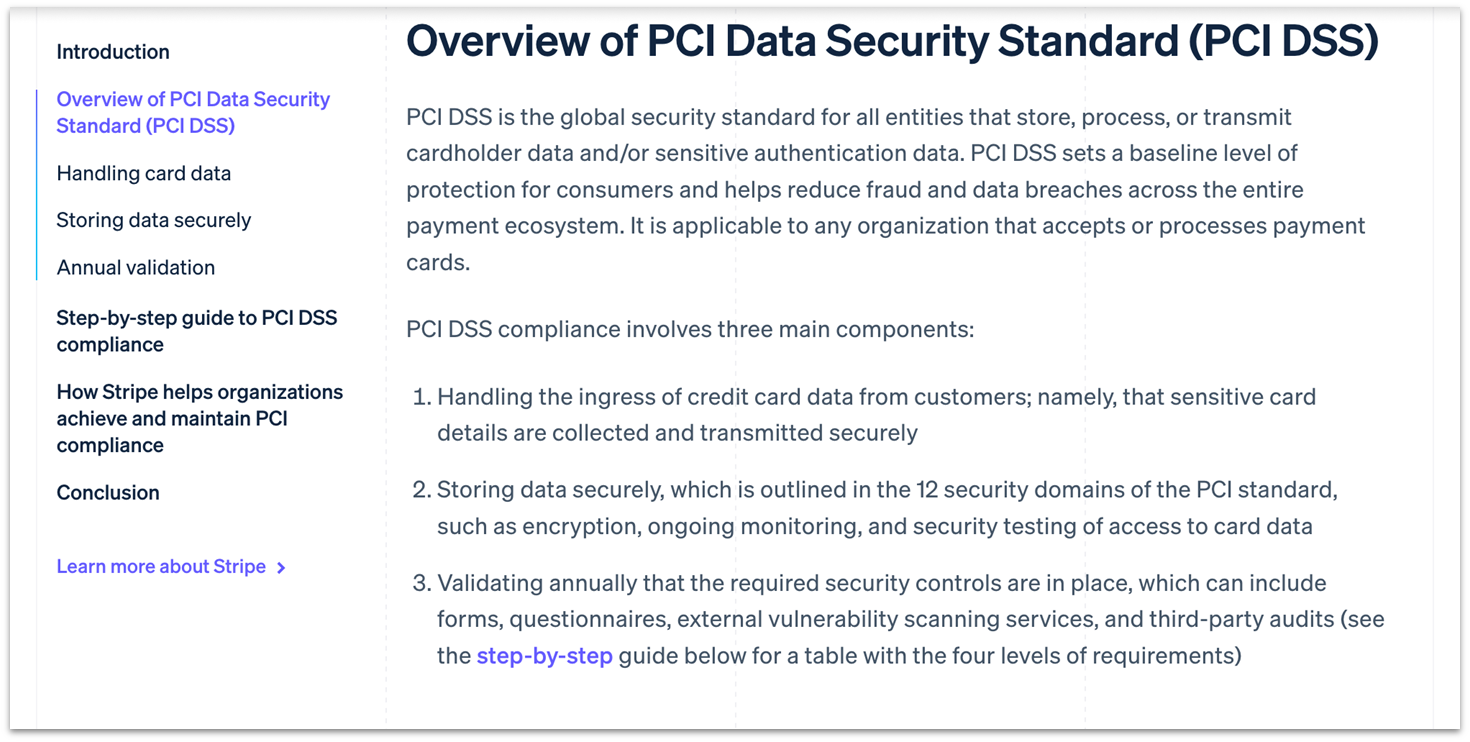

Stripe and Shopify offer robust security frameworks, including annual SOC reports, machine-learning-based fraud protection, encryption, and tokenization. However, they take different approaches to PCI compliance.

By default, Shopify automatically ensures that all its stores are PCI-compliant. Meanwhile, Stripe provides tailored PCI compliance recommendations based on your integration method and helps guide you through the appropriate validation process. Stripe’s approach to security is more extensive and, arguably, more cautious.

Still, you can rest assured that your store and payments are secure with Shopify. It’s also worth noting that Stripe powers Shopify Payments, so you’d likely get access to most of Stripe’s payment-related security features via Shopify Payments.

Beyond being PCI-certified, Stripe also aligns its policies with the NIST Cybersecurity Framework. It also offers additional security features such as access controls and auditing, HTTPS and HSTS protocols, proactive internet monitoring, and a dedicated team of security experts on standby.

Pricing

Shopify Is Cheaper Overall

Both Stripe and Shopify provide transparent and flexible pricing models. Stripe operates on a straightforward pay-as-you-go system with no monthly fees. You’ll pay a flat rate for each transaction – typically around 2.9% + 30¢ (online) and 2.7% + 5¢ (in-person). This makes Stripe appealing if you want to avoid recurring subscription costs.

Nevertheless, if you already have a website hosted outside of Shopify, you’re most likely paying a hosting or website builder subscription anyway. In that case, managing everything through a single platform, as Shopify allows, might offer more value and convenience while streamlining your operations.

Shopify offers tiered subscription plans, which include access to its payment processor, Shopify Payments. The base plan starts at $39.00 per month (but you’ll only pay $1 in your first month), and transaction fees vary depending on the chosen plan. For example, Shopify’s Basic online plan charges 2.9% + 30¢, while the more expensive online plans offer lower rates from 2.4% + 30¢. Meanwhile, in-person payments range from 2.5% + 10¢ (in-person) to 2.6% + 10¢ (in-person).

Concerning additional fees, Stripe has a bunch of those. Both platforms charge a $15 chargeback fee and a currency conversion fee. Shopify also charges additional transaction fees (0.2% to 2%) if you opt for a third-party payment provider instead of Shopify Payments. Stripe takes it further and charges 1.5% for international cards, 0.5% for manually entered cards, 0.7% for recurring payments, and 0.4% for invoices.

| Stripe | Shopify | |

| Monthly fee on the cheapest plan | N/A | 2.5% + 10¢ (in-person) |

| Transaction fees on the cheapest plan | 2.9% + 30¢ (online) | 2.9% + 30¢ (online) |

| POS system | Requires third-party | Included (POS Lite) |

| Reporting and analytics | Basic | Advanced with more tools |

| Payout times | 2–7 business days as standard | 1–5 business days |

| Additional fees |

|

|

| PCI assistance |

|

|

Support

Stripe and Shopify Offer Extensive and Helpful Support

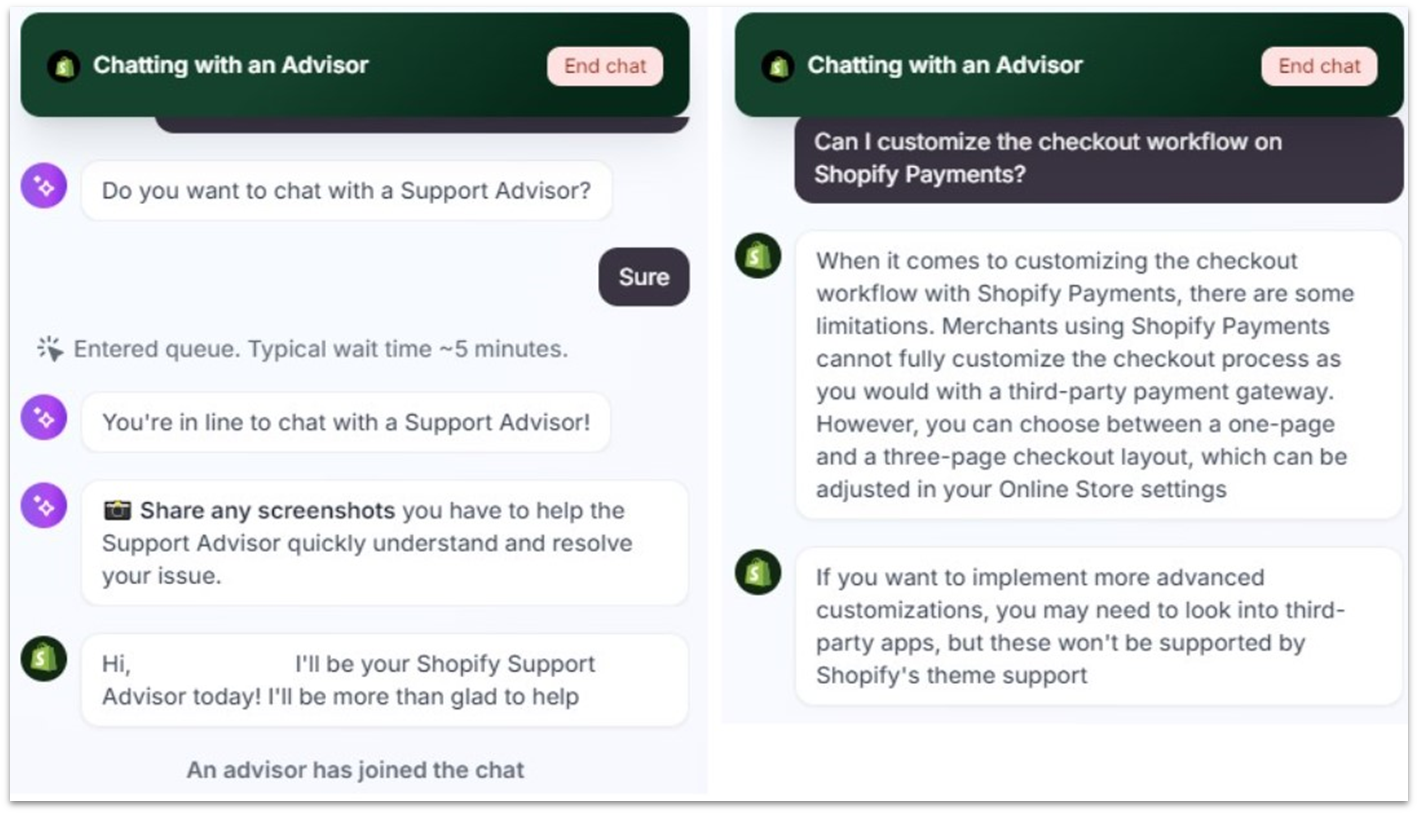

When it comes to customer support, both Stripe and Shopify offer multiple avenues for assistance and provide a wide range of resources to help you. These include 24/7 email, chat, and phone support, ensuring you can reach out through the medium that works best for you.

While both claim to offer 24/7 support, Shopify tends to provide faster responses, as my colleague experienced. Stripe, on the other hand, has a handful of negative reviews that suggest you’ll wait for quite some time before a representative gets back to you.

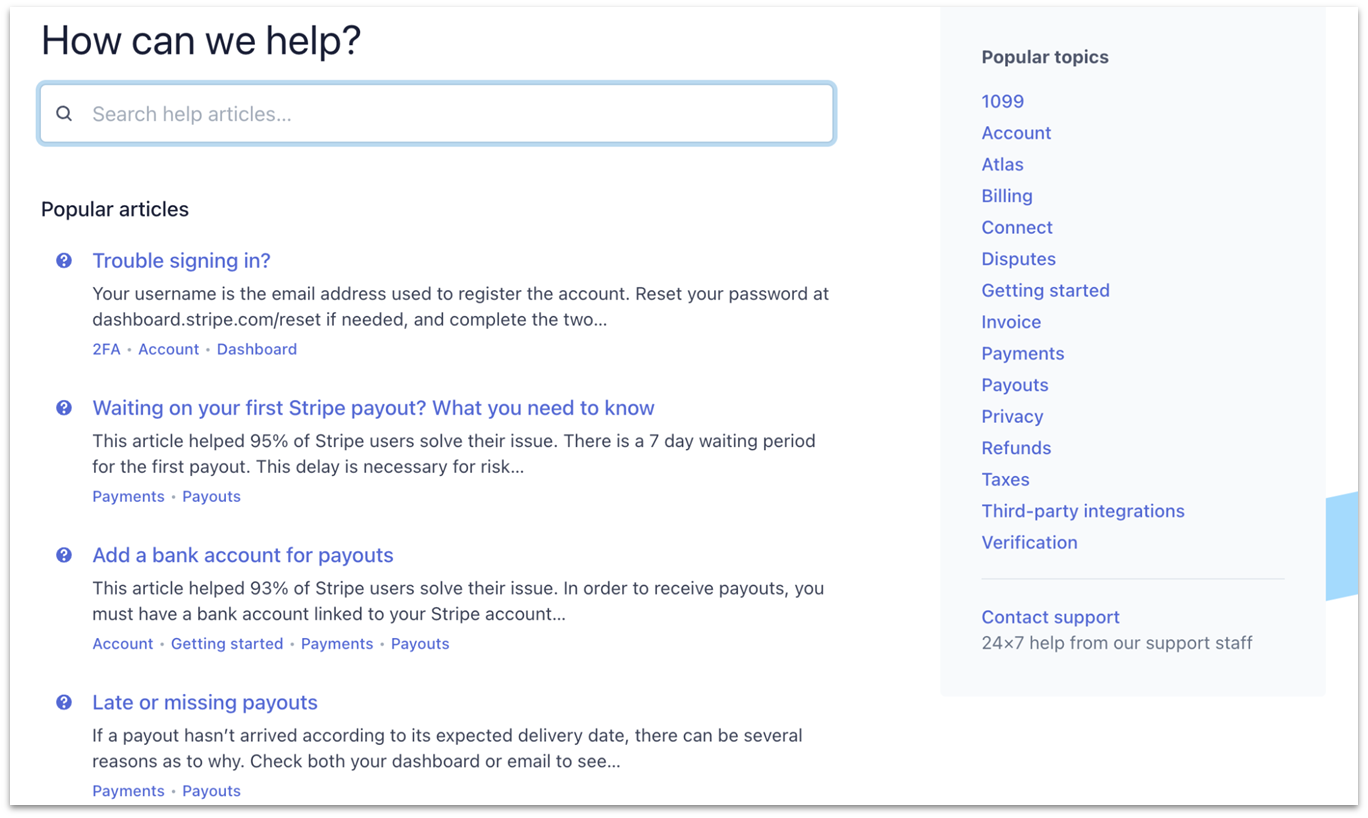

In addition to direct support, Stripe and Shopify both feature extensive online resources. Shopify’s help center includes written guides, community forums, and a comprehensive library of video tutorials covering everything from store setup to advanced e-commerce strategies.

Stripe’s knowledge base is similarly detailed, with guides that cater to developers and business owners alike. Stripe also offers video walkthroughs, though its focus tends to lean more on technical implementation. What’s more, both platforms can recommend an expert if you need help with any complex setups.

Shopify’s All-In-One Approach Makes E-Commerce Convenient

Shopify offers everything you need in one place, from building your website to managing inventory and processing payments. Its seamless integration of online and in-person sales and tools designed to simplify business operations make it more efficient. You won’t have to juggle multiple platforms, saving you time and effort.

Stripe is great if you need heavy customization and have a team of developers. Its extensive API support allows for highly tailored solutions, but this level of flexibility often complicates things if you want to focus on growing your business, not managing tech. I’d recommend Stripe if you’re running a unique setup and don’t need Shopify’s extra features.

Here’s a quick summary of how both services stacked up in my comparison:

FAQ

Is Shopify Payments better than Stripe?

Yes, Shopify Payments is better, especially if you’re already using Shopify for your online store. It’s integrated directly into Shopify, making it simpler to manage payments without needing third-party apps. Plus, it has cheaper fees and is easier to set up than Stripe.

Is Stripe no longer on Shopify?

You can still use Stripe to accept payments on your Shopify store. It’s listed among Shopify’s third-party payment providers. However, Stripe is not available as a separate payment gateway if Shopify Payments is enabled for your store.

Is Stripe easier to set up than Shopify?

No, Shopify is easier to set up for e-commerce because Shopify Payments is built into the platform. With Shopify Payments, you can start accepting payments right after launching your store. Stripe, on the other hand, requires more setup and technical knowledge, even if you are integrating it with non-Shopify platforms.

Does Shopify own Stripe?

No, Shopify does not own Stripe. Shopify Payments is powered by Stripe, but they’re separate entities. Stripe handles the backend processing for Shopify Payments, allowing Shopify to offer payment solutions directly to its users. To learn more about other payment services, check out our list of the top 10 credit card processors in 2026.