What problems are you solving for your customers?

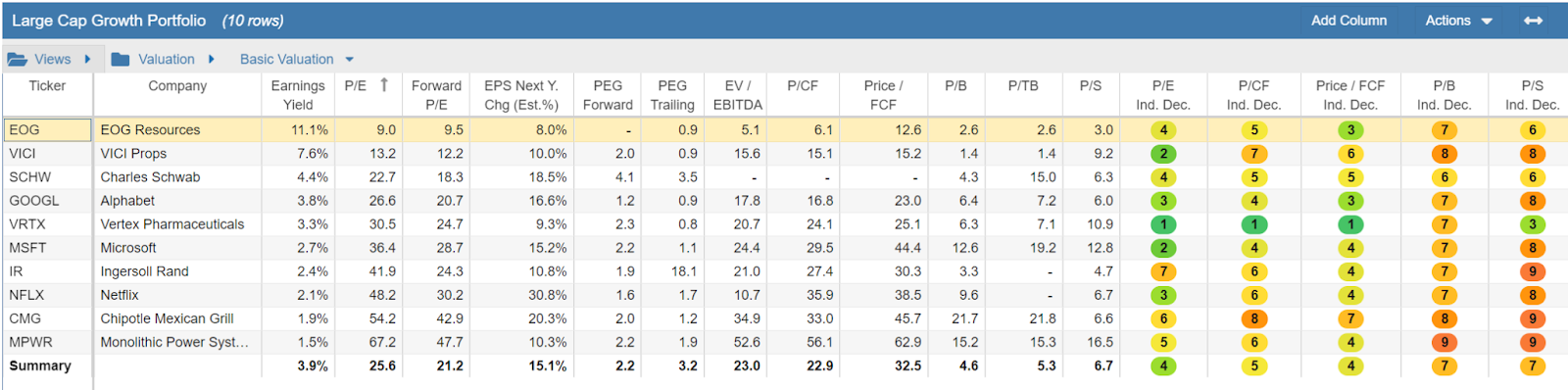

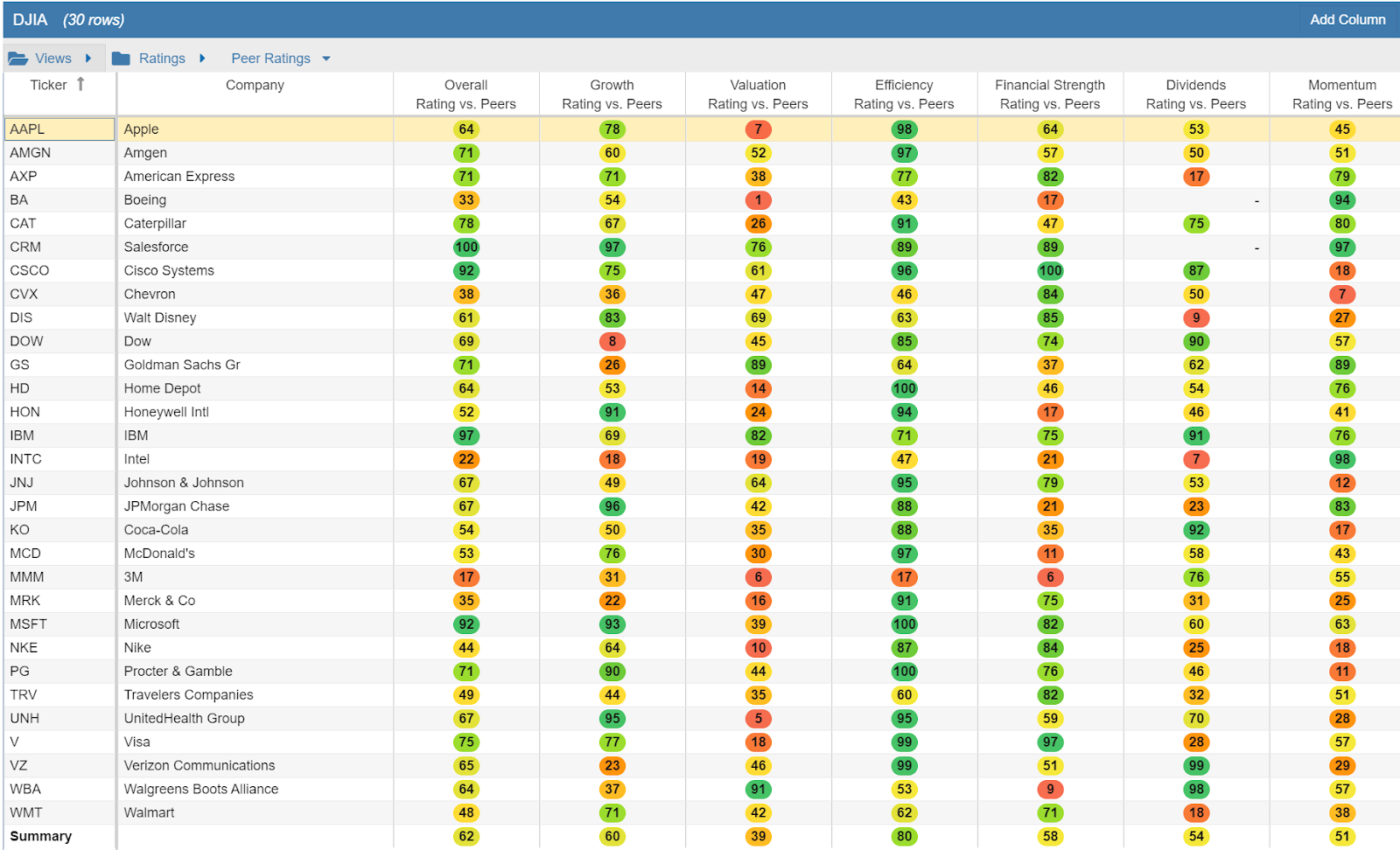

Our mission is to empower investors of all levels with comprehensive, clear and unbiased data that allow them to make more informed investment decisions. It is very difficult for individual investors to fully compare competing investment candidates. The reason is most web sites tend to provide a bunch of data in varying formats, focusing on individual tickers. However what investors really need is the ability to compare different companies, ETF and funds, side by side, across many areas of financial, operational and price performance in order to make more informed decisions on where to best apply their hard-earned capital. We solve that problem by providing data in a dynamic table with a set of views, each one with its own set of columns. A view addresses a specific investment category such as growth, valuation, price performance, balance sheet strength, analyst estimates and so on. There are over 50 separate investment views provided out of the box in Stock Rover. It takes one mouse click to switch views and change the comparison lens. Every table can be manipulated, (sorted, filtered, grouped, colored) and works with real time market data, so the data is live and up to the second. Below are sample screenshots of two of the over 50 views Stock Rover provides. The first view shows basic valuation statistics for a portfolio called Large Cap Growth. This second sample shows the Stock Ratings view for the Dow Jones 30.

This second sample shows the Stock Ratings view for the Dow Jones 30.

Individual investors also face challenges with their portfolios, first in assessing their overall financial state across portfolios, which often span multiple brokerage houses. And secondly, in determining whether portfolio construction and portfolio performance are meeting investor objectives.

Brokerage companies often do not provide the ability to analyze single portfolios, let alone the ability to aggregate and analyze multiple portfolios across multiple brokerages.

With our brokerage integration feature, we can do just that, providing analytics on portfolio construction, levels of risk and reward, volatility, correlation, and performance aggregated across portfolios.

Individual investors also face challenges with their portfolios, first in assessing their overall financial state across portfolios, which often span multiple brokerage houses. And secondly, in determining whether portfolio construction and portfolio performance are meeting investor objectives.

Brokerage companies often do not provide the ability to analyze single portfolios, let alone the ability to aggregate and analyze multiple portfolios across multiple brokerages.

With our brokerage integration feature, we can do just that, providing analytics on portfolio construction, levels of risk and reward, volatility, correlation, and performance aggregated across portfolios.

Which types of companies benefit the most from your services?

When we first developed Stock Rover, our target audience was individual investors who liked to make their own investment decisions and wanted unbiased investment data in an easy to digest format to help them invest better. We felt this was an underserved market. There is no shortage of investment professionals who will manage your money. And there are sophisticated investment research tools available to professional investors, such as the Bloomberg terminal. But their cost and complexity put them out of the reach of individual investors. However, there is a sizable population of individuals who want to do their own investing, and want good investment tools at a reasonable price to help them invest wisely. That is the gap we looked to fill with Stock Rover. And we have succeeded with the individual investor population based on the acceptance of our product. But what has surprised us is the number of professional investors who also use the product. This group is a significant percentage of our users, and they have requested features that have made the product better over time. Despite the addition of new features, we have strived to keep the product close to its roots, ensuring it is still accessible and easy to use for non-professional investors.

No website I’ve seen packs so much useful, context-appropriate information onto a single page.”

Barron’s Magazine

What makes them eventually choose you over your competitors?

Primarily because of how comprehensive and well-integrated the product is. Other reasons include our industry leading stock and ETF screening capabilities to help find good investment candidates, regardless of an investor’s investing style. And, of course, the brokerage integration piece has been a huge win for customers, as it allows them to maintain up-to-date portfolios across brokerages in Stock Rover with no work on their part. When customers switch from other platforms to ours, it is usually because we do something a competitor can’t do, or we do something better than the competitor. It can also be because of cost, as we strive for a reasonably priced product. And last, but definitely not least, it is often because they find our support incredibly responsive, which is something they may not have experienced at competing companies.Since you started, what helped you grow and retain your audience?

We are an unusual company in that we don’t spend money on marketing. Rather we market by trying to generate content that improves our organic search results. We do this via blogging on interesting and educational investment topics. We have a sizable mailing list that we email weekly with relevant investment content and periodically with product offers. Our affiliate network helps us market Stock Rover. The affiliates share in the revenue for customers that come our way via their channels. This works well because we provide strong support to the affiliates and we offer generous revenue splits, so the affiliates are strongly incentivized to market and generate Stock Rover business. We also don’t run ads on our site, even for our free users. This helps us retain customers’ loyalty and goodwill as we don’t pollute the experience of using our software or learning about investing from our blogs and educational materials.

I have never encountered a single data provider with as many features as Stock Rover.

To analyze how we are doing, we have a number of KPI we track regularly, including a lot of data from Google Analytics, Braintree Payments (our payment processor) and from GetResponse, our favorite email marketing platform.

We tried paid marketing in the past, using search terms for Google and marketing on Facebook, but found that we were not achieving the return on investment that we were hoping for, so we abandoned those efforts.

Once we have captured a customer, we retain that customer by adding content to the product without raising their price. If we do have a price increase, which is rare, we grandfather existing customers at the lower price point for life, as long as they maintain their subscription to Stock Rover.

Dr. Frederick Schadler, Associate Professor in Finance at East Carolina University

How are you doing today and what’s in the roadmap for the future?

So far, things are going well for Stock Rover. We are growing, we are profitable and our profitability is growing. I am really proud that we were able to get this company off the ground. We are bootstrapped, and everyone we talked to thought we would never make it… However, our product struck a chord with investors, who embraced it and allowed us to be successful.

Stock Rover brings institutional-quality research capabilities to the individual investor. It has quickly become my go to resource for fundamental screening and analysis.”

Going forward, Stock Rover is far from perfect and there are a number of things I would like to see accomplished in both the near term and the long term to help ensure our continued success. This includes handling markets beyond North America, handling multi currency accounts better, and improving some aspects of our portfolio management solution.

One thing that has changed over the last 10 years or so, is the increasing use of ETFs rather than stocks for capital allocation. When we started, stock selection was huge for investors. It is still very important, but ETF selection has become a much bigger part of the picture. In response to this, Stock Rover has developed extensive ETF analysis capabilities, but we need to do more in this area.

Brent Jaciow, Chief Investment Officer at Maseco Private Wealth S.A.