Inside this Article

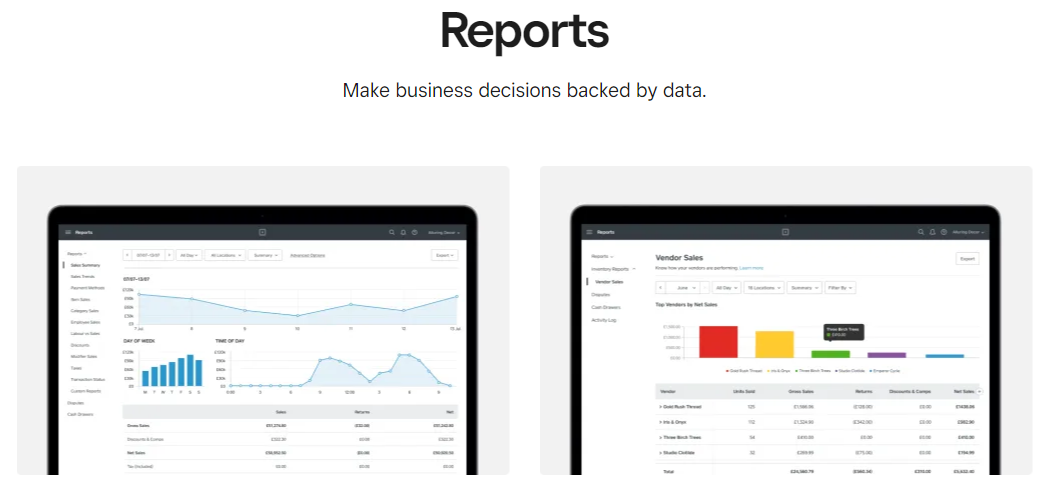

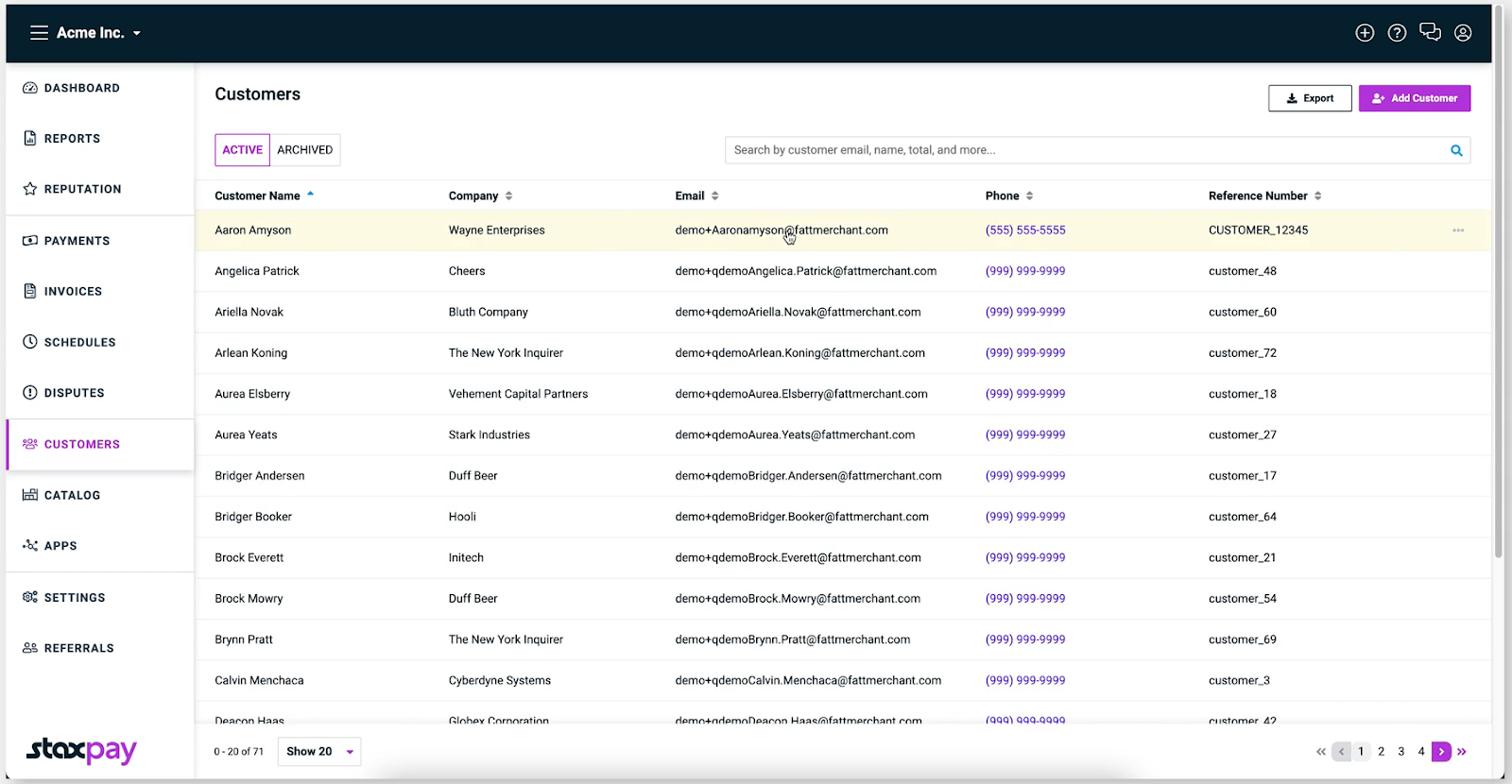

Features

POS Hardware Is Free With Stax

Both Stax and Square market themselves as all-in-one payment platforms, so you’ll get POS hardware, plus business management and e-commerce software included with your merchant account. However, this is where the similarities end.

Ease of Use

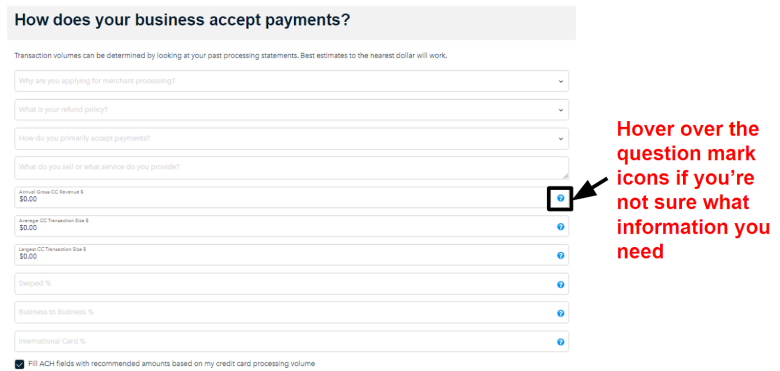

Square’s Lack of Underwriting Is a Problem

On the surface, Square should win this round. To sign up to Square, you just have to create an account and verify your identity. In comparison, Stax’s underwriting process – which involves providing your average yearly revenue, average transaction size, and an estimated percentage of the types of transactions you handle – feels tedious. But you only have to take a quick look at merchant reviews for Square to see why this quick onboarding is a problem. A significant portion of Square’s reviews claim that it shuts down merchant accounts or holds transactions for 90 days without warning. In most cases, merchants were given little explanation as to why their accounts were on hold or shut down. Typically, transaction holds are a key part of the payment processing industry as they protect processors against fraudulent merchants. If a customer files a chargeback and the merchant is either non-responsive or has gone out of business, the processor has to pay for the chargeback.

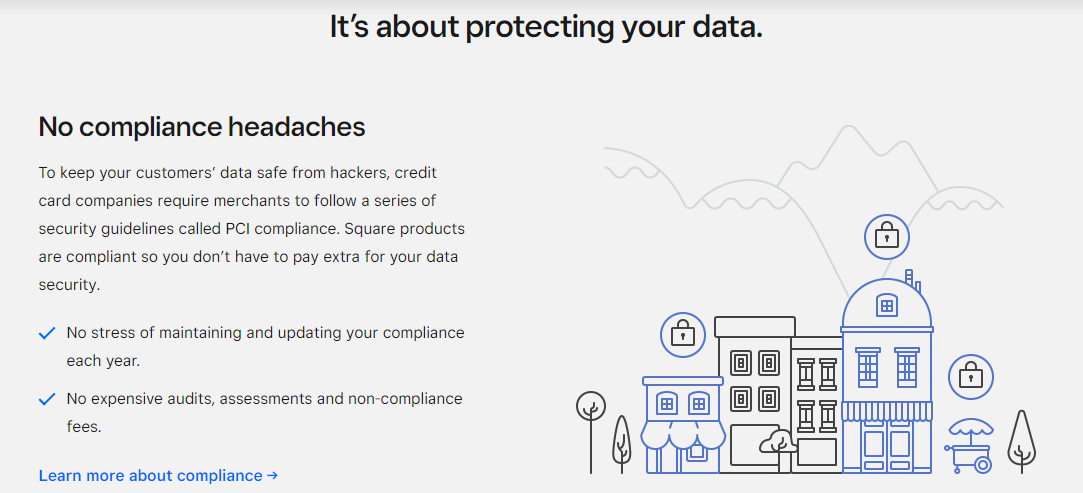

Compliance and Security

Square Takes on the Burden of PCI Compliance for You

Stax helps you to achieve PCI compliance via a third-party dashboard that guides you through completing your questionnaire. Certain merchants can also call a dedicated helpline to support them with their PCI compliance documentation. When it comes to payment security, Stax has a fantastic track record. Because it’s a PCI Level 1 processor, Stax is required to undergo regulatory third-party audits and network penetration testing to keep your payments and data secure. It’s also never suffered a data breach, which is a rare accolade for a card processor. Unfortunately, I can’t say the same about Square. Cash App – which is owned by Square – was breached only a few months ago. So why does Square win the Compliance and Security round? It’s because Square handles your PCI compliance for you, so you don’t have to worry about completing a questionnaire every year. While most credit card processors require that you be the Merchant on Record – making you solely responsible for PCI compliance, chargebacks, and refunds – Square takes on this responsibility itself.

Unsure which processor is best for your business?

Take this short quiz and get a tailor-made recommendation in seconds

Pricing

Square’s Interchange-Plus Pricing Adds Up Quickly

It’s difficult to compare Stax and Square’s pricing, especially since these payment processors have different pricing models.

Stax uses subscription-style pricing, so you’ll pay a flat fee each month in exchange for 0% markups on sales (though you’ll still need to pay a small flat transaction fee). This means that Stax is better suited for businesses that process a high volume of transactions each month.

On the other hand, Square’s interchange-plus pricing model means you won’t be charged any monthly fees for payment processing, but you’ll pay a percentage markup on all your transactions. This is a better option if you’re a small business that doesn’t process as many transactions each month.

With that being said, Square is not ideal if you primarily sell online. The transaction fee for card-not-present (CNP) transactions is significantly higher than most of our recommended interchange-plus credit card processors. Even if you’re only processing a handful of CNP transactions each day, these fees can start to add up quickly.

Not only that, but if your business operates across multiple locations, you’ll have to start paying a monthly fee to use Square’s software, and the price for this varies between $29 – $69/month. It’s not cheap, particularly because you’ll be paying this in combination with Square’s high per-transaction fees. Even though this is still cheaper than Stax’s monthly plans, you’ll almost certainly end up paying more overall.

Stax offers a lot more value for businesses with multiple locations or those that sell online. Not only is there no markup on interchange fees, but the transaction fee for CNP transactions is roughly half of what Square charges. Plus, Stax’s POS software works on unlimited devices, so it doesn’t matter how many locations you have.

| Stax | Square | |

|---|---|---|

| Monthly fee on the cheapest plan | $99 | $0 |

| Transaction fees on the cheapest plan | 8¢ + interchange (in-person) | 2.5% + 10¢ |

| Free hardware | Yes – your choice of third-party terminal | Yes – one mobile magstripe reader |

| Proprietary hardware? | ✘ | ✔ |

| Payout times | 24-72 hours for card payments, 4-5 business days for ACH | Next business day |

| Same-day payouts? | Paid add-on | Paid add-on |

| PCI support | Third-party dashboard to help with PCI questionnaire | No required PCI compliance or fees |

| Customer support | Email, ticket, phone, live chat, fax, chatbot, knowledge base | Email, ticket, phone, live chat, chatbot, knowledge base |

Support

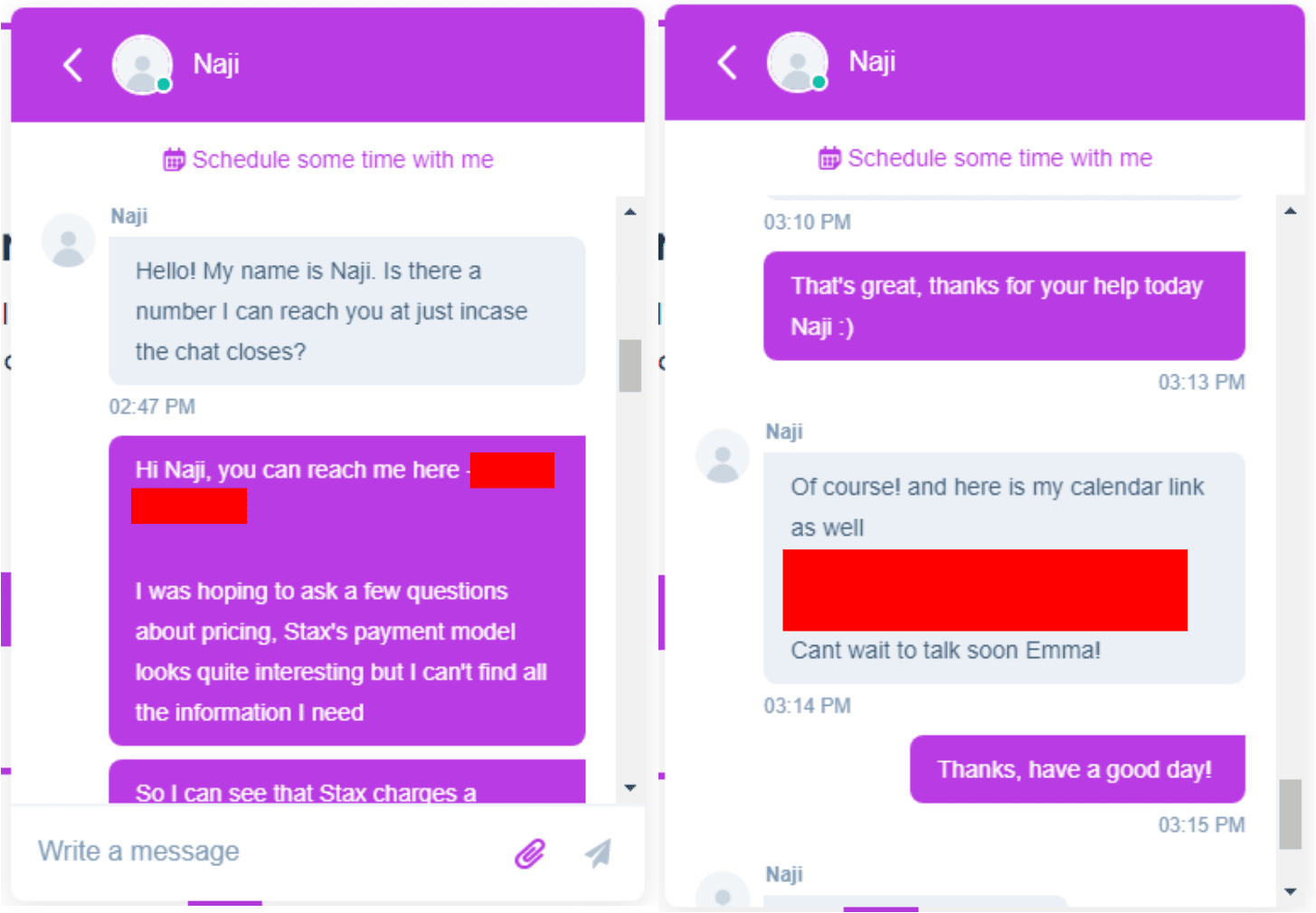

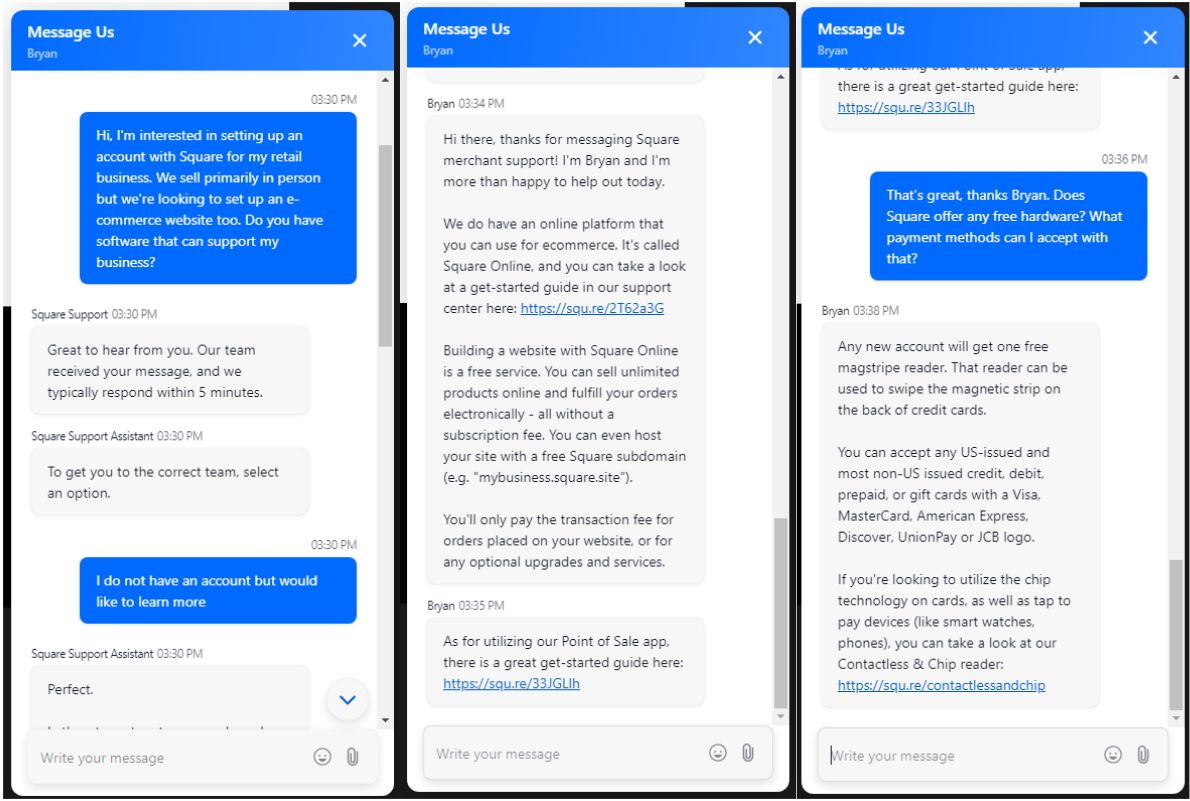

Both Are Friendly and Responsive, But Stax Cares More

Both Stax and Square offer a similar level of customer support – live chat, phone, email, ticket, and a comprehensive knowledge base are available. They also have chatbots that will search through the knowledge base for you, which is really helpful if you need help outside of customer support hours. Stax even has a fax customer support channel, which isn’t something I see often. While Stax doesn’t have any published hours for customer support, I had no issues getting in touch with its support team. I didn’t have to wait longer than a few minutes for a response from a live chat support agent, and I got an answer to my email the next business day.

Which Is the Best Merchant Services Provider for My Business?

Stax offers a lot of value to all types of businesses, which is why it wins in this comparison. Its 0% markups and low transaction fees make it a fantastic choice for high-volume merchants. For instance, you’ll get a free terminal and a comprehensive suite of POS, e-commerce, and business management software included in your monthly fee. On the other hand, Square isn’t a bad choice for small businesses. These types of businesses might find that the extra money they spend on payment processing with Square will still cost less than one of Stax’s monthly plans. However, as your business grows, you’ll likely find that you’ll save money with Stax. Here’s a quick breakdown of Stax vs Square.Stax

Square

Features

Free third-party terminal on approval and a comprehensive software suite

Free proprietary magstripe card reader and software

Ease of Use

Easy application process and approval within two business days

Easy application process, but some chance of held funds and account termination

Compliance

PCI Level 1 processor with a third-party dashboard to help merchants with PCI compliance

No PCI compliance requirement or fees – Square is Merchant on Record for payments

Pricing

Subscription-style with low per-transaction fees, software included in monthly price

Interchange-plus with high per-transaction fees, plus additional monthly fees for advanced software

Support

Email, ticket, phone, live chat, chatbot, fax, knowledge base

Email, ticket, phone, live chat, chatbot, knowledge base