Inside this Article

The Who and the Why: A Breakdown of Departures

X has seen a notable exodus of users and advertisers over the past three years, driven by its owner’s polarizing actions and shift toward controversial content. Many individuals and companies have left, while advertisers have pulled back due to misaligned values. This section breaks down who has departed, when, and why.Departures of Celebrities and Corporations

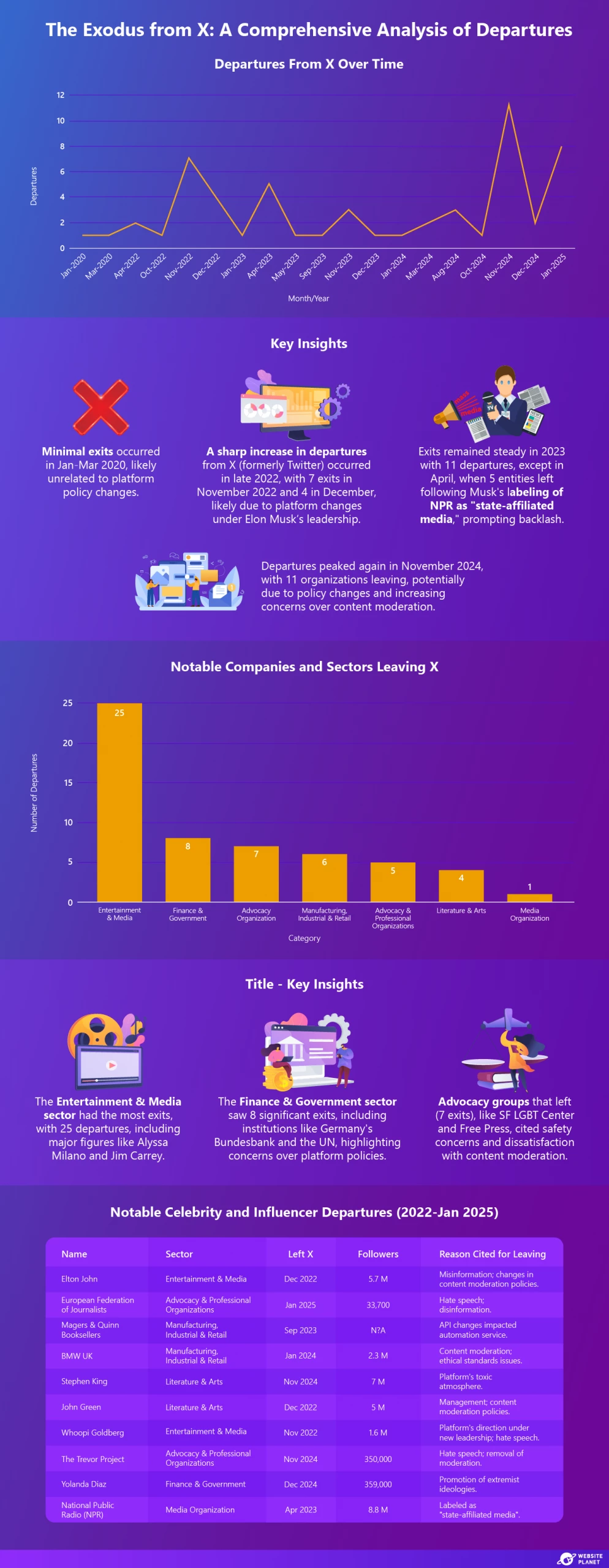

Several high-profile individuals and organizations, including the European Federation of Journalists in December 2024, left X over concerns about content moderation and the platform’s role in amplifying conspiracy theories, racism, far-right ideologies, and misogyny. This trend reflects growing concerns over platform management, content moderation, and alignment with personal or organizational values. The data shows a significant number of departures, with a total of 42 influential entities leaving the platform. The most affected sectors are Entertainment & Media (24 departures) followed by Advocacy & Professional Organizations (8 departures) and Manufacturing, Industrial & Retail (6 departures).

The data shows a significant number of departures, with a total of 42 influential entities leaving the platform. The most affected sectors are Entertainment & Media (24 departures) followed by Advocacy & Professional Organizations (8 departures) and Manufacturing, Industrial & Retail (6 departures).

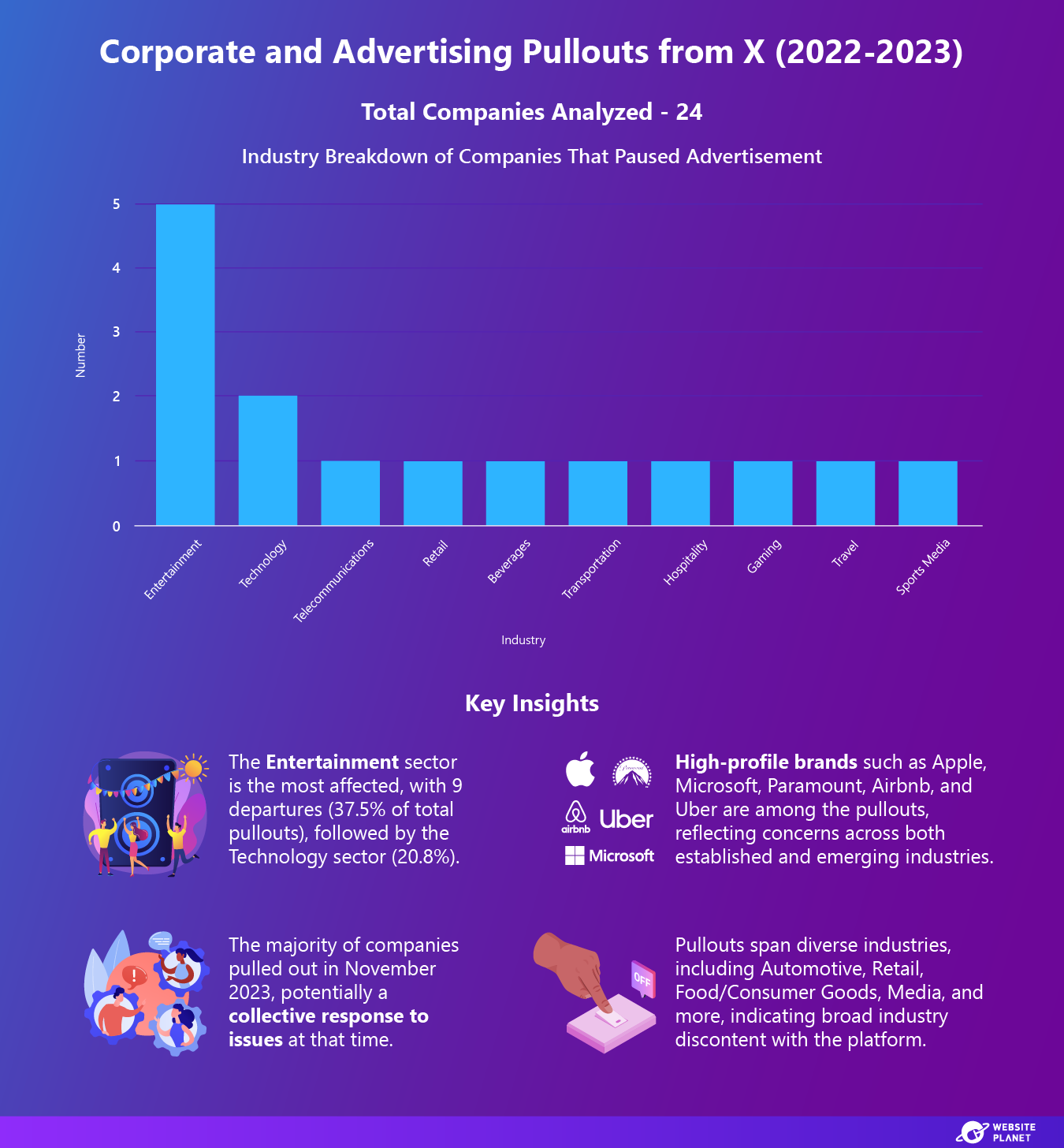

Corporate and Advertising Pullouts

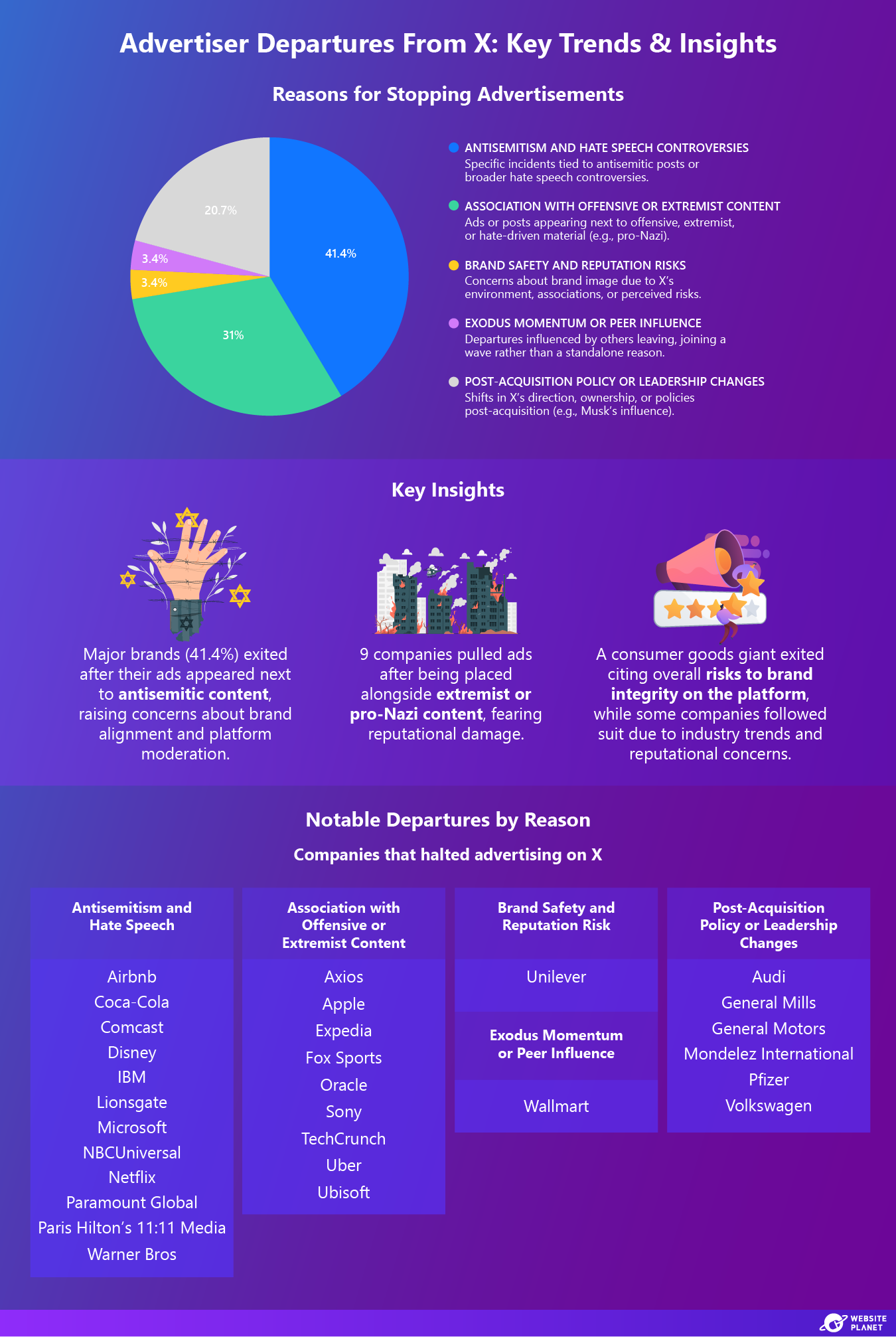

In November 2023, major brands such as Apple, Disney, Coca-Cola, and Uber stopped advertising on X. The primary reasons cited were the platform’s content moderation failures, including the display of ads next to offensive content such as pro-Nazi posts. Some, like Paramount and Walmart, expressed concerns over brand safety, signaling their dissatisfaction with Musk’s changes to the platform. The diverse range of industries represented by companies leaving X, many of which have significant global reach, indicate a broad concern over the platform’s content moderation and brand safety issues.

Given that these companies represent industries where brand image and trust are crucial, this underscores the increasing challenge for X to moderate its content in a way that its multiple audiences will be receptive to.

The diverse range of industries represented by companies leaving X, many of which have significant global reach, indicate a broad concern over the platform’s content moderation and brand safety issues.

Given that these companies represent industries where brand image and trust are crucial, this underscores the increasing challenge for X to moderate its content in a way that its multiple audiences will be receptive to.

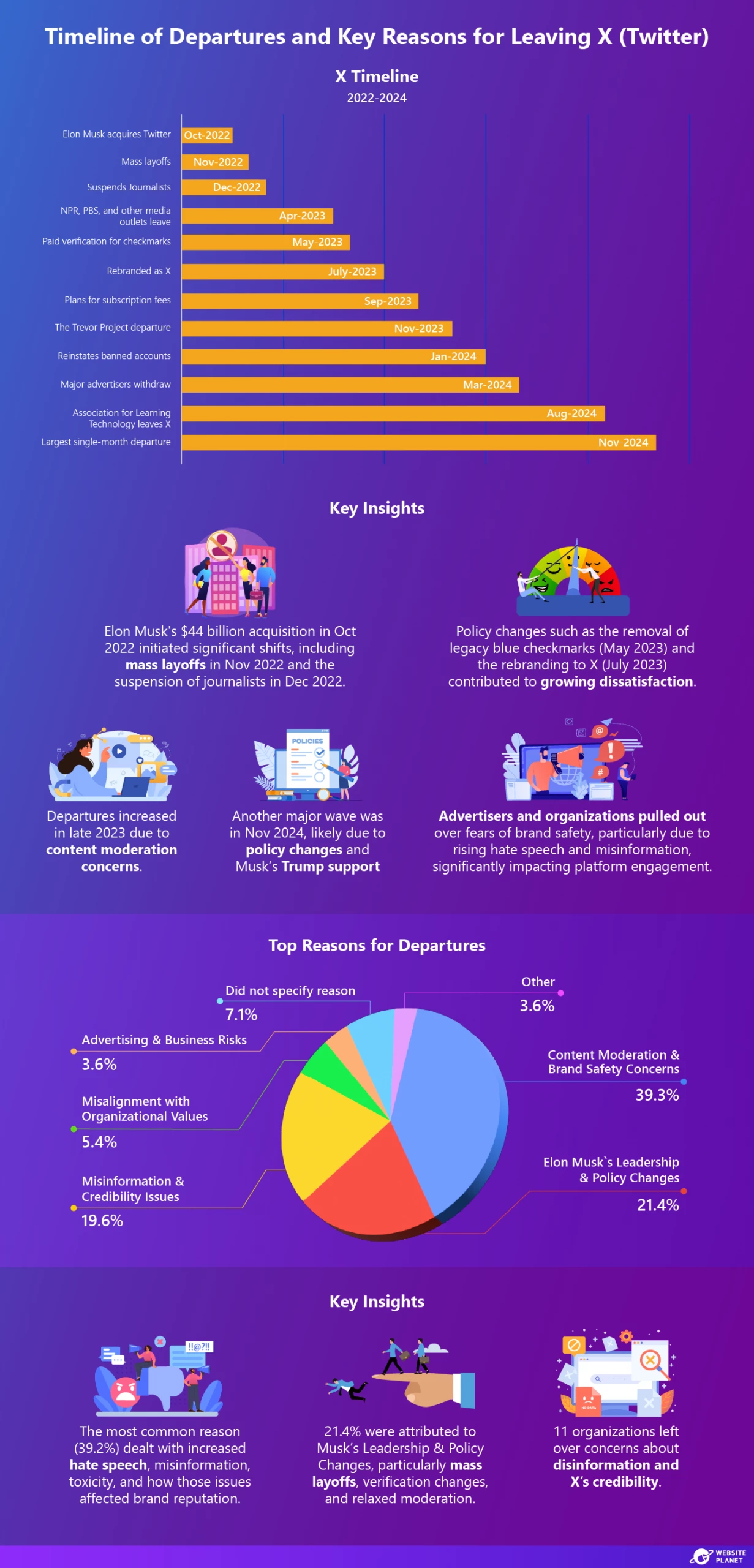

Timeline of Departures and Key Reasons for Leaving

This section highlights the key events and decisions that led to a wave of departures from X, focusing on the top reasons organizations chose to leave the platform and the timing of these shifts. To identify the key reasons behind these departures, we analyzed insights from 56 prominent celebrities, organizations, and advocacy groups, whose brand is widely trusted and recognized. Departures from X peaked during major platform events, such as the mass layoffs in November 2022 and the rebranding to “X” in July 2023. Another surge occurred in 2024 due to policy changes and rising brand safety concerns, with November 2024 recording the highest single-month departure rate.

The primary reasons for leaving included content moderation issues like rising hate speech and misinformation (22 cases), dissatisfaction with Musk’s leadership and policy changes (12 cases), and concerns over disinformation and credibility (11 cases).

Additionally, sector-wise advertising suspensions reflect similar concerns.

The primary reasons for leaving included content moderation issues like rising hate speech and misinformation (22 cases), dissatisfaction with Musk’s leadership and policy changes (12 cases), and concerns over disinformation and credibility (11 cases).

Additionally, sector-wise advertising suspensions reflect similar concerns.

Departures from X peaked during major platform events, such as the mass layoffs in November 2022 and the rebranding to “X” in July 2023. Another surge occurred in 2024 due to policy changes and rising brand safety concerns, with November 2024 recording the highest single-month departure rate.

The primary reasons for leaving included content moderation issues like rising hate speech and misinformation (22 cases), dissatisfaction with Musk’s leadership and policy changes (12 cases), and concerns over disinformation and credibility (11 cases).

Additionally, sector-wise advertising suspensions reflect similar concerns.

The primary reasons for leaving included content moderation issues like rising hate speech and misinformation (22 cases), dissatisfaction with Musk’s leadership and policy changes (12 cases), and concerns over disinformation and credibility (11 cases).

Additionally, sector-wise advertising suspensions reflect similar concerns.

Major bands (41.4%) across media, technology, automotive, and consumer goods have stopped ad spending due to antisemitism controversies, brand safety risks, and policy changes under new leadership. This departure trend highlights growing reputational risks for businesses and institutions on the platform.

Major bands (41.4%) across media, technology, automotive, and consumer goods have stopped ad spending due to antisemitism controversies, brand safety risks, and policy changes under new leadership. This departure trend highlights growing reputational risks for businesses and institutions on the platform.

The Fallout: How User Departures Have Reshaped X

The departures of users, brands, and advertisers from X have had significant impacts on the platform’s advertising revenue and user engagement.Impact of Departures on X’s User Base

Following Musk’s acquisition of X, the platform has seen significant declines in user engagement. According to Similarweb, by the end of October 2024, X’s US daily user declined from 32.3 million to 29.6 million (8.4% drop), highlighting retention challenges. The UK saw a sharper decline, with one-third of its daily active users leaving X, as reported by the Financial Times. In the EU, users decreased from 112.2 million in early 2023 to 105.9 million by mid-2024. Although X claims 550 million monthly active users globally, its growth has stalled, adding only 4 million new users between Q2 2023 and Q2 2024. This slow growth contrasts sharply with the platform’s previous trajectory of substantial growth before Musk’s takeover. By September 2023, X’s daily active users had fallen by 16% year-over-year, while competitors like Snapchat (+11%), Instagram (+8%), and TikTok (+3%) showed growth, according to The Wall Street Journal. In December 2024, analysts at eMarketer projected that X was expected to lose 7 million US monthly active users between 2022, when Musk took over, and 2025, citing factors like content moderation, increased bot activity, and a shift to platforms like Bluesky and Threads.Ad Revenue Decline and the Return of Some Advertisers

Since Musk’s takeover in October 2022, X has faced a sharp decline in ad revenue, with the steepest drop of 78% occurring in December 2022 (Guideline). Overall, US ad revenue has fallen at least 55% year-over-year (YoY) each month since the acquisition, according to third-party data provided to Reuters. By mid-2024, X’s internal data reported a further 40% YoY decline in US ad revenue, driven by concerns over brand safety, content moderation, and the platform’s increasingly polarized environment. Musk’s lawsuits against advertisers have added to the uncertainty, deterring partnerships and eroding brand trust. Despite these challenges, X’s large user base (reportedly over 600 million) and Musk’s growing political influence have prompted the return of major advertisers, including Comcast, IBM, Disney, Warner Bros. Discovery, and Lionsgate Entertainment. Additionally, new brands such as Karma Shopping, Canles Shoes, and Kueez Entertainment have emerged as top advertisers.

However, spending remains significantly lower. According to MediaRadar, despite the return of these six major brands, their collective ad spend from January to September 2024 totaled just $3.3 million, a staggering 98% drop from $170 million during the same period in 2023. This trend highlights a cautious approach among advertisers, reflecting concerns about the platform’s direction and a cautious approach to its future.

Despite these challenges, X’s large user base (reportedly over 600 million) and Musk’s growing political influence have prompted the return of major advertisers, including Comcast, IBM, Disney, Warner Bros. Discovery, and Lionsgate Entertainment. Additionally, new brands such as Karma Shopping, Canles Shoes, and Kueez Entertainment have emerged as top advertisers.

However, spending remains significantly lower. According to MediaRadar, despite the return of these six major brands, their collective ad spend from January to September 2024 totaled just $3.3 million, a staggering 98% drop from $170 million during the same period in 2023. This trend highlights a cautious approach among advertisers, reflecting concerns about the platform’s direction and a cautious approach to its future.

Where Did Users and Brands Go? A Look at Alternative Platforms

Growing dissatisfaction with X has led many high-profile users to migrate to alternative platforms like Bluesky, Mastodon, and Threads. The reasons vary. Some want more stability, others want a social media platform that better reflects their values, and many are looking for improved engagement tools. However, a key trend was visible — users and organizations are distributing themselves based on specific needs. B2B engagement: LinkedIn.Mass consumer engagement: Facebook, Instagram.

Decentralized alternatives: Bluesky, Mastodon.

Video-first content: YouTube, TikTok

This fragmentation confirms that there is no single replacement for X. Instead, users are spreading across multiple platforms.

Whether they’re looking for decentralized control, broader reach, or video engagement, digital audiences are more fragmented than ever. For brands and celebrities, this means adapting to a diversified social media ecosystem rather than relying on a single platform.

This fragmentation confirms that there is no single replacement for X. Instead, users are spreading across multiple platforms.

Whether they’re looking for decentralized control, broader reach, or video engagement, digital audiences are more fragmented than ever. For brands and celebrities, this means adapting to a diversified social media ecosystem rather than relying on a single platform.

Bluesky and Threads Surge in Popularity

Amid this fragmentation, Bluesky and Threads have experienced significant growth. Bluesky surpassed 21 million users globally as of March 2024, with a notable surge of 1 million new users in one week (Bluesky user tracker). The platform briefly became the top free app on Apple’s App Store on November 6, 2023, surpassing Threads in daily traffic (App Store rankings). Bluesky’s rapid rise, driven by political events, saw its user base grow by over 1,064% since October 2023 (Platform reports). Following the US election, its user base doubled twice in two weeks, reaching 2.8 million by November 2023 (Bluesky internal stats), while daily active users grew by 131% (Bluesky tracker, March 2024). Threads also saw a surge of 15 million new users in November 2023, bringing its total to over 275 million monthly active users, though it has not disclosed its daily active user count in the US (Instagram/Meta, November 2023).X’s Evolution: Struggling or Strategizing?

Since the October 2022 acquisition, X has rebranded and is aiming to become an everything app, similar to China’s WeChat. However, balancing this vision while maintaining core social media engagement remains a challenge.Monetization Efforts: New Revenue Streams

To recoup its losses and regain decreased revenue, X has tried to pivot to new revenue streams.Subscriptions

Musk introduced X Premium (formerly Twitter Blue) to boost revenue, offering verification, long-form posts, and fewer ads. However, the November 2022 Eli Lilly incident, where an impersonated account with a blue checkmark caused a $15 billion market cap loss, heightened concerns over the platform’s verification policies. X later refined the model into three tiers: Basic, Premium, and Premium Plus.- At $11/month on mobile, X Premium is the platform’s top in-app purchase.

- Revenue reached $14.7 million (Sept 2024), peaking at $16.5 million (Nov 2024) due to Black Friday deals and gifted subscriptions (Appfigures).

Advertising Challenges

X’s ad revenue declined as major brands exited over content concerns. While some brands returned with reduced spending, new advertisers like Karma Shopping, Canles Shoes, and Kueez Entertainment spent $68 million in 2024 (MediaRadar), signaling slow recovery.Creator Monetization

In early 2024, X tied creator payouts to engagement from Premium subscribers, aiming to drive sign-ups. While this increased content production, it also encouraged clickbait and divisive content. Financial Services and Payments X is expanding into financial services, securing money transmitter licenses in 38 US states, including California. By early 2025, CEO Linda Yaccarino confirmed an X Money partnership with Visa, enabling instant transfers, peer-to-peer payments, and bank withdrawals via Visa Direct. X’s Brand and Valuation Decline Since Musk’s takeover, X’s brand value has declined (Brand Finance, 2024):- Brand Value: $5.7 billion (2022) to $673 million (2024).

- Brand Strength Index (BSI): 80.7 (2022) to 56.7 (2025).

- Brand Awareness: 94% to 78%

- Familiarity: 58% to 53%.