Inside this Article

Features

Square and Payment Depot Both Excel When it Comes to Features

In terms of the sheer amount of features available, few credit card processors can compete with Square. Even a cursory look at its site reveals a vast selection of applications, equipment, and e-commerce functionality on offer. But, as it turns out, Payment Depot’s feature offering is nearly as extensive.

Ease of Use

Payment Depot Is Simple Enough, but Square Takes Only Minutes

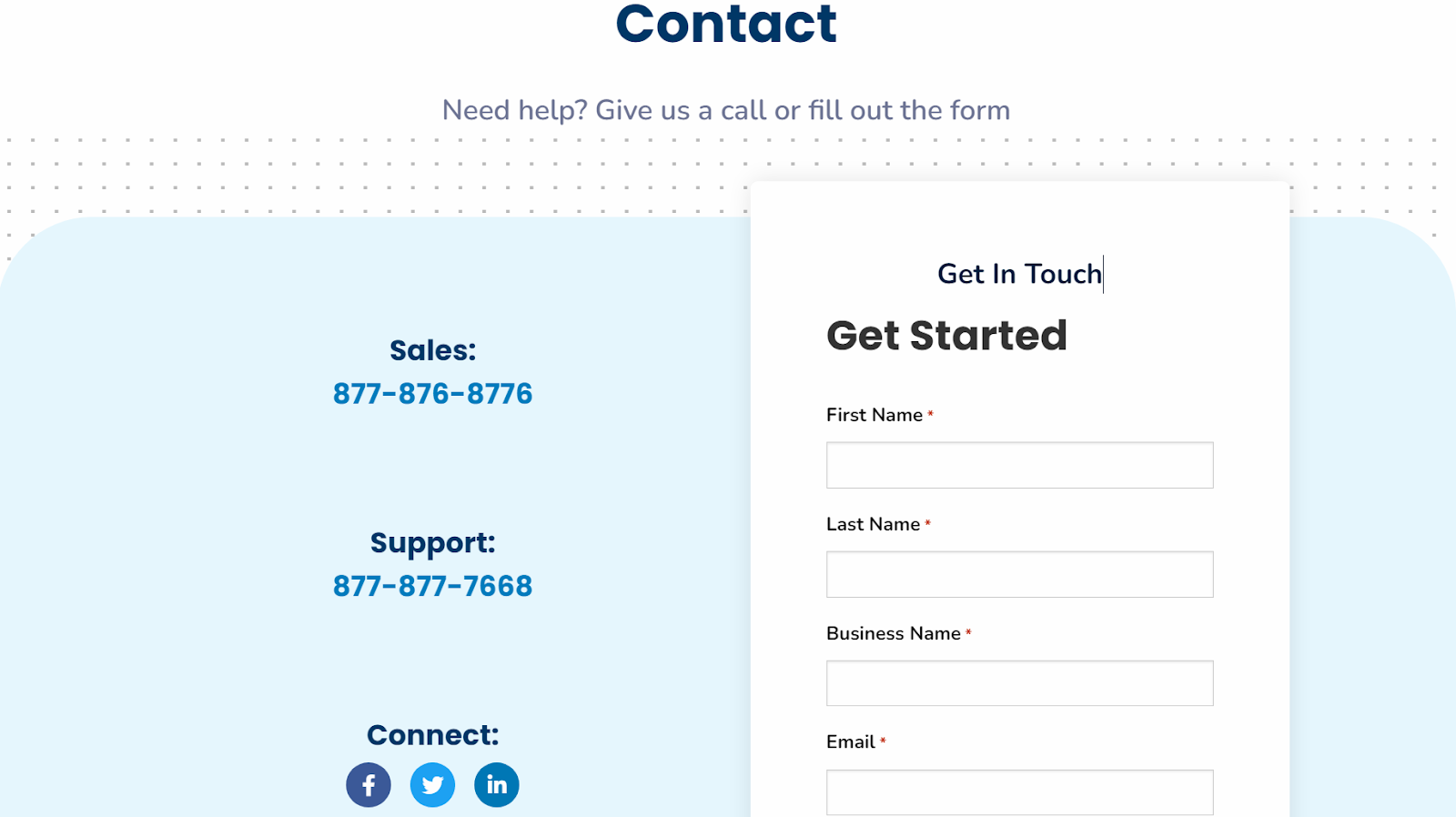

Both Square and Payment Depot have remarkably simple sign-up processes through their websites. Once you click on “Get Started,” you’ll need to provide your full name, company name, email address, and phone number. But while you might need to wait up to 24 hours to proceed with Payment Depot, you’ll be able to start processing with Square right away. Either way, you’ll eventually have to provide valid ID, your social security number, and bank details.

Compliance and Security

Payment Depot’s Robust Security Gives You Peace of Mind

Every credit card processor needs to be compliant with the Payment Card Industry Data Security Standard (PCI DSS). But not only does your processor need to be compliant, you must take steps to become compliant on your end too. So, how do these two processors compare on PCI compliance? Well, both processors are level 1 PCI-compliant, meaning they both follow the highest standards set by the PCI DSS. In terms of helping you become PCI compliant, neither provider goes above and beyond. Payment Depot doesn’t offer any explicit PCI compliance assistance on its site, but you can get guidance from customer support.

Unsure which processor is best for your business?

Take this short quiz and get a tailor-made recommendation in seconds

Pricing

Payment Depot Is the Cheaper Choice for Most Businesses

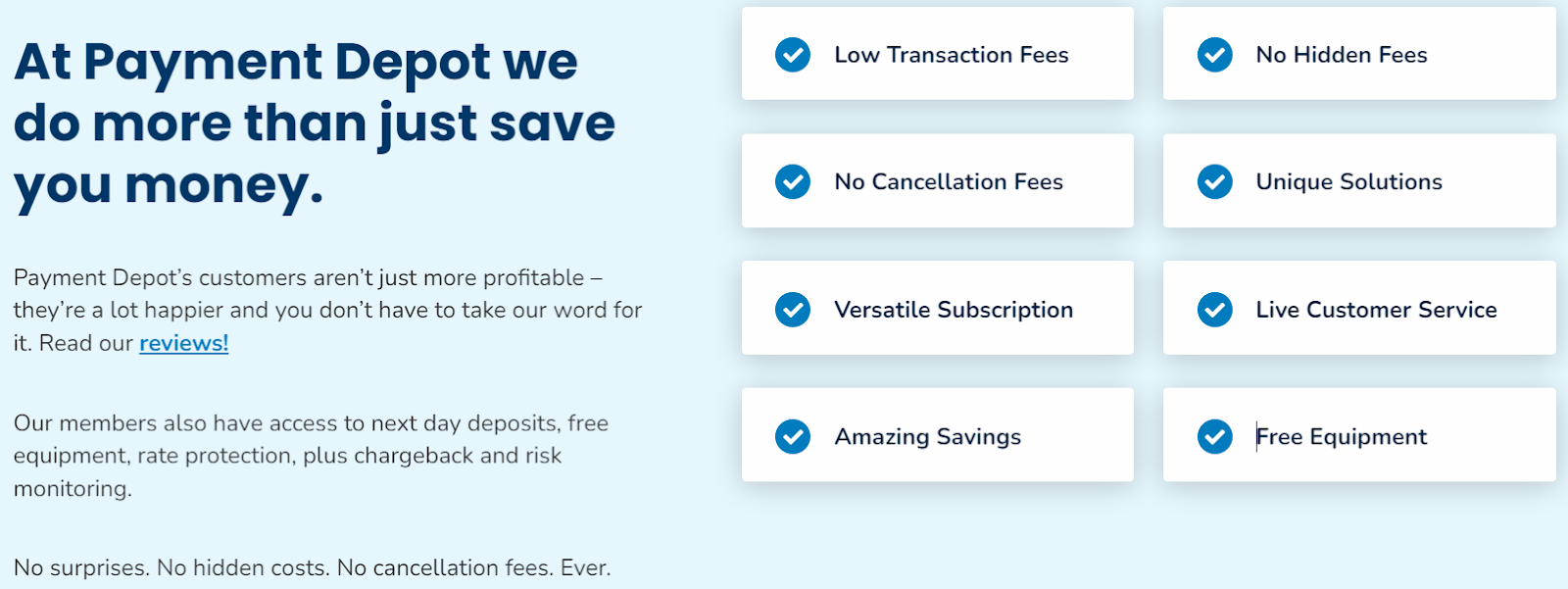

Square’s payment model is difficult to summarize since it offers so many different plans catering to various industries. Broadly speaking, you’ll pay either $0 or $25/mo (depending on whether you need industry-specific features) with a markup of around 2.5% + 10¢ for card-present transactions and 2.6% + 10¢ for card-not-present transactions. Payment Depot’s model is more straightforward – you pay $79 to $99 per month (depending on your yearly processing volume) and 0.2%-1.95% on transactions. If you process over $5,000 per month in credit card sales, this makes Payment Depot the cheaper option. The simplicity of this model will also give you greater stability if your income varies significantly month to month. Compared to many other credit card processors, Square is pretty affordable. However, Payment Depot’s simple pricing and low rates make it one of the cheapest credit card processors on the market, with merchants saving an average of $400 per month over providers that take a percentage of each sale you make, such as Square. It’s an especially great deal for high-revenue businesses and those handling lots of small transactions that would otherwise incur high transaction fees. For a quick comparison of these providers’ features, take a look at the table below.| Square | Payment Depot | |

|---|---|---|

| Monthly fee on the cheapest plan | $0 | $59 |

| Transaction fees on the cheapest plan | In-person: 2.5% + 10¢ Online: 2.6% + 10¢ | 0.2%-1.95% |

| POS Hardware | Range of modern but exclusive devices |

|

| Payment gateways | Proprietary | Authorize.net |

| Payout times | 1 business day or same-day funding for a fee | 1-2 business days or same-day funding for a fee |

| Options for recurrent billing | ✔ | ✔ |

| Analytic tools | Advanced tools like:

|

Simple tools like:

|

Support

Payment Depot’s Support Is Slow, but Square Never Got Back to Me

Payment Depot’s phone sales support is available from 8:30 a.m. to 7:30 p.m. EST, and its technical support is available 24/7. I called the sales line during the advertised business hours, and I had to wait over 15 minutes before someone picked up my call. Despite the short delay, once I got through, Payment Depot’s support representative was friendly and knowledgeable. They gave me lots of detailed help with setting up credit card processing for my (hypothetical) coffee shop. That being said, even if Payment Depot’s support had been far less helpful, it would’ve still beaten Square, simply because I received an answer. To contact Square, I filled out its contact form – and I still haven’t received a reply four days later (at the time of writing). Square doesn’t offer any phone support, and its chatbot asks for the same data as its contact form. It’s not all bad, though. Square offers a comprehensive knowledge base with detailed information about nearly all of its services.

Square Might Seem Attractive, but Nothing Beats Dependability

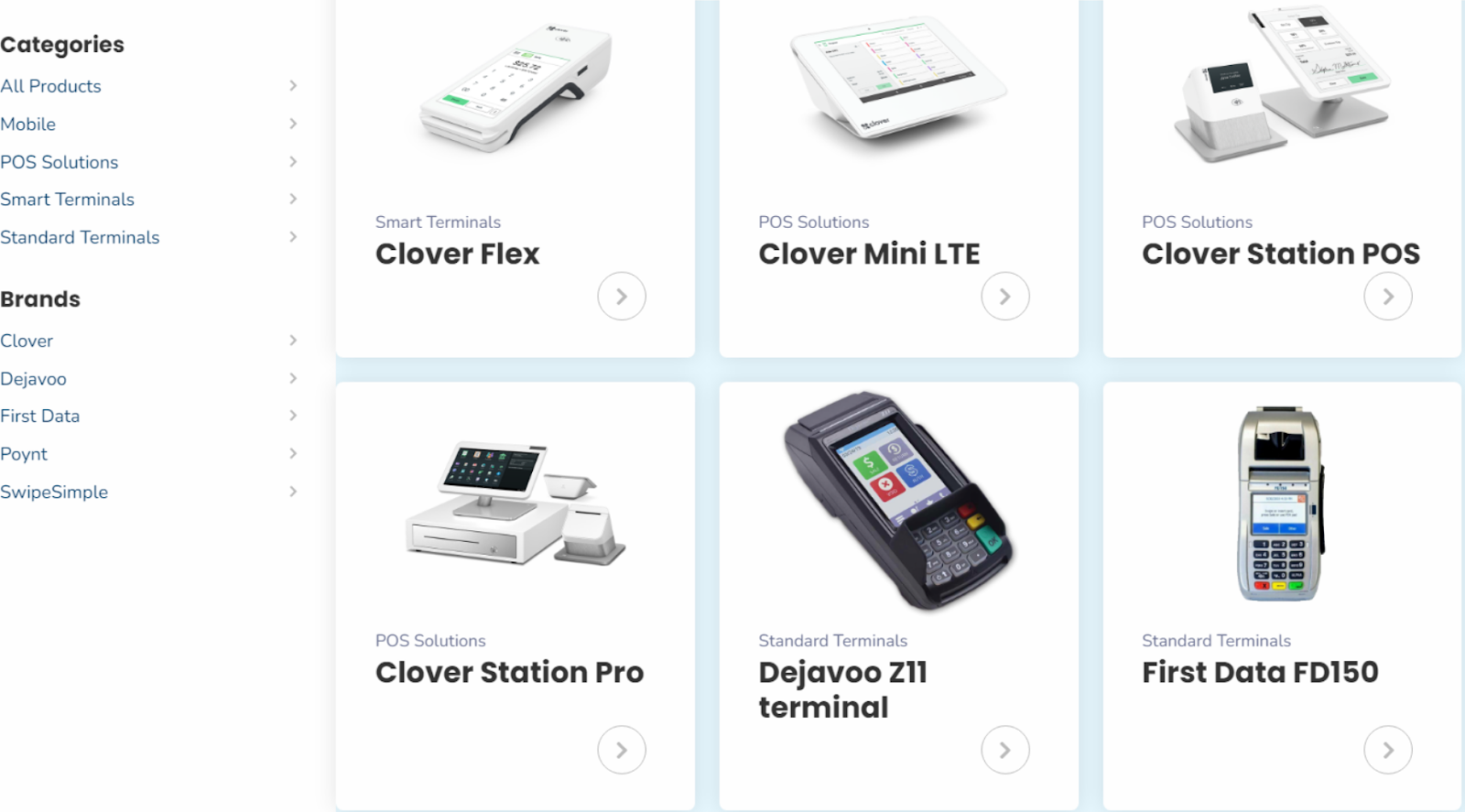

Although Square offers sleek and modern terminals with a full software ecosystem, Payment Depot won almost every category in my comparison, with its pricing model and overall reliability standing out the most. Payment Depot’s outstanding reputation among merchants makes it an ideal choice if you’re looking for a dependable service. What’s more, its third-party integrations and compatibility with tons of POS devices mean you won’t be locked out of any options if you ever decide to switch to another credit card processor. That doesn’t mean that Square’s all bad – far from it. Its modern, attractive terminals and excellent software make it an appealing option for trendy businesses, and its interchange-plus pricing model will probably work out cheaper if you’re processing less than $5,000 per month.Square

Payment Depot

Features

Advanced ecosystem of features

Reliable features with plenty of extensions

Ease of Use

Incredibly easy to set up with user-friendly software

An easy set-up process that can take some time

Security

PCI-compliant, but risk of account closure

Level 1 PCI-compliant, advanced fraud prevention and chargeback protection features

Pricing

Percentage markup on transactions saves money for low-revenue businesses

Fixed monthly payment with no markup fees – save more the money you earn.

Support

Robust knowledge base but poor quality support

Attentive support and a comprehensive blog