Evgeny, can you give us a brief overview of Payture as a company and its backstory?

Our company started its career in the Internet acquiring and payment service market in 2010, and until now we consider it our main mission to support innovation and develop payment services, ensure uninterrupted service for our customers in a 24/7 format, and solve specific and non-standard tasks of large businesses. Significant milestones in the development of our company in the Russian market were: – The introduction of Google Pay and Apple Pay for online payments was the first in Russia, – Obtaining the status of a Mastercard gold digital vendor, – Creating Masterpass, BusinessBonus, and Pay & Get services for Mastercard – Connecting the possibility of payment by QR code, – Connecting the ability to pay with tokenized PAY methods (T-Pay, SberPay, MirPay, Samsung Pay), and FPS (Fast Payment System) – Creating an accelerated on-boarding service for small and medium-sized businesses Payture Lite, Now we are the first Russian fintech company, who enter into a strategic partnership with BRICS Pay.Why is the status of independence important for you and for your partners?

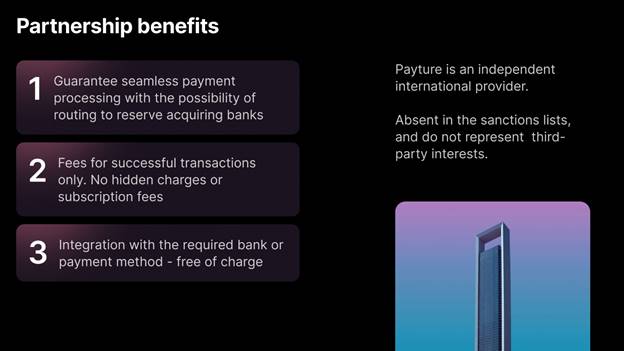

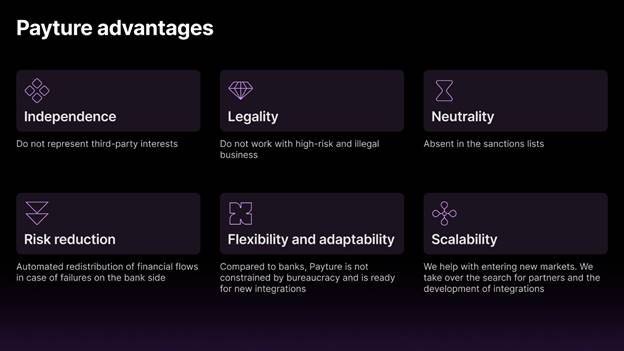

Processing centers, such as Payture, are a technological add-on over banks, and therefore, on the one hand, are their partners, and on the other, competitors. That is why at a certain point in time, banks in Russia began to provide Internet-acquiring services to end consumers themselves, and later, in order to expand their functionality, they began to acquire processing centers already operating on the market. So, over the past 5 years, there have been almost no large processing centers in Russia that are not affiliated with large banks or government agencies. We always strive to give maximum opportunities to our customers, and therefore, year by year, we expand our partner network not only in Russia but also abroad. As a payment partner, we help Russian companies with access to foreign markets, and foreign companies with access to the Russian market. This is possible thanks to a wide partner network in Russia, the CIS, Europe, America and Latin America, the Middle East, and Asia. Thanks to this and our status as an independent processing center, even despite the sanctions imposed in recent years, our customers still receive fast service at the same high level as before in all points of our presence.

How does Payture manage to maintain its status as a technology leader despite competing with banks?

To maintain market leadership and a high level of service for clients, we hire, train, and educate truly strong professionals not only in analytics and development, but also in the areas of customer service, marketing, and business analysis. At the same time, we do not inflate the corporate structure, thanks to which the team lives as a single professional organism, not constrained by excessive bureaucracy. Therefore, unlike market giants, Payture is a profitable partner for business due to the ability to maintain flexibility and independence in business, and quickly adapt to changes in technology and regulation, while maintaining stability in risk management. Also, among our advantages has always been independence, which allows us to give customers the services of those banks and providers that are really important for the development of their business. For example, we can simultaneously provide services and payment methods for competing organizations not only in the Russian Federation but also abroad. The presence in the markets of various countries and the presence of a wide network of partners guarantees our clients the ability to scale to foreign markets without the need to make additional integrations and immerse themselves in unnecessary complex bureaucracy. We help our customers scale without incurring additional charges. The settlement system always remains the same – a commission from successful transactions. The necessary integrations are at our expense. Partnership with Payture as a vendor and payment service provider allows the business to relieve itself of the tasks associated with the development, integration and support of software solutions in the field of online payments.

What payment methods do you support and work with?

We support payment by bank cards, payment by QR, Sber Pay, T-Pay, Mir Pay, Apple Pay, Google Pay, Samsung Pay, payment through mobile commerce, payment in parts, and payment by link.

Apart from Payture Lite, you also offer custom solutions to your customers. What features of Payture Lite are customizable and who may benefit by opting for each of the 2 options?

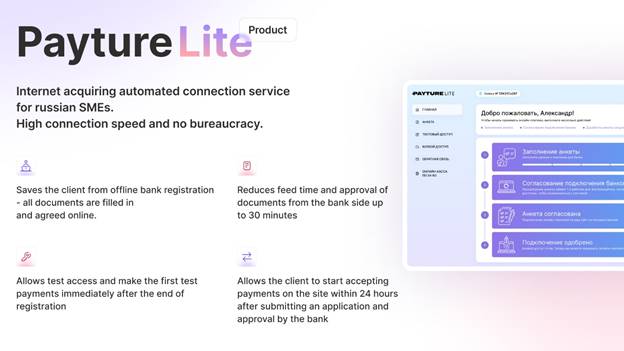

In Payture Lite, you can manage the data of your enterprise (for example, send a connection request for several legal entities), automatically obtain approval from the acquiring bank to connect payments, as well as control test operations and integration with a payment provider (all test data and terminals are generated automatically). In 2025, Payture Lite will also be able to choose an acquiring bank to connect and automatically connect the online payment fiscal service. The main benefit of Payture Lite is its quick connection to the bank, which is very valuable for small merchants, while the ability to integrate through the API and take into account individual requirements makes it possible for corporate clients to more flexibly manage the entire payment scenario and control its every stage. Payture Lite efficiency:

• Up to 85% savings in merchant time for submitting documents to the bank;

• 50% to 80% savings in merchant time to review and approve an application;

• Up to 95% saving of account managers time on the client onboarding process;

• 100% increase in conversion to connected customers since the product launch.

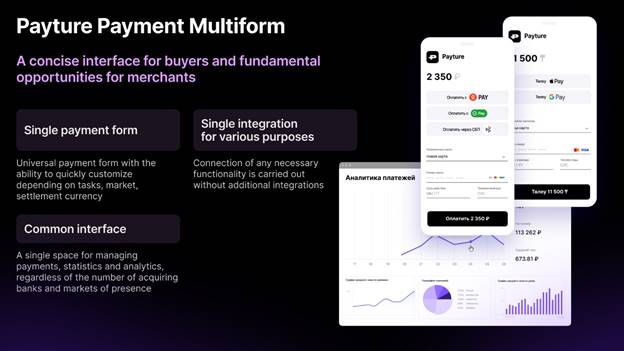

If we return to the second side of our service – API integration, then this can also be called a connection to the Payture Payment Multiform product.

Payture Payment Multiform is a product that allows businesses to discover a wide range of online payment opportunities through a single integration with the Payture International Processing Center.

The uniqueness of the product lies in a single and concise payment form that can organically adapt to any business needs, be it cross-border settlements, routing payments between different card issuing banks, cascading between acquiring banks, or a combination of different payment methods from competing banks – service providers.

Payture Lite efficiency:

• Up to 85% savings in merchant time for submitting documents to the bank;

• 50% to 80% savings in merchant time to review and approve an application;

• Up to 95% saving of account managers time on the client onboarding process;

• 100% increase in conversion to connected customers since the product launch.

If we return to the second side of our service – API integration, then this can also be called a connection to the Payture Payment Multiform product.

Payture Payment Multiform is a product that allows businesses to discover a wide range of online payment opportunities through a single integration with the Payture International Processing Center.

The uniqueness of the product lies in a single and concise payment form that can organically adapt to any business needs, be it cross-border settlements, routing payments between different card issuing banks, cascading between acquiring banks, or a combination of different payment methods from competing banks – service providers.

What is available “under the hood” of the Multiform?

• Cascading payments; • Mass payouts; • Multi-currency settlements; • Holding of funds; • Recurring and recurrent payments; • Cross-border payments; • Full or partial return; • Payment split; • Work with registers; • The ability to connect local and international payment methods: T-Pay, Sber Pay, Mir Pay, FPS (СБП), Apple Pay, Google Pay, Samsung Pay, mobile commerce, etc. Payture multiform in numbers: • Reduces infrastructure development and maintenance costs by 85%; • 10-20% More conversion of multicurrency payments; • Reduces standardization and document maintenance costs by 20%; • Up to 10% Us-on-Us savings; • 0.1% to 1.5% savings on risk losses due to availability of redundancy; • 0.5% to 1.5% conversion savings through payment routing.What can you tell me about your Anti-Fraud services?

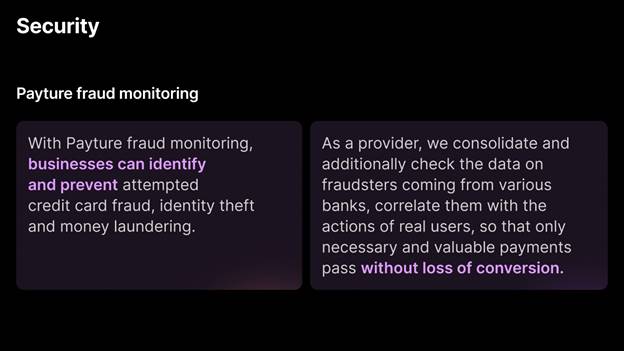

We have our own anti-fraud solution, which is tightly integrated with our payment services and is provided to customers free of charge when connected to Payture. Our solution supports all basic limits and restrictions on exceeding specific payment parameters (for example, payment frequency or amount), blacklist and whitelist functionality, collection of data from the payment form (fingerprint), use of the payer profile, and many other internal functions to determine both valid and fraudulent payments. One more of our primary goals is to collect as many relevant metrics and payer parameters as possible. In addition to the usual browser or mobile device data, we collaborate with merchants to process internal service parameters that are not visible to users. This allows us to conduct a comprehensive assessment of a transaction across various business sectors, without being limited to a standard set of parameters. Of course, in addition to the internal service of fraud monitoring, we also fully support the 3DSecure 2.0 security standard, and we closely monitor its ongoing developments.

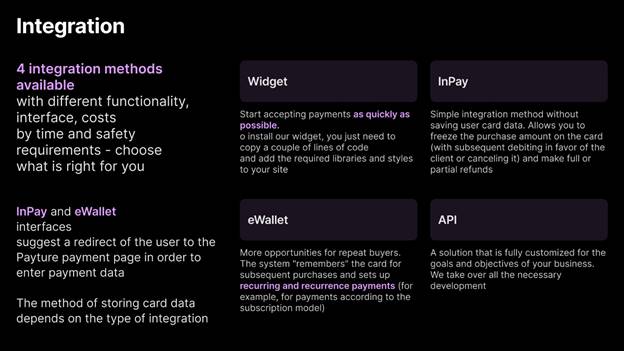

What methods of integration do you support?

We support API integration with the merchant payment form, integration using the Payture payment form, and integration with saving payment data in Payture for further implementation of the subscription payment service. Payture is a certified payment provider that meets all the requirements of the payment card storage security standard – PCI DSS, so our partners can be 100% sure of the safety of their customers’ card data.

To learn more about Payture, you can visit payture.com