Inside this Article

How To Use Square’s Magstripe and Contactless & Chip Reader

Step 1: Charge Your Reader

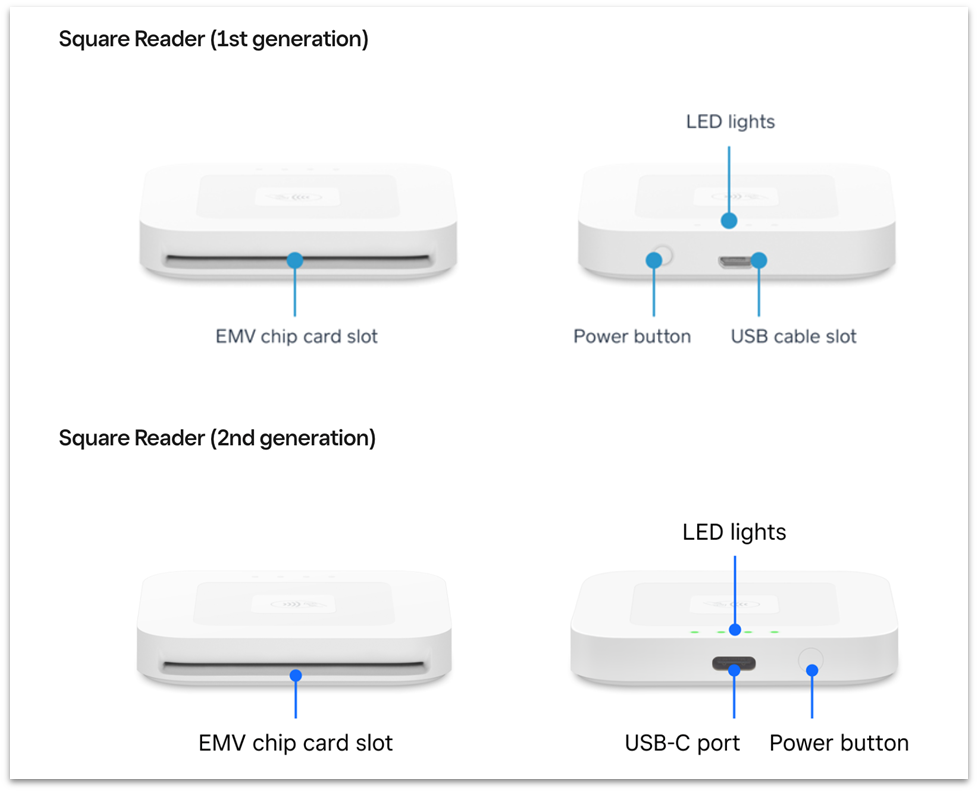

The contactless and chip reader comes with a charging cable, a USB port for the charging cable, a built-in contactless antenna, a power button, and a card slot. A full charge takes 2-3 hours and provides your reader with about a day of battery life. The magstripe reader doesn’t need to be charged!Step 2: Install the Square POS App

- Go to the Apple App Store or Google Play Store to download the Square POS app on your device. Depending on your chosen plan and device, you’ll download the Square POS, Square for Restaurants, Square for Retail, or Square Appointments app.

- Next, open the app and sign in with your existing Square account or set up a new one.

- Go to your device settings and turn on Bluetooth. Then, open your device’s Square POS app and select More > Settings > Hardware > Square card readers. Tap on “Connect a Reader.”

- Next, press and hold the power button on the reader and release it when 4 orange lights start flashing. Once these lights turn green, your reader is connected to your device. If your reader disconnects from your device, press the power button once to reconnect instantly.

Step 3: Start Taking Payments

- Select items from your Square item library and add them to the cart, or just enter a dollar amount for a new item and click on Charge.

- When a green light appears on your contactless and chip reader, your customer can hold their card or device near the contactless symbol or insert their card into the card slot. For magstripe readers, your customer would need to swipe their card through the reader with the magnetic strip facing toward the thick side of the reader.

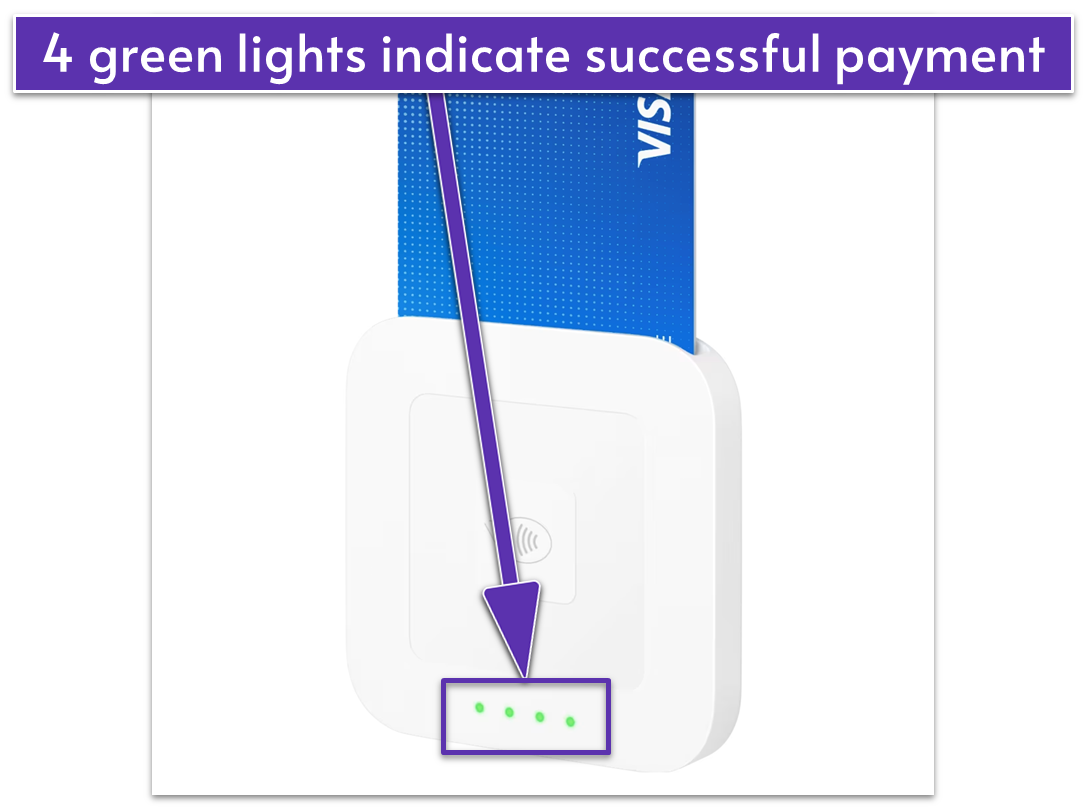

- Once a checkmark appears on your POS app, or you see 4 green lights on your reader and hear a beep, the payment is complete.

- You can then send receipts via email or text or print one by connecting a wireless printer.

Taking Payments Without Your Square Reader

In today’s fast-paced business environment, there are times when you might need to process a payment without having your Square reader handy. Whether you take an order over the phone or forget your reader, Square offers several convenient solutions for card-not-present transactions.Virtual Terminal

One of the easiest ways to accept card-not-present payments is through Square’s Virtual Terminal. You can access it via the Square Dashboard on your computer and manually enter payment details without needing any additional hardware. Now would be a great time to set up your online store if you haven’t already. How to use the virtual terminal:- Log into your Square Dashboard on your computer.

- Navigate to the Virtual Terminal.

- Enter the transaction amount, credit card information, and any additional notes about the sale.

- Click “Charge” to complete the transaction.

Manually Keying In Credit Card Information

Another method for processing payments without a reader is to manually enter credit card details directly into the Square POS app. While this method carries a higher risk of fraud and higher processing fees, it’s a reliable backup option when needed.

To minimize fees and reduce chargeback risk, I recommend using manual entry sparingly and only when necessary, such as when a card is damaged or your reader is unavailable.

Steps for manual entry:- Open the Square POS app on your mobile device.

- Enter the transaction amount.

- Manually input the customer’s credit card details.

- Complete the transaction by tapping “Charge.”

Card-on-File Transactions

Saving your customer’s card information for future transactions can streamline your sales process. With Square, you can securely store card details and use them for subsequent purchases. Remember that card-on-file transactions are considered card-not-present, so they incur slightly higher processing fees. How to save and use card-on-file:- When completing a sale, choose the option to save the customer’s card information.

- For future transactions, select “Card on File” to charge the saved card.

Invoices

Square Invoices is convenient for accepting payments without keying in card information. This method is particularly useful for higher-value transactions or when you’d rather avoid handling card details directly. How to send an invoice:- Open the Square Dashboard or POS app.

- Navigate to the Invoices section and create a new invoice.

- Enter the customer’s email address and the transaction details.

- Send the invoice. Your customer will receive the invoice via email and can securely enter their payment information from their device.

Set Up Your E-Commerce Store

If you want to sell online, you need a website to promote and sell your products. The process doesn’t have to be complicated, especially if you use an easy-to-use builder like Square Online. The Square reader links up to the Square POS app, and it can automatically sync data to and from your Square Online store. Using Square Online with the Square POS app provides seamless two-way inventory management. When you sell a product, your inventory updates automatically in both your physical and online stores, ensuring accuracy and saving you time. Any changes you make are instantly reflected across all sales channels. Plus, you get integrated sales reporting, giving you a comprehensive view of your business performance in one place. Although useful, Square Online has few customization options. If you want to create an online store that accurately represents your brand and truly stands out, you’ll need to use a different platform. The best e-commerce platforms give you all the features you need to run your e-commerce business while also ensuring it is as unique and personalized as possible. What if you don’t need an e-commerce store yet and don’t have a website, either? Well, there’s a high chance you’re losing valuable traffic to your competitors. Keep up by using a top website builder to promote your business – you can always add an online store later.

Unsure which processor is best for your business?

Take this short quiz and get a tailor-made recommendation in seconds

Square Reader Pricing

Square’s pricing for its card readers is very straightforward and transparent. There are no hidden fees or compulsory subscriptions. Also, processing fees are the same regardless of the type of card. Fees vary only based on the form of payment.

Standard Processing Fees

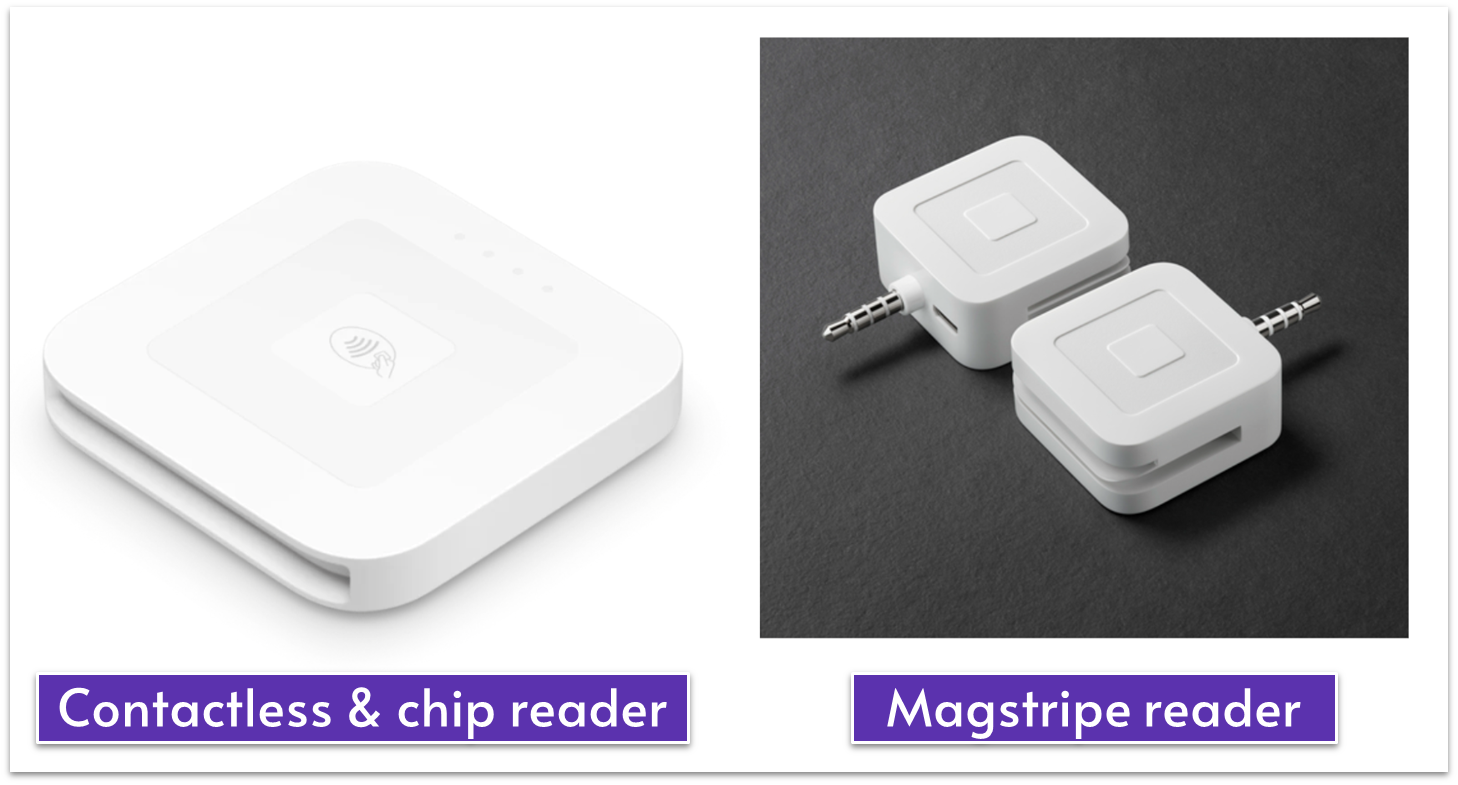

Mobile card reader fees: When using Square’s card reader with your smartphone or tablet, you’ll incur a standard processing fee of 2.5% + 10¢ per dip, tap, or swipe payment. Or, if you’re on Square’s ‘free’ plan, you’ll pay 2.6% + 10¢ per transaction. Manually entered transactions: When you manually enter the credit card number, the processing fee is 3.5% + $0.15 per transaction. This higher rate reflects the increased risk associated with manually entered transactions, but it’s still transparent and competitive overall. Card-on-file transactions: When you’ve saved a customer’s card information for future transactions, it incurs a processing fee of 3.5% + $0.15 per transaction. Invoices: For transactions where you prefer not to enter card details manually, you can send an invoice through Square Invoices. The processing fee for invoices is 2.9% + $0.30 per transaction. This method allows customers to securely enter their payment information at their convenience. Afterpay transactions: For businesses offering the buy now, pay later option through Afterpay, Square charges a processing fee of 6% + $0.30 per transaction. While this rate is much higher than usual, it’s a reasonable trade-off: customers can avoid a large upfront cost while you still get the full amount immediately.Card Reader Options

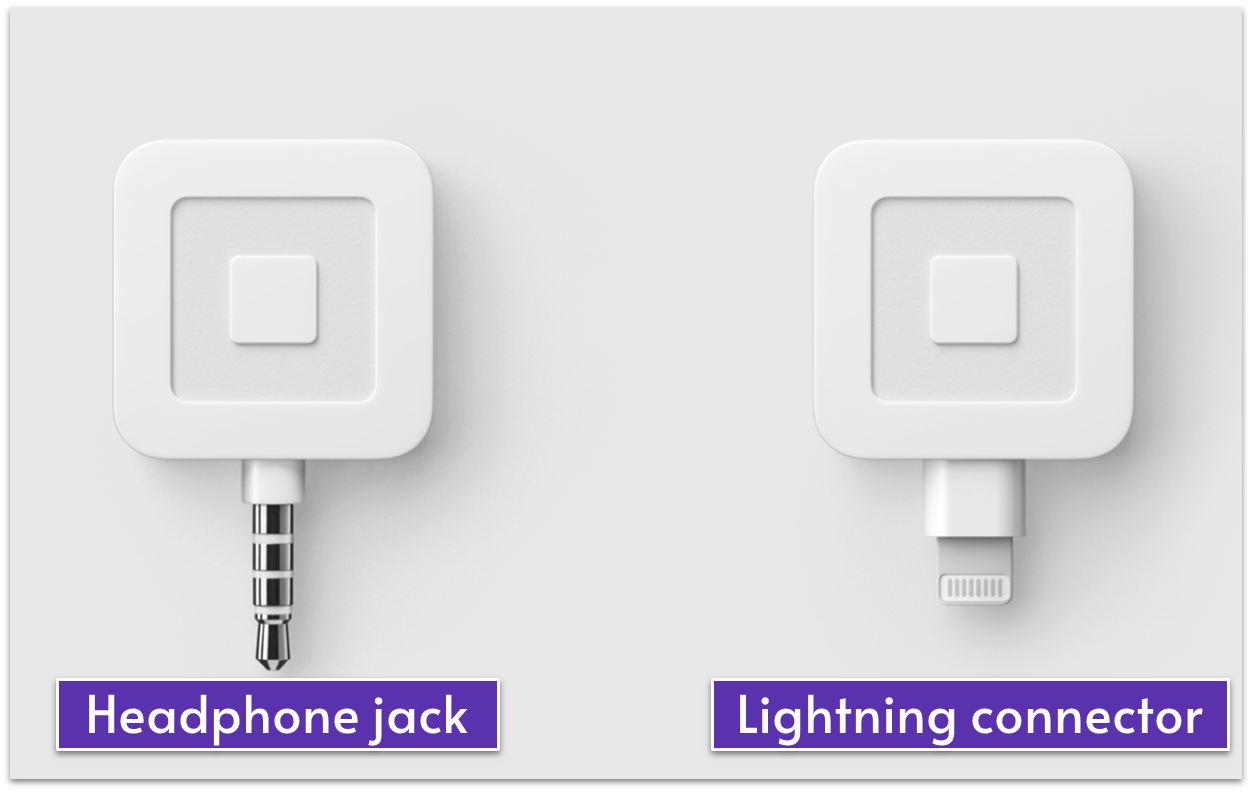

Upon signing up for a new Square account, you can receive a free Square magstripe reader shipped directly to you at no cost. Depending on your device’s compatibility, you can choose between:- Lightning connector reader for iOS Devices.

- Headphone jack reader – compatible with most Android devices and older iOS models.

Consider Alternatives to Square’s Reader

Although Square has several devices available, and they’re pretty easy to set up, the payment processor itself is pretty inflexible when it comes to POS equipment. For instance, you can only use Square’s proprietary hardware as a Square merchant – you can’t reprogram your existing hardware to use with your Square account.

Plus, if you decide to switch processors in the future, you won’t be able to reuse any of the devices you bought from Square.

And crucially, while Square’s fees are transparent, they aren’t the lowest. Other payment processors offer lower rates, which matters more for your business’ earnings in the long run than having a nice card reader.

All the credit card processors below offer low rates alongside card readers that are as easy to set up as Square’s but are also more flexible.

Leaders Merchant Services

Our Score

Our Score

Negotiable Low Credit Card Processing Rates

Monthly Fee:

$9

Transaction Fee:

From 0.15% + $0

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Paysafe

Our Score

Our Score

Top Global Payment Processor With Industry-Specific Merchant Accounts

Monthly Fee:

$7.95

Transaction Fee:

From 0.50% + $0.10

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Stax

Our Score

Our Score

Save Up to 40% on Credit Card Processing Fees

Monthly Fee:

From $99

Transaction Fee:

From 8¢ + Interchange

Pricing Model:

Subscription

Subscription

With subscription-style pricing, you’ll pay a fixed monthly fee instead of a percentage-based markup on each credit and debit card transaction. While this will considerably reduce your per-transaction fees, you’ll typically still pay a small flat fee on each transaction. This amount is unaffected by the variable interchange fees charged by the different card networks (e.g. Visa, Mastercard), helping to keep your payment processing fees more predictable.