Inside this Article

Benefits of Mobile Credit Card ProcessingMobile Credit Card Processing ComponentsMobile Credit Card Processing and Fraud RiskHow To Choose a Mobile Payment ProcessorSetting Up Mobile Credit Card ProcessingOur Top 4 Mobile Credit Card Processing CompaniesWhy Businesses Need Mobile Credit Card ProcessingFAQ

Benefits of Mobile Credit Card Processing

First, why should your business invest in mobile payment processing?- It’s a budget-friendly POS option. You can accept card payments without paying hundreds or thousands of dollars for POS devices. mPOS devices usually cost a fraction of a full-size terminal, while most payment gateways and virtual terminals will offer mPOS apps for free.

- It’s more convenient for all parties. This is particularly true if you have a field services business that would otherwise invoice customers for work completed. Instead of chasing invoices, you can ask customers to pay your technician before they leave the customer’s house.

- It can boost your sales. You can minimize lost sales opportunities by offering customers multiple ways to pay.

- It reduces the risk for field service technicians. By removing the need for your technicians to carry cash, you can reduce the risk of theft or financial loss in the field. This keeps both your financial health and your technicians safe.

Mobile Credit Card Processing Components

You’ll need a smartphone app to process credit card payments on your phone. You’ll also need a mobile card reader to accept different payment methods.mPOS Apps

- More payment methods (some apps allow you to process cash, check, and even contactless payments)

- Offline payments

- Digital receipts

- Digital invoicing

- Payment links and QR codes

- Inventory management

- Transaction management

- Reporting and analytics

Top Tip: Device Compatibility

When considering an mPOS app, ensure it’s compatible with the version of Android or iOS on your smartphone. Any reputable mPOS app will work on the latest version of your smartphone’s operating system, but backward compatibility will vary greatly. The best mPOS apps typically support iOS 13/Android 8 and up.mPOS Devices

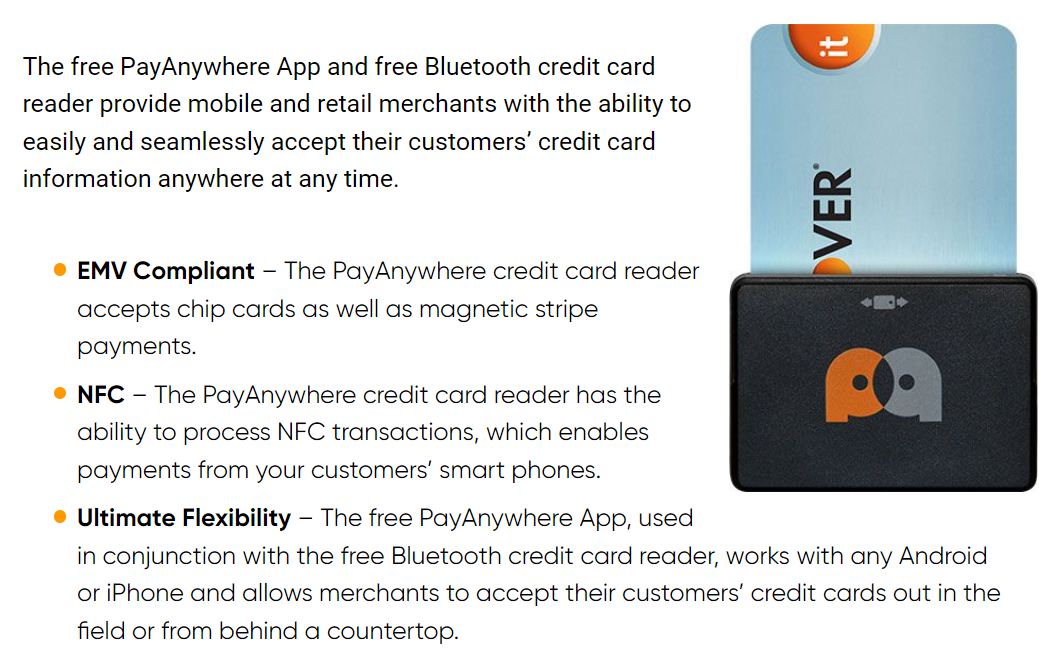

- Standalone card terminals. These usually connect to a smartphone via Bluetooth, Wi-Fi, or cellular data so you can hand them to the customer. Accepted payment methods usually include EMV, swiped, and contactless.

- Wireless PIN pads. Like standalone terminals, these devices connect to your smartphone via Bluetooth, Wi-Fi, or cellular data. However, instead of providing a full display, these devices either lack a screen or simply show the transaction total. Customers can typically use EMV, swiped, or contactless payment methods.

- Compact card readers. These are the simplest kind of mPOS devices. Some connect wirelessly, while others plug into your smartphone’s headphone jack or charger port. Because of their size, you may only be able to accept one payment method. However, there are options for EMV, swiped, and contactless payments. Any customer-facing display appears on your smartphone instead of the mPOS device.

Mobile Credit Card Processing and Fraud Risk

Even though keyed-in payments are still secure, they present a greater risk of fraud because there aren’t as many verification checks. The customer doesn’t have to input a PIN or provide additional verification apart from their billing address. Although every reputable payment processor should use address verification (AVS), it can’t always prevent fraud. As a merchant, you also can’t trust that the payment card presented by the customer at the point of sale belongs to them. In addition, there’s a greater risk of so-called “friendly” fraud (e.g., when a customer raises an illegitimate chargeback request). Because there are fewer verification checks, it’s easier for customers to claim that their card was stolen. The best way to reduce your mobile credit card processing costs and the risk of fraud is to use an mPOS. If you’re working with a limited budget, a simple, compact reader provides additional verification, making it easier to win a chargeback dispute. In addition, we recommend doing the following to protect your business from the risks of mobile payment processing:- Send digital receipts. Most mPOS apps can send digital receipts to cardholders. Depending on the app, you may also be able to save copies of receipts on a customer’s file for easy reference if something goes wrong.

- Use itemized invoices. Always itemize invoices so customers know exactly what they’re paying for. If possible, I recommend asking the customer to sign the invoice as additional verification they received and were happy with the goods/services provided.

- Be aware of the signs of fraud. These change regularly as fraudsters attempt to stay ahead of the curve. Typical “tells” include customers asking you to type in card details instead of using mPOS devices, the name on the card having no relation to the payer, and defaced cards.

Unsure which processor is best for your business?

Take this short quiz and get a tailor-made recommendation in seconds

How To Choose a Mobile Payment Processor

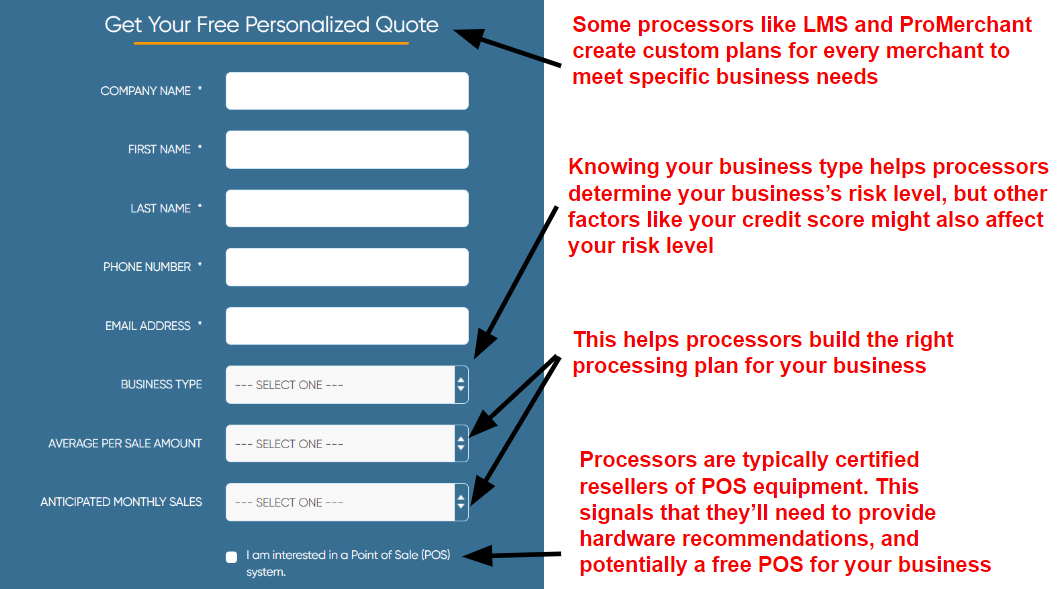

Before you start looking for a mobile payment processor, it’s crucial to understand how your business operates. You’ll need to know your business’s monthly income as well as transaction size and volume. Most importantly, you must assess how many transactions you process outside your business location. You might not have this information if you’re still setting up your business, so it’s a good idea to get a financial projection before you apply. If you already process transactions in the field, take note of the payment methods your customers prefer to use. For example, if you already take keyed-in payments on your phone, a payment processor offering a free mobile card reader and an easy-to-use app would be a good choice. You must also determine where you take payments to determine which mPOS app and devices you need. To process mobile payments, you’ll need a reliable Wi-Fi or 4G (at minimum) connection for your smartphone and your mobile terminal (if you’re using one). If you can’t guarantee a decent internet connection, you’ll need an app that supports offline payments. A reliable option is the SwipeSimple app offered by Leaders Merchant Services.Setting Up Mobile Credit Card Processing

Getting started with mobile card processing is simple, but depending on your payment processor, setting things up can take a few days.1. Research Your Options

Once you’ve got a good idea of your business, how your customers pay, and where you take payments, check our top 4 mobile payment processors. While this isn’t an exhaustive list of every reputable mobile payment processor, these companies offer the best mPOS features for a reasonable price. On top of that, make sure you read about the best credit card processing apps to learn more about specific app features.2. Apply for a Merchant Account

- Previous payment processing statements and/or bank statements

- Proof of ID

- EIN Number

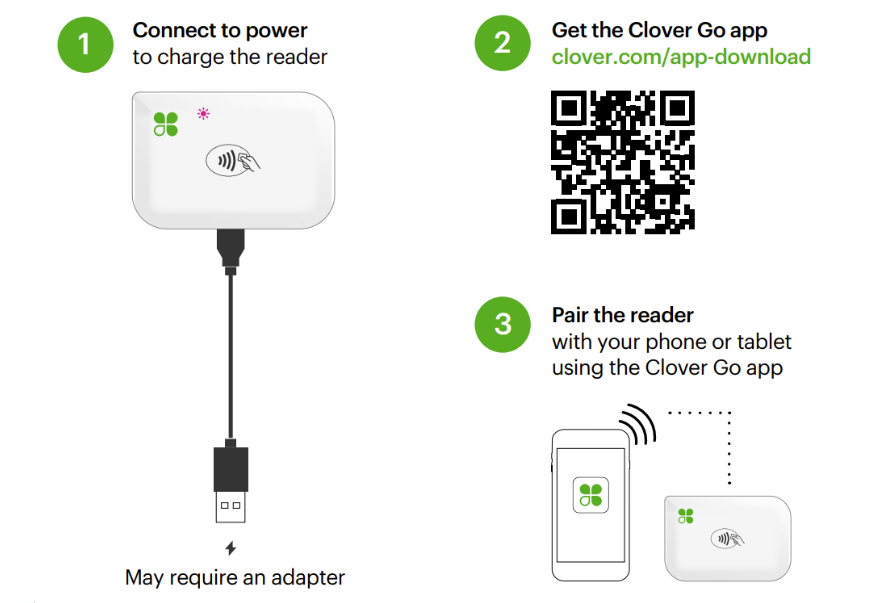

3. Set Up Your mPOS App (and Devices)

Top Tip: Smartphone Security

While reputable mPOS apps go through rigorous testing and receive regular security patches, you must also ensure your device remains safe. Only download your mPOS app from a verified source as fake apps can and do circulate on official app stores. Use two-factor authentication where possible, and remember to set a fingerprint lock or facial recognition on your phone.Our Top 4 Mobile Credit Card Processing Companies

Our payment processing experts spent months researching and evaluating payment processing companies to find the best options for your business. Here are our top four for mobile payment processing.

Free Card Reader

Our Score

Our Score

Best Credit Card Processor in 2025

Negotiable Low Credit Card Processing Rates

Monthly Fee:

$9

Transaction Fee:

From 0.15% + $0

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

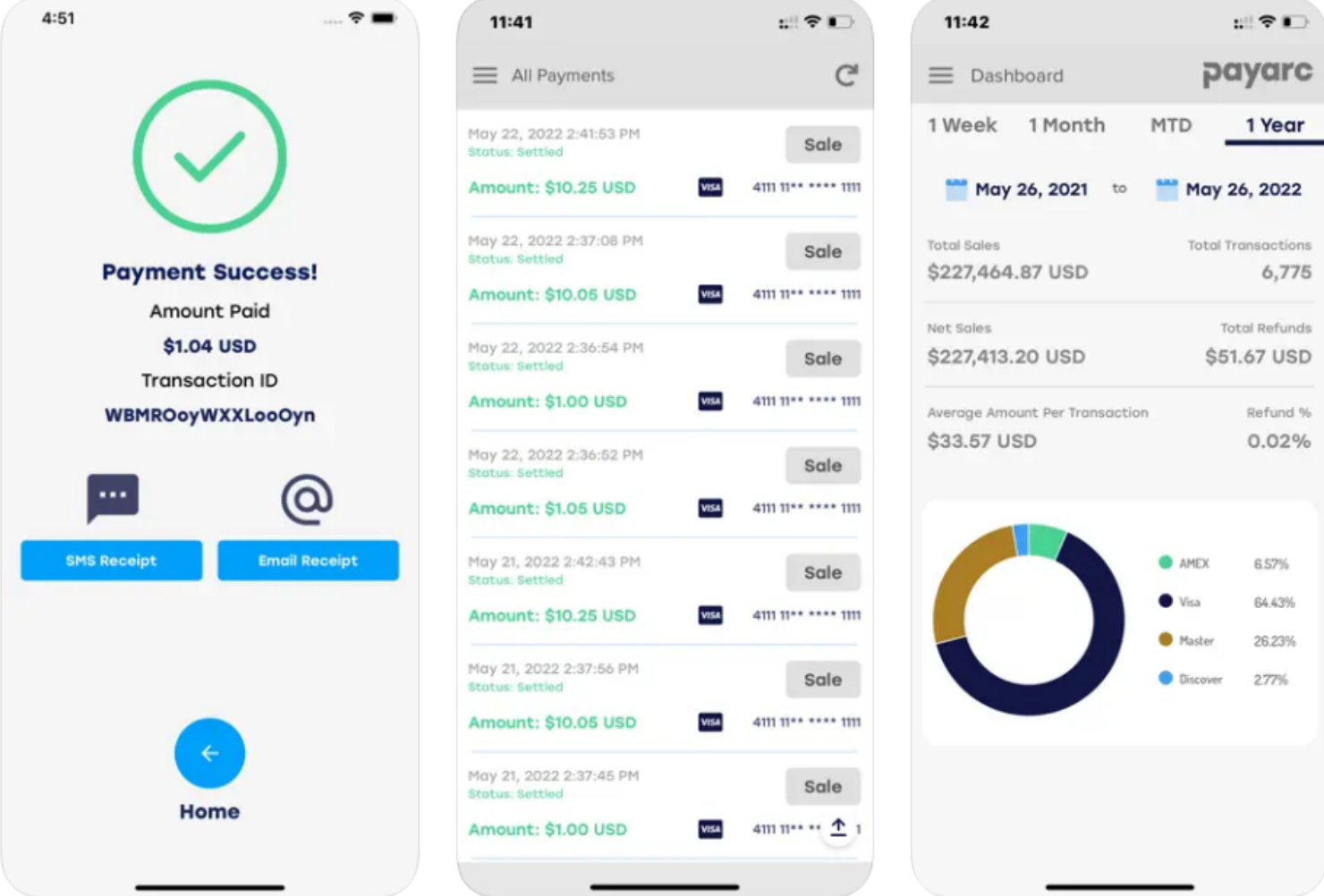

2. PAYARC: All-in-One mPOS Tool for iPhone Users

Our Score

Our Score

Custom Payment Processing Plans With No Hidden Costs

Monthly Fee:

From $69

Transaction Fee:

From 0% + 15¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

3. ProMerchant: Free Mobile App and Reader To Accept Payments

Our Score

Our Score

Interchange-Plus & Zero Cost Processing Plans Ideal for Restaurants and Retail

Monthly Fee:

$7.95

Transaction Fee:

From 3% + 10¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

4. Flagship Merchant Services: Accept Cash, Card, or Check

Our Score

Our Score

Fast Onboarding & Quick Payouts With Same-Day Funding

Monthly Fee:

From $15

Transaction Fee:

From 1.58% + 19¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.