Quick Guide: How to Accept Credit Card Payments in 4 Easy Steps

- Apply for a merchant account. While the features you need will vary depending on your business, Stax is the best choice for most established businesses. Its subscription-style pricing model can save you up to 40% on your processing bill.

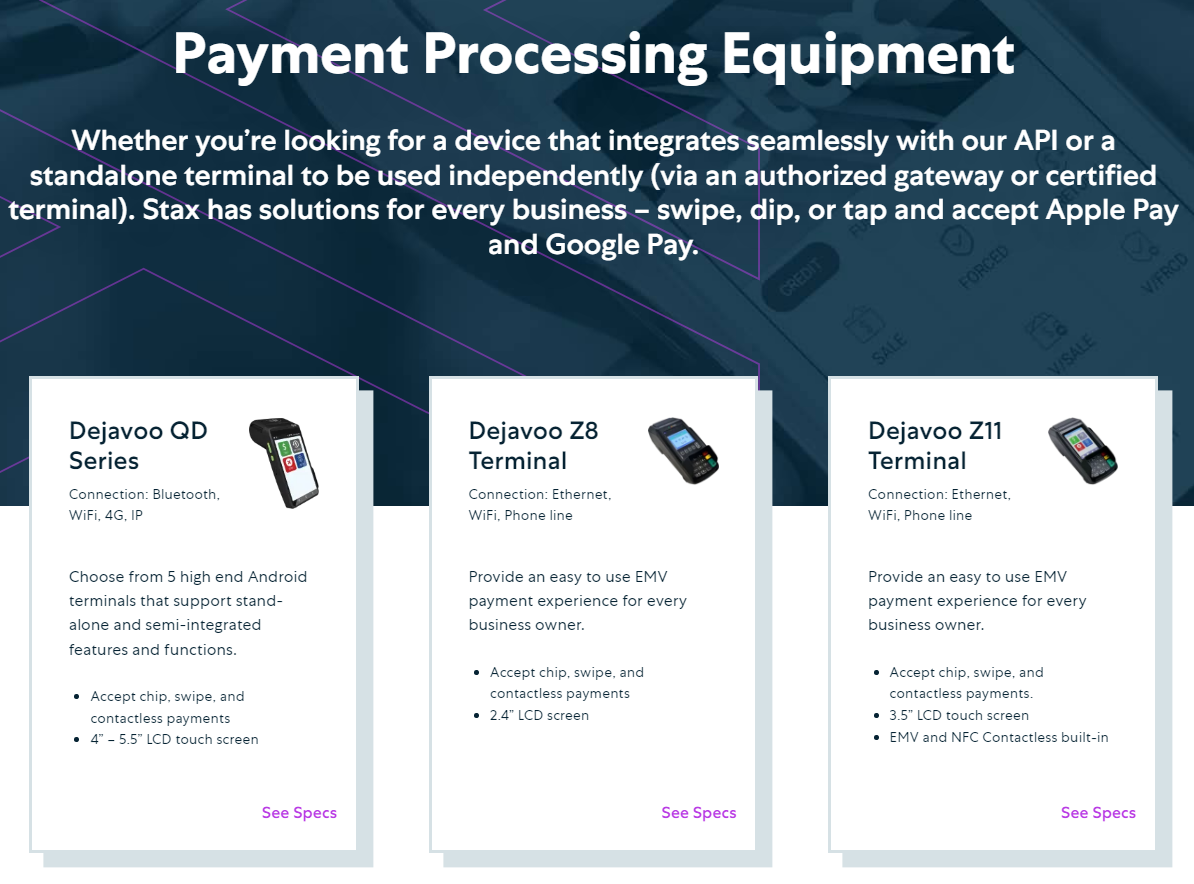

- Set up any hardware or software. Once you’ve been accepted for a merchant account, you’ll be sent detailed setup instructions to help you get started with any credit card readers or payment software you require for taking payments in-person, online, or over the phone.

- Set up legal compliance. Before you start taking credit card payments, your business needs to be PCI compliant, and you may need to ensure you follow any industry-specific data protection regulations.

- Start accepting payments. Now you’re ready to start selling your products or services to your customers. Go forth and grow your business!

How Does Credit Card Processing Work?

No matter how you accept card payments, each transaction will follow the same basic steps.- The customer inputs their payment information during a transaction. The card reader or payment gateway captures that information and forwards it to the payment processor. This data is then forwarded to the card network.

- The business’s payment processor communicates with the card’s issuing bank. The bank will check there are sufficient funds or enough credit available to complete the transaction. In addition, the bank and the payment processor will perform fraud detection checks.

- The transaction is approved. The payment processor instructs the issuing bank to release funds to the business’s merchant account.

Top Tip: Payout times

You’ll typically receive your funds in a few business days. This can depend on a variety of factors, such as congestion on the card network delaying approval, payment methods, or your merchant account provider’s processing time. Our top 3 recommended credit card processors all offer payouts within 72 hours, which is ideal if you need a regular cash flow.How you capture payment information will depend on the payment method used. These are typically split into two groups: card-present (CP) and card-not-present (CNP) transactions.

Card-Present Transactions

In a card-present transaction, the customer’s card has to physically interact with a point-of-sale (POS) device to transfer payment information. So, these payment methods include:- EMV/dip/chip-and-pin. The customer inserts a chip card into a card reader and enters a PIN number.

- Swipe. Customers swipe the magnetic stripe on their card and input their signature on a card reader or sign a receipt to confirm their identity.

- Tap/contactless. The customer taps their card on a card reader. Both the card and reader must be contactless-enabled.

- Near-field communication (NFC). Near-field communication allows customers to use their smart device to transfer payment information from a digital wallet to a card reader in the same manner as tapped payments.

- Pre-authorized payment. Also referred to as a deferred payment, this allows you to capture a customer’s payment information and hold funds in their account for (typically) up to 5 days. You can then run the transaction when the service has been provided.

Point-of-Sale (POS) Devices

- Card terminals and PIN pads

- Cash drawers

- POS terminals

- Mobile card readers

Top Tip: Proprietary POS Devices

Some payment processors offer what’s known as proprietary hardware – these are branded devices that only work with that specific processor. We advise against purchasing proprietary devices as most can’t be reprogrammed, which leaves you out of pocket if you end up leaving that payment processor.Card-Not-Present Transactions

Card-not-present transactions are any transactions where the customer’s card doesn’t physically interact with the point-of-sale device. You may see these payment types referred to as e-commerce or remote transactions. Card-not-present payment methods include:- Payment gateways. The customer inputs their card information into a secure form on your website or a third-party checkout page.

- Digital wallets. Wallets like Google Pay, Apple Pay, and PayPal offer one-click checkout buttons. This allows customers to pay for their online purchases without having to input their card information into your website.

- Virtual terminals. The customer gives you their card information (typically over the phone) that you then input into a virtual terminal.

- Recurring payments. The customer pays a set amount to your business on a regular basis. They will use their card for the first purchase, but after that, payments will be taken automatically until the service is canceled or the payment period ends.

Payment Software

- Payment gateways/virtual terminals

- E-commerce platforms

- Mobile point-of-sale (mPOS) apps

- Invoicing and billing software

- Shopping cart integrations

Fraud Detection Checks

Banks and payment processors will run specific checks to ensure that the transaction is genuine. The checks used will depend on each business. In general, banks use machine learning and AI to check if the transaction is something a legitimate customer would do. Payment processors will use multiple checks to detect fraud. The two most common are Address Verification System (AVS) and Card Verification Value (CVV). AVS checks that the billing address submitted by the customer matches the data that the bank has on file. CVV checks that the payer has access to the payment card by asking the customer to input a three-digit number found on the back of the payment card.

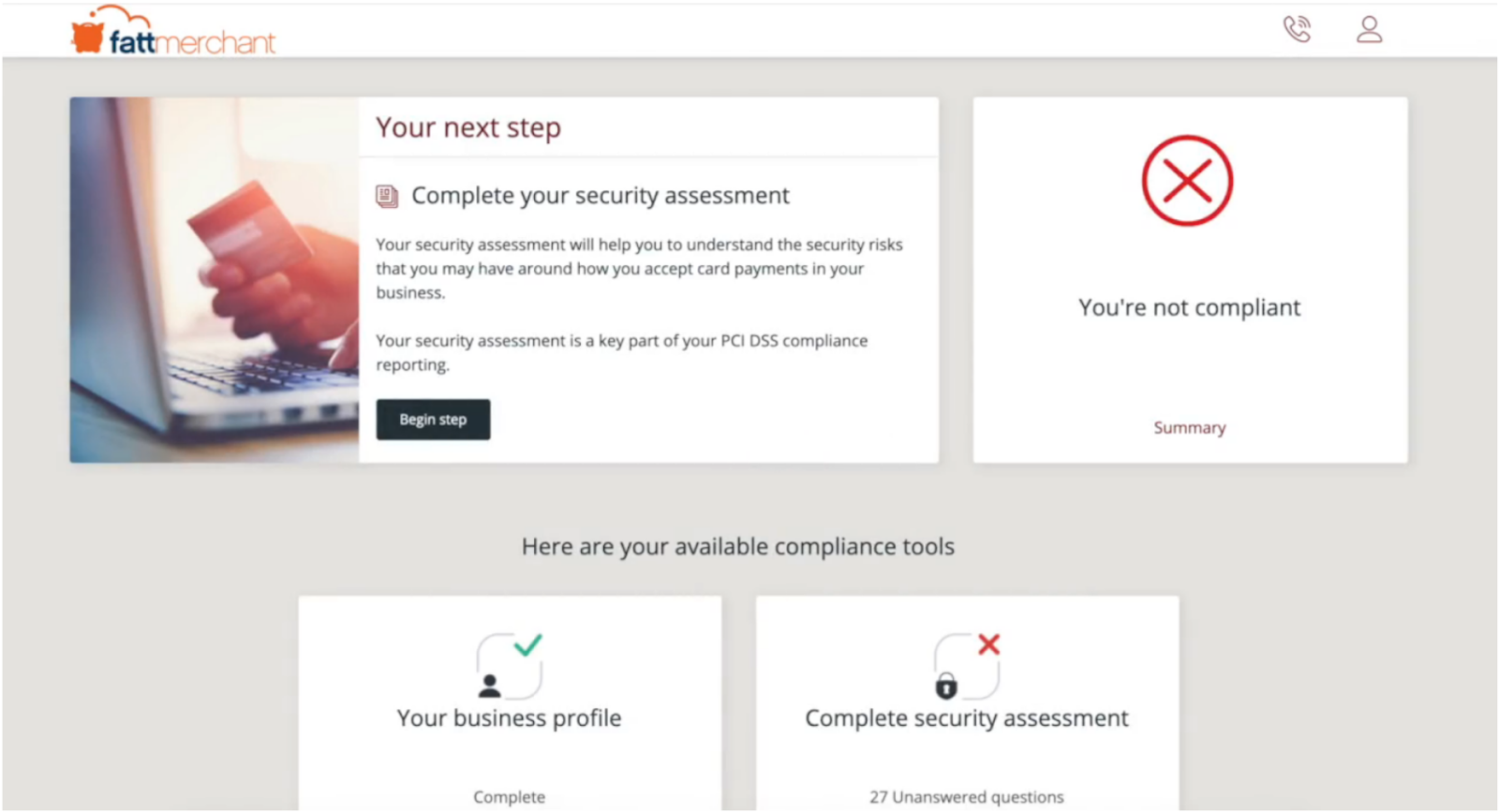

Credit Card Processing Legal Requirements

It doesn’t matter how many transactions you process – if you accept card payments, you have certain legal requirements you need to fulfill. The main one you need to be aware of is the Payment Card Industry Data Security Standard (PCI-DSS, or PCI). This is a set of standards that merchants and payment processors have to abide by to keep payment data secure. As a merchant, you will have to complete a yearly Self-Assessment Questionnaire (SAQ) to maintain compliance. There are multiple questionnaires in use, and the one you’ll have to fill out will depend on how you accept and store payment information. In addition, you may need to undertake additional network scans and assessments if you process a large number of transactions.

Other Financial Data Protection Regulations

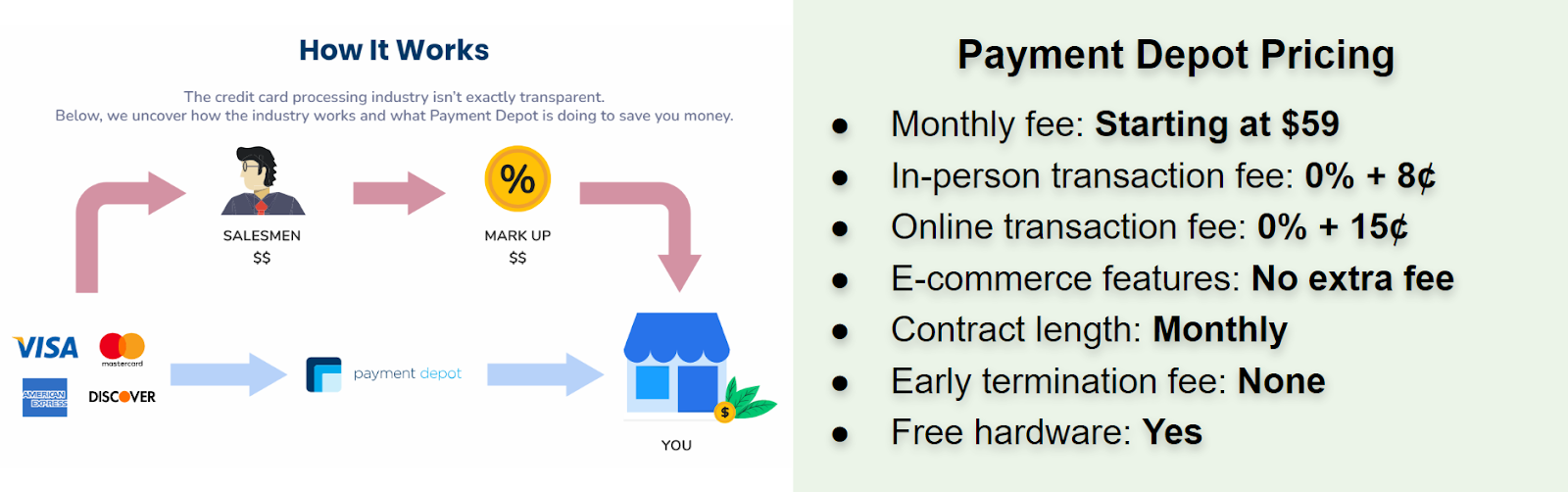

Depending on your industry and location, you may have to comply with other data protection regulations. The two most common are the Health Insurance Portability and Accountability Act (HIPAA) and the General Data Protection Regulation (GDPR). While credit card processing is exempt from HIPAA regulations, healthcare businesses will need to ensure that their payment processor offers HIPAA-compliant software or can connect HIPAA-compliant software to their software suite. In addition, businesses that process card payments from EU citizens must be GDPR-compliant, regardless of where the business is based. Not all payment processors are GDPR-compliant. If you accept payments from EU citizens, we recommend Payment Depot – it’s GDPR-compliant and has a stellar track record for data protection and security.Credit Card Processing Fees Breakdown

Credit card processing fees fall into two distinct categories: those charged by card networks, and those charged by payment processors.

Card Network Fees

Card network fees are charged per transaction, and payment processors don’t have any control over these fees. The amount will depend on the network, card type, and payment method. You’ll pay these fees through your payment processor.- Interchange rate. This is charged as a percentage of each sale. Interchange rates typically range from 1.4% – 3.5%.

- Transaction fee. On top of the interchange rate, you may be charged a flat fee of a few cents per transaction. You won’t be charged this fee with every card network or card type. Typical transaction fees range from 15¢ – 22¢.

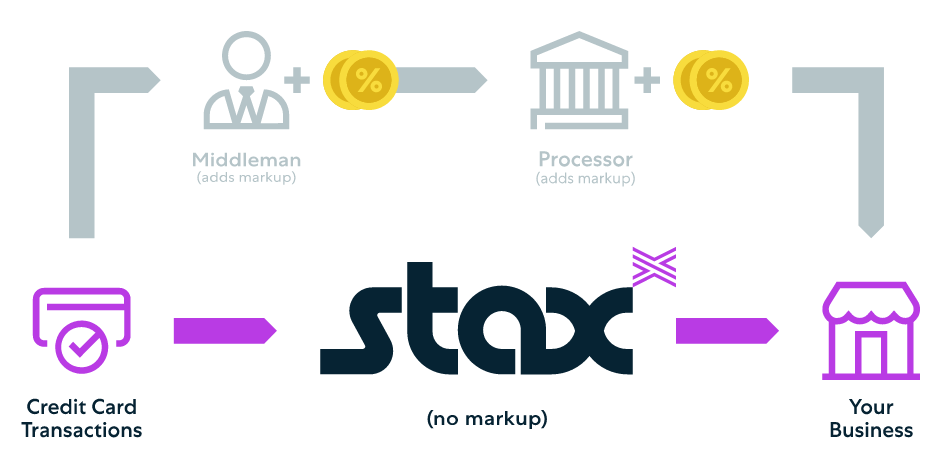

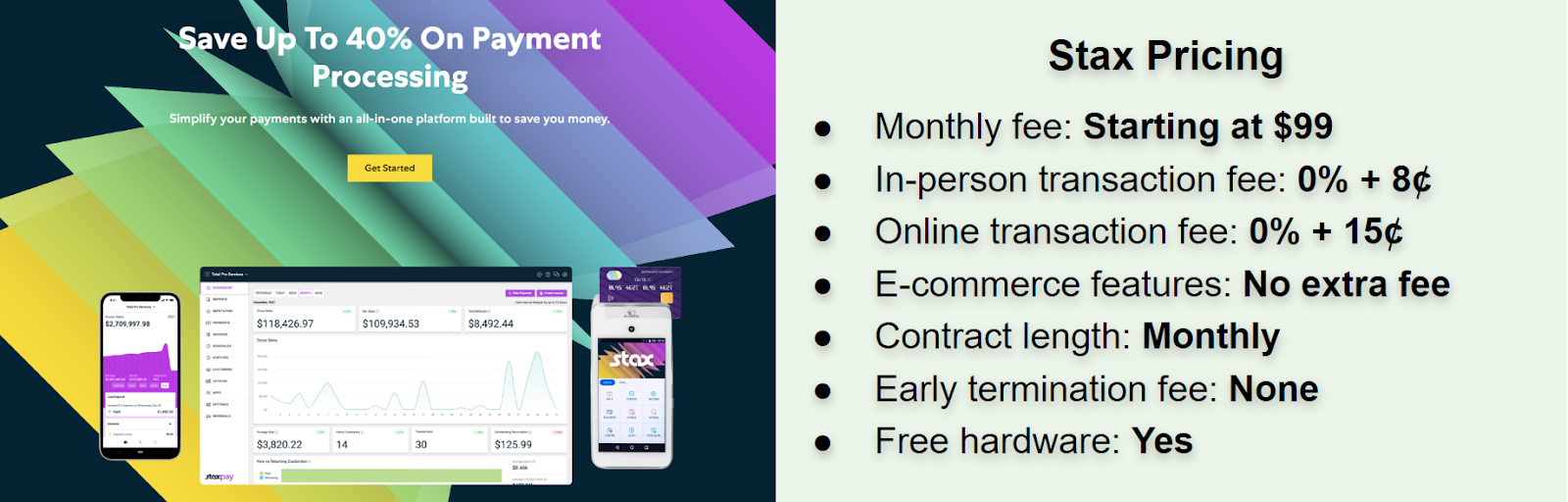

Payment Processing Fees

These fees will depend on the payment processor you choose and its payment model. Processing fees are charged in addition to the card network fees listed above. Per-transaction fees are typically determined by payment method.- Interchange markup. This is charged as a percentage of each sale. On average, you can expect to pay around 2% – 4%. Not every processor charges a separate markup – this depends on the processor’s pricing model. For example, Stax charges a 0% markup on interchange rates, which can save you up to 40% on your overall processing fees.

- Transaction fee. You may also need to pay an additional flat fee of a few cents per transaction. On average, you can expect to pay an extra 10¢ – 30¢ depending on the payment method and processor’s payment model.

- Monthly fee. Most payment processors charge a monthly fee to use their service. Most processors charge around $10/month, though subscriptions subscription-style processors like Stax and Payment Depot tend to charge considerably more in exchange for 0% markup on interchange rates.

- Monthly minimum. Some processors charge a monthly minimum, which is a cumulative amount of transaction fees you need to meet each month. If you don’t meet your monthly minimum, you’ll have to pay the remaining balance on your bill.

- PCI compliance fee. This is an ongoing monthly or annual fee. Not every processor charges these fees separately. Stax, for example, includes PCI compliance in its monthly fee.

- PCI non-compliance fee. You’ll typically be fined an average of $20 – $30 for each month your business isn’t PCI compliant.

- Chargeback fee. If a customer raises a chargeback dispute against your business, your payment processor will charge you a fee. Most processors will refund this fee if you win the dispute.

Pricing Models

- Subscription-style. A single monthly fee, a 0% markup on interchange rates, and a small flat transaction fee of a few cents.

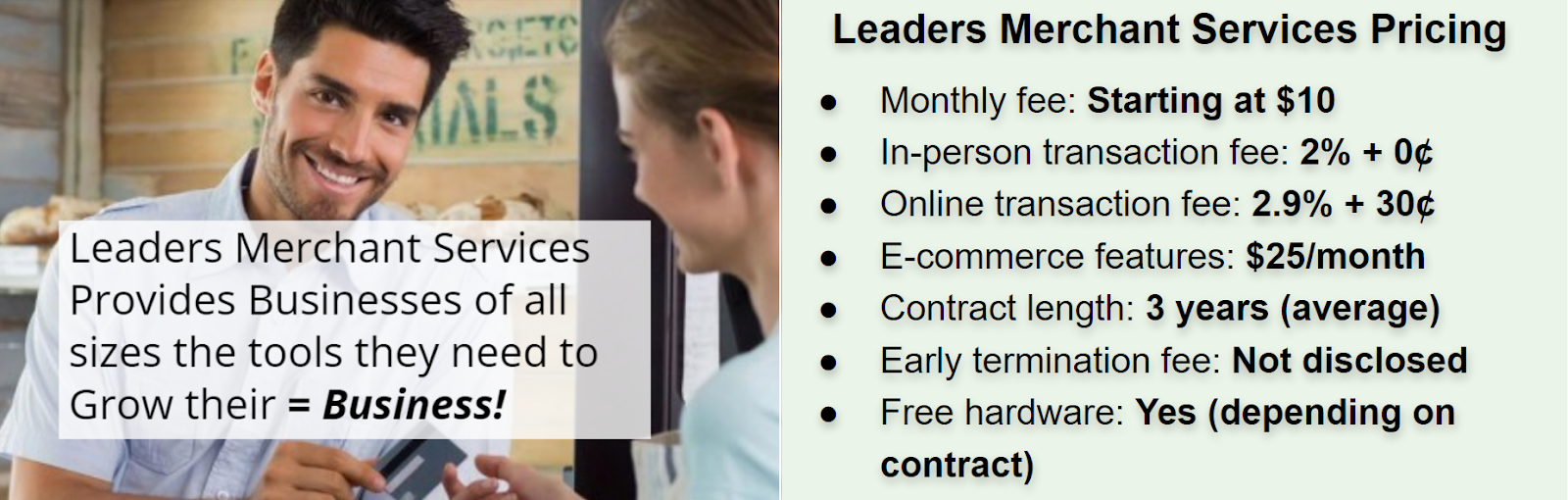

- Interchange-plus. An interchange markup and transaction fee on each sale, plus a small monthly fee to use the processor’s service. Some processors, like Leaders Merchant Services, let you negotiate for the lowest rates possible.

- Flat rate. A single rate per transaction (regardless of the customer’s payment method), plus a small monthly fee.

- Tiered pricing. Per transaction fees based on one of three different rates (qualified, mid-qualified, and non-qualified) that are dependent on the transaction’s level of risk. You’ll also have to pay a monthly fee.

- Cash discount. By offering a discount to customers who pay with cash, you can cover your credit card processing costs by incorporating them into your baseline prices. This effectively passes these costs on to your card-paying customers without adding a surcharge. You’ll still have to pay a monthly fee.

Top Tip: Per-Transaction Fees

Some payment processors quote their per-transaction fees with card network fees included, while others only quote their markup percentage and fees. In general, subscription-style and interchange-plus fees are in addition to card network fees, while tiered pricing and flat rate fees are inclusive of card network fees. When you receive a quote for your payment processing, make sure to ask for a fee breakdown so it’s clear whether the advertised rate is the total fee or a markup.How to Choose a Credit Card Processor

The first thing you need to do when choosing a credit card processor is analyze your business’s transaction history (or, if you’re a new business, any financial predictions). Specifically, you’ll need to get an idea of your business’s transaction volume, transaction size, and monthly income. You’ll also need to decide what payment methods you need to offer. Almost every modern payment processor will offer options for in-person, online, mobile, and over-the-phone payment processing. Determining which options you need ahead of time will make it easier to narrow your choices when it comes to choosing a processor. If you’re looking for suggestions, take a look at our top 3 payment processors in 2025. We’ve found that almost all businesses will benefit from one of these three options, so they’re a good place to start when you’re comparing payment processors.Top Tip: High-Risk Businesses

Not all businesses will be able to sign up with a payment processor. A business can be classed as high-risk because:- It’s a new business with limited or no processing history

- The business or its owners have a poor credit history

- It’s in a high-risk industry (e.g., alcohol, travel, bars and nightclubs, etc.)

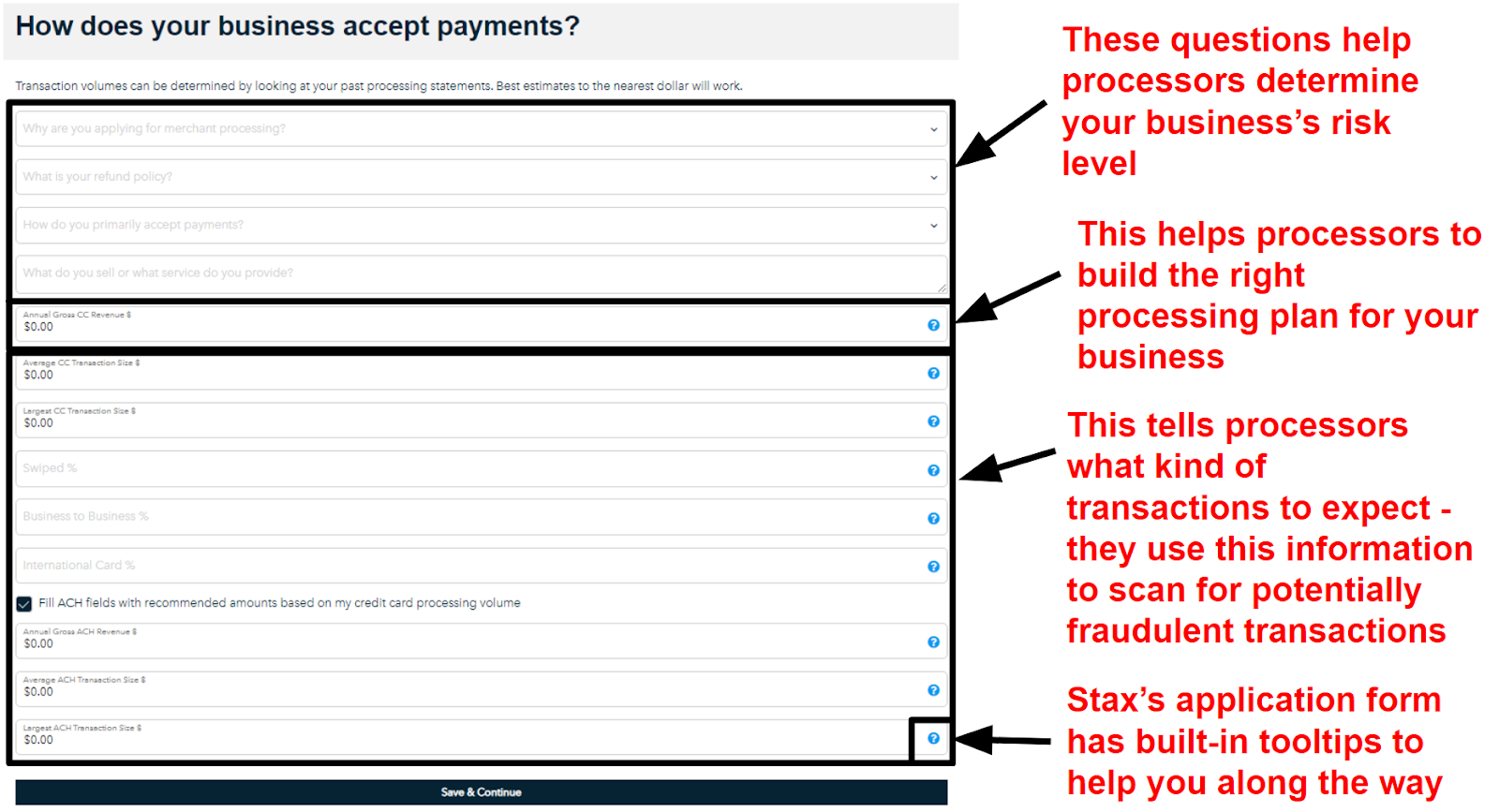

How to Start Processing Credit Cards

If you’ve never processed credit cards and want to get started, don’t worry – any reputable payment processor will make the process as easy as possible for new merchants.1. Apply for a Merchant Account

- Previous payment processing statements

- ID documents

- Employer Identification Number (EIN)

2. Set Up Your E-Commerce Software

Once you’re accepted for a merchant account, the first thing you’ll likely receive is access to your e-commerce software. This should already be connected to your merchant account, so all you need to do is integrate it with the software tools you already use. There are two ways to do this. The first – and easiest – is to use pre-built integrations, which are usually offered by your payment processor or software. You can also build custom integrations using the software’s developer toolkit. This is more time-intensive and requires development experience, but it’s sometimes necessary if there aren’t any pre-built integrations that work for your business. Stax provides a wide range of integrations and developer tools (complete with documentation) to help you create a custom solution.3. Set Up Your Virtual Terminal

Your virtual terminal should already be connected to your merchant account by your payment processor. Depending on your virtual terminal, you may find it helpful to integrate it with your existing payment software tools so you can quickly import customer details and inventory.

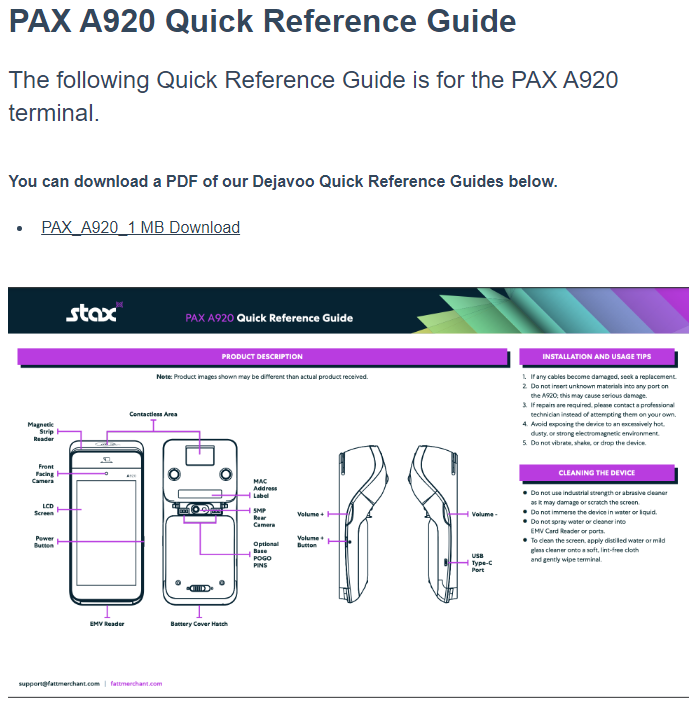

4. Set Up Your POS Devices

5. Start Taking Payments!

When you start taking payments, your transactions will be held in a “batch” until they’re “closed” (the authorization codes have been sent to the customer’s bank). Authorization codes will typically be stored in your payment software and, in most cases, batch settling is as easy as submitting them through your software dashboard. However, some processors may still require you to settle batches from your POS device. Make sure you add batch settling to your end-of-day cash-out process. You typically have to settle transactions within 24 hours of authorization, as some processors and card networks will charge higher rates if you don’t.Our Top 3 Recommended Credit Card Processing Services

Are you prepared to commence accepting card payments? Our expert team spent months conducting reviews of payment processors and comparing them to the competition to identify the top options available in today’s market. Let’s introduce you to the three key choices you should be aware of.

1. Stax: Significant Savings for High-Volume Businesses

2. Payment Depot: Low-Cost Subscription-Style Processing for Medium Businesses

3. Leaders Merchant Services: Budget-Friendly Rates for Small Businesses