Inside this Article

Square’s Core Pricing

| Payment method | Fees |

| Card-present (tap, swipe, or EMV) | 2.6% + 10¢ |

| Card-not-present (e-commerce or invoice payments) | 2.9% + 30¢ |

| Keyed-in and card-on-file | 3.5% + 15¢ |

| Afterpay (one-time charge) | 6% + 30¢ |

| ACH transfers | 1%, minimum fee of $1 |

- Square’s POS software

- Chargeback dispute management

- Advanced fraud prevention tools

- Reporting tools

- CRM software

- Team management software

- Inventory management software

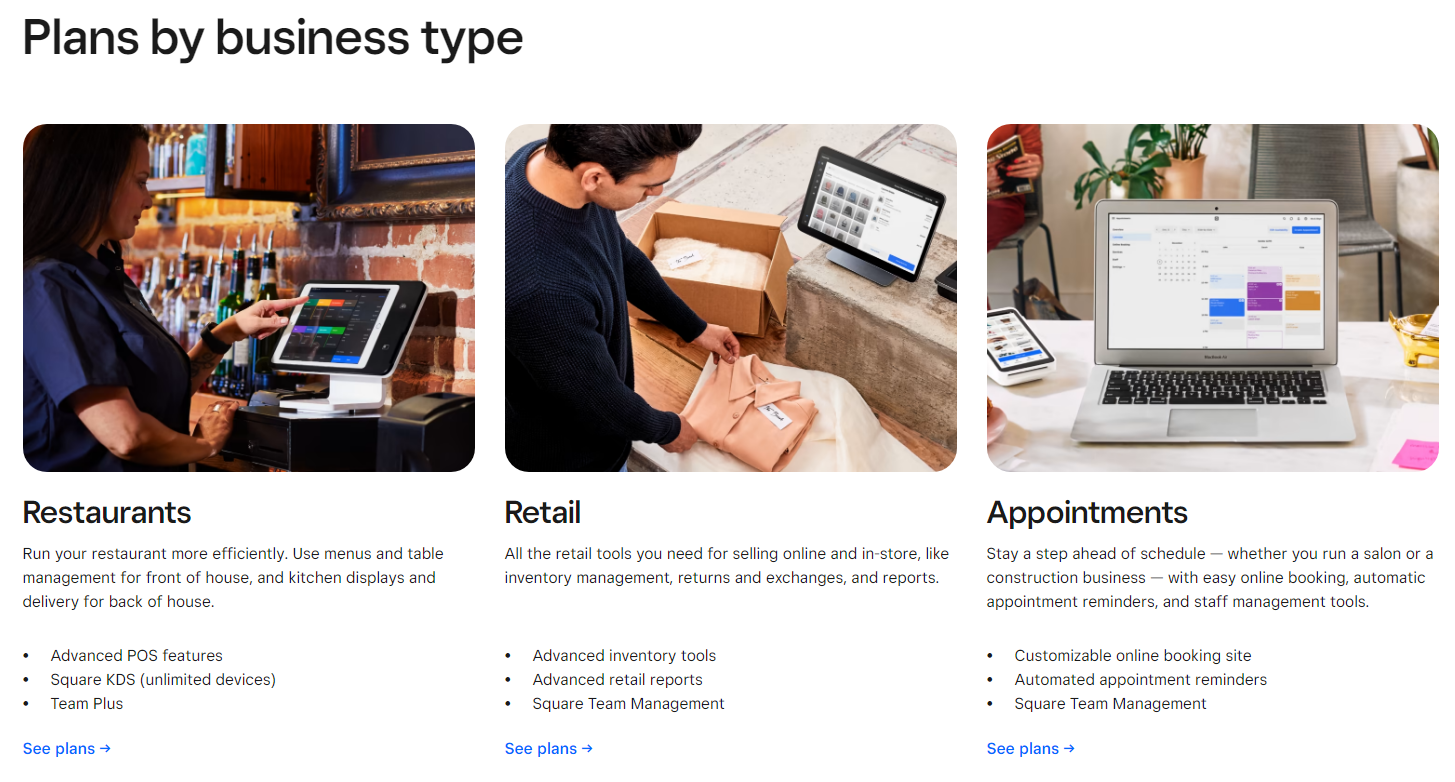

Square’s Additional Monthly Fees

| Plan name | Monthly fee | Additional features |

| Plus (Appointments) | $29 per location |

|

| Plus (Retail) | $60 per location |

|

| Plus (Restaurant) | $60 per location |

|

| Plan name | Monthly fee | Additional features |

| Premium (Appointments) | $69 per location |

|

| Premium (Retail) | Custom pricing |

|

| Premium (Restaurant) | Custom pricing |

|

Square’s Hardware Costs

Square offers four hardware devices: the Reader, Stand, Terminal, and Register. You’ll get a free Square Reader for Magstripe when you sign up. If you need additional hardware, you’ll need to purchase it outright or set up a payment plan.

| Device | Price | Description | Features |

| Square Reader for Magstripe | $10, but you’ll get one for free at sign-up | Small mobile reader that attaches to your smartphone via your headphone jack or Lightning connector |

|

| Square Reader (wireless) | $49 | Palm-sized Bluetooth mobile reader |

|

| Square Stand | $149 | iPad dock with built-in credit card reader |

|

| Square Terminal | $299 | Smart credit card terminal with built-in receipt printer |

|

| Square Register | $799 | All-in-one POS device with large touchscreen and wired customer display with built-in credit card reader |

|

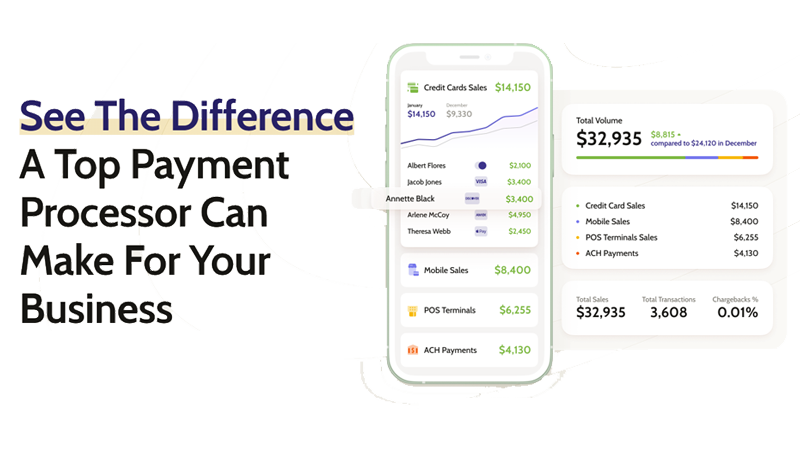

Top 5 Square Alternatives

Whether you’re a brand-new business or your business becomes too large to benefit from Square’s flat-rate pricing, you’ve come to the right place. Our expert team of researchers has collectively spent hundreds of hours scouring the market for the best Square alternatives. Here are a few great options for your business.

1. Leaders Merchant Services: Best Square Alternative for Brick-And-Mortar Businesses

Free Card Reader

Our Score

Our Score

Best Credit Card Processor in 2025

Negotiable Low Credit Card Processing Rates

Monthly Fee:

$9

Transaction Fee:

From 0.15% + $0

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- Business funding. LMS offers merchant cash advances, a flexible way of accessing finance to upgrade your business. You won’t need to put up collateral for this kind of loan, either.

- 24/7 support. Whether something’s gone wrong or you need advice, LMS’s customer support is available to help round the clock. Its representatives respond quickly and are friendly and informative.

- 98% approval rate. Even if you’ve got limited (or no) financial history, there’s a good chance LMS will approve your application. Plus, you can get started with LMS in as little as 24 hours.

- Great software. LMS offers the popular Authorize.net, one of the most secure payment tools on the market, as its payment gateway solution. You’ll also get fantastic pre-built shopping carts and a wide variety of integrations.

| Pricing model | Interchange-plus |

| Software included | Some basic software is included, the rest is available for an extra monthly fee |

| Additional fees |

|

| Transaction fees on cheapest plan | ~0.15% + $0 |

| Monthly fee on cheapest plan | $9.00 |

2. PaymentCloud: Best Square Alternative for High-Risk Businesses

Our Score

Our Score

Affordable Rates & Advanced Security Features for High-Risk Businesses

Monthly Fee:

$14

Transaction Fee:

From 2.1% + 15¢

Pricing Model:

Interchange plus

Interchange plus

Interchange-plus pricing involves two fees for each credit or debit card transaction. The first is the interchange fee, a variable amount set by the card network (e.g. Visa, Mastercard). The second is a markup fee charged by the payment processor, typically a percentage of the transaction amount plus a small flat transaction fee. This allows you to see exactly how much of what you pay goes to the card networks and how much to the payment processor.

Features and Benefits

- Negotiable rates. Unlike Square, PaymentCloud encourages customers to negotiate rates when signing up. You can easily get a custom pricing plan that offers your business the best possible value.

- Fraud prevention tools. PaymentCloud’s customizable fraud detection and prevention suite is well-suited to high-risk businesses. You’ll also get access to an account manager that can offer advice on preventing chargebacks and fraud.

- Simple mobile payments. Not every business can afford to outfit workers in the field with mobile card readers. PaymentCloud’s solution is Paysley, which allows customers to pay using QR codes or custom links – no apps or additional hardware required.

- Same-day onboarding. PaymentCloud aims to review all applications within one business day. Many get their new merchant account up and running on the day they apply.

| Pricing model | Interchange-plus |

| Software included | Some basic software is included, the rest is available for an extra monthly fee |

| Additional fees |

|

| Transaction fees on cheapest plan | 2.1% + 15¢ |

| Monthly fee on cheapest plan | $14.00 |

3. Stax: Best Square Alternative for Large Businesses

Our Score

Our Score

Save Up to 40% on Credit Card Processing Fees

Monthly Fee:

From $99

Transaction Fee:

From 8¢ + Interchange

Pricing Model:

Subscription

Subscription

With subscription-style pricing, you’ll pay a fixed monthly fee instead of a percentage-based markup on each credit and debit card transaction. While this will considerably reduce your per-transaction fees, you’ll typically still pay a small flat fee on each transaction. This amount is unaffected by the variable interchange fees charged by the different card networks (e.g. Visa, Mastercard), helping to keep your payment processing fees more predictable.

Features and Benefits

- Custom pricing available. Every Stax plan allows you to process up to $500,000/year. If you process more than that, you can negotiate custom pricing to help you optimize your budget even more.

- Unlimited devices. Unlike Square, Stax doesn’t limit how many devices you can use on its plans. Plus, Stax is compatible with 90% of third-party POS devices and will reprogram them for free.

- Surcharging. This tool allows you to pass the per-transaction fee onto customers that pay by card. It’s a paid add-on, but it can save you quite a bit if you process a lot of credit card payments.

- Quick payouts. Stax pays out in 24–72 hours as standard, but the timeframe can vary depending on the payment method. If you need your money paid out faster, Stax offers a same-day payment add-on for an extra fee.

| Pricing model | Subscription-style |

| Software included | ✔ |

| Additional fees |

|

| Transaction fees on cheapest plan | 8¢ + interchange (in-person) |

| Monthly fee on cheapest plan | $99.00 |

4. Payment Depot: Best Square Alternative for Mid-Sized Businesses

Our Score

Our Score

Excellent Customer Service Backed by a Dedicated Risk Monitoring Team

Monthly Fee:

$0

Transaction Fee:

From 0% + 10¢

Pricing Model:

Subscription

Subscription

With subscription-style pricing, you’ll pay a fixed monthly fee instead of a percentage-based markup on each credit and debit card transaction. While this will considerably reduce your per-transaction fees, you’ll typically still pay a small flat fee on each transaction. This amount is unaffected by the variable interchange fees charged by the different card networks (e.g. Visa, Mastercard), helping to keep your payment processing fees more predictable.

Features and Benefits

- Software included. Like Stax, Payment Depot’s monthly fee includes all the software you need. On top of that, you get plenty of integrations with popular e-commerce tools like Shopify and OpenCart.

- Free hardware. Payment Depot helps you get set up by offering a free Dejavoo terminal when you sign up. You can also use any third-party POS devices you might have with Payment Depot, too.

- 24/7 fraud monitoring. Payment Depot’s 24/7 fraud monitoring team will protect your merchant account . This team closely monitors changes in bank policy and fraud methods to proactively implement solutions, helping keep your money and data safe.

- Rapid onboarding. Unlike Square, you’ll need to apply and get approved to get your Payment Depot merchant account. However, this process can take as little as 24 hours, so you won’t have to wait long to switch.

| Pricing model | Subscription-style |

| Software included | ✔ |

| Additional fees |

|

| Transaction fees on cheapest plan | 0.2%-1.95% |

| Monthly fee on cheapest plan | $0 |

5. National Processing: Best Square Alternative for Small Businesses

Our Score

Our Score

Transparent Pricing With Guaranteed Locked-In Rates

Monthly Fee:

From $9.95

Transaction Fee:

From 0.14% + 7¢

Pricing Model:

Interchange plus

Interchange plus

Interchange-plus pricing involves two fees for each credit or debit card transaction. The first is the interchange fee, a variable amount set by the card network (e.g. Visa, Mastercard). The second is a markup fee charged by the payment processor, typically a percentage of the transaction amount plus a small flat transaction fee. This allows you to see exactly how much of what you pay goes to the card networks and how much to the payment processor.

Features and Benefits

- Pricing options. On top of great interchange-plus plans, National Processing also offers subscription-style pricing and a cash discount plan. You’ve got plenty of options to find the pricing that saves your business the most money.

- Software included. All the software you need is included with your subscription. While you can add other software tools (such as Clover), you don’t need to in order to support your business.

- Fraud prevention. To protect against fraud, you can customize National Processing’s payment gateway to use AVS, CVV2, and specific restrictions like transaction thresholds and location monitoring.

- 24/7 support. If you’ve been frustrated by your provider’s lack of support, National Processing offers a refreshing change. It offers 24/7 support via phone and email, and live chat during US business hours.

| Pricing model | Interchange-plus, subscription-style, or cash discount |

| Software included | ✔ |

| Additional fees |

|

| Transaction fees on cheapest plan | 2.4% + 0.10¢ (in-person transactions) |

| Monthly fee on cheapest plan | $9.95 |

Unsure which processor is best for your business?

Take this short quiz and get a tailor-made recommendation in seconds

Is Square a Budget-Friendly Option in 2025?

I can’t recommend Square for any business except brand-new or small enterprises. Its flat fee structure, while simple and affordable for the occasional transaction, becomes increasingly unaffordable as you start processing multiple transactions daily. Sure, you’ll receive a large assortment of software options on the “free” plan, but the monthly plans don’t offer enough additional features to make them worth the cost. So, what are your alternatives? If you have a small brick-and-mortar business, consider Leaders Merchant Services. LMS’s interchange-plus plan is cheaper than Square’s high flat fees. Plus it’s highly likely to approve your business, even if you’ve got limited to no financial history. If your business is in a mid- to high-risk industry and you’re worried about your payment processor spontaneously canceling your account, PaymentCloud may be the solution. Not only does this processor welcome high-risk merchants, but it also has tools in place to help you reduce chargebacks and fraud. For larger businesses, I recommend Stax. Stax’s simple subscription-style pricing with no interchange markups can save you a lot of money in the long run, particularly if you’re a high-volume merchant. Here’s what you need to know about our top Square alternatives:| Pricing model | Main advantage over Square | Per transaction fee | Monthly fee | ||

| Leaders Merchant Services | Interchange-plus | Negotiable interchange-plus pricing to suit your business | ~0.15% + $0 | $9.00 | |

| PaymentCloud | Interchange-plus | Reliable accounts for mid- and high-risk merchants that include advanced fraud and chargeback prevention tools | 2.1% + 15¢ | $14.00 | |

| Stax | Subscription-style | High-volume businesses can save up to 40% against Stripe’s pricing | 8¢ + interchange (in-person) | $99.00 | |

| Payment Depot | Subscription-style | Significantly lower per-transaction fees starting at the same monthly cost as Stripe Plus | 0.2%-1.95% | $0 | |

| National Processing | Interchange-plus, subscription-style, and cash discount | Flexible pricing plans and contract lengths to help small business find the best solution for them | 2.4% + 0.10¢ (in-person transactions) | $9.95 |