Fast Fashion at a Glance

From the rapid turnarounds of its production lines to the worldwide roots of its top brands, we explore how shopping habits power an industry known for its environmental and ethical dilemmas. Examining the CO2 emissions and transparency scores of prominent fast fashion names, we reveal the pressing sustainability hurdles and the growing demand for change. Is the price of staying in vogue one our planet can afford?1. Fast Fashion Production Far Outpaces Traditional Fashion

Since the rise of industrial clothing production, traditional fashion houses have created just two to three collections annually. However, with brands like Zara and H&M introducing fast fashion in the ’90s and early 2000s, this number has skyrocketed over the past few decades.

By taking a garment from sketchbook to stores at never-before-seen speeds, these brands made fashion trends more accessible and affordable. Now, the ultra-fast fashion sector – led by digital-first companies such as ASOS, Boohoo, Fashion Nova, and Shein – is pushing the envelope even further.

These brands use a direct-to-customer model that means shoppers typically receive their garments within five to seven days of ordering. This rapid production means that only items of clothing that are in demand are produced, making it convenient and cost-effective for both customers and fast fashion companies.

Since the rise of industrial clothing production, traditional fashion houses have created just two to three collections annually. However, with brands like Zara and H&M introducing fast fashion in the ’90s and early 2000s, this number has skyrocketed over the past few decades.

By taking a garment from sketchbook to stores at never-before-seen speeds, these brands made fashion trends more accessible and affordable. Now, the ultra-fast fashion sector – led by digital-first companies such as ASOS, Boohoo, Fashion Nova, and Shein – is pushing the envelope even further.

These brands use a direct-to-customer model that means shoppers typically receive their garments within five to seven days of ordering. This rapid production means that only items of clothing that are in demand are produced, making it convenient and cost-effective for both customers and fast fashion companies.

2. Where Were Fast Fashion Companies Founded?

In 1947, the first H&M store was opened in Västerås, Sweden, with the aim to make “great fashion available and affordable to everyone”. The company did this by identifying key fashion trends that its customers would love, and outsourcing production to independent suppliers in Europe and Asia.

Zara, founded in Spain in 1975, took this idea further and significantly shortened the time to take clothes from the catwalk to consumers to drive even greater sales. Fast fashion caught on relatively quickly after this, with Primark (Ireland) opening its first store in 1969. Just 15 years later, brands UNIQLO (Japan), Forever 21 (US), and Mango (Spain) also entered the market.

The digital era created an opportunity for brands like Shein from China, which leveraged online platforms and advanced data analytics to further accelerate the fast fashion model, significantly reducing the time from design to market.

In 1947, the first H&M store was opened in Västerås, Sweden, with the aim to make “great fashion available and affordable to everyone”. The company did this by identifying key fashion trends that its customers would love, and outsourcing production to independent suppliers in Europe and Asia.

Zara, founded in Spain in 1975, took this idea further and significantly shortened the time to take clothes from the catwalk to consumers to drive even greater sales. Fast fashion caught on relatively quickly after this, with Primark (Ireland) opening its first store in 1969. Just 15 years later, brands UNIQLO (Japan), Forever 21 (US), and Mango (Spain) also entered the market.

The digital era created an opportunity for brands like Shein from China, which leveraged online platforms and advanced data analytics to further accelerate the fast fashion model, significantly reducing the time from design to market.

3. What Consumers Spend on Fast Fashion

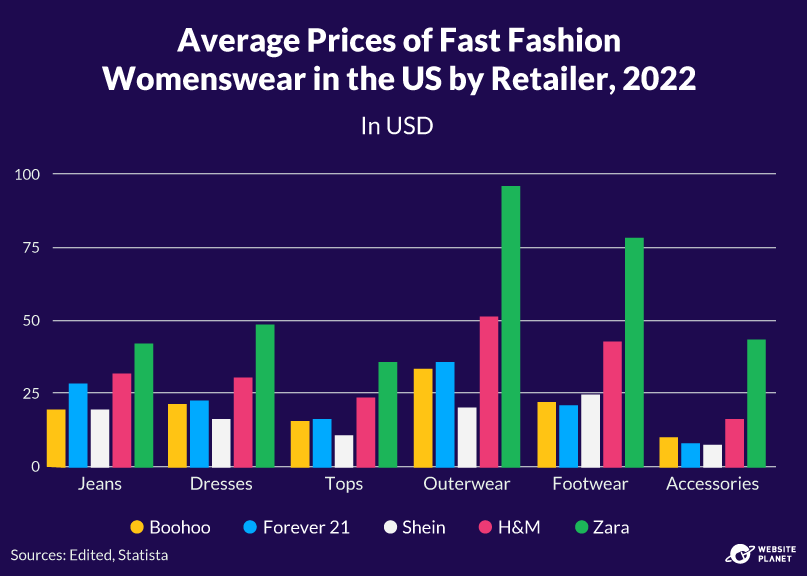

Fast fashion prices are a draw for consumers. Clothing sold by these retailers usually costs a fraction of what it would if bought from a traditional fashion retailer.

For perspective, women’s jeans, once averaging $165 at regular retailers, can now be found at fast fashion retailers for almost a quarter of that price. Shein, a relative newcomer in the industry, slashes prices further; the average price of a pair of jeans from its collections is $18.85, compared to $31.20 at H&M, and $41.54 at Zara.

Shein keeps its prices low by operating online only. It also benefits from tax exemptions available to direct-to-consumer businesses in China. What’s more, by distributing products by air directly from its local warehouses, the company is able to sidestep many import and export duties. All of this enables Shein to undercut many of its fast fashion competitors.

Fast fashion prices are a draw for consumers. Clothing sold by these retailers usually costs a fraction of what it would if bought from a traditional fashion retailer.

For perspective, women’s jeans, once averaging $165 at regular retailers, can now be found at fast fashion retailers for almost a quarter of that price. Shein, a relative newcomer in the industry, slashes prices further; the average price of a pair of jeans from its collections is $18.85, compared to $31.20 at H&M, and $41.54 at Zara.

Shein keeps its prices low by operating online only. It also benefits from tax exemptions available to direct-to-consumer businesses in China. What’s more, by distributing products by air directly from its local warehouses, the company is able to sidestep many import and export duties. All of this enables Shein to undercut many of its fast fashion competitors.

4. Fashion’s Environmental Footprint

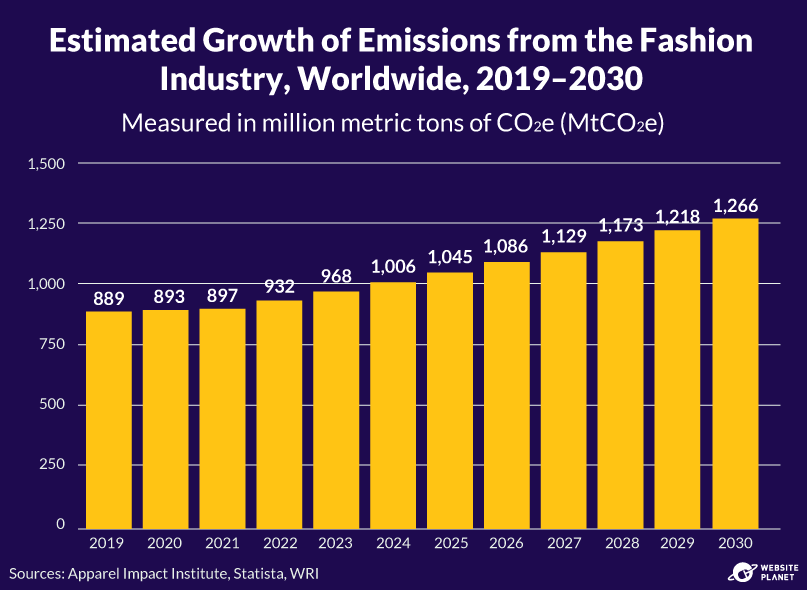

Fast fashion is responsible for 50% of the fashion industry’s total carbon emissions, which was projected at 968 metric gigatons (MGT, or 968 000 000 000 metric tons) in 2023. This means fast fashion alone was responsible for approximately 484 MGT of carbon emissions in that year, and could be responsible for 633 MGT annually by 2030.

Beyond CO₂ emissions, fast fashion’s environmental footprint is vast. This is in part due to its rapid production and high turnover, but is also driven by the materials used to manufacture clothes.

Many clothing items are created using synthetic fibers, the production of which uses some 342 million barrels of oil annually. Cotton is also a problem, as growing it requires significant land and water resources.

Fast fashion is responsible for 50% of the fashion industry’s total carbon emissions, which was projected at 968 metric gigatons (MGT, or 968 000 000 000 metric tons) in 2023. This means fast fashion alone was responsible for approximately 484 MGT of carbon emissions in that year, and could be responsible for 633 MGT annually by 2030.

Beyond CO₂ emissions, fast fashion’s environmental footprint is vast. This is in part due to its rapid production and high turnover, but is also driven by the materials used to manufacture clothes.

Many clothing items are created using synthetic fibers, the production of which uses some 342 million barrels of oil annually. Cotton is also a problem, as growing it requires significant land and water resources.

5. Transparency Scores of Leading Fast Fashion Brands

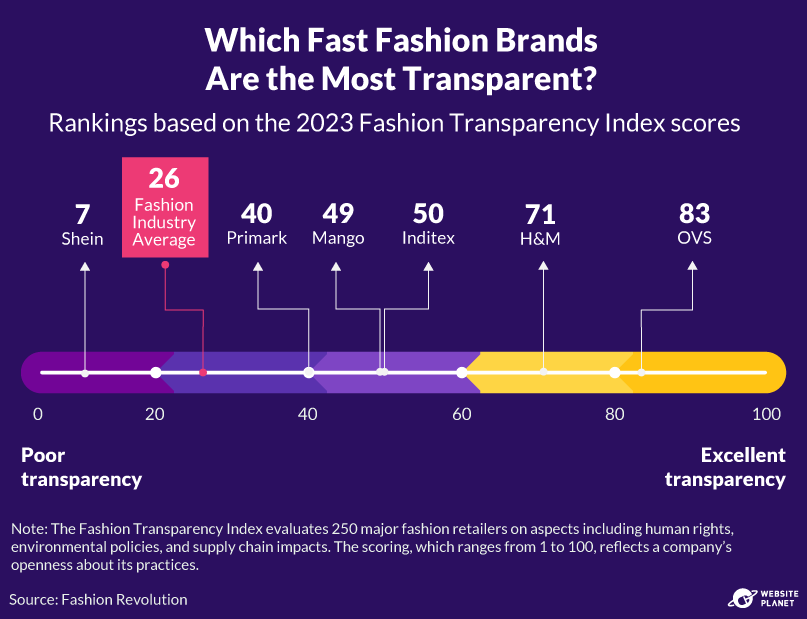

Transparency is important for fashion brands because it helps showcase their true ecological impact and can build trust, or distrust, among shoppers. The Fashion Transparency Index, which assesses the degree to which companies disclose information about their practices, shows varied progress among 250 major brands.

The average score in 2023 was 26%, with only two brands surpassing 80%. Fast fashion brands show a wide spectrum of results with H&M scoring 71%, reflecting a high degree of transparency, whereas Shein scored a mere 7%, indicating minimal disclosure on issues like human rights and environmental records.

Many brands scored poorly due to a lack of detailed reporting. 88% don’t disclose annual production volumes, only 12% have committed to zero deforestation, and just 9% disclose how they will support renewable energy investment within their supply chain. Additionally, while 51% of brands have targets for sustainable materials, just 44% define what they consider “sustainable.”

Transparency is important for fashion brands because it helps showcase their true ecological impact and can build trust, or distrust, among shoppers. The Fashion Transparency Index, which assesses the degree to which companies disclose information about their practices, shows varied progress among 250 major brands.

The average score in 2023 was 26%, with only two brands surpassing 80%. Fast fashion brands show a wide spectrum of results with H&M scoring 71%, reflecting a high degree of transparency, whereas Shein scored a mere 7%, indicating minimal disclosure on issues like human rights and environmental records.

Many brands scored poorly due to a lack of detailed reporting. 88% don’t disclose annual production volumes, only 12% have committed to zero deforestation, and just 9% disclose how they will support renewable energy investment within their supply chain. Additionally, while 51% of brands have targets for sustainable materials, just 44% define what they consider “sustainable.”

6. Which Fast Fashion Companies Have the Highest CO2 Emissions?

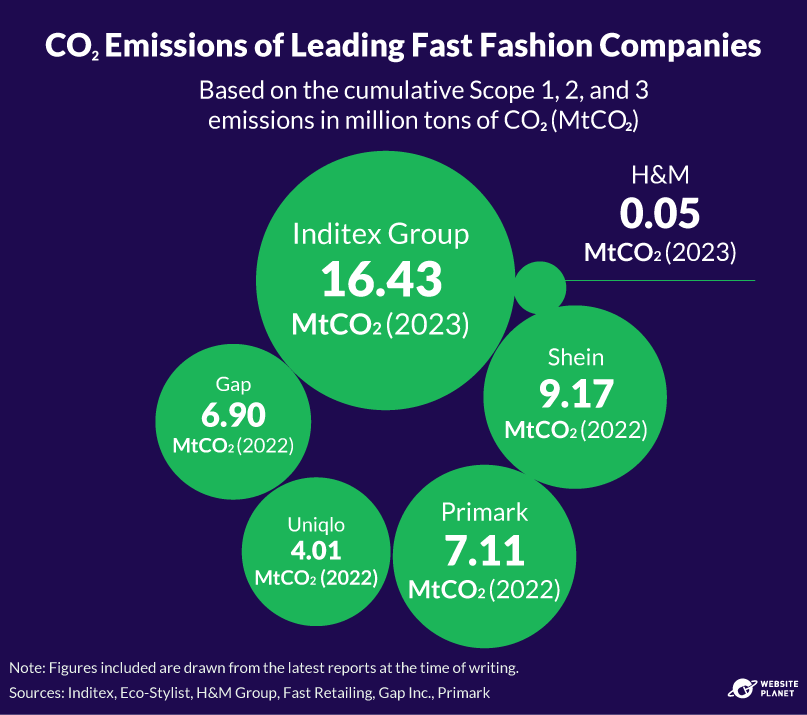

The fashion industry is responsible for an estimated 8 to 10% of global greenhouse gas emissions. This issue is particularly pronounced in fast fashion, which produces 80 to 100 billion new garments annually, leading to substantial resource consumption and waste.

In the European Union, textile purchases result in approximately 270 kg of CO2 emissions per person each year. Those emissions are roughly equivalent to the amount released over 21 days of driving a gasoline-powered car.

In 2022, the major fast fashion retailers reported high levels of CO2 emissions. The Inditex group generated over 16 million metric tons, while Shein declared more than 9 million metric tons, covering both direct and indirect emissions (Scope 1, 2, and 3).

The fashion industry is responsible for an estimated 8 to 10% of global greenhouse gas emissions. This issue is particularly pronounced in fast fashion, which produces 80 to 100 billion new garments annually, leading to substantial resource consumption and waste.

In the European Union, textile purchases result in approximately 270 kg of CO2 emissions per person each year. Those emissions are roughly equivalent to the amount released over 21 days of driving a gasoline-powered car.

In 2022, the major fast fashion retailers reported high levels of CO2 emissions. The Inditex group generated over 16 million metric tons, while Shein declared more than 9 million metric tons, covering both direct and indirect emissions (Scope 1, 2, and 3).

Before the Store: The Impacts of Fast Fashion Manufacturing

The journey of fast fashion starts well before the clothes hit online stores or physical retail spaces. Examining the early stages of the fast fashion life cycle, we trace the origins of garments from factories around the world, considering dilemmas like design theft and the environmental toll of the materials chosen for production. We also confront the tough realities faced by workers in the industry, many of whom endure unsafe conditions for pay that falls short of a living wage. By linking production practices with their wider consequences, we reveal the hidden costs veiled by the lure of affordable trends.7. Where Is Fast Fashion Manufactured?

Fast fashion brands gravitate toward nations with a robust garment-making heritage and an abundant supply of inexpensive labor, which drives quick and cost-effective clothing production.

China and Bangladesh are at the forefront of fast fashion manufacturing, with China’s exports at a remarkable $293.6 billion and Bangladesh at $47.38 billion in 2023. However, as operational costs in China rise, the industry is turning to countries like Vietnam, India, and Pakistan, which combine cheap labor costs with expanding production capabilities.

Manufacturing in lower-cost, developing nations often comes with labor issues. Workers are regularly subjected to subpar working conditions and receive wages that scarcely cover the cost of living.

Fast fashion brands gravitate toward nations with a robust garment-making heritage and an abundant supply of inexpensive labor, which drives quick and cost-effective clothing production.

China and Bangladesh are at the forefront of fast fashion manufacturing, with China’s exports at a remarkable $293.6 billion and Bangladesh at $47.38 billion in 2023. However, as operational costs in China rise, the industry is turning to countries like Vietnam, India, and Pakistan, which combine cheap labor costs with expanding production capabilities.

Manufacturing in lower-cost, developing nations often comes with labor issues. Workers are regularly subjected to subpar working conditions and receive wages that scarcely cover the cost of living.

8. Fast Fashion Design Theft

The fast fashion industry’s relentless pursuit of the latest trends often comes at a significant cost to intellectual property rights, leading to widespread allegations of design theft.

Shein has found itself at the center of controversy, implicated in over 93 lawsuits in the United States since 2018. Allegations of trademark and copyright infringement are the most commonly levied complaints, usually by smaller brands and independent creators.

However, Shein isn’t the only fast fashion company to come under fire for design theft. Brands such as Forever 21, H&M, Primark, Fashion Nova, and Zara have also encountered numerous copyright infringement lawsuits. This underscores a systemic issue within the industry: a culture of replication that prioritizes speed and cost over respect for original design work.

The fast fashion industry’s relentless pursuit of the latest trends often comes at a significant cost to intellectual property rights, leading to widespread allegations of design theft.

Shein has found itself at the center of controversy, implicated in over 93 lawsuits in the United States since 2018. Allegations of trademark and copyright infringement are the most commonly levied complaints, usually by smaller brands and independent creators.

However, Shein isn’t the only fast fashion company to come under fire for design theft. Brands such as Forever 21, H&M, Primark, Fashion Nova, and Zara have also encountered numerous copyright infringement lawsuits. This underscores a systemic issue within the industry: a culture of replication that prioritizes speed and cost over respect for original design work.

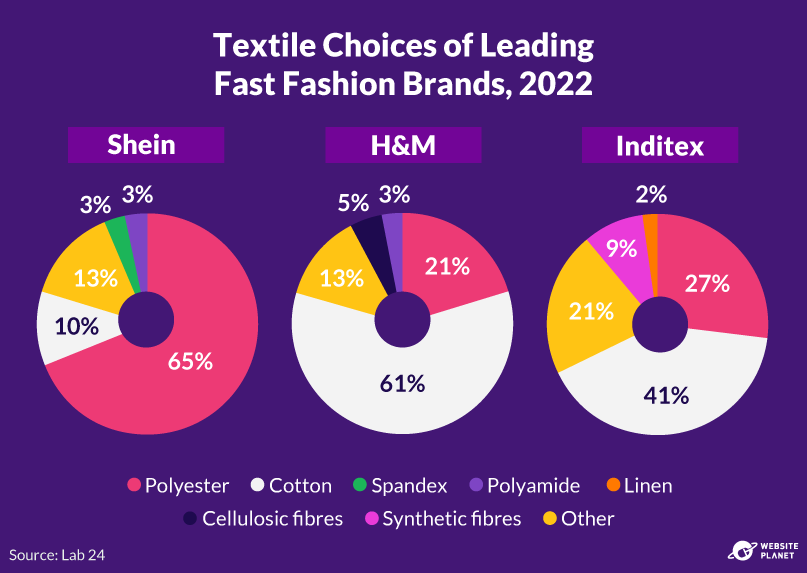

9. The Environmental Cost of Fast Fashion’s Fiber Choices

Much of fast fashion’s environmental impact can be tied to its use of synthetic fibers – think polyester, nylon, and acrylic.

These materials are favored for their affordability and versatility, but they come at a cost: their production is responsible for 1.35% of global oil consumption. This is more than the annual oil consumption of a country the size of Spain.

Synthetic materials are also a primary source of microplastic pollution, contributing to over a third of the microplastics found in our oceans. A typical laundry load can release up to 700,000 microplastic fibers into habitats like oceans, which may persist in the environment for over two centuries before decomposing.

Much of fast fashion’s environmental impact can be tied to its use of synthetic fibers – think polyester, nylon, and acrylic.

These materials are favored for their affordability and versatility, but they come at a cost: their production is responsible for 1.35% of global oil consumption. This is more than the annual oil consumption of a country the size of Spain.

Synthetic materials are also a primary source of microplastic pollution, contributing to over a third of the microplastics found in our oceans. A typical laundry load can release up to 700,000 microplastic fibers into habitats like oceans, which may persist in the environment for over two centuries before decomposing.

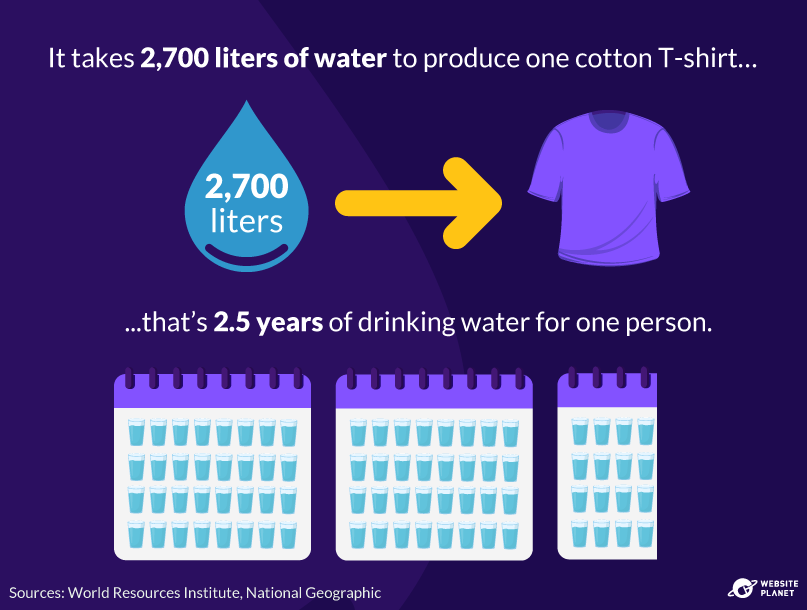

10. Cotton’s Water Footprint in Fast Fashion

Synthetic fibers are usually the scapegoat for fast fashion’s massive environmental effects, but their natural counterparts aren’t without issues. Cotton is a leading consumer of insecticides and pesticides and has a high water footprint.

It is the most water-intensive crop on the planet. Producing just one kilogram of cotton requires about 10,000 liters of water. Plus, 95% of the approximately 44 trillion liters of water that go towards irrigating crops grown for textile manufacturing is used for cotton.

Aside from diminishing our water resources, textile manufacturing and dyeing operations are responsible for 20% of total wastewater outputs. This wastewater is laden with toxic chemicals and often flows directly into rivers, threatening ecosystems and marine life.

Synthetic fibers are usually the scapegoat for fast fashion’s massive environmental effects, but their natural counterparts aren’t without issues. Cotton is a leading consumer of insecticides and pesticides and has a high water footprint.

It is the most water-intensive crop on the planet. Producing just one kilogram of cotton requires about 10,000 liters of water. Plus, 95% of the approximately 44 trillion liters of water that go towards irrigating crops grown for textile manufacturing is used for cotton.

Aside from diminishing our water resources, textile manufacturing and dyeing operations are responsible for 20% of total wastewater outputs. This wastewater is laden with toxic chemicals and often flows directly into rivers, threatening ecosystems and marine life.

11. Fast Fashion’s Cheap Labor – Not So Cheap Afterall

Fewer than 2% of the 75 million workers employed by the fast fashion industry worldwide earn a living wage. In manufacturing hubs like Bangladesh, China, and India, wages fall short of living costs, perpetuating poverty and preventing upward mobility of those who work in these environments.

Things don’t necessarily get better in more regulated markets, either. An overwhelming 85% of factories in Los Angeles, which are staffed primarily by immigrant women, were found to be in violation of labor laws. These included federal wage and working hour statutes.

Zara’s operations in Spain are an exception to the rule, paying approximately 3,000 workers an average of €8 per hour. At well above the €0.40 typical in Asian garment factories, this illustrates some major issues around wage discrimination.

Fewer than 2% of the 75 million workers employed by the fast fashion industry worldwide earn a living wage. In manufacturing hubs like Bangladesh, China, and India, wages fall short of living costs, perpetuating poverty and preventing upward mobility of those who work in these environments.

Things don’t necessarily get better in more regulated markets, either. An overwhelming 85% of factories in Los Angeles, which are staffed primarily by immigrant women, were found to be in violation of labor laws. These included federal wage and working hour statutes.

Zara’s operations in Spain are an exception to the rule, paying approximately 3,000 workers an average of €8 per hour. At well above the €0.40 typical in Asian garment factories, this illustrates some major issues around wage discrimination.

12. Safety Shortcomings in Fast Fashion Manufacturing

Fast fashion workers, many of whom are women and children, often work under hazardous conditions for up to 16 hours a day, seven days a week.

The tragic Rana Plaza Factory collapse in Bangladesh in 2013, which claimed 1,100 lives and injured 2,500, highlighted the dangers that come with fashion factory working conditions. This incident, the deadliest in modern garment industry history, occurred despite clear structural risks and warnings given to shop stewards.

In addition to working in structurally unsound buildings, workers are often exposed to harmful chemicals and poor ergonomic conditions. Many workers also report being subjected to verbal, psychological, physical, and even sexual abuse.

Fast fashion workers, many of whom are women and children, often work under hazardous conditions for up to 16 hours a day, seven days a week.

The tragic Rana Plaza Factory collapse in Bangladesh in 2013, which claimed 1,100 lives and injured 2,500, highlighted the dangers that come with fashion factory working conditions. This incident, the deadliest in modern garment industry history, occurred despite clear structural risks and warnings given to shop stewards.

In addition to working in structurally unsound buildings, workers are often exposed to harmful chemicals and poor ergonomic conditions. Many workers also report being subjected to verbal, psychological, physical, and even sexual abuse.

At the Store and After: Fast Fashion Consumption

Fast fashion doesn’t slow down once it hits the shelves. As we move on from the frenzied cycle of fast production, we look at the relentless changes to store inventories, the brisk pace at which new items arrive, and the brief life spans they often have before becoming waste. Investigating further, we uncover the vast scale of clothing waste, tracking where these discarded items end up and the repercussions of the industry’s prevalent return culture. This insight into the cycle of buy-wear-discard might challenge you to rethink your fashion footprint.13. How Often Are New Items Added to the Store?

In an era defined by a relentless cycle of new trends, brands are pushing the limits of production and consumption. Brands will often launch multiple collections each year to meet customers’ demands for the newest styles. The shift towards these high-frequency releases began in the early 2000s when Zara started to drop new clothes into stores every two weeks. A practice that has since become the norm across the industry. Today, fast fashion’s biggest brands add thousands of new pieces to digital and physical racks every month. Online giants like Shein can sometimes release up to 10,000 items in a single day.

14. How Many Times Is the Average Piece of Fast Fashion Worn?

The average fast fashion item is worn just seven times before being discarded, a trend that has escalated over the past few decades.

A study conducted between 2000 and 2016 found that the number of times a garment is worn overall decreased by 36%, even as our new clothing purchases surged by 60%. The longevity of our attire has dwindled too, with the same percentage of new purchases hanging in our closets for less than a year before being cast off.

This decrease in wearable lifetime is partly due to the poor quality and durability of fast fashion items, which struggle to withstand the wear and tear of regular use. The rapid trend cycle is also to blame here.

The average fast fashion item is worn just seven times before being discarded, a trend that has escalated over the past few decades.

A study conducted between 2000 and 2016 found that the number of times a garment is worn overall decreased by 36%, even as our new clothing purchases surged by 60%. The longevity of our attire has dwindled too, with the same percentage of new purchases hanging in our closets for less than a year before being cast off.

This decrease in wearable lifetime is partly due to the poor quality and durability of fast fashion items, which struggle to withstand the wear and tear of regular use. The rapid trend cycle is also to blame here.

15. How Much Clothing Do We Waste?

Consumers buy five times more clothes than they did in the ’80s, but these garments only last half as long. This shift has led to a startling reality: one garbage truck of clothes is burned or sent to landfills every second.

A large part of this waste comes from fast fashion, with garments being discarded after just a few wears. Notably, this issue is not uniform across all demographics – those with higher incomes generate on average 76% more clothing waste than those with lower incomes.

In the United States, each person throws away an average of 81.5 pounds of clothing every year. Globally, 92 million metric tons of textile waste are produced each year, amounting to a garbage truck full of clothes being dumped into landfills every second.

If current trends continue, the world is expected to discard more than 134 million metric tons of textiles annually by 2030.

Consumers buy five times more clothes than they did in the ’80s, but these garments only last half as long. This shift has led to a startling reality: one garbage truck of clothes is burned or sent to landfills every second.

A large part of this waste comes from fast fashion, with garments being discarded after just a few wears. Notably, this issue is not uniform across all demographics – those with higher incomes generate on average 76% more clothing waste than those with lower incomes.

In the United States, each person throws away an average of 81.5 pounds of clothing every year. Globally, 92 million metric tons of textile waste are produced each year, amounting to a garbage truck full of clothes being dumped into landfills every second.

If current trends continue, the world is expected to discard more than 134 million metric tons of textiles annually by 2030.

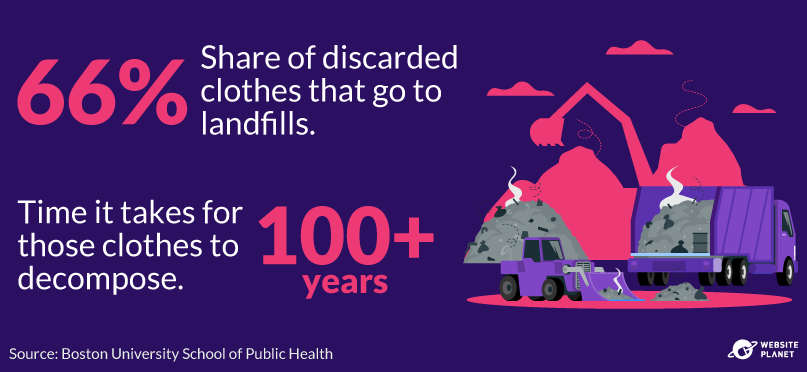

16. Where Does Our Wasted Clothing Go?

In the US, 66% of discarded fast fashion items land in dumps, with no hope of them decomposing due to the materials they’re made from. This waste contributes to local and global environmental issues, including the protracted release of greenhouse gasses and potential soil and water contamination.

Reportedly 15% of used textiles are recycled, but the reality is often a cycle of displacement, with many of these items being sent to developing countries. These garments swamp markets, undermine local industries, and create waste management crises.

Take West Africa as an example. Markets like Kantamanto in Accra, Ghana, receive millions of secondhand clothes each week, yet some 30% to 40% aren’t resellable and end up as waste, often burned or disposed of in the ocean.

Looking at these figures in combination, it’s likely that a substantial portion of garments – potentially up to 80% – end up in landfills globally.

In the US, 66% of discarded fast fashion items land in dumps, with no hope of them decomposing due to the materials they’re made from. This waste contributes to local and global environmental issues, including the protracted release of greenhouse gasses and potential soil and water contamination.

Reportedly 15% of used textiles are recycled, but the reality is often a cycle of displacement, with many of these items being sent to developing countries. These garments swamp markets, undermine local industries, and create waste management crises.

Take West Africa as an example. Markets like Kantamanto in Accra, Ghana, receive millions of secondhand clothes each week, yet some 30% to 40% aren’t resellable and end up as waste, often burned or disposed of in the ocean.

Looking at these figures in combination, it’s likely that a substantial portion of garments – potentially up to 80% – end up in landfills globally.

The Business of Fast Fashion

Understand the economics of the fast fashion industry, where profit meets pace in the global marketplace. Here, we explore the sprawling empire of fast fashion’s market value, alongside the towering revenues and profits that define its leading players. We spotlight Shein’s ambitions for an IPO and highlight the unique profit margins that set fast fashion apart from the broader apparel industry. We also look at the stark contrast in growth trajectories for the burgeoning sustainable fashion sector and illuminate the financial strain of return policies on the industry.17. Fast Fashion’s Economic Growth

The fast fashion industry has grown exponentially in recent years. From a valuation of around $91 billion in 2021, it’s projected to reach nearly $185 billion by 2027. A key driver of this growth is younger generations’ attraction to affordable, trendy clothing.

While economically attractive, this growth could have unfortunate implications. Fast fashion’s accelerated production and turnover rates contribute significantly to environmental issues, including increased natural resource use and waste.

The fast fashion industry has grown exponentially in recent years. From a valuation of around $91 billion in 2021, it’s projected to reach nearly $185 billion by 2027. A key driver of this growth is younger generations’ attraction to affordable, trendy clothing.

While economically attractive, this growth could have unfortunate implications. Fast fashion’s accelerated production and turnover rates contribute significantly to environmental issues, including increased natural resource use and waste.

18. Revenues and Profits of the Industry Giants

In 2023, fast fashion powerhouse Intidex, Zara’s parent company, reported revenue of nearly $40 billion. The company not only maintained its position as the top moneymaker in the fast fashion industry but also surpassed the revenues of ASOS, Forever 21, Mango, and Boohoo combined.

Shein, which does not release its revenue figures, is estimated to have generated over $30 billion, underscoring the rapid rise of online-first retail models in capturing consumer interest and market share. H&M followed with $22.1 billion in sales.

The substantial gap between these leaders and other key players emphasizes the concentration of power within the industry and the increasing importance of digital strategies and global presence in driving revenue growth.

In 2023, fast fashion powerhouse Intidex, Zara’s parent company, reported revenue of nearly $40 billion. The company not only maintained its position as the top moneymaker in the fast fashion industry but also surpassed the revenues of ASOS, Forever 21, Mango, and Boohoo combined.

Shein, which does not release its revenue figures, is estimated to have generated over $30 billion, underscoring the rapid rise of online-first retail models in capturing consumer interest and market share. H&M followed with $22.1 billion in sales.

The substantial gap between these leaders and other key players emphasizes the concentration of power within the industry and the increasing importance of digital strategies and global presence in driving revenue growth.

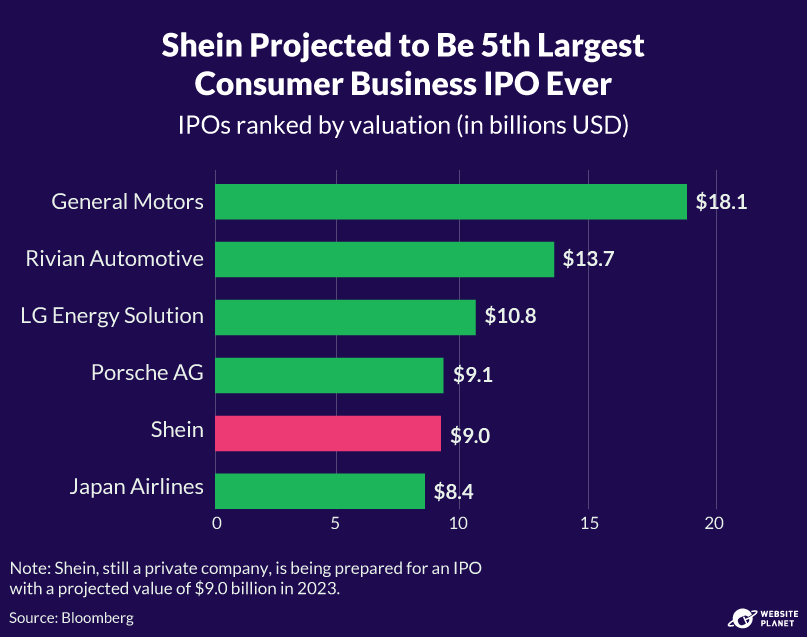

19. Shein’s IPO Ambitions

Shein has eyed a $90 billion valuation in a potential US initial public offering (IPO). This would be a landmark debut on the New York Stock Exchange, making Shein the fifth-largest consumer IPO.

However, Shein’s aspirations in the US are clouded in part by scrutiny over the labor practices of its manufacturers.

Legislators in the country have called for a pause on Shein’s share offering until the brand can confirm its supply chain is devoid of forced labor. As such, Shein is considering moving its IPO to London, Hong Kong, or Singapore.

Shein has eyed a $90 billion valuation in a potential US initial public offering (IPO). This would be a landmark debut on the New York Stock Exchange, making Shein the fifth-largest consumer IPO.

However, Shein’s aspirations in the US are clouded in part by scrutiny over the labor practices of its manufacturers.

Legislators in the country have called for a pause on Shein’s share offering until the brand can confirm its supply chain is devoid of forced labor. As such, Shein is considering moving its IPO to London, Hong Kong, or Singapore.

20. Profit Margins in Fast Fashion

Fast fashion brands report profit margins of up to 16%, surpassing those of typical specialty retailers by 9%. Their strategy? Charging 4 to 5 times more than their clothes cost to make, doubling the usual 2.2 to 2.5 times industry markup.

The fast fashion advantage comes from the ability to quickly move from design to sales, contrasting with traditional fashion brands that keep markups lower, focusing on ethical production and sustainability.

Fast fashion brands report profit margins of up to 16%, surpassing those of typical specialty retailers by 9%. Their strategy? Charging 4 to 5 times more than their clothes cost to make, doubling the usual 2.2 to 2.5 times industry markup.

The fast fashion advantage comes from the ability to quickly move from design to sales, contrasting with traditional fashion brands that keep markups lower, focusing on ethical production and sustainability.

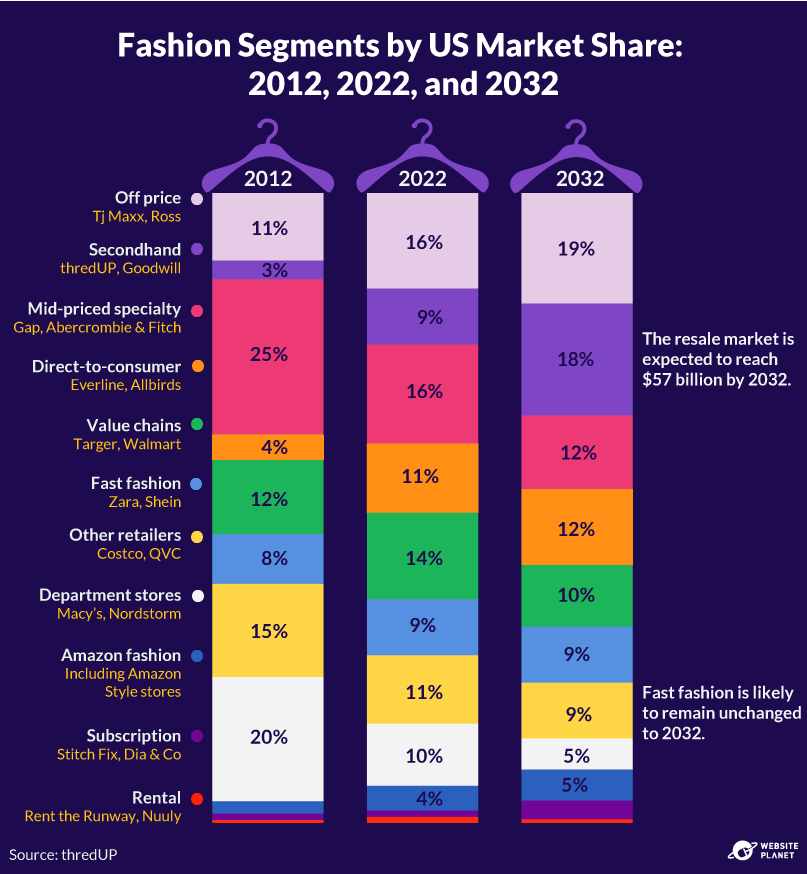

21. Fast Fashion’s Market Share

The retail landscape is shifting and fast fashion’s market share in the US is expected to hit a standstill, maintaining a steady 9% from 2022 all the way to 2032. In contrast, secondhand shopping is projected to double its market share to reach 18% over the same period.

Data shows that younger shoppers are setting the trend, with every two out of five pieces in the wardrobes of Gen Zs being pre-owned. While value remains the top influence on clothing purchases, finding sustainable brands and unique, one-of-a-kind items are top priorities among these shoppers.

The retail landscape is shifting and fast fashion’s market share in the US is expected to hit a standstill, maintaining a steady 9% from 2022 all the way to 2032. In contrast, secondhand shopping is projected to double its market share to reach 18% over the same period.

Data shows that younger shoppers are setting the trend, with every two out of five pieces in the wardrobes of Gen Zs being pre-owned. While value remains the top influence on clothing purchases, finding sustainable brands and unique, one-of-a-kind items are top priorities among these shoppers.

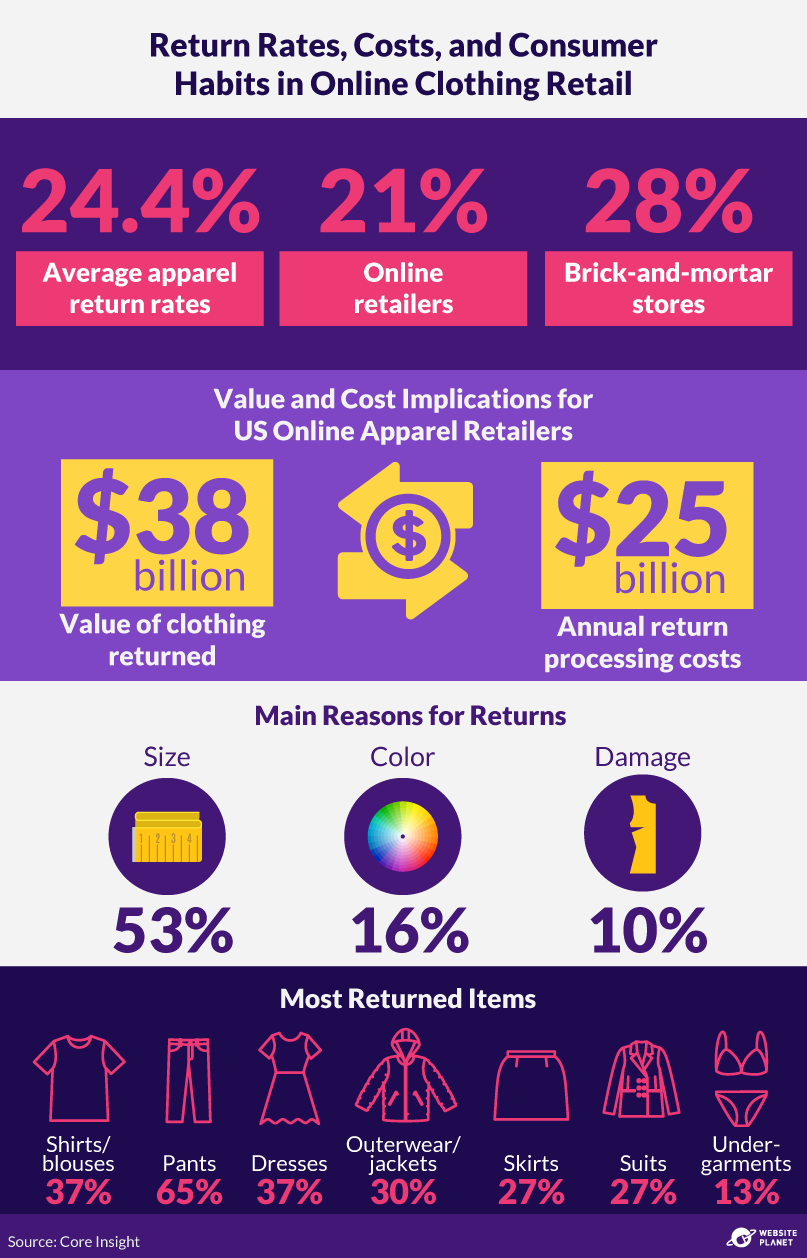

22. The Cost of Returns in Fashion

The fashion industry experiences the highest return rates across all industries, with a global average of 30%. In the US, fashion brands grapple with an average return rate of 24.4%, which drives an estimated $25 billion in returns processing costs alone.

Many returned items are deemed “unsellable” once returned and sent to the landfill or incinerated due to the resources required to process, clean, repackage, and redistribute them. Brands may also discard clothing simply because it’s fallen out of fashion.

Despite this, a study reveals that reducing returns isn’t a top priority for retailers. Nearly one-third of retailers accept returns as an industry norm and are more focused on adjusting return policies – like charging customers to send purchases back to the store – than addressing the root causes, like size and color mismatches.

The fashion industry experiences the highest return rates across all industries, with a global average of 30%. In the US, fashion brands grapple with an average return rate of 24.4%, which drives an estimated $25 billion in returns processing costs alone.

Many returned items are deemed “unsellable” once returned and sent to the landfill or incinerated due to the resources required to process, clean, repackage, and redistribute them. Brands may also discard clothing simply because it’s fallen out of fashion.

Despite this, a study reveals that reducing returns isn’t a top priority for retailers. Nearly one-third of retailers accept returns as an industry norm and are more focused on adjusting return policies – like charging customers to send purchases back to the store – than addressing the root causes, like size and color mismatches.

Greening the Fast Fashion Industry

There’s no doubt that the fast fashion industry will have to green its image if it wants to survive in the long term. From embracing renewable energy to the rise of circular fashion in Europe, we delve into the industry’s pivot towards sustainability. Yet, amid these strides, the shadow of greenwashing looms, challenging us to discern genuine eco-efforts from marketing spin.23. Greenwashing and the Truth behind Recycling Claims

Sustainability sells, but at what cost? With 39% of fashion sustainability claims potentially false or misleading, the industry faces a crisis of credibility.

Brands, eager to appeal to eco-conscious consumers, often promise more than they can deliver. This phenomenon, known as greenwashing, sees companies projecting an eco-friendly image while their practices tell a different story.

Commitments to recycled materials, take-back systems, and recycling schemes clash with ever-growing fashion production, making these promises nearly impossible to fulfill and opening many brands up to criticism.

In response to this greenwashing epidemic, the European Commission aims to introduce stringent rules around product durability and repairability, banning vague or unsubstantiated green claims.

Sustainability sells, but at what cost? With 39% of fashion sustainability claims potentially false or misleading, the industry faces a crisis of credibility.

Brands, eager to appeal to eco-conscious consumers, often promise more than they can deliver. This phenomenon, known as greenwashing, sees companies projecting an eco-friendly image while their practices tell a different story.

Commitments to recycled materials, take-back systems, and recycling schemes clash with ever-growing fashion production, making these promises nearly impossible to fulfill and opening many brands up to criticism.

In response to this greenwashing epidemic, the European Commission aims to introduce stringent rules around product durability and repairability, banning vague or unsubstantiated green claims.

24. Can We Green Fast Fashion?

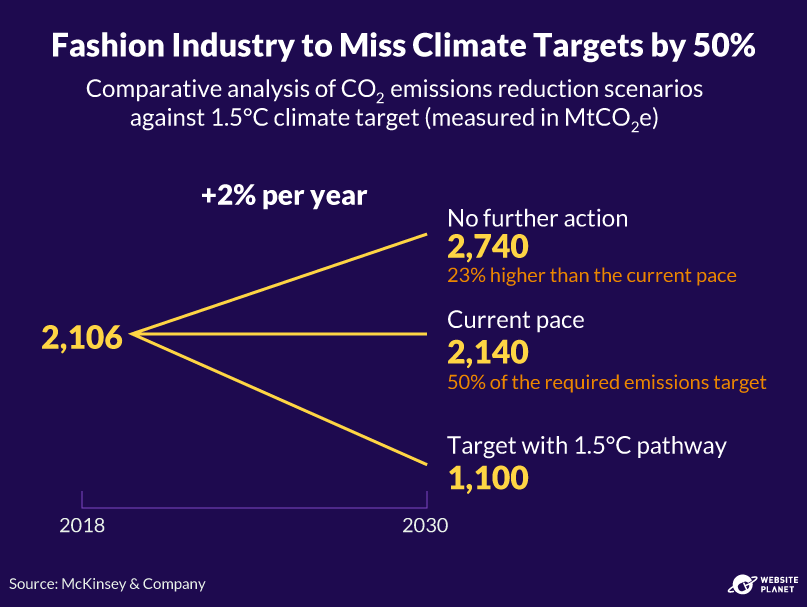

In the face of escalating climate concerns, the fashion industry finds itself at a crossroads. To align with the Paris Agreement’s ambitious goal of limiting the global temperature increase to 1.5°C, the industry must slash its emissions by 50% by 2030.

Current projections have fashion producing a staggering 2.7 billion metric tons of emissions by 2030. The industry could slash emissions by 347 million metric tons and exploit a $560 billion economic opportunity by pivoting to circular business models such as clothing rental, resale, and repair.

In the face of escalating climate concerns, the fashion industry finds itself at a crossroads. To align with the Paris Agreement’s ambitious goal of limiting the global temperature increase to 1.5°C, the industry must slash its emissions by 50% by 2030.

Current projections have fashion producing a staggering 2.7 billion metric tons of emissions by 2030. The industry could slash emissions by 347 million metric tons and exploit a $560 billion economic opportunity by pivoting to circular business models such as clothing rental, resale, and repair.

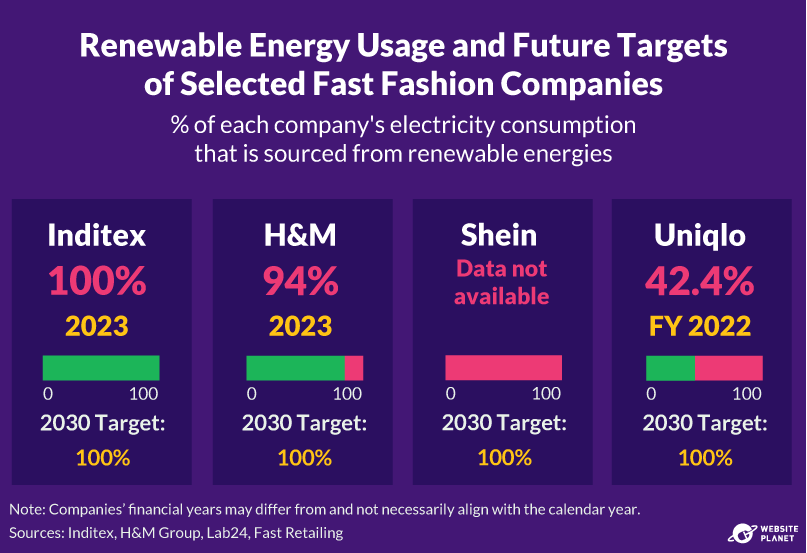

25. The Shift to Renewable Energy in Fast Fashion

Key players in the fast fashion industry are increasingly adopting renewable energy and sustainability measures. In 2022, Inditex achieved 100% renewable electricity usage and aims for a 25% reduction in water consumption by 2025, along with net-zero emissions by 2040.

H&M is progressing towards sustainability, with 23% of its materials recycled in 2022 and a target to reduce CO2 emissions by 56% by 2030. Shein plans to convert 31% of its polyester products to recycled materials and cut greenhouse gas emissions by 25% by 2030.

Mango and Primark are also contributing to these efforts, focusing on reducing emissions and increasing the use of natural and recycled fibers.

Key players in the fast fashion industry are increasingly adopting renewable energy and sustainability measures. In 2022, Inditex achieved 100% renewable electricity usage and aims for a 25% reduction in water consumption by 2025, along with net-zero emissions by 2040.

H&M is progressing towards sustainability, with 23% of its materials recycled in 2022 and a target to reduce CO2 emissions by 56% by 2030. Shein plans to convert 31% of its polyester products to recycled materials and cut greenhouse gas emissions by 25% by 2030.

Mango and Primark are also contributing to these efforts, focusing on reducing emissions and increasing the use of natural and recycled fibers.

26. Europe Pioneering Circular Fashion Initiatives

The economic potential of circular fashion is substantial. The Ellen MacArthur Foundation estimates that the industry could unlock an estimated $560 billion in economic opportunities by moving to a circular system.

Europe is leading the charge in circular fashion, with notable legislative efforts shaping the industry’s future. France’s 2021 law on textile waste prevention and the European Commission’s 2022 plan for mandatory recycled fiber content in textiles are pivotal steps towards enforcing sustainable practices.

The US is also creating fashion-forward environmental legislation. The Fashion Sustainability and Social Accountability Act is aimed at making large clothing companies more transparent about their operations and accountable for their effects.

The economic potential of circular fashion is substantial. The Ellen MacArthur Foundation estimates that the industry could unlock an estimated $560 billion in economic opportunities by moving to a circular system.

Europe is leading the charge in circular fashion, with notable legislative efforts shaping the industry’s future. France’s 2021 law on textile waste prevention and the European Commission’s 2022 plan for mandatory recycled fiber content in textiles are pivotal steps towards enforcing sustainable practices.

The US is also creating fashion-forward environmental legislation. The Fashion Sustainability and Social Accountability Act is aimed at making large clothing companies more transparent about their operations and accountable for their effects.

27. Sustainability Goals of the Biggest Fast Fashion Brands

As the fast fashion industry faces increasing scrutiny over its environmental impacts, leading brands are setting ambitious sustainability goals to reduce their footprint.

Companies like Inditex, H&M, and Shein are spearheading efforts to embrace more sustainable practices. These initiatives range from adopting recycled or sustainably sourced materials for all products to achieving net-zero emissions and enhancing the recyclability of clothing.

These commitments reflect a growing recognition of consumer demand for more ethical and eco-conscious products.

As the fast fashion industry faces increasing scrutiny over its environmental impacts, leading brands are setting ambitious sustainability goals to reduce their footprint.

Companies like Inditex, H&M, and Shein are spearheading efforts to embrace more sustainable practices. These initiatives range from adopting recycled or sustainably sourced materials for all products to achieving net-zero emissions and enhancing the recyclability of clothing.

These commitments reflect a growing recognition of consumer demand for more ethical and eco-conscious products.

Alternatives to Fast Fashion

Secondhand apparel and sustainable fashion markets have seen impressive growth and increased market presence over the past few years. We probe consumers’ ability to navigate and identify truly sustainable options. We also spotlight the trailblazers of sustainable fashion, those brands leading the charge toward a more ethical and environmentally friendly industry. Circular and sustainable practices are not just alternatives, but increasingly the mainstay of fashion’s future.28. The Surge of Secondhand Fashion

Millennials and Gen Zs are drawn to secondhand shopping for its affordability and environmental benefits. Another drawcard is the rise of online retail and rental platforms, like The RealReal and Poshmark, which are projected to outpace the general apparel market’s growth threefold by 2026.

These shopping habits are estimated to save approximately 44% in CO2 emissions compared to buying new. They’re also driving massive growth in the market.

The global secondhand apparel market, valued at $177 billion in 2022, is expected to more than double to $351 billion by 2027. The growth will be particularly strong in the US, where the market is expected to see 16 times higher growth than the overall apparel market over the same period.

Millennials and Gen Zs are drawn to secondhand shopping for its affordability and environmental benefits. Another drawcard is the rise of online retail and rental platforms, like The RealReal and Poshmark, which are projected to outpace the general apparel market’s growth threefold by 2026.

These shopping habits are estimated to save approximately 44% in CO2 emissions compared to buying new. They’re also driving massive growth in the market.

The global secondhand apparel market, valued at $177 billion in 2022, is expected to more than double to $351 billion by 2027. The growth will be particularly strong in the US, where the market is expected to see 16 times higher growth than the overall apparel market over the same period.

29. Do Customers Know Which Clothing Is Sustainable?

There’s a high demand for eco-friendly fashion. A significant majority of US and UK shoppers – over 60% – want online retailers to increase their offerings of environmentally friendly fashion items.

However, a 2022 survey found that 53% of online consumers struggle to discern the sustainability of clothing items on digital platforms. Plus, only 12% felt confident in making such assessments.

The challenge stems from issues like diverse sustainability criteria to the complex environmental impacts of materials like recycled plastics. This is increasingly driving consumers to call for greater transparency and more easily understandable sustainability information on retail websites.

There’s a high demand for eco-friendly fashion. A significant majority of US and UK shoppers – over 60% – want online retailers to increase their offerings of environmentally friendly fashion items.

However, a 2022 survey found that 53% of online consumers struggle to discern the sustainability of clothing items on digital platforms. Plus, only 12% felt confident in making such assessments.

The challenge stems from issues like diverse sustainability criteria to the complex environmental impacts of materials like recycled plastics. This is increasingly driving consumers to call for greater transparency and more easily understandable sustainability information on retail websites.

30. Most Popular Sustainable Fashion Brands

The popularity of sustainable brands is part of a broader trend towards slow fashion, which focuses on small-batch production, ethical manufacturing practices, and long-term environmental goals.

Patagonia, the most searched sustainable brand online, is renowned for using 98% recycled materials in its products. The brand’s Fair Trade Certified products, made from organic cotton and recycled materials, embody its commitment to environmental and ethical practices.

Many of the most well-known sustainable fashion brands have committed to using sustainable, organic, and recycled materials to create their products. They also often boast various environmental certifications. However, it’s crucial for consumers to research brands thoroughly, as greenwashing is prevalent in the industry.

The popularity of sustainable brands is part of a broader trend towards slow fashion, which focuses on small-batch production, ethical manufacturing practices, and long-term environmental goals.

Patagonia, the most searched sustainable brand online, is renowned for using 98% recycled materials in its products. The brand’s Fair Trade Certified products, made from organic cotton and recycled materials, embody its commitment to environmental and ethical practices.

Many of the most well-known sustainable fashion brands have committed to using sustainable, organic, and recycled materials to create their products. They also often boast various environmental certifications. However, it’s crucial for consumers to research brands thoroughly, as greenwashing is prevalent in the industry.

How You Can Lessen Fast Fashion’s Environmental Impact

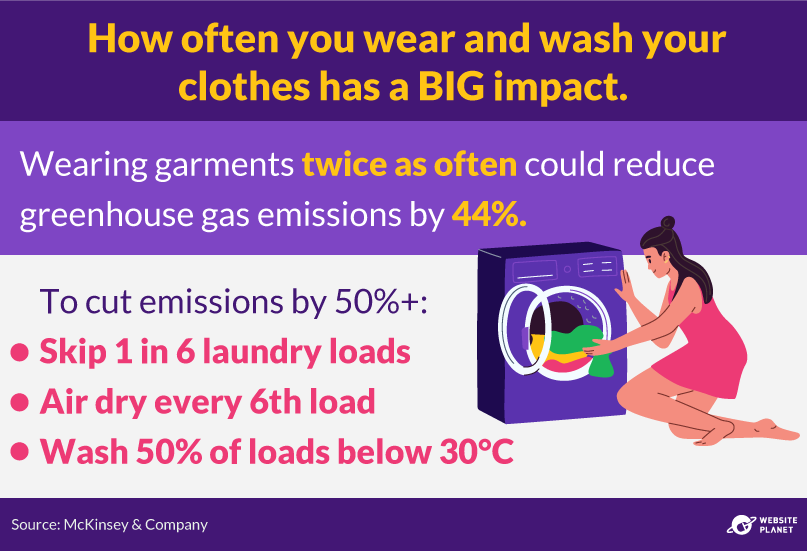

The environmental impact of fast fashion is significant, and consumer choices play a crucial role in shaping this industry. With awareness growing – 50% of buyers recognize the industry’s negative environmental impact – there is potential for meaningful change. One great way to make an impact is by extending the wearable lifetime of your clothes. Doubling the average number of wears for each garment could reduce greenhouse gas emissions by 44% when compared with the impact of producing a new piece. The #30WearsChallenge motivates consumers to extend the life of our clothes, suggesting that each item should be worn at least 30 times to significantly cut down CO2 emissions and waste. This initiative also sheds light on the fact that the majority of us regularly wear only about 10% of our wardrobe. Shoppers often gravitate toward fast fashion brands due to their affordability and the challenge of identifying sustainable products. However, there are several strategies consumers can adopt to mitigate fast fashion’s carbon footprint.1. Embrace Circular Fashion and Shop Secondhand

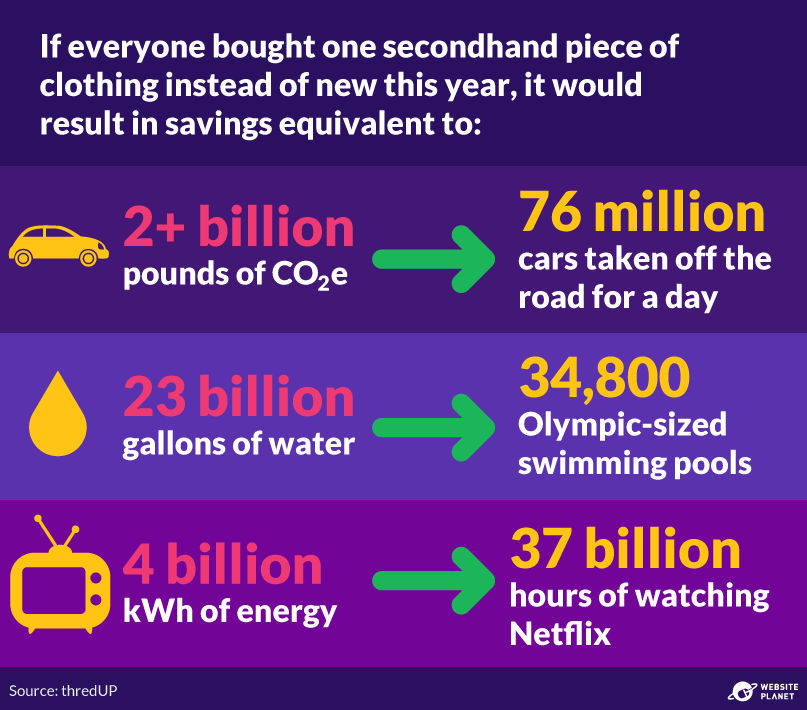

By participating in the circular fashion movement (e.g. through buying secondhand), we can extend the lifetime of garments and reduce the need for new resource-intensive production.

Choosing pre-owned over new reduces carbon emissions by 25% on average. Over a lifetime, buying used garments saves 8.41 pounds of CO2 emissions, 16.48 kWh of energy, and 88.89 gallons of water compared to buying new items. That’s a powerful change, as simple as swapping a trip to a fast fashion outlet for a secondhand shop.

By participating in the circular fashion movement (e.g. through buying secondhand), we can extend the lifetime of garments and reduce the need for new resource-intensive production.

Choosing pre-owned over new reduces carbon emissions by 25% on average. Over a lifetime, buying used garments saves 8.41 pounds of CO2 emissions, 16.48 kWh of energy, and 88.89 gallons of water compared to buying new items. That’s a powerful change, as simple as swapping a trip to a fast fashion outlet for a secondhand shop.

2. Shift Purchase Habits

Seek out sustainable products. Meanwhile, understanding the trade-offs between natural and synthetic fibers can also help you make sustainable purchasing decisions. Nearly a quarter (24%) of companies aim to produce at least half of their products from recycled materials by 2025. Favor these brands and join the 65% of Gen Z and millennials opting for sustainable purchases.3. Prioritize Longevity and Reduce Consumption

Invest in durable clothes and use repair services. Embrace quality over quantity; remember, extending a garment’s life by one year can reduce its environmental impact by 24%. For example, Patagonia repairs 50,000 items each year to reduce the number of garments potentially going to the landfill.4. Maintain Your Clothes Responsibility

Simple changes in how we care for our clothes can make a significant difference. Washing clothes at lower temperatures (below 30 degrees) and using high-quality detergents can extend the lifespan of garments by up to 4 times and reduce microfibre pollution.

Simple changes in how we care for our clothes can make a significant difference. Washing clothes at lower temperatures (below 30 degrees) and using high-quality detergents can extend the lifespan of garments by up to 4 times and reduce microfibre pollution.

5. Dispose Responsibly

Once clothes reach the end of their lifespan, proper disposal is crucial to minimize landfill waste. Tossing textiles in the trash isn’t ideal, as they can release greenhouse gasses and potentially harmful chemicals. Instead, consider repurposing old clothing into cleaning rags or materials for crafts. They can also serve as stuffing for items such as pillows and pet beds. If crafting isn’t for you, look into donation options—many animal shelters, schools, and community centers welcome fabric scraps for various uses. Rather than add to the waste cycle, let your old clothes serve new purposes and support your community.The Bottom Line

While fast fashion companies generate staggering revenues and offer convenience to customers, their success often comes at a cost to the environment and workers’ rights. Fast fashion companies are hugely carbon intensive, generate large amounts of waste and pollution, and frequently don’t pay workers a living wage.Major fast fashion companies are beginning to acknowledge these impacts and take steps toward sustainability, but the journey is far from complete. These companies must change drastically to meet sustainability goals in line with the Paris Agreement.

Alternative practices like circular and sustainable fashion offer hope for the fashion industry. But the power to influence change extends to us as consumers, too.

By embracing even minor lifestyle adjustments – like investing in secondhand clothing – we can help diminish fast fashion’s environmental impact. When multiplied across millions of consumers, small individual changes can potentially reshape the entire fashion industry.