Inside this Article

Understanding Credit Card Processing FeesHow Pricing Models Affect Your Credit Card Processing FeesAdditional Fees that Can Add to Your Overall Processing CostsHow to Calculate Your Business’s True Processing CostHow to Offset or Lower Your Credit Card Processing FeesOur Top Five Recommended Credit Card Processing CompaniesChoose a Company with Fair and Transparent Credit Card Processing FeesFAQ

Understanding Credit Card Processing Fees

The total credit card processing fee your business will pay for each transaction is actually a combination of multiple fees.

These include the fee you’ll pay to the card network, the fee you’ll pay to the bank that issued the credit card to your customer (interchange or bank rate fee), and the fee you’ll pay to your credit card processing company (payment processing fee).

Processing fees will also vary based on how your customer pays. For example, many credit card processors charge higher transaction fees for card-not-present transactions, such as when a customer makes a purchase online or over the phone, or when you or your staff key in payment details.

Card Network/Assessment Fee

The assessment fee or card brand fee is the fee you pay to the credit card network itself. Major brands include American Express, Discover, Mastercard, and Visa. These fees are generally quite low, ranging from 0.13% for Discover to 0.15% for American Express. Updates to these fees occur twice a year. Most payment processors will lump the assessment fee and interchange fee as a single charge on your monthly statement.Interchange Fee

The bank that issued the credit or debit card will also charge a fee based on the transaction amount. This interchange fee varies by type of card used, your business type or merchant category (MCC), and whether a customer pays in person or online. Interchange fees typically range from 1.5% – 3.5%, but some card issuers may charge a higher percentage based on the transaction amount or whether the customer uses a basic or rewards credit card. Cards that offer travel rewards and other perks like purchase protections typically have higher interchange fees. You can also expect to pay a higher fee for online and other card-not-present payments because banks consider these types of transactions to be riskier than those made in person. On top of the interchange rate, some transactions will also include a flat fee, which can range from 10¢ – 22¢. Here are the average rates for the four major card networks:| Card Brand | Average Interchange Rates for Credit Cards | Average Interchange Rates for Debit Cards |

|---|---|---|

| Visa | 1.38% – 2.73% | 0.8% – 1.75% |

| Mastercard | 1.48% – 2.83% | 0.05% – 1.76% |

| Discover | 1.57% – 2.70% | 0.05% – 1.75% |

| American Express | 2.3% – 3.5% | N/A |

Payment Processing Fee

Your payment processing fee will depend on the plan you choose and payment model: subscription style, interchange plus, tiered pricing, or flat rate. Payment processing fees are charged in addition to the interchange (or bank rate fee) and the card network fee. They are the fees you pay to your processing company for handling credit card transactions. Some credit card processors like PAYARC and CreditCardprocessing.com offer plans with zero interchange markup, which can help you save on processing costs. While the interchange and card network fees are set in stone, you may be able to negotiate a better processing fee with your credit card processor.How Pricing Models Affect Your Credit Card Processing Fees

Processors use different pricing models and fee structures, which are often difficult to navigate. Figuring out which model will best serve your needs is key to understanding how to minimize your processing costs.

The four most common pricing models you’ll encounter are subscription-style (or membership), interchange-plus, tiered pricing, and flat rate pricing.

Subscription-Style

Interchange-Plus

The name says it all: your processing fee under this pricing model includes the card network assessment fee, the variable wholesale interchange fee the card issuer charges, plus the processor’s markup on the interchange rate. This is one of the more transparent pricing models because the processor’s markup and per transaction fee are clearly spelled out.Tiered

With this pricing model you’ll pay a different rate based on the “tier” your transactions fall under. A common approach is to classify transactions as qualified (credit cards without reward programs), mid-qualified (credit cards with basic reward programs), or non-qualified (corporate cards and cards with generous reward programs). While tiered pricing may look less expensive than interchange-plus, it tends to be more costly. Processors often quote the rate for the lowest tier when they’re encouraging you to sign up and then downgrade transactions and put them into the tier with the highest possible rate.Flat Rate

Under this pricing model, when a customer pays with a credit card, digital wallet, or debit card, you’ll pay a percentage of the total transaction amount plus a flat fee. The processor’s fee is the same for all in-person credit card payments and typically averages 2.6% – 2.99% with a flat fee of 10¢ – 49¢ for these transactions. As with interchange-plus, the percentage markup for online and other card-no-present transactions is higher, ranging from about 2.9% to as much as 3.49%. Processors that offer flat rate pricing are attractive to merchants looking for a simple, easy to understand pricing structure and no monthly fee. However, because the markup on the bank and card network fees is higher, flat rate pricing can be more expensive as your sales volume grows.Pro Tip: Pricing Transparency

Tiered pricing is the least transparent pricing structure. By bundling interchange fees and markups into tiers, you can’t tell what your processor is charging for the different types of transactions. Subscription-style pricing is the most transparent because you pay a monthly plan fee, no interchange markup, and a few cents for any type of transaction.Additional Fees that Can Add to Your Overall Processing Costs

While transaction fees make up the biggest slice of your credit card processing costs, the total amount you’ll pay on a monthly or annual basis includes more than the sum of your processing fees. These additional charges can add up quickly. Some of the most common fees include:- Monthly plan fee. Most processors charge a monthly fee to use their services. For interchange-plus and tiered pricing payment structures, the monthly fee averages about $10.

- Monthly minimum fee. If you’re only charged $15 in processing fees and you have a $30 monthly minimum, you’ll be charged an additional $15.

- Payment gateway/virtual terminal fee. Some processors charge a monthly fee to use their virtual terminal and payment gateway. Prices can range from $7.95 to $25 per month. You may also be charged a setup fee.

- PCI compliance fee. This can be a regular monthly charge or one-time annual fee of up to $120. Not all processors charge for PCI compliance. For example, PAYARC and ProMerchant include the PCI compliance fee in your plan.

- PCI non-compliance fee. You’ll be charged anywhere from $20 to $44 per month until your business becomes compliant. You can avoid this fee by filing your PCI Self-Assessment Questionnaire (SAQ). Many processors will help you with this process.

Unsure which processor is best for your business?

Take this short quiz and get a tailor-made recommendation in seconds

How to Calculate Your Business’s True Processing Cost

To calculate your true processing costs, you’ll have to do a bit of math. Add up the card issuer’s interchange fee, the card network (or assessment) fee, and your payment processor’s total fees (including markup, monthly plan, and other charges).

Then, divide the sum of all your credit card processing costs by the total amount processed and multiply that number by 100 to get your effective rate. For low-risk merchants, the effective rate should average 3% – 4%. High-risk merchants should expect to pay as much as 2% more.

Your effective rate is your true credit card processing cost, and you may be surprised to learn it’s higher than you thought – especially when you factor in all the miscellaneous credit card processing fees that you may not have considered when projecting your costs.

Pro Tip: How to Calculate Your Effective Rate

You can use this equation to calculate your effective rate: Effective rate = total credit card processing fee/total amount processed x 100 For example, if your monthly transaction amount is $5,000 and your processing fees are $160, your effective rate would be 3.2%.How to Offset or Lower Your Credit Card Processing Fees

Low-risk businesses and those with brick-and-mortar locations that primarily accept in-person payments typically qualify for the lowest credit card rates. But don’t despair if your business is considered mid- to high-risk and most of your customers pay online. There are still ways to reduce your costs. To start, you should shop around for multiple quotes and ask each service to provide a detailed breakdown of all processing, monthly, and incidental fees. Be sure to ask about special discounts, such as lower rates if you process a high volume of transactions.Negotiate Better Rates With Your Current Processor

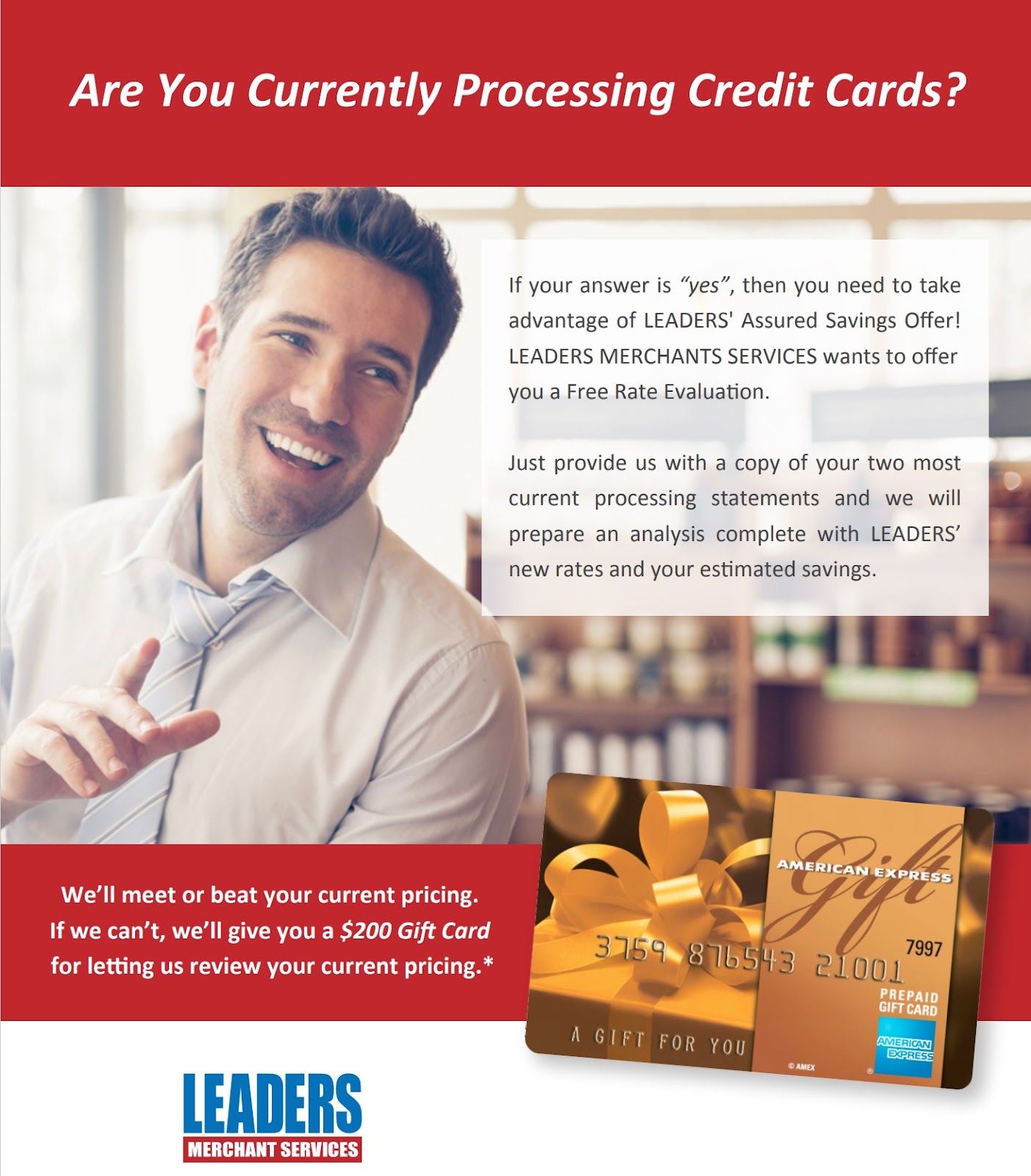

If you feel your current credit card processing company is taking too big a bite out of your earnings, you can negotiate. While it can’t change the interchange rate and card network fee, your processor may be open to reducing the interchange markup and/or transaction fee. You can also ask to have other monthly fees (such as your plan, payment gateway, or equipment fee) lowered.Check Out the Competition

Consider Surcharging

Surcharging passes the credit card processing fee (up to a maximum of 4%) onto the customer. If the customer chooses to pay with a credit card rather than a debit card, cash, ACH transfer, or e-check, they’ll see the surcharge on their bill. If you decide to sign up for a surcharging plan, it pays to choose a processor that will ensure your business complies with the complex card brand, federal, and state regulations.Offer a Cash Discount

When you offer a cash discount, the processing fee is already added into the purchase price, and customers who pay with cash pay less. As with surcharging, the maximum discount you can legally offer is 4%.

Our Top Five Recommended Credit Card Processing Companies

Our experts have spent hundreds of hours reviewing credit card processors’ fees and practices to find the most reliable companies that offer affordable pricing and disclose fees upfront. Some even encourage you to negotiate the rates best suited for your business.

1. Leaders Merchant Services: Budget-Friendly Interchange-Plus Pricing

Free Card Reader

Our Score

Our Score

Best Credit Card Processor in 2025

Negotiable Low Credit Card Processing Rates

Monthly Fee:

$9

Transaction Fee:

From 0.15% + $0

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

2. PAYARC: Affordable Subscription-Style Plans With No Hidden Costs

Our Score

Our Score

Custom Payment Processing Plans With No Hidden Costs

Monthly Fee:

From $69

Transaction Fee:

From 0% + 15¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

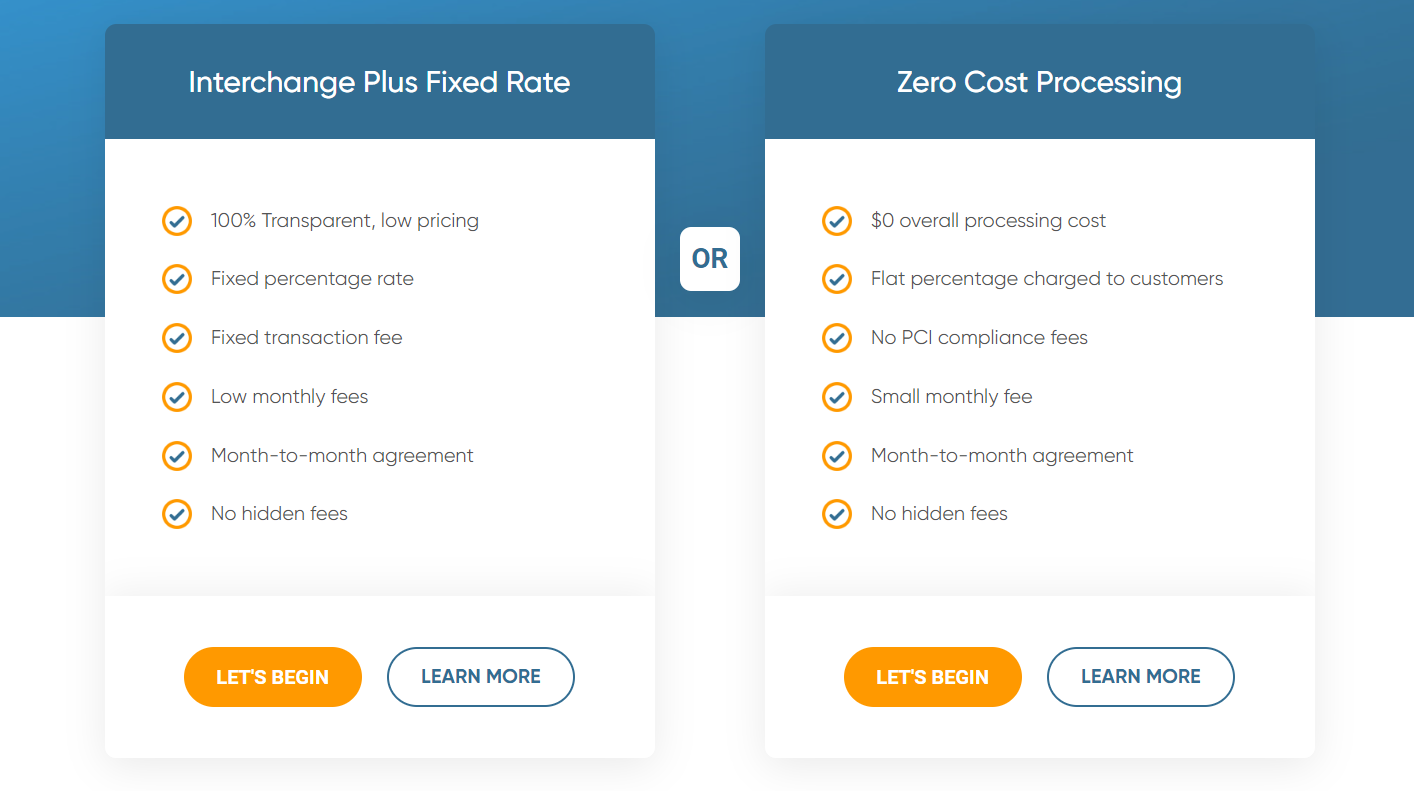

3. ProMerchant: Fixed Low Rates for Retailers and Restaurants

Our Score

Our Score

Interchange-Plus & Zero Cost Processing Plans Ideal for Restaurants and Retail

Monthly Fee:

$7.95

Transaction Fee:

From 3% + 10¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

4. Flagship Merchant Services: Fast Payouts and Easy Onboarding

Our Score

Our Score

Fast Onboarding & Quick Payouts With Same-Day Funding

Monthly Fee:

From $15

Transaction Fee:

From 1.58% + 19¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

5. CreditCardProcessing.com: Best for High Volume Merchants

Our Score

Our Score

Competitive Credit Card Processing Fees for High-Volume Businesses

Monthly Fee:

From $15

Transaction Fee:

From 0% + 0.05¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Choose a Company with Fair and Transparent Credit Card Processing Fees

With credit card transactions rising each year, every business needs to be able to process credit card payments. While there are dozens of credit card processing companies out there, not all offer fair or honest pricing. Our expert team has put in countless hours researching payment processors to find the best companies for different business needs. Learn which processors met our stringent criteria for fair pricing in our in-depth review of the best credit card processing companies in 2025. Here’s a summary of my top recommendations.| Pricing Model | Monthly Fee on Cheapest Plan | Transaction Fee on Cheapest Plan | ||

| Leaders Merchant Services | Interchange-plus or tiered | $9.00 | ~0.15% + $0 | |

| PAYARC | Subscription style, interchange-plus or cash discount | $69.00 | 0% + 15¢ (in-person & online) | |

| ProMerchant | Interchange-plus or cash discount | $7.95 | 3% + 10¢ (credit) | |

| Flagship | Interchange-plus or tiered | $7.95 | 1.58% + 19¢ (in person) | |

| CreditCardProcessing.com | Subscription style, Interchange-plus, or cash discount | $15.00 | 0.30% + 0.10¢ |