Inside this Article

Bitcoin Basics and Background

Imagine you have a notebook that’s shared with thousands of people worldwide. Every time a new page is added, it gets locked in place permanently — no one can change or erase it. This is similar to what happens in a blockchain, the technology that powers Bitcoin. With Bitcoin, every transaction becomes part of a digital ledger, much like a shared notebook. Each block (like a page) holds a set of records, and these blocks link together in the order they were added, forming a chain. The distributed nature of the ledger makes it almost impossible to rewrite anything in the blockchain, making it a secure way to conduct transactions without needing a bank to keep records. Bitcoin set the precedent in cryptocurrency of making its blockchain completely decentralized. Instead of being controlled by one bank or company, thousands of computers worldwide (called nodes) work together to verify each transaction and add new blocks to the chain. This means anyone, anywhere, can send or receive bitcoin securely, and everyone can trust that the record of their transaction will remain unchanged and transparent.How a Bitcoin Transaction Works

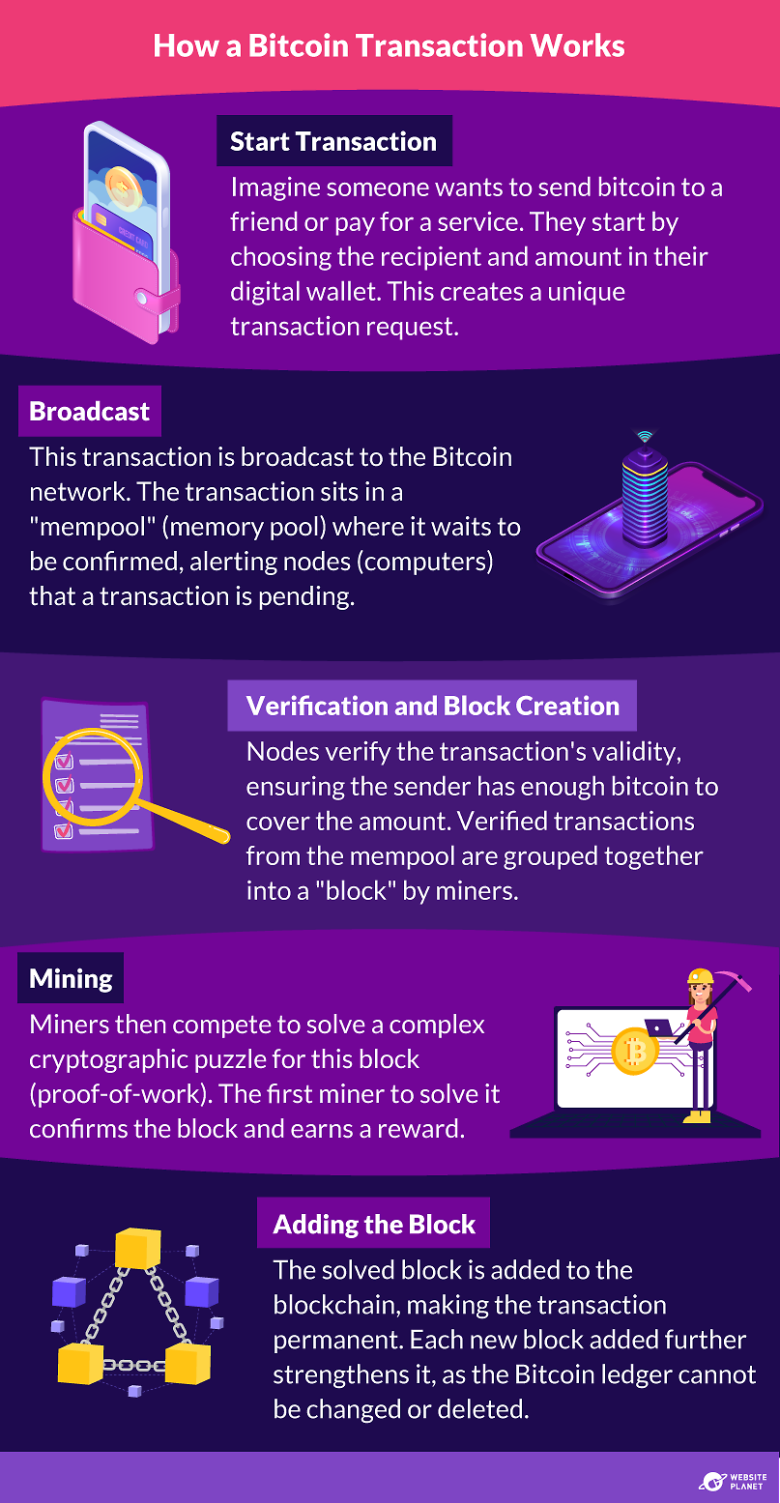

At the core of Bitcoin’s appeal is how blockchain enables a person-to-person, digital currency system.

Imagine you want to send bitcoin to a friend. To make this transaction, you need two things: a digital wallet (similar to a bank account but for digital currencies) and your friend’s Bitcoin address (similar to an email address).

In your wallet, you enter your friend’s Bitcoin address and the amount you want to send. Once you initiate the transaction, the network verifies it to make sure you have enough Bitcoin to complete the transfer. This transaction then joins a block, which is added to the blockchain. Once confirmed, your friend will see the bitcoin in their own wallet.

Through this process, Bitcoin transactions happen securely, without needing a bank or central authority to oversee them. It offers people a new way to exchange currency.

At the core of Bitcoin’s appeal is how blockchain enables a person-to-person, digital currency system.

Imagine you want to send bitcoin to a friend. To make this transaction, you need two things: a digital wallet (similar to a bank account but for digital currencies) and your friend’s Bitcoin address (similar to an email address).

In your wallet, you enter your friend’s Bitcoin address and the amount you want to send. Once you initiate the transaction, the network verifies it to make sure you have enough Bitcoin to complete the transfer. This transaction then joins a block, which is added to the blockchain. Once confirmed, your friend will see the bitcoin in their own wallet.

Through this process, Bitcoin transactions happen securely, without needing a bank or central authority to oversee them. It offers people a new way to exchange currency.

How Big Is the Bitcoin Blockchain?

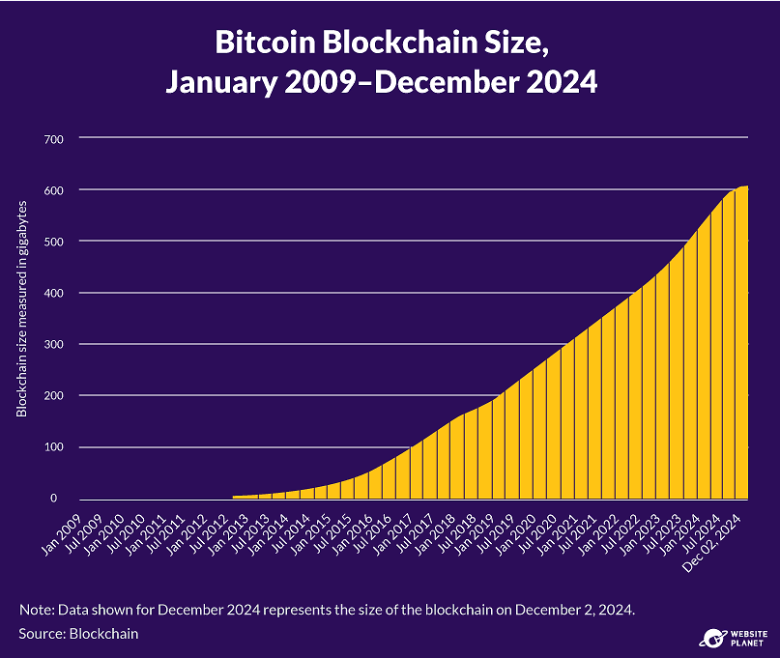

Since its launch in 2009, every Bitcoin transaction has been permanently recorded on the blockchain. By November 2024, this blockchain had grown in size to 598 gigabytes — a digital record that requires significant storage capacity to manage.

Each time someone buys, sells, or sends bitcoin, the transaction data is bundled into a block and added to the chain. Over time, these blocks have caused the blockchain to grow exponentially, from just 15 GB in 2014 to almost 600 GB in 2024, with new blocks adding nearly a gigabyte every few days. By 2030, experts predict the Bitcoin blockchain could surpass 1 terabyte.

This growth brings challenges for the network. Nodes now need much larger storage, and as more transactions fill blocks, network congestion can lead to slower transaction times and higher fees.

Since its launch in 2009, every Bitcoin transaction has been permanently recorded on the blockchain. By November 2024, this blockchain had grown in size to 598 gigabytes — a digital record that requires significant storage capacity to manage.

Each time someone buys, sells, or sends bitcoin, the transaction data is bundled into a block and added to the chain. Over time, these blocks have caused the blockchain to grow exponentially, from just 15 GB in 2014 to almost 600 GB in 2024, with new blocks adding nearly a gigabyte every few days. By 2030, experts predict the Bitcoin blockchain could surpass 1 terabyte.

This growth brings challenges for the network. Nodes now need much larger storage, and as more transactions fill blocks, network congestion can lead to slower transaction times and higher fees.

The Role of Bitcoin Nodes

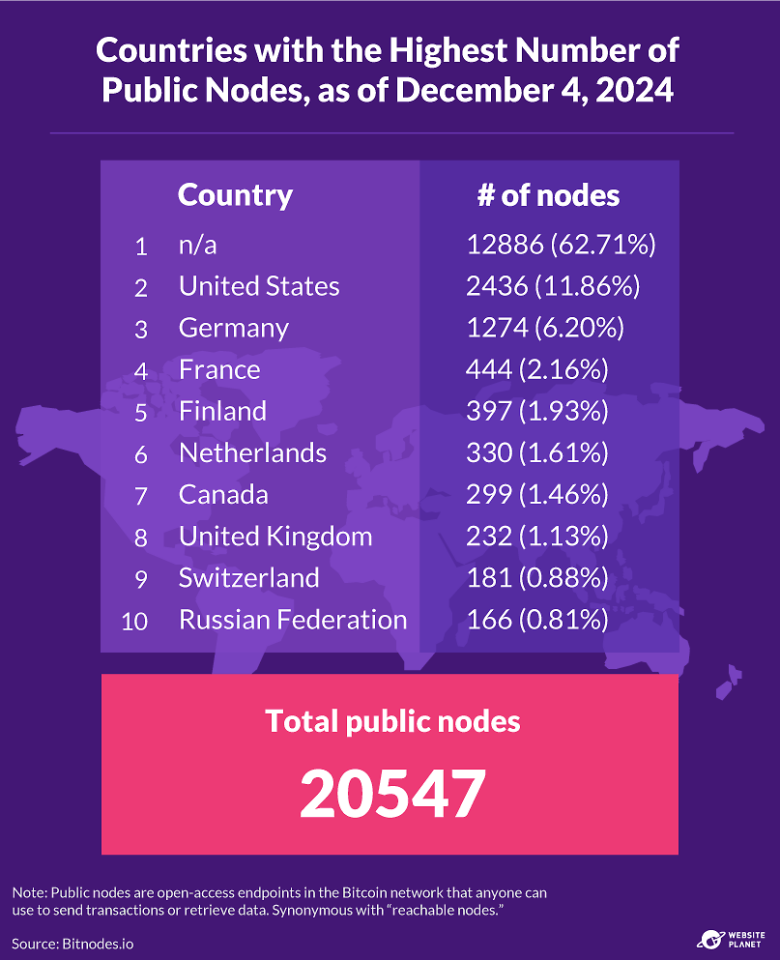

In the Bitcoin network, nodes are computers that work together to verify and secure transactions. Imagine nodes as “guardians” of the Bitcoin blockchain. Each one monitors the network, validating every transaction to ensure that each bitcoin is only spent once, preventing fraud and building trust in the system.

A “full node” stores the entire Bitcoin blockchain and helps keep the network decentralized by sharing this information with other nodes. Full nodes don’t receive financial rewards but play a crucial role in keeping the network secure and transparent.

With nearly 20,000 reachable nodes worldwide as of November 2024, each node helps Bitcoin remain a truly decentralized currency, allowing people everywhere to transact directly without relying on a central authority. As the blockchain grows, data is spread across the network, making it resilient and more secure for all users.

In the Bitcoin network, nodes are computers that work together to verify and secure transactions. Imagine nodes as “guardians” of the Bitcoin blockchain. Each one monitors the network, validating every transaction to ensure that each bitcoin is only spent once, preventing fraud and building trust in the system.

A “full node” stores the entire Bitcoin blockchain and helps keep the network decentralized by sharing this information with other nodes. Full nodes don’t receive financial rewards but play a crucial role in keeping the network secure and transparent.

With nearly 20,000 reachable nodes worldwide as of November 2024, each node helps Bitcoin remain a truly decentralized currency, allowing people everywhere to transact directly without relying on a central authority. As the blockchain grows, data is spread across the network, making it resilient and more secure for all users.

What Is Bitcoin Mining and How Profitable Is It?

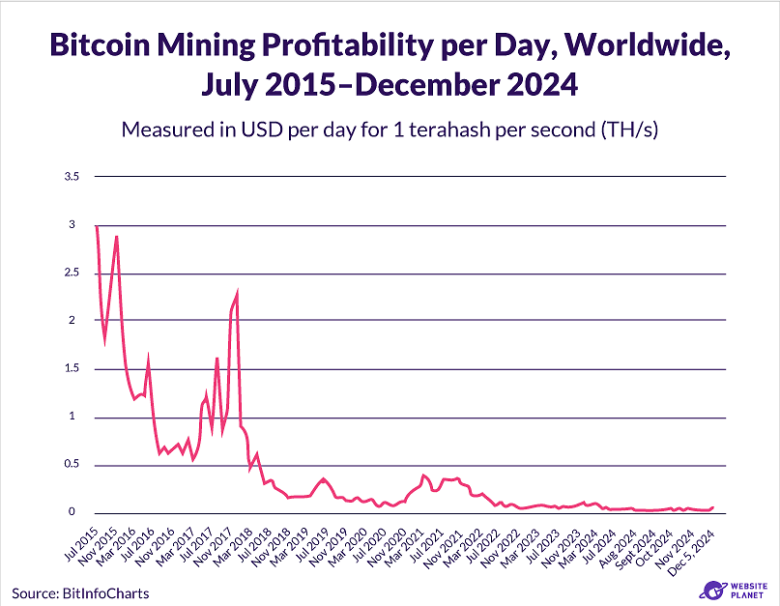

The distributed nature of Bitcoin creates challenges in validating transactions. A seller could, in theory, promise the same bitcoin to two people in exchange for goods. Because each of these transactions would arrive at different nodes at different times, a system had to be created to verify which transaction occurred first and was therefore legitimate.

Bitcoin’s creator solved this problem through a proof-of-work consensus mechanism called mining. Bitcoin mining is the process through which new bitcoins are created and transactions are verified on the blockchain. Miners use powerful computers to solve complex puzzles, which secure the network and validate transactions. In return, miners receive bitcoin as a reward.

Mining has become increasingly challenging and less profitable over time. As more miners join the network, the difficulty of the cryptographic puzzles they need to solve increases. This maintains a steady rate of mined coins, but means miners need more computing power, and more electricity, to successfully earn rewards. Specialized, energy-intensive mining equipment has become essential for anyone looking to mine profitably.

As of November 2024, Bitcoin miners collectively earn around $40 million per day, an increase of about 15.76% from the previous year, thanks to Bitcoin’s price recovery and improvements in mining technology.

The distributed nature of Bitcoin creates challenges in validating transactions. A seller could, in theory, promise the same bitcoin to two people in exchange for goods. Because each of these transactions would arrive at different nodes at different times, a system had to be created to verify which transaction occurred first and was therefore legitimate.

Bitcoin’s creator solved this problem through a proof-of-work consensus mechanism called mining. Bitcoin mining is the process through which new bitcoins are created and transactions are verified on the blockchain. Miners use powerful computers to solve complex puzzles, which secure the network and validate transactions. In return, miners receive bitcoin as a reward.

Mining has become increasingly challenging and less profitable over time. As more miners join the network, the difficulty of the cryptographic puzzles they need to solve increases. This maintains a steady rate of mined coins, but means miners need more computing power, and more electricity, to successfully earn rewards. Specialized, energy-intensive mining equipment has become essential for anyone looking to mine profitably.

As of November 2024, Bitcoin miners collectively earn around $40 million per day, an increase of about 15.76% from the previous year, thanks to Bitcoin’s price recovery and improvements in mining technology.

The Limited Supply of Bitcoin

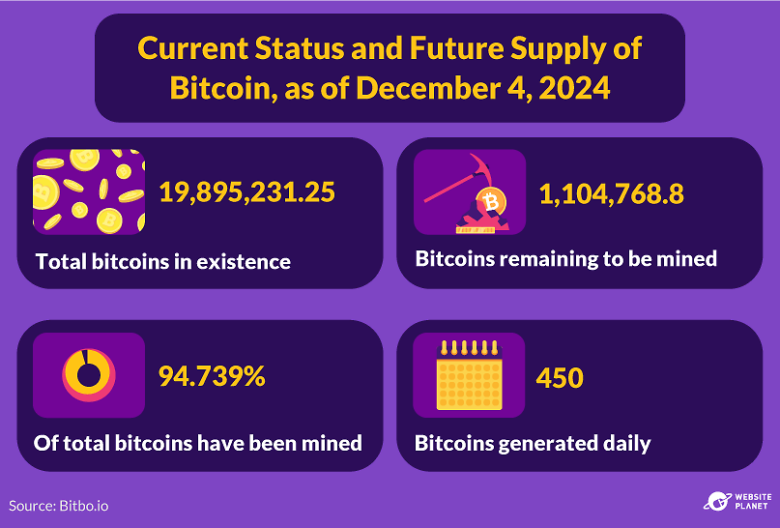

Bitcoin operates on a unique principle of digital scarcity. Unlike traditional currencies, which governments can print as needed, Bitcoin has a hard cap of 21 million coins. This limited supply, set by Bitcoin’s pseudonymous creator, Satoshi Nakamoto, is designed to make Bitcoin a finite resource like gold.

Bitcoin operates on a unique principle of digital scarcity. Unlike traditional currencies, which governments can print as needed, Bitcoin has a hard cap of 21 million coins. This limited supply, set by Bitcoin’s pseudonymous creator, Satoshi Nakamoto, is designed to make Bitcoin a finite resource like gold.

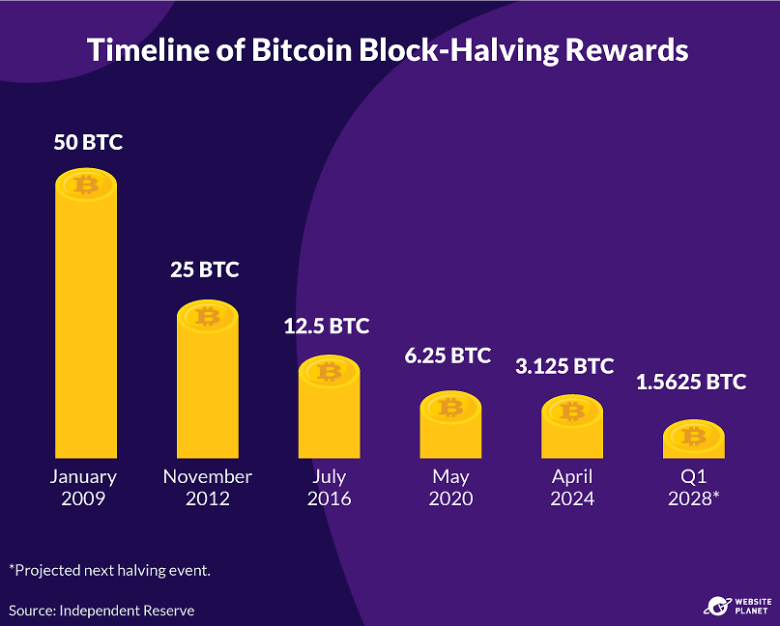

To control the rate at which new bitcoins enter the system, Bitcoin uses a process called halving. Approximately every four years, the reward that miners earn for verifying transactions is cut in half. For example, in 2009 miners earned 50 BTC per block, but in 2012 this reward dropped to 25 BTC. With the reward now 3.125 BTC per block, the halving process will continue until around 2140, when the final bitcoin is mined.

This predictable scarcity contributes to Bitcoin’s value over time. Unlike traditional currencies, which governments can debase by increasing the money supply, Bitcoin was hardcoded with a limit of 21 million coins. As fewer new bitcoins enter circulation and demand outstrips supply, Bitcoin is likely to maintain or even increase its value. With over 90% of all bitcoins already mined, Bitcoin’s finite supply positions it as a hedge against inflation, setting it apart from inflation-prone fiat currencies.

To control the rate at which new bitcoins enter the system, Bitcoin uses a process called halving. Approximately every four years, the reward that miners earn for verifying transactions is cut in half. For example, in 2009 miners earned 50 BTC per block, but in 2012 this reward dropped to 25 BTC. With the reward now 3.125 BTC per block, the halving process will continue until around 2140, when the final bitcoin is mined.

This predictable scarcity contributes to Bitcoin’s value over time. Unlike traditional currencies, which governments can debase by increasing the money supply, Bitcoin was hardcoded with a limit of 21 million coins. As fewer new bitcoins enter circulation and demand outstrips supply, Bitcoin is likely to maintain or even increase its value. With over 90% of all bitcoins already mined, Bitcoin’s finite supply positions it as a hedge against inflation, setting it apart from inflation-prone fiat currencies.

Bitcoin’s History (So Far)

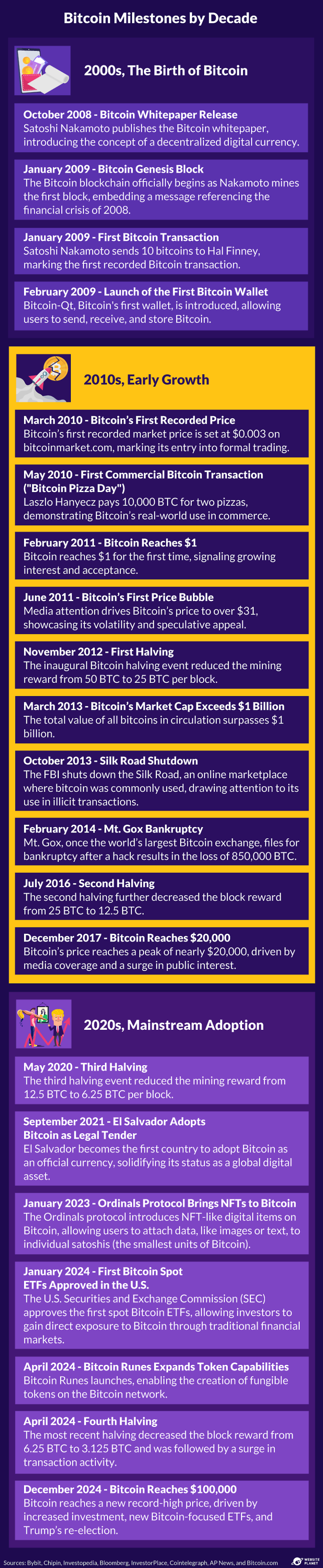

Bitcoin’s story began in 2008 when an anonymous creator (or group) known as Satoshi Nakamoto introduced a bold vision in the Bitcoin whitepaper: a decentralized currency that could be sent directly from person to person without a bank.

In January 2009, Bitcoin’s network went live, and Satoshi mined the first block, known as the Genesis Block, embedding a message about the instability of traditional banking. Shortly after, Satoshi sent the first Bitcoin transaction to cryptographer Hal Finney, marking the beginning of its journey.

In its early days, Bitcoin was experimental, a digital token with no set value. It wasn’t until 2010 that Bitcoin saw its first price of $0.003 and was even used to buy two pizzas for 10,000 BTC, a transaction that’s now become known as Bitcoin Pizza Day, since the bitcoins used to buy those pizzas would now be worth around $1 billion.

Today, Bitcoin is recognized and used globally, with the value of a single bitcoin surpassing $100,000 in December 2024. Bitcoin has gained official status in countries like El Salvador, where it serves as legal tender, and financial products like ETFs allow traditional investors to access Bitcoin within the stock market.

Looking ahead, experts predict continued growth. Some forecasts suggest bitcoin could reach $200,000 in 2025, and others believe it could hit $3 million by 2050 if widely adopted as a reserve asset. Although its future remains uncertain, Bitcoin’s trajectory from a niche technology to a global financial asset suggests it will keep making headlines for years to come.

Bitcoin’s story began in 2008 when an anonymous creator (or group) known as Satoshi Nakamoto introduced a bold vision in the Bitcoin whitepaper: a decentralized currency that could be sent directly from person to person without a bank.

In January 2009, Bitcoin’s network went live, and Satoshi mined the first block, known as the Genesis Block, embedding a message about the instability of traditional banking. Shortly after, Satoshi sent the first Bitcoin transaction to cryptographer Hal Finney, marking the beginning of its journey.

In its early days, Bitcoin was experimental, a digital token with no set value. It wasn’t until 2010 that Bitcoin saw its first price of $0.003 and was even used to buy two pizzas for 10,000 BTC, a transaction that’s now become known as Bitcoin Pizza Day, since the bitcoins used to buy those pizzas would now be worth around $1 billion.

Today, Bitcoin is recognized and used globally, with the value of a single bitcoin surpassing $100,000 in December 2024. Bitcoin has gained official status in countries like El Salvador, where it serves as legal tender, and financial products like ETFs allow traditional investors to access Bitcoin within the stock market.

Looking ahead, experts predict continued growth. Some forecasts suggest bitcoin could reach $200,000 in 2025, and others believe it could hit $3 million by 2050 if widely adopted as a reserve asset. Although its future remains uncertain, Bitcoin’s trajectory from a niche technology to a global financial asset suggests it will keep making headlines for years to come.

The Global Bitcoin Market

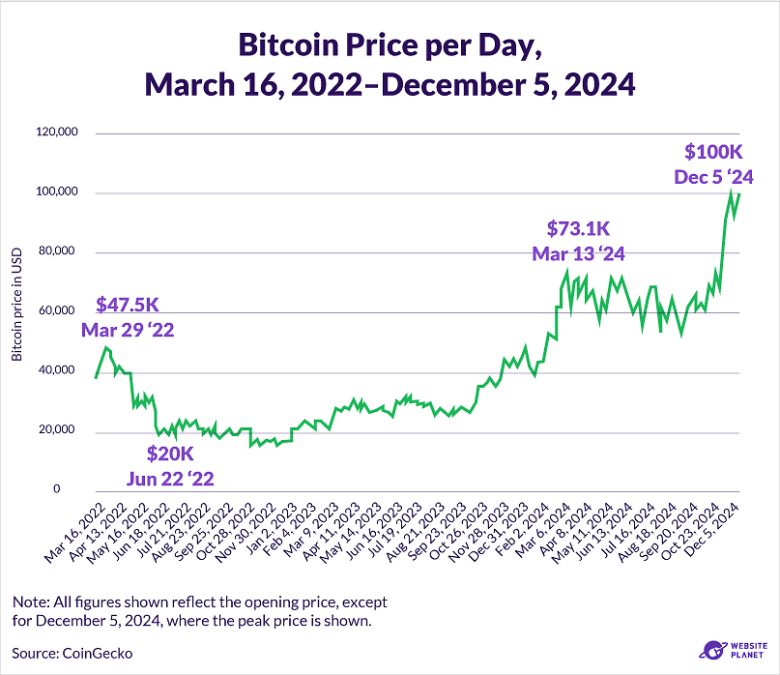

The global Bitcoin market has grown massively in recent years. In 2024, Bitcoin reached record prices, driven by new investment options like spot ETFs and major political shifts. This section looks at the numbers, trends, and events shaping Bitcoin’s role today, showing how it continues to influence markets and investors worldwide.Bitcoin Hits Record Highs in 2024

Bitcoin saw dramatic growth in 2024, hitting several new all-time highs. After the launch of spot Bitcoin ETFs in January, Bitcoin’s price surged to $73,000 in March. However, it climbed even higher following the U.S. presidential election in November, when Donald Trump’s victory sparked optimism in the crypto market.

On December 5, Bitcoin surpassed $100,000 for the first time, reportedly fueled by traders’ belief that Trump’s return to the White House could mean friendlier policies for cryptocurrency. During his campaign, Trump pledged to make the United States the “global capital” of Bitcoin, promising to support the Bitcoin mining industry and establish a “strategic Bitcoin stockpile.”

Despite these gains, Bitcoin’s price remains highly volatile, influenced both by political developments and economic trends, as well as the actions of large holders known as whales. These whales hold roughly 92% of Bitcoin’s supply, meaning their trades can have a significant impact on market movements.

Bitcoin saw dramatic growth in 2024, hitting several new all-time highs. After the launch of spot Bitcoin ETFs in January, Bitcoin’s price surged to $73,000 in March. However, it climbed even higher following the U.S. presidential election in November, when Donald Trump’s victory sparked optimism in the crypto market.

On December 5, Bitcoin surpassed $100,000 for the first time, reportedly fueled by traders’ belief that Trump’s return to the White House could mean friendlier policies for cryptocurrency. During his campaign, Trump pledged to make the United States the “global capital” of Bitcoin, promising to support the Bitcoin mining industry and establish a “strategic Bitcoin stockpile.”

Despite these gains, Bitcoin’s price remains highly volatile, influenced both by political developments and economic trends, as well as the actions of large holders known as whales. These whales hold roughly 92% of Bitcoin’s supply, meaning their trades can have a significant impact on market movements.

Bitcoin Leads the Cryptocurrency Market

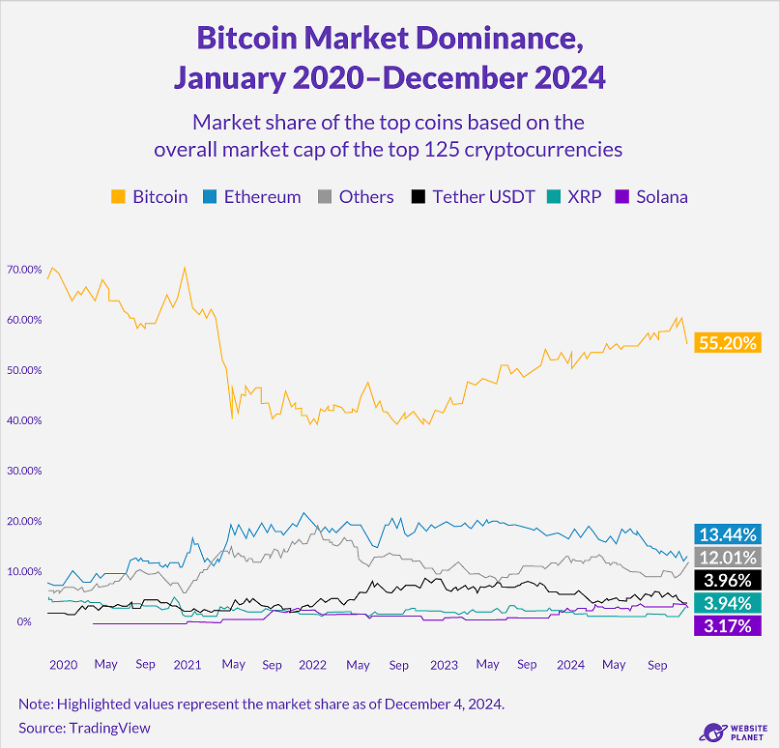

Bitcoin holds the top spot in the cryptocurrency market, with nearly 60% of the total market share as of November 2024. Despite the rise of numerous alternative coins, or “altcoins,” Bitcoin remains the dominant digital asset thanks to its established reputation, security, and widespread adoption.

Ethereum, the second-largest cryptocurrency, holds just under 14% of the market, showcasing its role as the leading platform for decentralized applications (dApps) and smart contracts. Together, Bitcoin and Ethereum account for nearly three-quarters of the entire crypto market, leaving smaller shares for other cryptocurrencies like Tether and Solana.

Bitcoin holds the top spot in the cryptocurrency market, with nearly 60% of the total market share as of November 2024. Despite the rise of numerous alternative coins, or “altcoins,” Bitcoin remains the dominant digital asset thanks to its established reputation, security, and widespread adoption.

Ethereum, the second-largest cryptocurrency, holds just under 14% of the market, showcasing its role as the leading platform for decentralized applications (dApps) and smart contracts. Together, Bitcoin and Ethereum account for nearly three-quarters of the entire crypto market, leaving smaller shares for other cryptocurrencies like Tether and Solana.

How Does Bitcoin Compare to Traditional Assets?

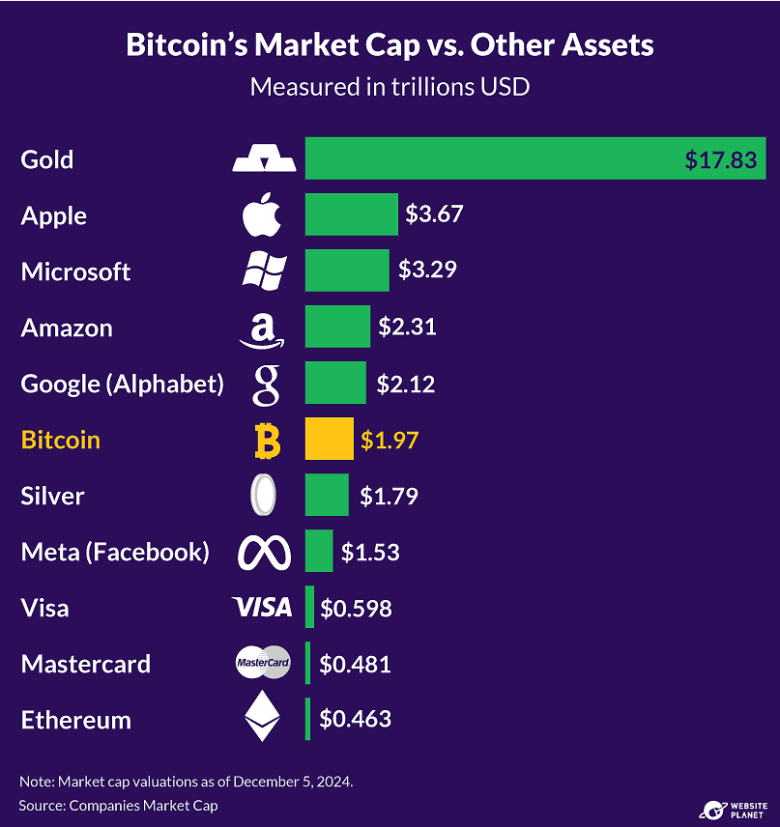

Although Bitcoin is a relatively new asset, its market value has grown rapidly, reaching $1.97 trillion as of December 2024. This places it alongside major assets and companies, with a market cap now on par with silver and surpassing tech giants like Meta (Facebook), Visa, and Mastercard. Gold, however, remains the largest store of value with a market cap of over $17 trillion.

Bitcoin is often compared to gold, as both assets are limited in supply. Bitcoin has a fixed cap of 21 million coins, while gold’s supply is naturally scarce. In recent years, Bitcoin has even outperformed gold, generating higher returns and becoming increasingly popular among investors.

Despite its rapid growth, Bitcoin still only represents about 1.7% of the combined value of gold, U.S. stocks, and the U.S. dollar.

Although Bitcoin is a relatively new asset, its market value has grown rapidly, reaching $1.97 trillion as of December 2024. This places it alongside major assets and companies, with a market cap now on par with silver and surpassing tech giants like Meta (Facebook), Visa, and Mastercard. Gold, however, remains the largest store of value with a market cap of over $17 trillion.

Bitcoin is often compared to gold, as both assets are limited in supply. Bitcoin has a fixed cap of 21 million coins, while gold’s supply is naturally scarce. In recent years, Bitcoin has even outperformed gold, generating higher returns and becoming increasingly popular among investors.

Despite its rapid growth, Bitcoin still only represents about 1.7% of the combined value of gold, U.S. stocks, and the U.S. dollar.

How Many People Own Bitcoin?

Bitcoin ownership has grown significantly around the world, with an estimated 106 million people owning Bitcoin as of 2024. This ownership is spread globally but with a higher proportion in emerging markets, where people often see Bitcoin as a way to protect against economic instability.

In India alone, over 85 million people are estimated to own Bitcoin, more than in any other country. And despite restrictions on cryptocurrency, China has more Bitcoin owners than the United States.

Beyond ownership, around 400,000 people use Bitcoin daily for transactions, while many others hold it as a long-term investment, hoping it will appreciate in value. There are also approximately 200 million Bitcoin wallets worldwide.

Determining the exact number of Bitcoin users is challenging due to the decentralized nature of the network. A single person can hold multiple Bitcoin wallets, and many store their bitcoin on centralized exchanges that manage coins on their behalf.

Bitcoin ownership has grown significantly around the world, with an estimated 106 million people owning Bitcoin as of 2024. This ownership is spread globally but with a higher proportion in emerging markets, where people often see Bitcoin as a way to protect against economic instability.

In India alone, over 85 million people are estimated to own Bitcoin, more than in any other country. And despite restrictions on cryptocurrency, China has more Bitcoin owners than the United States.

Beyond ownership, around 400,000 people use Bitcoin daily for transactions, while many others hold it as a long-term investment, hoping it will appreciate in value. There are also approximately 200 million Bitcoin wallets worldwide.

Determining the exact number of Bitcoin users is challenging due to the decentralized nature of the network. A single person can hold multiple Bitcoin wallets, and many store their bitcoin on centralized exchanges that manage coins on their behalf.

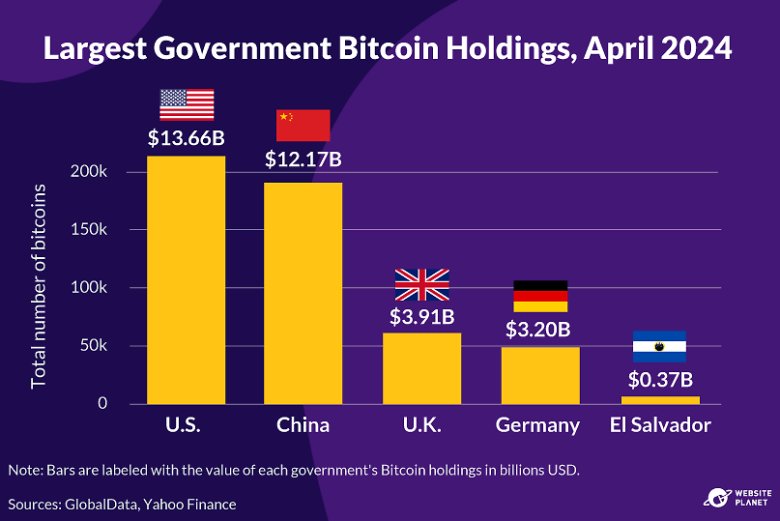

Governments hold a surprisingly large number of bitcoins, with a combined total of 567,000 worth over $56.7 billion as of December 2024.

Most of these holdings weren’t bought — they were seized from criminal cases, such as the Silk Road bust by the U.S. and China’s crackdown on the PlusToken ponzi scheme. El Salvador stands out as the only country actively buying Bitcoin, using it as legal tender since 2021.

For comparison, public companies hold around 305,000 bitcoins, with MicroStrategy — a business intelligence firm — owning the largest share. MicroStrategy has accumulated over 214,000 bitcoins as part of its strategy to make Bitcoin its primary treasury reserve asset.

While no central bank holds Bitcoin as an official reserve yet, these government assets could appreciate significantly if Bitcoin’s value continues to rise, and could potentially become as significant as traditional reserves like gold.

Governments hold a surprisingly large number of bitcoins, with a combined total of 567,000 worth over $56.7 billion as of December 2024.

Most of these holdings weren’t bought — they were seized from criminal cases, such as the Silk Road bust by the U.S. and China’s crackdown on the PlusToken ponzi scheme. El Salvador stands out as the only country actively buying Bitcoin, using it as legal tender since 2021.

For comparison, public companies hold around 305,000 bitcoins, with MicroStrategy — a business intelligence firm — owning the largest share. MicroStrategy has accumulated over 214,000 bitcoins as part of its strategy to make Bitcoin its primary treasury reserve asset.

While no central bank holds Bitcoin as an official reserve yet, these government assets could appreciate significantly if Bitcoin’s value continues to rise, and could potentially become as significant as traditional reserves like gold.

Number of Bitcoin Transactions per Day

The Bitcoin network processes over 270,000 transactions each day. In April 2024, Bitcoin hit a new all-time high of 926,842 daily transactions — a record that was set just three days after the latest Bitcoin halving and coincided with the launch of Bitcoin Runes.

Bitcoin Runes, a new protocol enabling the issuance of fungible tokens on the Bitcoin network, allows users to create and trade tokens directly on the Bitcoin blockchain. In the first four months following their launch, users processed over 15.6 million Runes-related transactions, generating $162.4 million in fees.

Each day, between 700,000 and 1,000,000 addresses are active on the Bitcoin network, with around 300,000 to 500,000 unique users likely sending or receiving bitcoin. While Bitcoin’s price has risen, the number of active addresses has slightly decreased, suggesting that many users are choosing to hold their bitcoin rather than move it around.

The Bitcoin network processes over 270,000 transactions each day. In April 2024, Bitcoin hit a new all-time high of 926,842 daily transactions — a record that was set just three days after the latest Bitcoin halving and coincided with the launch of Bitcoin Runes.

Bitcoin Runes, a new protocol enabling the issuance of fungible tokens on the Bitcoin network, allows users to create and trade tokens directly on the Bitcoin blockchain. In the first four months following their launch, users processed over 15.6 million Runes-related transactions, generating $162.4 million in fees.

Each day, between 700,000 and 1,000,000 addresses are active on the Bitcoin network, with around 300,000 to 500,000 unique users likely sending or receiving bitcoin. While Bitcoin’s price has risen, the number of active addresses has slightly decreased, suggesting that many users are choosing to hold their bitcoin rather than move it around.

The Impact of Bitcoin ETFs on the Market

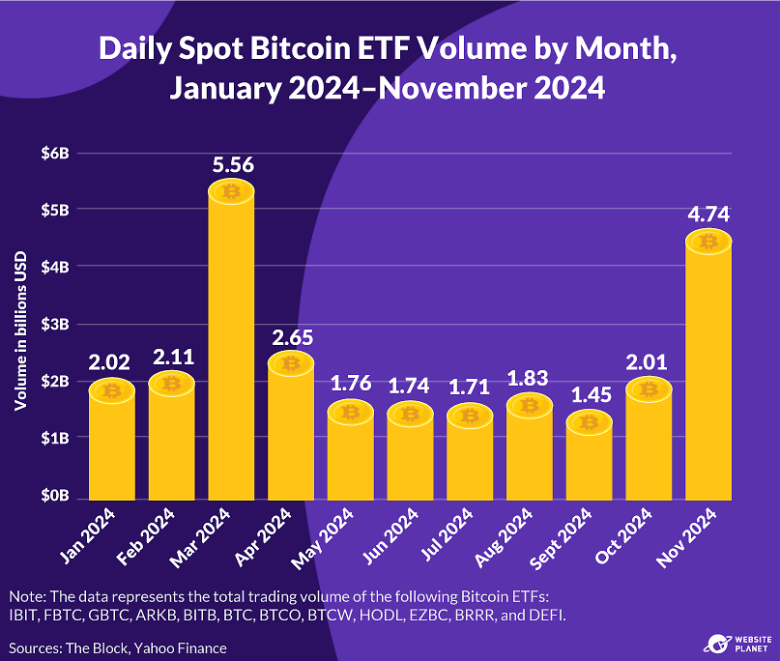

Bitcoin ETFs have created a bridge between traditional finance and the crypto market, offering investors a way to access bitcoin through regular brokerage accounts. The first U.S. Bitcoin futures ETF, launched in October 2021, quickly became the fastest ETF to reach $1 billion in assets. This futures ETF allows investors to speculate on Bitcoin’s future price through contracts rather than directly holding bitcoin.

In January 2024, the SEC approved spot Bitcoin ETFs, marking a turning point for cryptocurrency. Unlike futures ETFs, spot ETFs hold actual Bitcoin, giving investors more direct exposure to its price. Spot ETFs provide a closer link to Bitcoin’s true market value.

Since the launch of these ETFs trading volumes have surged, with daily volumes peaking at nearly $10 billion in March. Demand has been so strong that Bitcoin ETF inflows have even outpaced those of the first gold ETFs from 2005. It has also driven increased transfer volumes, with a significant rise in transactions over $1 million.

Bitcoin ETFs have created a bridge between traditional finance and the crypto market, offering investors a way to access bitcoin through regular brokerage accounts. The first U.S. Bitcoin futures ETF, launched in October 2021, quickly became the fastest ETF to reach $1 billion in assets. This futures ETF allows investors to speculate on Bitcoin’s future price through contracts rather than directly holding bitcoin.

In January 2024, the SEC approved spot Bitcoin ETFs, marking a turning point for cryptocurrency. Unlike futures ETFs, spot ETFs hold actual Bitcoin, giving investors more direct exposure to its price. Spot ETFs provide a closer link to Bitcoin’s true market value.

Since the launch of these ETFs trading volumes have surged, with daily volumes peaking at nearly $10 billion in March. Demand has been so strong that Bitcoin ETF inflows have even outpaced those of the first gold ETFs from 2005. It has also driven increased transfer volumes, with a significant rise in transactions over $1 million.

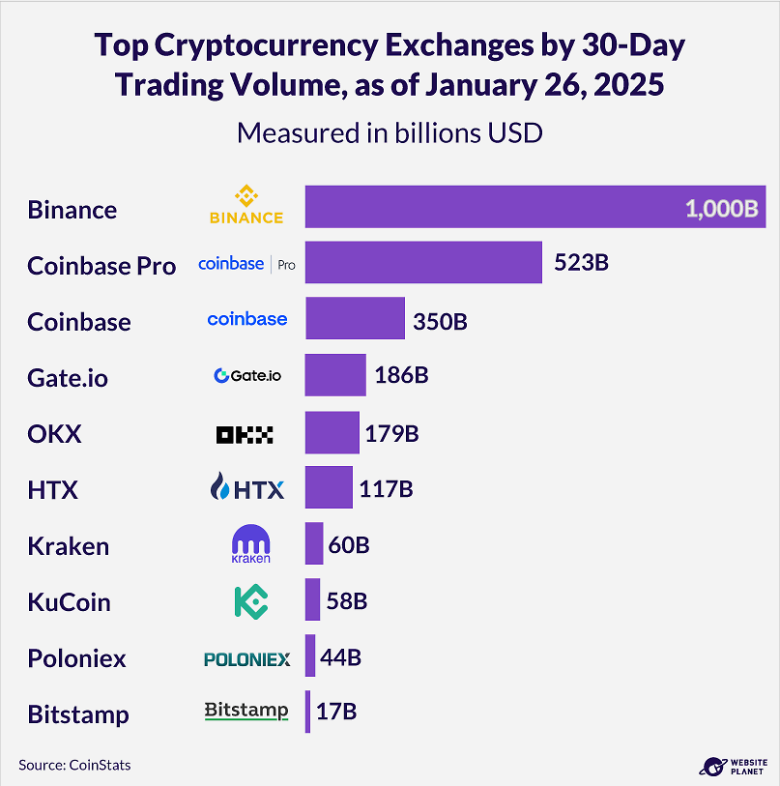

Top Cryptocurrency Exchanges Worldwide

Cryptocurrency exchanges are key platforms for buying, selling, and trading digital assets. Binance leads the market, handling over $3.8 trillion in trading volume in 2023, accounting for 52.6% of the total trading market. Other exchanges like Bybit, OKX, and Coinbase also top the list with multi-billion dollar daily volumes.

Despite its dominance, Binance has encountered major legal challenges in the United States, including a $4.3 billion settlement that mandates its exit from the U.S. market under regulatory oversight. Coinbase, the largest U.S.-based exchange, remains a popular choice for American investors, valued for its regulatory compliance and accessibility.

Cryptocurrency exchanges are key platforms for buying, selling, and trading digital assets. Binance leads the market, handling over $3.8 trillion in trading volume in 2023, accounting for 52.6% of the total trading market. Other exchanges like Bybit, OKX, and Coinbase also top the list with multi-billion dollar daily volumes.

Despite its dominance, Binance has encountered major legal challenges in the United States, including a $4.3 billion settlement that mandates its exit from the U.S. market under regulatory oversight. Coinbase, the largest U.S.-based exchange, remains a popular choice for American investors, valued for its regulatory compliance and accessibility.

Bitcoin Adoption and Market Trends in the United States

Bitcoin adoption in the United States continues to expand, driven by growing investment options, rising ownership rates, and increasing use for payments. About 90% of Americans are now familiar with Bitcoin. Let’s take a closer look at the numbers behind its market growth, who is using it, where it’s accepted, and how Bitcoin is shaping trends like retirement savings and ATM accessibility across the country.Overview of the U.S. Bitcoin Market

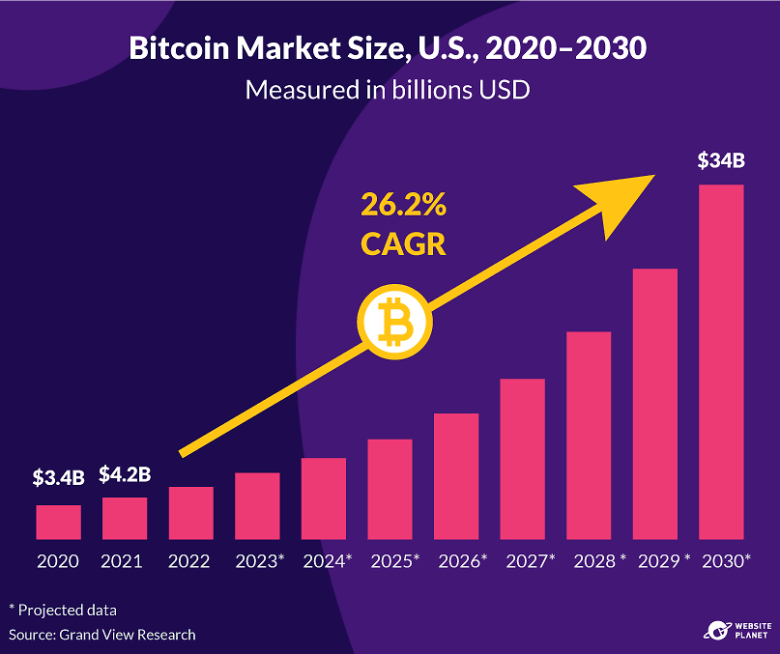

The U.S. Bitcoin market is projected to grow at a compound annual growth rate (CAGR) of 26.2%, reaching over $34 billion by 2030. This growth is driven by increasing demand for digital payment solutions, the accessibility provided by cryptocurrency exchanges, and a broader shift toward decentralized finance.

Exchanges currently dominate the market, holding over 45% of the revenue share due to high trading volumes. Many investors see Bitcoin as a reliable way to preserve wealth, similar to how gold is used, rather than just a means of payment or trading. This perception of Bitcoin as a “store of value” drives significant market activity.

Payments and wallets are expected to expand, too, as Bitcoin’s low transaction fees and fast settlement times make it particularly attractive for digital payments.

The U.S. Bitcoin market is projected to grow at a compound annual growth rate (CAGR) of 26.2%, reaching over $34 billion by 2030. This growth is driven by increasing demand for digital payment solutions, the accessibility provided by cryptocurrency exchanges, and a broader shift toward decentralized finance.

Exchanges currently dominate the market, holding over 45% of the revenue share due to high trading volumes. Many investors see Bitcoin as a reliable way to preserve wealth, similar to how gold is used, rather than just a means of payment or trading. This perception of Bitcoin as a “store of value” drives significant market activity.

Payments and wallets are expected to expand, too, as Bitcoin’s low transaction fees and fast settlement times make it particularly attractive for digital payments.

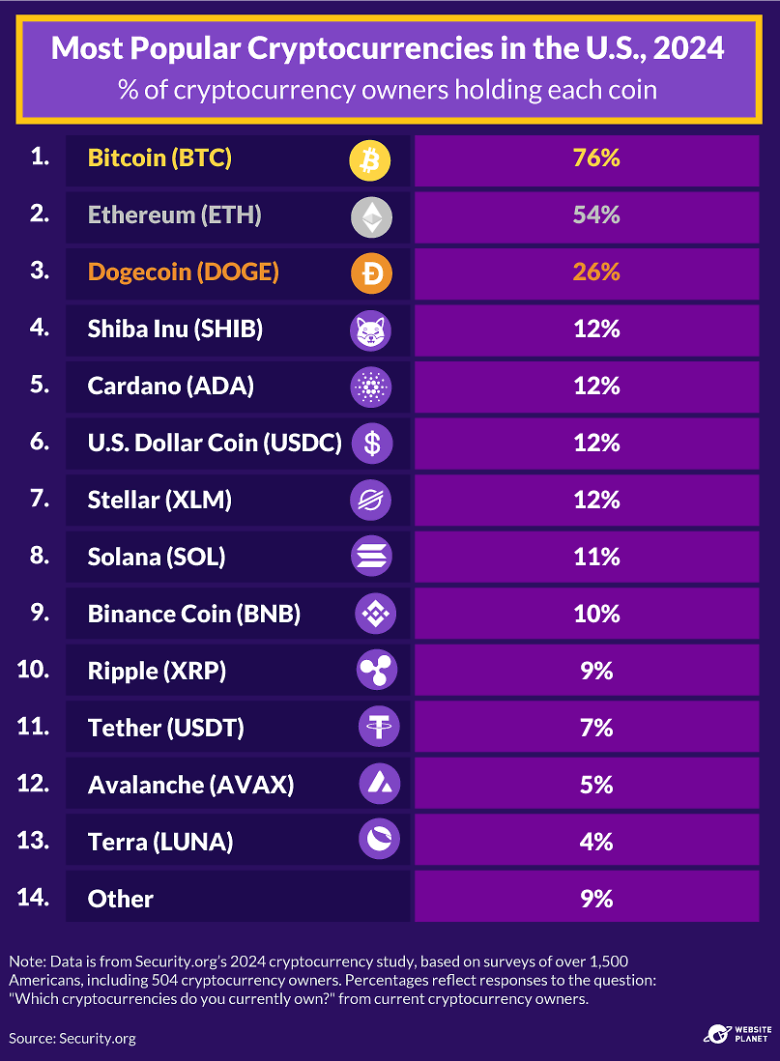

Bitcoin Is the Most Popular Cryptocurrency in the United States

Bitcoin is the most popular cryptocurrency in the U.S., with 76% of American crypto owners holding BTC in 2024. For years, Bitcoin has held the top spot in crypto ownership, driven by its position as the original cryptocurrency and its appeal as a long-term investment.

Ethereum is the second most widely held cryptocurrency, though the percentage of crypto owners who hold Ethereum has declined from 65% in 2021 to 54% in 2024. While the Ethereum Merge in 2022 initially drove interest, newer smart contract platforms like Solana (SOL) and Binance Coin (BNB), as well as high transaction fees, have contributed to a drop in ETH ownership.

Dogecoin, Ripple, and newer entrants like Shiba Inu have also carved out their own spaces in the U.S. crypto landscape, though at lower ownership rates. Ripple (XRP), for instance, gained traction in 2023 following a favorable court ruling in its ongoing SEC case, bringing ownership to 9%.

With 63% of U.S. crypto owners planning to buy more over the next year, Bitcoin remains the top currency they aim to invest in, especially following the approval of spot Bitcoin ETFs by the SEC in January 2024.

Bitcoin is the most popular cryptocurrency in the U.S., with 76% of American crypto owners holding BTC in 2024. For years, Bitcoin has held the top spot in crypto ownership, driven by its position as the original cryptocurrency and its appeal as a long-term investment.

Ethereum is the second most widely held cryptocurrency, though the percentage of crypto owners who hold Ethereum has declined from 65% in 2021 to 54% in 2024. While the Ethereum Merge in 2022 initially drove interest, newer smart contract platforms like Solana (SOL) and Binance Coin (BNB), as well as high transaction fees, have contributed to a drop in ETH ownership.

Dogecoin, Ripple, and newer entrants like Shiba Inu have also carved out their own spaces in the U.S. crypto landscape, though at lower ownership rates. Ripple (XRP), for instance, gained traction in 2023 following a favorable court ruling in its ongoing SEC case, bringing ownership to 9%.

With 63% of U.S. crypto owners planning to buy more over the next year, Bitcoin remains the top currency they aim to invest in, especially following the approval of spot Bitcoin ETFs by the SEC in January 2024.

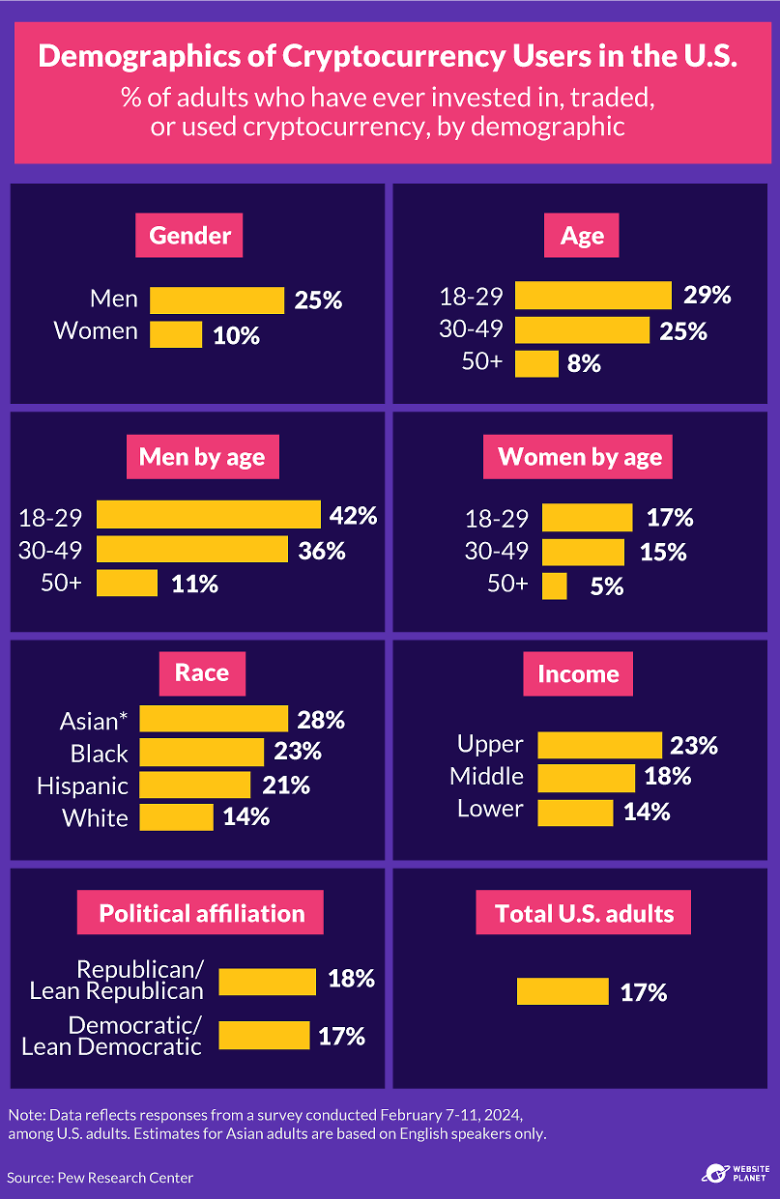

Who Is the Average Crypto Investor in the U.S.?

In 2024, 17% of U.S. adults report having invested in, traded, or used cryptocurrency such as Bitcoin. Leading the charge are men under 50, with 42% of those between the ages of 18-29 saying they’ve ventured into the crypto space. Meanwhile, women’s participation lags behind, with only 10% reporting any involvement.

Adoption rates are higher among Asian, Hispanic, and Black adults, groups historically underserved by traditional banking. Many Black investors view crypto as a way to bypass financial barriers and consider it fairer than the stock market. The U.S. has also seen an increase in crypto marketing campaigns targeting Black consumers and promoting crypto as a path to generational wealth and new financial opportunities.

However, despite these growing adoption rates, many Americans remain skeptical. Roughly 63% express low confidence in the safety and reliability of current crypto investment methods, with only 5% saying they are “very” or “extremely” confident, which makes it seem like there’s a long road ahead to broader mainstream adoption.

In 2024, 17% of U.S. adults report having invested in, traded, or used cryptocurrency such as Bitcoin. Leading the charge are men under 50, with 42% of those between the ages of 18-29 saying they’ve ventured into the crypto space. Meanwhile, women’s participation lags behind, with only 10% reporting any involvement.

Adoption rates are higher among Asian, Hispanic, and Black adults, groups historically underserved by traditional banking. Many Black investors view crypto as a way to bypass financial barriers and consider it fairer than the stock market. The U.S. has also seen an increase in crypto marketing campaigns targeting Black consumers and promoting crypto as a path to generational wealth and new financial opportunities.

However, despite these growing adoption rates, many Americans remain skeptical. Roughly 63% express low confidence in the safety and reliability of current crypto investment methods, with only 5% saying they are “very” or “extremely” confident, which makes it seem like there’s a long road ahead to broader mainstream adoption.

Where Bitcoin Payments Are Accepted Across the U.S.

Cryptocurrency acceptance as payment in the United States has steadily expanded, with an increasing number of companies allowing customers to buy goods and services using bitcoin and other major cryptocurrencies.

Dozens of well-known brands, including AMC, Starbucks, Microsoft, and AT&T, now accept crypto either directly or through third-party apps like PayPal. Most crypto payments are made with bitcoin, especially for essentials like groceries, clothing, and subscriptions.

In addition to direct acceptance by some major brands, crypto debit cards from providers like Coinbase, Crypto.com, and Binance allow consumers to spend cryptocurrency at any retailer that accepts Visa or Mastercard.

Cryptocurrency acceptance as payment in the United States has steadily expanded, with an increasing number of companies allowing customers to buy goods and services using bitcoin and other major cryptocurrencies.

Dozens of well-known brands, including AMC, Starbucks, Microsoft, and AT&T, now accept crypto either directly or through third-party apps like PayPal. Most crypto payments are made with bitcoin, especially for essentials like groceries, clothing, and subscriptions.

In addition to direct acceptance by some major brands, crypto debit cards from providers like Coinbase, Crypto.com, and Binance allow consumers to spend cryptocurrency at any retailer that accepts Visa or Mastercard.

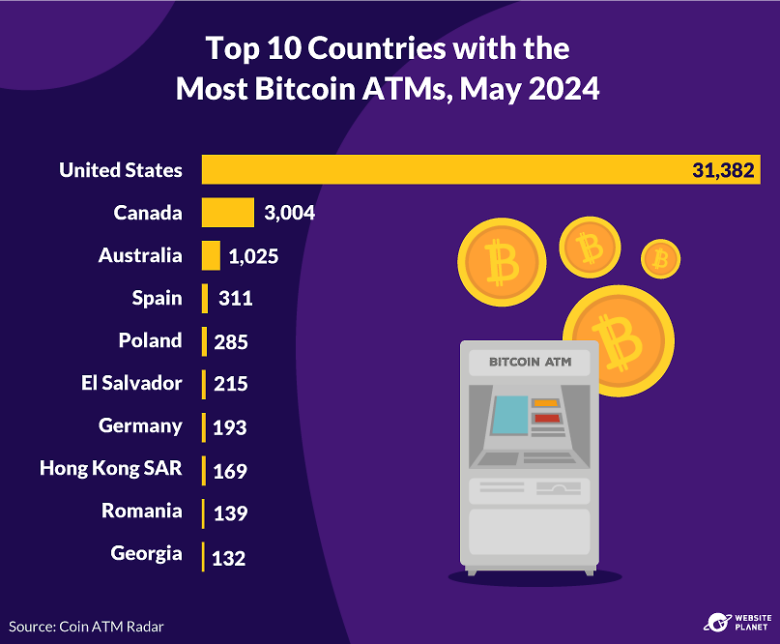

Bitcoin ATM Locations in the U.S.

The United States leads the world in Bitcoin ATM installations, with over 31,000 machines as of May 2024 — far outpacing other countries like Canada, which has around 3,000.

These ATMs allow users to either buy bitcoin directly or, in the case of more complex machines, both buy and sell the cryptocurrency. Unlike traditional ATMs, Bitcoin ATMs don’t connect to bank accounts; instead, they connect users to a Bitcoin wallet or exchange, enabling them to convert cash into digital currency.

The distribution of Bitcoin ATMs in the U.S. doesn’t always align with city size. While Los Angeles leads with 1,336 Bitcoin ATMs, cities like Dallas and Atlanta have more ATMs than New York City. Strict regulations in New York State have created challenges for operators, limiting the number of Bitcoin ATMs compared to other major cities.

The United States leads the world in Bitcoin ATM installations, with over 31,000 machines as of May 2024 — far outpacing other countries like Canada, which has around 3,000.

These ATMs allow users to either buy bitcoin directly or, in the case of more complex machines, both buy and sell the cryptocurrency. Unlike traditional ATMs, Bitcoin ATMs don’t connect to bank accounts; instead, they connect users to a Bitcoin wallet or exchange, enabling them to convert cash into digital currency.

The distribution of Bitcoin ATMs in the U.S. doesn’t always align with city size. While Los Angeles leads with 1,336 Bitcoin ATMs, cities like Dallas and Atlanta have more ATMs than New York City. Strict regulations in New York State have created challenges for operators, limiting the number of Bitcoin ATMs compared to other major cities.

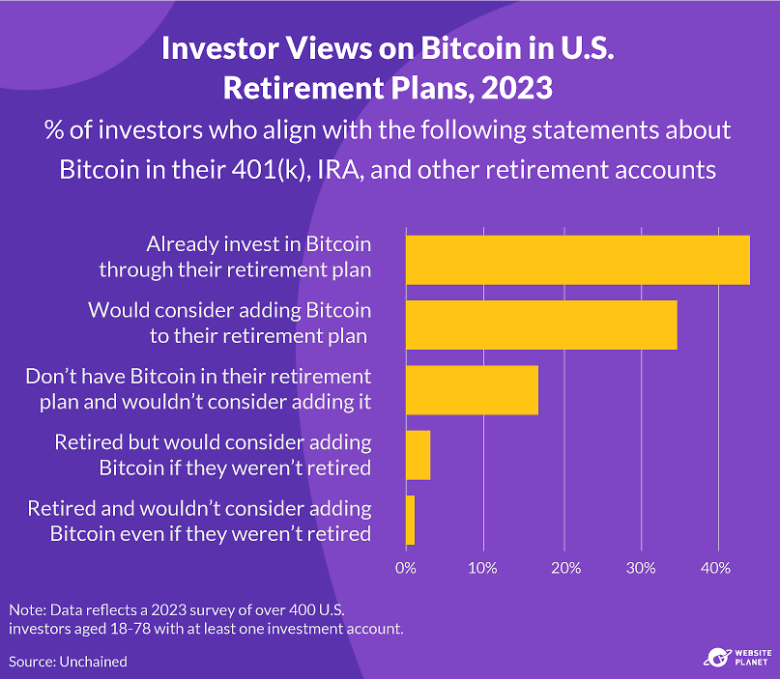

More Americans Consider Bitcoin for Retirement Savings

The idea of including bitcoin in retirement plans is gaining traction in the U.S., with 79% of current bitcoin holders saying they either already invest in BTC through their 401(k), IRA, or other retirement accounts or would consider doing so in 2024. 23% of investors who don’t currently own bitcoin are open to adding it to their retirement portfolios.

The recent approval of Bitcoin ETFs has made accessing bitcoin easier for mainstream investors, including retirees. These ETFs can be held in many retirement accounts, offering a more straightforward way to diversify portfolios with cryptocurrency. However, these ETFs also introduce concerns for regulators, who worry about volatility and potential market manipulation impacting retirement savings.

The idea of including bitcoin in retirement plans is gaining traction in the U.S., with 79% of current bitcoin holders saying they either already invest in BTC through their 401(k), IRA, or other retirement accounts or would consider doing so in 2024. 23% of investors who don’t currently own bitcoin are open to adding it to their retirement portfolios.

The recent approval of Bitcoin ETFs has made accessing bitcoin easier for mainstream investors, including retirees. These ETFs can be held in many retirement accounts, offering a more straightforward way to diversify portfolios with cryptocurrency. However, these ETFs also introduce concerns for regulators, who worry about volatility and potential market manipulation impacting retirement savings.

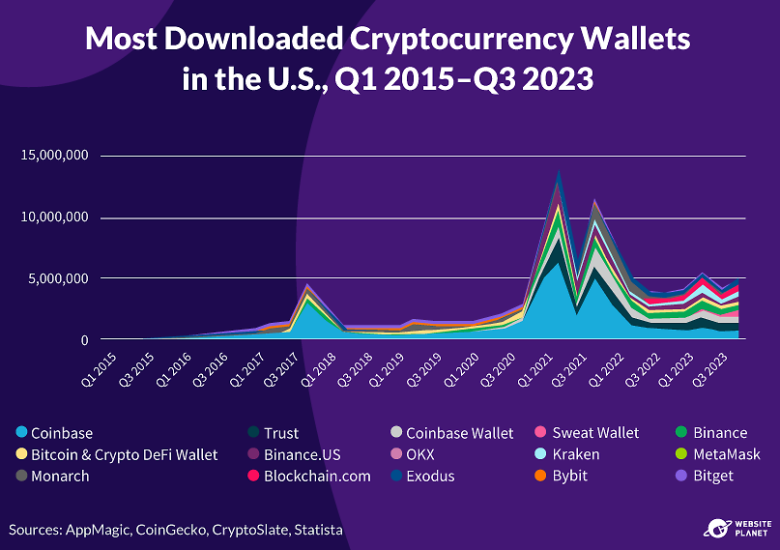

Top Cryptocurrency Wallets Used by Americans

Crypto wallets provide users with secure access to their cryptocurrency holdings. As crypto adoption grows, wallet features have expanded to cater to both newcomers and experienced investors.

In Q4 2023, Coinbase, Trust, and Sweat Wallet were the top wallets in the U.S., each reaching about half a million downloads. Coinbase and Binance’s wallets, backed by major exchanges, are popular among beginners and active traders due to their easy integration with trading platforms. Sweat Wallet, a relative newcomer, has gained traction with its unique approach of combining fitness and crypto rewards, where users earn tokens based on physical activity.

Most American crypto holders (81%) appear to treat crypto as an investment rather than a payment tool, as U.S. wallets are primarily used for asset storage rather than daily spending. While platforms like BitPay enable crypto-to-fiat conversions at checkout, these payment options remain less common.

Crypto wallets provide users with secure access to their cryptocurrency holdings. As crypto adoption grows, wallet features have expanded to cater to both newcomers and experienced investors.

In Q4 2023, Coinbase, Trust, and Sweat Wallet were the top wallets in the U.S., each reaching about half a million downloads. Coinbase and Binance’s wallets, backed by major exchanges, are popular among beginners and active traders due to their easy integration with trading platforms. Sweat Wallet, a relative newcomer, has gained traction with its unique approach of combining fitness and crypto rewards, where users earn tokens based on physical activity.

Most American crypto holders (81%) appear to treat crypto as an investment rather than a payment tool, as U.S. wallets are primarily used for asset storage rather than daily spending. While platforms like BitPay enable crypto-to-fiat conversions at checkout, these payment options remain less common.

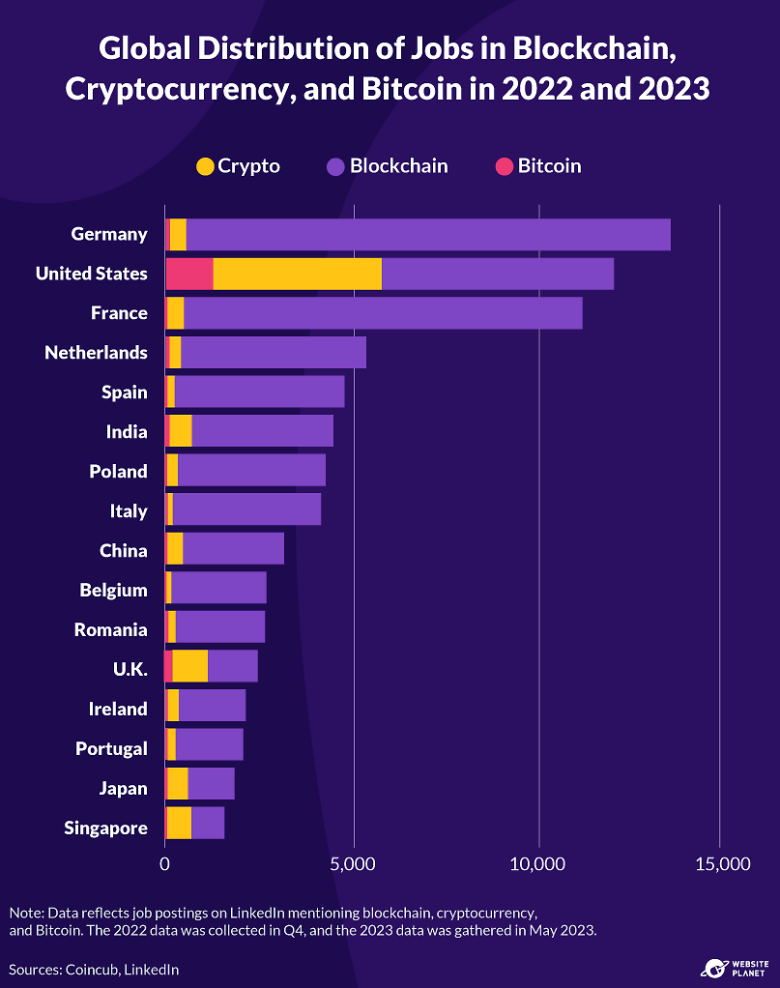

Is the U.S. a Hub for Bitcoin-Related Careers?

While crypto-related jobs are on the rise, it’s blockchain technology that’s powering real growth in the job market. Cryptocurrencies like Bitcoin experience cycles of popularity, but blockchain remains in high demand across various sectors. In Germany, for instance, of over 13,000 blockchain-related jobs, fewer than 10% are directly tied to cryptocurrencies.

In the United States, the picture is different. Of the nearly 12,000 blockchain jobs, around 40% specifically mention cryptocurrency, which signals a strong focus on crypto in the U.S. job market. The U.S. also leads globally in Bitcoin-specific roles, with over 1,000 job postings mentioning Bitcoin, well ahead of Canada’s 400.

Globally, demand for blockchain skills continues to exceed expectations, with countries like Ireland, Italy, and Spain reporting robust job growth even when cryptocurrency itself faces increased scrutiny.

While crypto-related jobs are on the rise, it’s blockchain technology that’s powering real growth in the job market. Cryptocurrencies like Bitcoin experience cycles of popularity, but blockchain remains in high demand across various sectors. In Germany, for instance, of over 13,000 blockchain-related jobs, fewer than 10% are directly tied to cryptocurrencies.

In the United States, the picture is different. Of the nearly 12,000 blockchain jobs, around 40% specifically mention cryptocurrency, which signals a strong focus on crypto in the U.S. job market. The U.S. also leads globally in Bitcoin-specific roles, with over 1,000 job postings mentioning Bitcoin, well ahead of Canada’s 400.

Globally, demand for blockchain skills continues to exceed expectations, with countries like Ireland, Italy, and Spain reporting robust job growth even when cryptocurrency itself faces increased scrutiny.

Bitcoin Mining and Its Environmental Impact

Bitcoin mining plays a crucial role in maintaining the network but comes with significant environmental costs. Let’s look at where mining activity is concentrated, the energy sources powering it, and the carbon footprint it leaves behind to better understand how Bitcoin’s energy demands impact the planet.Where Does Bitcoin Mining Take Place?

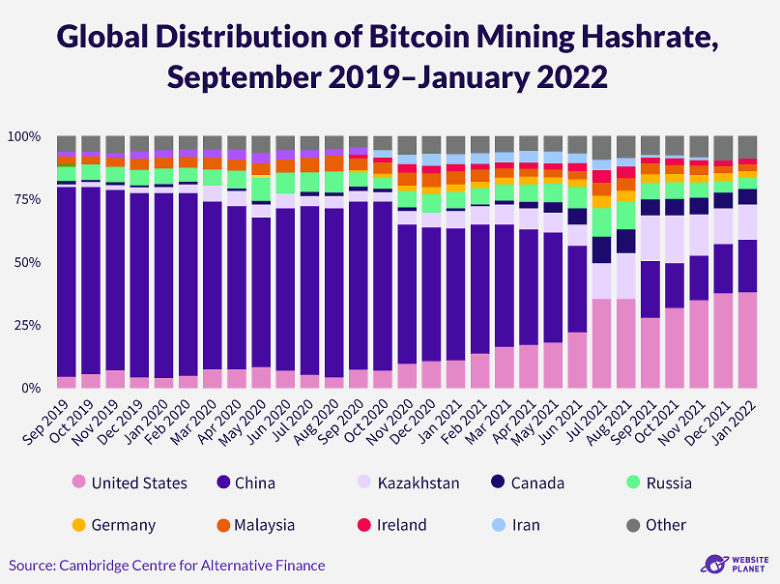

Bitcoin mining relies heavily on computing power and electricity. The United States has become the largest hub for Bitcoin mining, as miners look for affordable and stable energy sources.

This shift happened after China, which once led global mining with over 60% of the world’s Bitcoin hashrate, implemented a strict ban on cryptocurrency mining in 2021. Following the crackdown, many mining operations relocated to countries with relatively inexpensive electricity, such as the U.S., Kazakhstan, and Russia.

Electricity costs play a major factor in the concentration of Bitcoin mining. For example, electricity prices in Germany are more than ten times higher than in energy-rich countries like China, making it a less attractive option for miners.

In the United States, mining activity is particularly concentrated in states like Texas, Georgia, and New York, which host large-scale mining facilities due to their energy availability, stable infrastructure, and robust legal systems.

Bitcoin mining relies heavily on computing power and electricity. The United States has become the largest hub for Bitcoin mining, as miners look for affordable and stable energy sources.

This shift happened after China, which once led global mining with over 60% of the world’s Bitcoin hashrate, implemented a strict ban on cryptocurrency mining in 2021. Following the crackdown, many mining operations relocated to countries with relatively inexpensive electricity, such as the U.S., Kazakhstan, and Russia.

Electricity costs play a major factor in the concentration of Bitcoin mining. For example, electricity prices in Germany are more than ten times higher than in energy-rich countries like China, making it a less attractive option for miners.

In the United States, mining activity is particularly concentrated in states like Texas, Georgia, and New York, which host large-scale mining facilities due to their energy availability, stable infrastructure, and robust legal systems.

Where Does the Energy for Bitcoin Mining Come From?

The need for cleaner energy alternatives to reduce Bitcoin’s heavy carbon footprint is clear. Bitcoin mining’s energy demand is primarily met by fossil fuels, with coal alone supplying 45% of the power for global mining operations and an additional 21% from natural gas. Renewable sources like hydropower, solar, and wind account for less than a quarter of Bitcoin’s energy mix.

The industry’s focus remains on cheaper, fossil-fuel-based power sources, particularly in the U.S., where fossil fuels made up about 82% of the energy mix in 2023, though their availability and cost can vary across the country. This reliance on non-renewable energy makes Bitcoin mining especially carbon-intensive, and the rise in mining activity has led to significant increases in greenhouse gas emissions.

If left unchecked, Bitcoin mining’s emissions could help push global warming beyond the Paris Agreement’s 2-degree Celsius limit.

The need for cleaner energy alternatives to reduce Bitcoin’s heavy carbon footprint is clear. Bitcoin mining’s energy demand is primarily met by fossil fuels, with coal alone supplying 45% of the power for global mining operations and an additional 21% from natural gas. Renewable sources like hydropower, solar, and wind account for less than a quarter of Bitcoin’s energy mix.

The industry’s focus remains on cheaper, fossil-fuel-based power sources, particularly in the U.S., where fossil fuels made up about 82% of the energy mix in 2023, though their availability and cost can vary across the country. This reliance on non-renewable energy makes Bitcoin mining especially carbon-intensive, and the rise in mining activity has led to significant increases in greenhouse gas emissions.

If left unchecked, Bitcoin mining’s emissions could help push global warming beyond the Paris Agreement’s 2-degree Celsius limit.

How Much Energy Does Bitcoin Consume?

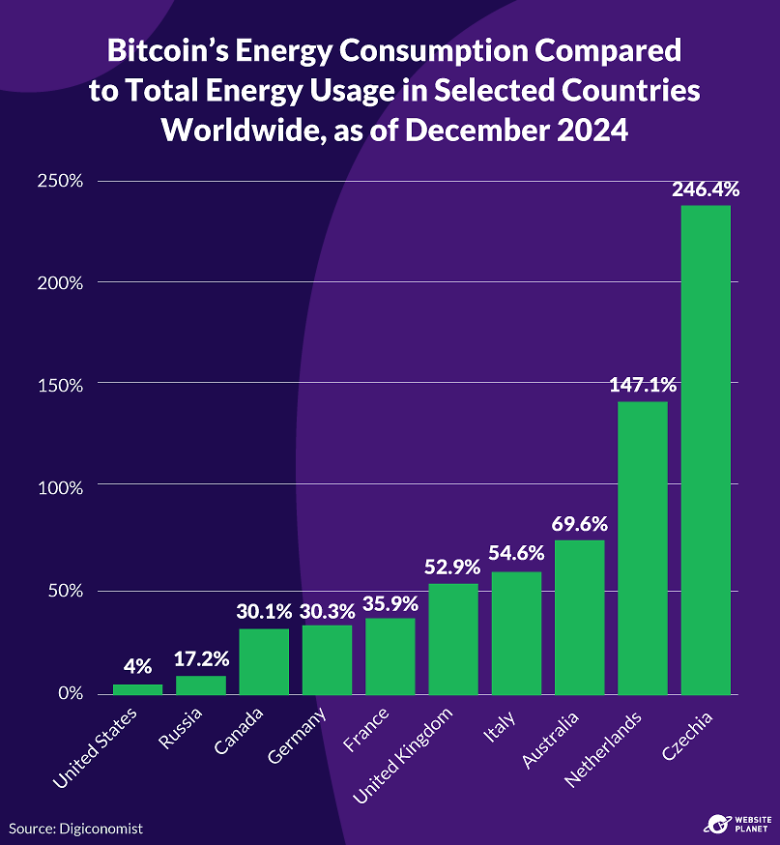

As Bitcoin’s popularity and security demands have grown, its energy consumption has reached levels comparable to a small country. In December 2024, Bitcoin’s annual electricity use was estimated at 175.87 TWh — about 4% of the total energy produced in the U.S., and higher than the consumption of smaller countries like Czechia and the Netherlands.

This demand stems from Bitcoin’s proof-of-work (PoW) process, which requires miners to operate powerful machines that consume substantial amounts of electricity to secure the network and validate transactions. As more miners join the network to capitalize on higher profits, energy demands increase.

Bitcoin’s environmental impact is closely tied to its price. Between 2021 and 2022, a 400% increase in Bitcoin’s price led to a 140% surge in global mining energy consumption, as more miners and advanced equipment entered the network to make more money.

As Bitcoin’s popularity and security demands have grown, its energy consumption has reached levels comparable to a small country. In December 2024, Bitcoin’s annual electricity use was estimated at 175.87 TWh — about 4% of the total energy produced in the U.S., and higher than the consumption of smaller countries like Czechia and the Netherlands.

This demand stems from Bitcoin’s proof-of-work (PoW) process, which requires miners to operate powerful machines that consume substantial amounts of electricity to secure the network and validate transactions. As more miners join the network to capitalize on higher profits, energy demands increase.

Bitcoin’s environmental impact is closely tied to its price. Between 2021 and 2022, a 400% increase in Bitcoin’s price led to a 140% surge in global mining energy consumption, as more miners and advanced equipment entered the network to make more money.

The Carbon Footprint of Bitcoin

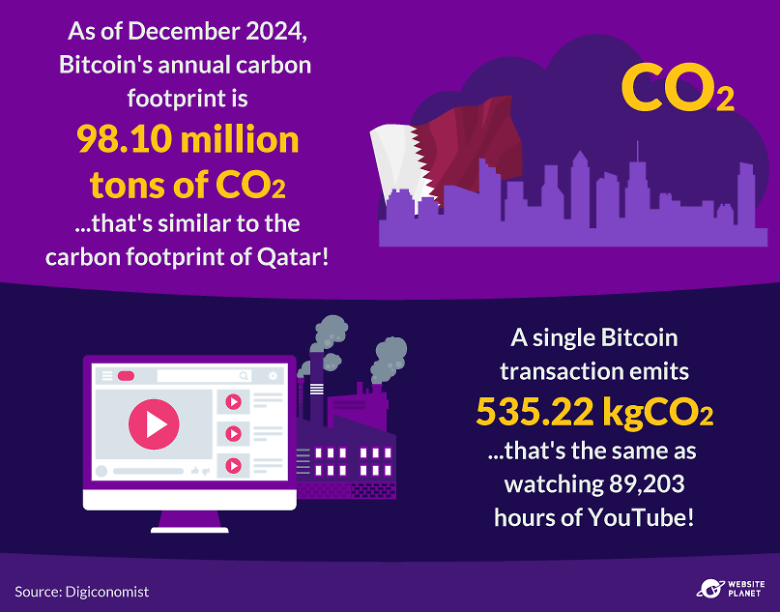

Bitcoin’s carbon footprint mirrors its high energy consumption, generating emissions similar to that of a medium-sized country. As of December 2024, Bitcoin mining produces approximately 98.10 million metric tons of CO₂ annually, comparable to the carbon emissions of Qatar.

Each Bitcoin transaction alone generates around 535 kg of CO₂ — equivalent to 1,186,233 VISA transactions or 89,203 hours of YouTube streaming.

This massive carbon output is tied to Bitcoin’s reliance on the energy-intensive PoW process, which, as discussed, consumes vast amounts of electricity. With much of this energy coming from fossil fuels, Bitcoin’s carbon emissions remain high, especially when compared to other cryptocurrencies like Ethereum, which have transitioned to more energy-efficient mining processes like proof-of-stake.

Bitcoin’s carbon footprint mirrors its high energy consumption, generating emissions similar to that of a medium-sized country. As of December 2024, Bitcoin mining produces approximately 98.10 million metric tons of CO₂ annually, comparable to the carbon emissions of Qatar.

Each Bitcoin transaction alone generates around 535 kg of CO₂ — equivalent to 1,186,233 VISA transactions or 89,203 hours of YouTube streaming.

This massive carbon output is tied to Bitcoin’s reliance on the energy-intensive PoW process, which, as discussed, consumes vast amounts of electricity. With much of this energy coming from fossil fuels, Bitcoin’s carbon emissions remain high, especially when compared to other cryptocurrencies like Ethereum, which have transitioned to more energy-efficient mining processes like proof-of-stake.

Bitcoin Risks and Regulation

Bitcoin’s rise has been accompanied by significant challenges, including security breaches, regulatory uncertainty, and its association with illegal activities. Governments around the world are racing to establish rules for the cryptocurrency sector, balancing innovation with the need to protect consumers and combat financial crime.Global Legal Stances on Bitcoin

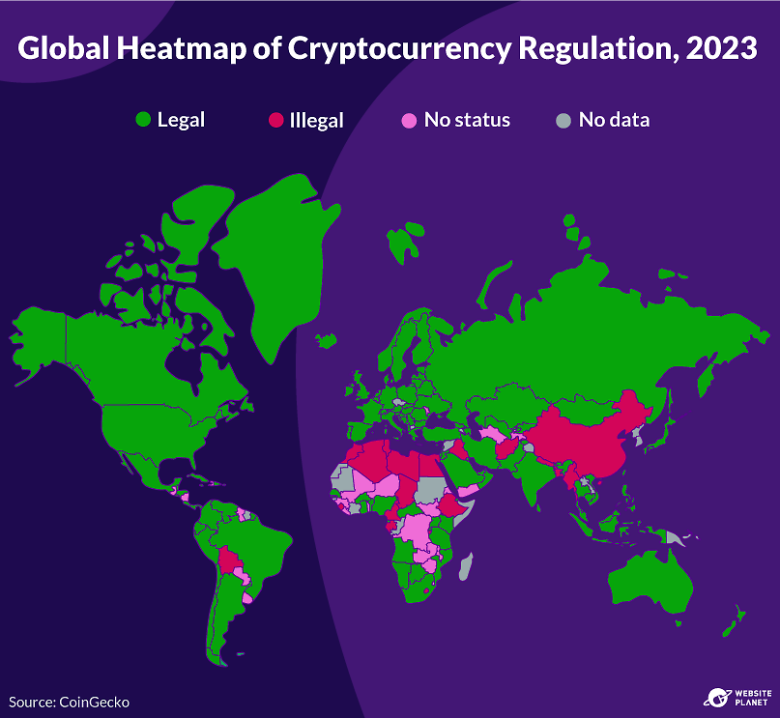

While Bitcoin was once largely unregulated, governments worldwide are now actively shaping policies for the cryptocurrency sector. This is mainly driven by the need to protect investors and prevent fraud, spurred by incidents such as bank collapses linked to crypto and the high-profile FTX bankruptcy in 2022.

In the U.S., regulatory progress has slowed after initial advances on bills like the Financial Innovation and Technology (FIT) for the 21st Century Act, aimed at clarifying crypto’s classification as securities or commodities. However, crypto policies in the U.S. could see a major overhaul as Trump, who has pledged to create a crypto advisory council, enacts new policies.

The European Union is leading globally with its Markets in Crypto-Assets Regulation (MiCA), which mandates licenses for crypto service providers and strict anti-money laundering protocols.

Countries in Asia are a mixed landscape — while Japan and South Korea have embraced crypto regulation, China enforces a complete ban on crypto trading and mining, and India’s regulatory stance has changed many times, without sign of stabilizing.

Other countries are also advancing crypto legislation. Brazil recently granted its central bank authority over digital assets, and the U.K. is focusing on stablecoins, seeing them as a tool for faster payments but requiring compliance with strict Financial Conduct Authority regulations.

While Bitcoin was once largely unregulated, governments worldwide are now actively shaping policies for the cryptocurrency sector. This is mainly driven by the need to protect investors and prevent fraud, spurred by incidents such as bank collapses linked to crypto and the high-profile FTX bankruptcy in 2022.

In the U.S., regulatory progress has slowed after initial advances on bills like the Financial Innovation and Technology (FIT) for the 21st Century Act, aimed at clarifying crypto’s classification as securities or commodities. However, crypto policies in the U.S. could see a major overhaul as Trump, who has pledged to create a crypto advisory council, enacts new policies.

The European Union is leading globally with its Markets in Crypto-Assets Regulation (MiCA), which mandates licenses for crypto service providers and strict anti-money laundering protocols.

Countries in Asia are a mixed landscape — while Japan and South Korea have embraced crypto regulation, China enforces a complete ban on crypto trading and mining, and India’s regulatory stance has changed many times, without sign of stabilizing.

Other countries are also advancing crypto legislation. Brazil recently granted its central bank authority over digital assets, and the U.K. is focusing on stablecoins, seeing them as a tool for faster payments but requiring compliance with strict Financial Conduct Authority regulations.

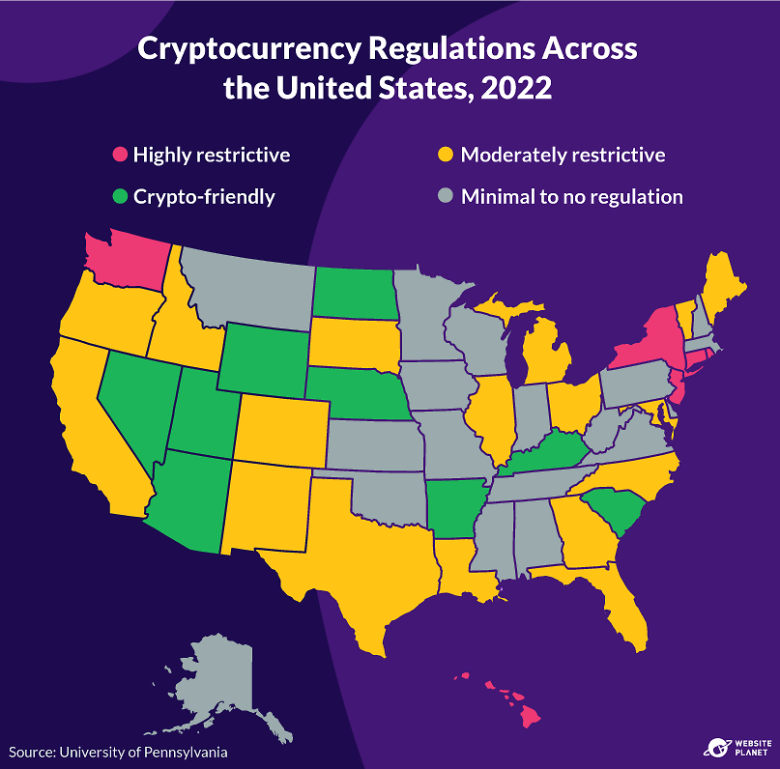

Cryptocurrency Regulations Across U.S. States

As digital currencies like Bitcoin grow in popularity, each state has taken a unique approach to cryptocurrency regulation, ranging from highly restrictive to crypto-friendly. At least 35 states have introduced or enacted legislation to address cryptocurrency and digital asset regulations in 2024, covering topics from mining practices to the legal status of decentralized autonomous organizations (DAOs).

States like Arkansas, Georgia, and Louisiana have implemented laws affecting how digital currencies are mined or transacted, with regulations on issues such as noise reduction for mining operations, restrictions on central bank digital currencies (CBDCs), and rights to operate nodes and mine at home. Meanwhile, Nebraska and South Dakota have passed laws opposing the adoption of a national CBDC, emphasizing state control over digital assets.

As digital currencies like Bitcoin grow in popularity, each state has taken a unique approach to cryptocurrency regulation, ranging from highly restrictive to crypto-friendly. At least 35 states have introduced or enacted legislation to address cryptocurrency and digital asset regulations in 2024, covering topics from mining practices to the legal status of decentralized autonomous organizations (DAOs).

States like Arkansas, Georgia, and Louisiana have implemented laws affecting how digital currencies are mined or transacted, with regulations on issues such as noise reduction for mining operations, restrictions on central bank digital currencies (CBDCs), and rights to operate nodes and mine at home. Meanwhile, Nebraska and South Dakota have passed laws opposing the adoption of a national CBDC, emphasizing state control over digital assets.

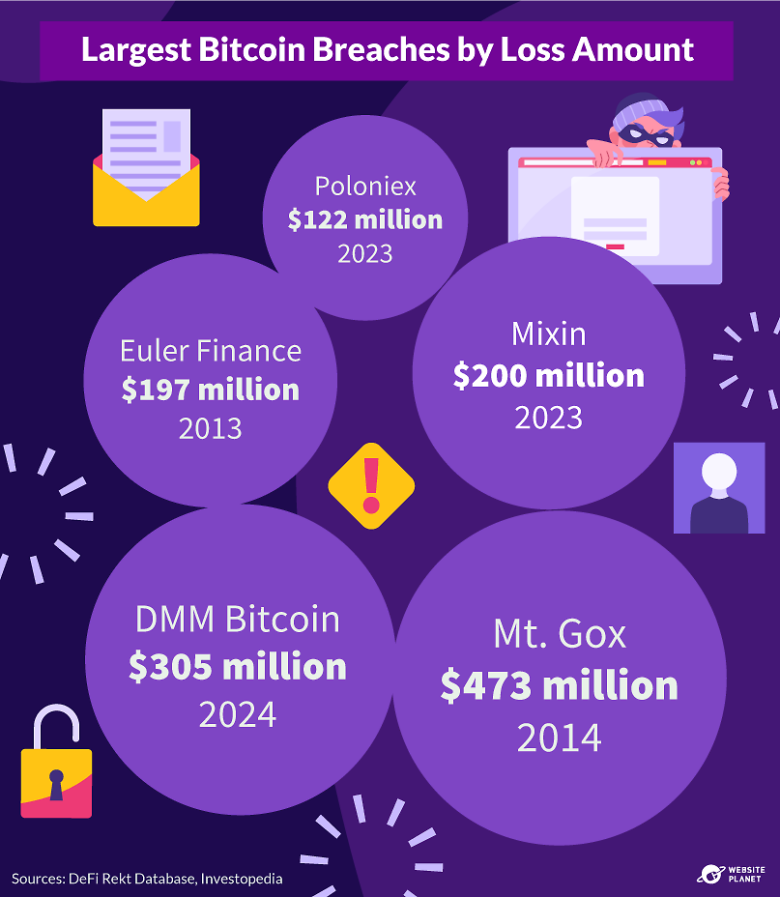

Bitcoin’s Biggest Breaches

Bitcoin and cryptocurrency exchanges have long been targets for criminals, and security breaches of these third parties have resulted in significant financial losses. This highlights ongoing concerns about security and regulation.

A notable early incident was the 2014 Mt. Gox hack, where over 750,000 bitcoins, about 7% of all Bitcoin at the time, were stolen due to vulnerabilities in the exchange’s hot wallet. Valued at $473 million then, the loss would be worth billions today. A year earlier, Euler Finance faced a $197 million flash loan attack, where hackers exploited price manipulation. A portion of the funds were later returned because the hackers feared for their safety.

Large-scale attacks have continued to affect the industry. In 2023, the Mixin Network lost $200 million after attackers breached its cloud provider’s database, while Poloniex experienced a $122 million loss after attackers exploited wallet vulnerabilities. In May 2024, Japanese exchange DMM Bitcoin lost $305 million under unknown circumstances, with North Korea’s Lazarus Group suspected as the culprit.

Bitcoin and cryptocurrency exchanges have long been targets for criminals, and security breaches of these third parties have resulted in significant financial losses. This highlights ongoing concerns about security and regulation.

A notable early incident was the 2014 Mt. Gox hack, where over 750,000 bitcoins, about 7% of all Bitcoin at the time, were stolen due to vulnerabilities in the exchange’s hot wallet. Valued at $473 million then, the loss would be worth billions today. A year earlier, Euler Finance faced a $197 million flash loan attack, where hackers exploited price manipulation. A portion of the funds were later returned because the hackers feared for their safety.

Large-scale attacks have continued to affect the industry. In 2023, the Mixin Network lost $200 million after attackers breached its cloud provider’s database, while Poloniex experienced a $122 million loss after attackers exploited wallet vulnerabilities. In May 2024, Japanese exchange DMM Bitcoin lost $305 million under unknown circumstances, with North Korea’s Lazarus Group suspected as the culprit.

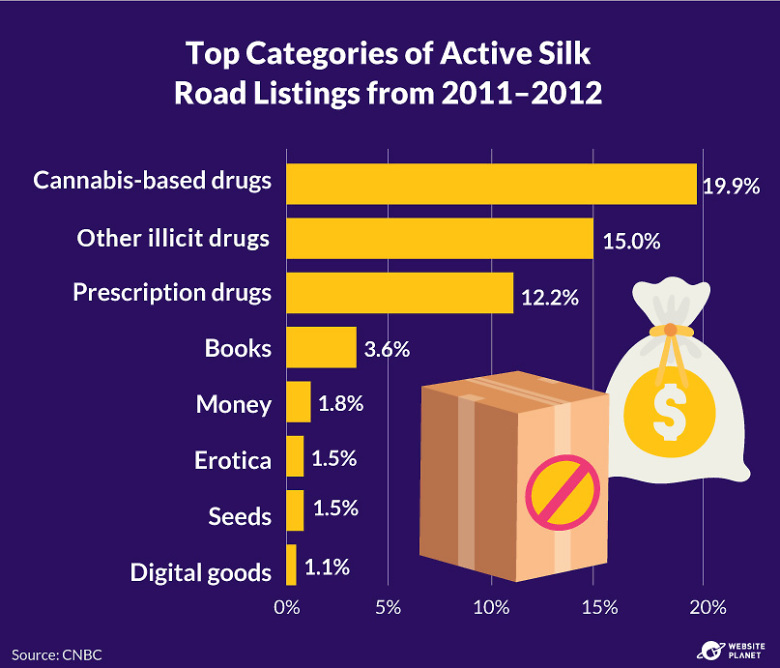

Bitcoin’s Role in the Silk Road

Bitcoin’s association with illegal activities became prominent through its role in the Silk Road, an infamous darknet marketplace active from 2011 to 2013. The Silk Road facilitated anonymous transactions, primarily for cannabis and narcotics, with bitcoin as the sole accepted currency due to its pseudonymity and decentralized nature.

During its operation, the Silk Road facilitated transactions totaling 9,519,664 bitcoins — worth approximately $869 billion today. These transactions mostly involved illicit goods, including drugs, erotica, and other digital items, solidifying Bitcoin’s early reputation as a tool for anonymous financial exchanges.

The Silk Road’s downfall came in 2013 when the FBI shut it down, seized 144,000 bitcoins (then valued at $34 million), and arrested its founder, Ross Ulbricht, who had earned an estimated $80 million in commissions. Ulbricht was serving a life sentence without parole until he was pardoned in January 2025 by President Trump.

Though the Silk Road is long gone, its legacy remains a reminder of the potential misuse of Bitcoin and cryptocurrencies generally, prompting regulatory efforts to address similar risks and prevent new platforms from popping up.

Bitcoin’s association with illegal activities became prominent through its role in the Silk Road, an infamous darknet marketplace active from 2011 to 2013. The Silk Road facilitated anonymous transactions, primarily for cannabis and narcotics, with bitcoin as the sole accepted currency due to its pseudonymity and decentralized nature.

During its operation, the Silk Road facilitated transactions totaling 9,519,664 bitcoins — worth approximately $869 billion today. These transactions mostly involved illicit goods, including drugs, erotica, and other digital items, solidifying Bitcoin’s early reputation as a tool for anonymous financial exchanges.

The Silk Road’s downfall came in 2013 when the FBI shut it down, seized 144,000 bitcoins (then valued at $34 million), and arrested its founder, Ross Ulbricht, who had earned an estimated $80 million in commissions. Ulbricht was serving a life sentence without parole until he was pardoned in January 2025 by President Trump.

Though the Silk Road is long gone, its legacy remains a reminder of the potential misuse of Bitcoin and cryptocurrencies generally, prompting regulatory efforts to address similar risks and prevent new platforms from popping up.

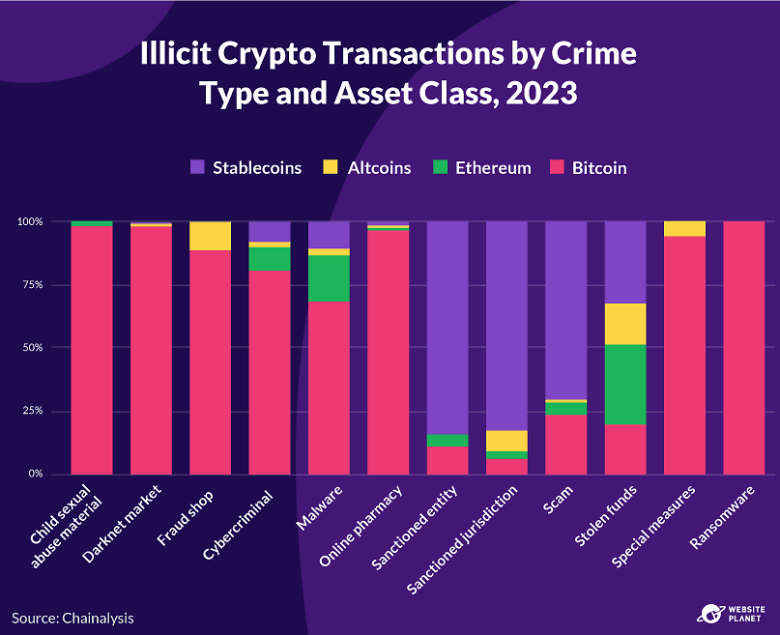

Why Stablecoins Are Outpacing Bitcoin in Illicit Use

Bitcoin was once the go-to currency for cybercriminals but has been overtaken by stablecoins, especially in scams and transactions tied to sanctioned entities. Stablecoins are digital assets designed to hold a steady value, usually pegged to the U.S. dollar, making them less volatile than typical cryptocurrencies. This stability is appealing for those looking to avoid the swings of other digital currencies while still benefiting from crypto’s privacy.

That said, Bitcoin still dominates in some areas of illicit activity, like ransomware and darknet market sales, where it’s as popular as ever. Meanwhile, stablecoins have become favored in sanctioned regions, where they offer a stable, dollar-like alternative for transactions that would otherwise be difficult to conduct.

In response, stablecoin issuers are stepping up oversight. For example, in 2023, Tether froze assets linked to terrorism-related activities in Israel and Ukraine, showing how issuers can take action when they detect misuse on their networks.

Bitcoin was once the go-to currency for cybercriminals but has been overtaken by stablecoins, especially in scams and transactions tied to sanctioned entities. Stablecoins are digital assets designed to hold a steady value, usually pegged to the U.S. dollar, making them less volatile than typical cryptocurrencies. This stability is appealing for those looking to avoid the swings of other digital currencies while still benefiting from crypto’s privacy.

That said, Bitcoin still dominates in some areas of illicit activity, like ransomware and darknet market sales, where it’s as popular as ever. Meanwhile, stablecoins have become favored in sanctioned regions, where they offer a stable, dollar-like alternative for transactions that would otherwise be difficult to conduct.

In response, stablecoin issuers are stepping up oversight. For example, in 2023, Tether froze assets linked to terrorism-related activities in Israel and Ukraine, showing how issuers can take action when they detect misuse on their networks.

Conclusion

Bitcoin has changed how we think about money and finance, and offers new possibilities through decentralization. In the U.S., where an estimated 38% of Bitcoin mining takes place, its impact is particularly significant. However, challenges remain, from regulatory hurdles to environmental concerns; the network consumed an estimated 175 TWh per year of electricity, as of February 2025 — more than some entire countries. Understanding Bitcoin’s statistics and trends is essential for newcomers and seasoned investors alike. Its future will be shaped by advancing technologies, evolving regulations, and public sentiment. Whether you see it as a groundbreaking asset or a high-risk investment, Bitcoin’s story is far from over and its impact on the financial world is only just beginning.Content attribution: Website Planet is the sole owner of the visual and written content on this website. You are free to share our content and visuals on your site, but we ask that you provide a link back to the resource if you do, enabling us to continue providing authoritative reviews and guides to help individuals and businesses thrive online.