Inside this Article

What We Look For in the Best QR Code Payment Apps1. Leaders Merchant Services: Cheapest QR Code Payment App2. Square: Easy QR Code Solutions for Quick Payments3. Paysafe: Best for eCash Payments and Restaurants4. Stax: Best for High-Volume QR Code Payments5. Chase Payment Solutions: Fast Payouts6. Helcim: Best for E-Commerce BusinessesOther Notable QR Code Payment AppsPick the Best QR Code Payment App for Your BusinessFAQ

Short on Time? These Are the Best QR Code Payment Apps in 2025

- Leaders Merchant Services – Affordable rates, secure QR code payments, and seamless Clover integration.

- Square – Easy QR code creation for local and remote ordering and payments.

- Paysafe – Secure online payments via barcode and restaurant-specific QR code payments.

What We Look For in the Best QR Code Payment Apps

While researching the best QR code payment apps, I focused on specific features that enhance ease of use and security for you and your customers. Here’s what I prioritized:- Ease of setup and use. The app needs to be quick to set up and easy to use, so I looked for platforms with intuitive interfaces that minimize friction in the payment process.

- Low transaction fees. I prioritized apps that offer low transaction fees without compromising on features, helping you maximize profitability.

- Multiple payment methods. To cater to different customer preferences, I chose apps that support various payment methods, including credit cards, digital wallets, and bank transfers, so you never miss a sale.

- Security features. Your customers’ trust is essential, so I prioritized apps offering robust encryption and security measures to protect sensitive payment information.

- Multi-platform compatibility. I selected apps that work seamlessly across multiple platforms, such as desktops, smartphones, or tablets.

Our Score

Our Score

Negotiable Low Credit Card Processing Rates

Monthly Fee:

$9

Transaction Fee:

From 0.15% + $0

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- Multiple contactless payment options. LMS supports a range of contactless payment methods that work seamlessly with QR code payments. These include all major credit and debit cards, Google Pay, Apple Pay, and Samsung Pay. What’s more, LMS allows you to process PayPal and Venmo payments via your Clover POS system.

- High approval rate. LMS boasts a 98% approval rate. So even if you run a high-risk business or have a low credit score, you’re more likely to get approved without the usual back-and-forth.

- Cash advances for merchants. If you need extra funds to expand your business or manage cash flow, LMS offers cash advances to its merchants. And you don’t need to worry about payback deadlines, as you pay back through a tiny commission on future transactions with LMS.

- Dedicated chargeback department. Chargebacks can be a headache, but LMS has a dedicated chargeback department to handle disputes. Having a team focused on managing chargebacks means you’re not left dealing with these issues on your own.

| Versatile QR code payment solution | ✔ (via Clover integration) |

| Payment methods accepted | Credit and debit cards, digital wallets, ACH, bank transfers |

| Payout time | 72 hours |

| Transaction fees on cheapest plan | ~0.15% + $0 |

| Monthly fee on cheapest plan | $9.00 |

Our Score

Our Score

Advanced E-Commerce and Security Solutions for Start-Ups

Monthly Fee:

From $0

Transaction Fee:

From 2.5% + 10¢

Pricing Model:

Flat rate

Flat rate

Flat rate pricing simplifies your payment processing bill by charging the same percentage markup on every credit or debit card transaction you receive. The payment processor still pays the variable interchange fee set by the card network (e.g. Visa, Mastercard) on each transaction, but you always pay the same fixed rate regardless.

Features and Benefits

- Multiple e-commerce integrations. Square integrates smoothly with various e-commerce platforms, including Shopify, WooCommerce, WordPress, Wix, and Ecwid. So it’s a great option if you’re looking to sell online.

- Extensive app marketplace. Whether you need additional accounting tools, marketing solutions, or inventory management, the app marketplace has something to fit your needs.

- Super fast onboarding process. One of the standout experiences with Square is how quickly you can get started. The onboarding process is swift, allowing you to set up your account and begin creating QR codes almost immediately.

- Free mobile card reader. Square sweetens the deal by offering a free mobile card reader. Not all customers will use QR codes for payment, so having a mobile card reader ensures you can accommodate those who prefer to swipe or tap their card.

| Versatile QR code payment solution | ✔ (built-in functionality) |

| Payment methods accepted | Payment methods accepted Credit and debit cards, PayPal, Apple Pay, Afterpay, and Google Pay |

| Payout time | 24 hours before 5 p.m., 48 hours after 5 p.m., optional same-day payout |

| Transaction fees on cheapest plan | 2.6% + 10¢ |

| Monthly fee on cheapest plan | $0 |

Unsure which processor is best for your business?

Take this short quiz and get a tailor-made recommendation in seconds

Our Score

Our Score

Top Global Payment Processor With Industry-Specific Merchant Accounts

Monthly Fee:

$7.95

Transaction Fee:

From 0.50% + $0.10

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- 250+ payment methods. Paysafe doesn’t disappoint when it comes to payment options. It supports over 250 payment methods across 120 countries, giving you the flexibility to cater to a broad audience.

- Multichannel payment options. Paysafe supports QR code payments, digital invoicing, pay-by-link, mail order/telephone order (MOTO), and subscription-based payments. This allows you to meet your customers’ preferences, no matter how they choose to pay.

- Dedicated account manager. Navigating the complexities of setting up a payment system can be tasking, but Paysafe makes it easier with a dedicated account manager. Personal support will help you through the account setup and show you how to accept QR code payments effectively.

- Merchant Back Office. It’s a comprehensive online dashboard that lets you easily track and monitor all your payments. From viewing transactions to taking orders through a virtual terminal, processing refunds, and generating detailed reports, this tool gives you complete control over your payment processing.

| Versatile QR code payment solution | ✔ (built-in functionality) |

| Payment methods accepted | Credit and debit, ACH, EFT, digital wallets, bank transfers, cash, prepaid vouchers/gift cards |

| Payout time | 1–2 business days |

| Transaction fees on cheapest plan | 0.50% + $0.10 |

| Monthly fee on cheapest plan | $7.95 |

Our Score

Our Score

Save Up to 40% on Credit Card Processing Fees

Monthly Fee:

From $99

Transaction Fee:

From 8¢ + Interchange

Pricing Model:

Subscription

Subscription

With subscription-style pricing, you’ll pay a fixed monthly fee instead of a percentage-based markup on each credit and debit card transaction. While this will considerably reduce your per-transaction fees, you’ll typically still pay a small flat fee on each transaction. This amount is unaffected by the variable interchange fees charged by the different card networks (e.g. Visa, Mastercard), helping to keep your payment processing fees more predictable.

Features and Benefits

- Seamless Zapier integration. Stax’s Zapier integration allows you to automate various tasks without lifting a finger, such as syncing your payment data with other software.

- Reporting and analytics software. Good data is essential for making informed decisions, and Stax’s reporting and analytics software delivers just that. It’s incredibly useful for tracking payment-related metrics, such as payment types and methods, transaction amounts, and chargeback rates.

- Credit card surcharging. You can use Stax’s credit card surcharge to offset the costs of credit card transactions by passing on the processing fees to your customers. This can be particularly useful in industries where margins are tight and every cent counts.

- Secure credit card storage. If you have regular customers, Stax’s end-to-end encryption and tokenization secure your customers’ credit card details, making it easier to manage repeat transactions.

| Versatile QR code payment solution | ✔ (built-in functionality) |

| Payment methods accepted | Credit and debit cards, Google Pay, Apple Pay, ACH, bank transfers |

| Payout time | 72 hours as standard, optional same-day payout add-on |

| Transaction fees on cheapest plan | 15¢ + interchange (online) |

| Monthly fee on cheapest plan | $99.00 |

5. Chase Payment Solutions: Fast Payouts

Our Score

Our Score

Favorable Flat Rate Pricing & E-Commerce Features for SMEs

Monthly Fee:

$0

Transaction Fee:

From 2.6% + 10¢

Pricing Model:

Flat rate

Flat rate

Flat rate pricing simplifies your payment processing bill by charging the same percentage markup on every credit or debit card transaction you receive. The payment processor still pays the variable interchange fee set by the card network (e.g. Visa, Mastercard) on each transaction, but you always pay the same fixed rate regardless.

Features and Benefits

- Chase Customer Insights. This business analytics software lets you dig into your sales data, tracking your daily, weekly, and monthly sales with ease. It helps you identify trends and see when your customers are most likely to shop.

- Chase Mobile. Managing QR code payments on the go is a breeze with Chase Mobile. The app brings everything together – payment acceptance, dispute management, and even banking functions. It’s available for Android and iOS, so you can keep tabs on your business from wherever you are.

- Recurring billing. Chase Payment Solutions lets you set up an automatic payment process that securely stores your customer data. That’s great if your business relies on repeat customers and you want to avoid delays.

- Robust developer kit. If you’re tech-savvy or have a developer on your team, Chase’s robust developer kit includes SDKs and APIs that allow you to create customized solutions tailored to your business needs.

| Versatile QR code payment solution | ✔ (for restaurants only via TouchBistro – customers of other businesses need the Zelle app to pay via QR code) |

| Payment methods accepted | Credit and debit cards, PayPal, Apple Pay, Google Pay, Samsung Pay, ACH |

| Payout time | Same day if you deposit into a Chase business account, next day if you deposit into a third-party account |

| Transaction fees on cheapest plan | 2.6% + 10¢ |

| Monthly fee on cheapest plan | $0 |

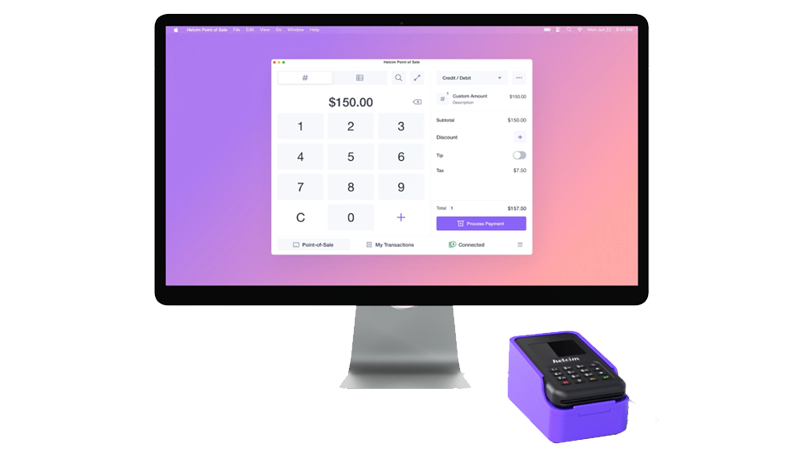

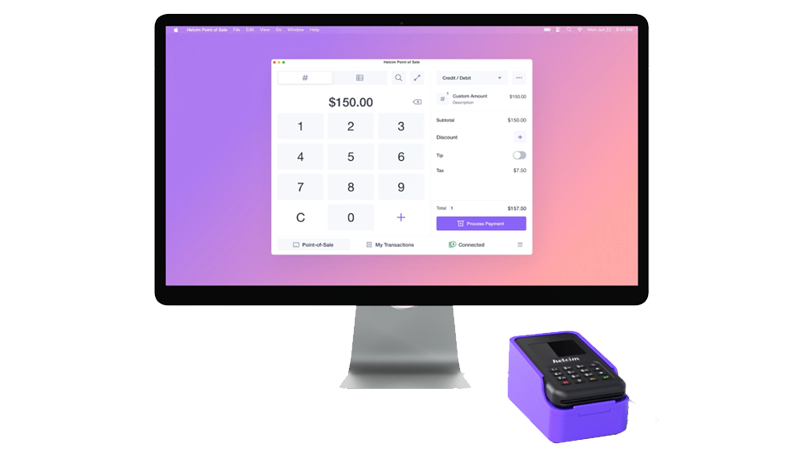

6. Helcim: Best for E-Commerce Businesses

Our Score

Our Score

Budget-Friendly Credit Card Processing Ideal for New or Low-Volume Businesses

Monthly Fee:

None

Transaction Fee:

From 0.30% + 8¢

Pricing Model:

Interchange plus

Interchange plus

Interchange-plus pricing involves two fees for each credit or debit card transaction. The first is the interchange fee, a variable amount set by the card network (e.g. Visa, Mastercard). The second is a markup fee charged by the payment processor, typically a percentage of the transaction amount plus a small flat transaction fee. This allows you to see exactly how much of what you pay goes to the card networks and how much to the payment processor.

Features and Benefits

- Comprehensive knowledge base. Helcim’s knowledge base is packed with tutorials and resources, making it easier to navigate the ins and outs of QR code payments. There’s a well-detailed guide that breaks down everything you need to know.

- Built-in customer relationship management (CRM) system. Helcim lets you easily manage customer information, and with its Card Vault tool, payment details are stored securely. Plus, the feature is built-in, so you’ll save money on third-party software.

- Built-in online food ordering system. If you’re in the food business, this feature can streamline your operations significantly. The system integrates smoothly with the payment process, and you can leverage QR codes here, too, making it easier for customers to pay for their orders quickly and without contact.

- Integrated customer portal. It lets your customers manage their subscriptions, payment methods, and other details without needing to contact you directly. This self-service approach is a huge time-saver and reduces the headaches that come with overdue invoices.

| Versatile QR code payment solution | ✔ (built-in functionality) |

| Payment methods accepted | Credit and debit cards, Google Pay, Apple Pay, ACH, bank transfers |

| Payout time | 48 hours |

| Transaction fees on cheapest plan | 0.30% + 8¢ (in-person) |

| Monthly fee on cheapest plan | $0 |

Other Notable QR Code Payment Apps

7. Payment Depot

Our Score

Our Score

Excellent Customer Service Backed by a Dedicated Risk Monitoring Team

Monthly Fee:

From $79

Transaction Fee:

From 0% + 10¢

Pricing Model:

Subscription

Subscription

With subscription-style pricing, you’ll pay a fixed monthly fee instead of a percentage-based markup on each credit and debit card transaction. While this will considerably reduce your per-transaction fees, you’ll typically still pay a small flat fee on each transaction. This amount is unaffected by the variable interchange fees charged by the different card networks (e.g. Visa, Mastercard), helping to keep your payment processing fees more predictable.

8. POS Pros

Our Score

Our Score

Specialized Point-of-Sale Solutions for In-Person and Online Sales

Monthly Fee:

From $5

Transaction Fee:

From 0.30% + 10¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

9. PaymentCloud

Our Score

Our Score

Affordable Rates & Advanced Security Features for High-Risk Businesses

Monthly Fee:

$14

Transaction Fee:

From 2.1% + 15¢

Pricing Model:

Interchange plus

Interchange plus

Interchange-plus pricing involves two fees for each credit or debit card transaction. The first is the interchange fee, a variable amount set by the card network (e.g. Visa, Mastercard). The second is a markup fee charged by the payment processor, typically a percentage of the transaction amount plus a small flat transaction fee. This allows you to see exactly how much of what you pay goes to the card networks and how much to the payment processor.

Pick the Best QR Code Payment App for Your Business

Finding the right QR code payment app can significantly impact your business’s efficiency and customer satisfaction. After exploring the top options, here are my final recommendations. Leaders Merchant Services is my top pick if you’re looking for affordable rates to maximize profits. It offers low fees, open negotiations, and a seamless Clover integration, making it ideal for businesses of all sizes that want to implement QR code payments smoothly. If you prefer a solution that excels in e-commerce and flexibility, go with Square. It allows you to create custom QR codes for both online and in-store use and has a fast onboarding process, making it great for businesses that want versatility in payment options. Or, if you run a big-ticket business or restaurant, consider Paysafe. It’s perfect for businesses in the food industry, thanks to its integration with Applova. Plus, it offers competitive rates that won’t take up a chunk of your profits.Below is a brief comparison of the best QR code payment apps for your business.

| Best Feature | Best For | Monthly fee on cheapest plan | Transaction fees on cheapest plan | ||

| Leaders Merchant Services | Low fees and negotiable rates | Businesses looking for an affordable QR code payment solution | $9.00 | ~0.15% + $0 | |

| Square | Comprehensive QR code functionality | Businesses looking for a centralized QR code payment process | $0 | 2.6% + 10¢ | |

| Paysafe | Applova partnership and eCash payment solution | Restaurants and high-ticket businesses | $7.95 | 0.50% + $0.10 | |

| Stax | 40% discount for high-volume businesses | High-volume businesses generating $8,000+ monthly revenue | $99.00 | 15¢ + interchange (online) | |

| Chase | Same-day funding and Zelle integration | Businesses that want fast access to their funds | $0 | 2.6% + 10¢ | |

| Helcim | Free hosted payment pages for QR code payments | E-commerce businesses | $0 | 0.30% + 8¢ (in-person) |