Inside this Article

What We Look For in the Best Payment Gateways for E-Commerce1. Leaders Merchant Services: Affordable Payment Gateway for E-Commerce Businesses2. ProMerchant: Best Payment Gateway for Retail E-Commerce Businesses and Restaurants3. Stax: Fantastic Suite of E-Commerce Solutions for High-Volume Businesses4. Helcim: Free Payment Gateway and Software for E-Commerce Startups5. CreditCardProcessing.com: Best Payment Gateway for Subscription-Based E-Commerce Businesses6. Paysafe: Best for International E-Commerce BusinessesOther Notable Payment Gateways for E-CommercePick the Best Payment Gateway for Your E-Commerce BusinessFAQ

Short on Time? These Are the Best Payment Gateways for E-Commerce in 2025

- Leader Merchant Services – Secure and reliable payment gateway and negotiable rates for your merchant account.

- ProMerchant – Best payment gateway for retail and restaurants with an e-commerce website.

- Stax – Powerful e-commerce features and a transparent payment model for large businesses.

What We Look For in the Best Payment Gateways for E-Commerce

In my search for the top payment gateways for e-commerce, I focused on the following key features and benefits:- Ease of use. I made sure that merchants were saying positive things about their experience with the credit card processors I recommended. I also looked for processors with user-friendly payment gateways that are easy to set up and offer e-commerce solutions like recurring billing, prebuilt shopping carts, digital invoicing, and more.

- Affordable pricing. Cost-effectiveness is key, so I prioritized processors that offer competitive pricing for all types of businesses and sales volumes.

- Robust security. All my recommendations excel in e-commerce security. They offer features like fraud detection and protection, while some go as far as providing policies for reducing or preventing future chargebacks.

- Multiple payment methods. The services I recommend all accept various payment methods, including debit and credit cards, digital wallets like PayPal, and ACH so your customers can easily make payments with a method they trust.

- Support for international transactions. All my top picks support international transactions through their payment gateways, allowing you to reach a global audience and make more sales online.

Free Card Reader

Our Score

Our Score

Best Credit Card Processor in 2025

Negotiable Low Credit Card Processing Rates

Monthly Fee:

$9

Transaction Fee:

From 0.15% + $0

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- Email customer receipts. CartManager automatically displays a printable receipt whenever your customer completes a successful order. You can also email a copy of this receipt to them.

- Worldwide transactions. While LMS does not support merchant accounts for e-commerce businesses that are not US-based, Authorize.net allows you to accept payments in other currencies for an additional fee.

- Meet-or-beat offer. If you’re currently using another payment processor, LMS promises to either meet or beat your current rates. If it can’t, you’ll receive a $200 gift card.

- Customer engagement solutions. LMS offers value-added services, including gift card and loyalty programs, which help increase customer loyalty and build stronger relationships. You can also create coupons and discounts for your customers using CartManager.

| Payment gateway | Authorize.net, NMI |

| Security features | PCI compliant, advanced fraud detection and prevention, end-to-end encryption, tokenization |

| Accepted payment methods | Credit and debit cards, digital wallets, ACH, bank transfers |

| Transaction fees on cheapest plan | $9.00 |

| Monthly fee on cheapest plan | ~0.15% + $0 |

2. ProMerchant: Best Payment Gateway for Retail E-Commerce Businesses and Restaurants

Our Score

Our Score

Interchange-Plus & Zero Cost Processing Plans Ideal for Restaurants and Retail

Monthly Fee:

$7.95

Transaction Fee:

From 3% + 10¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- No extra fees. ProMerchant doesn’t have any hidden fees and doesn’t charge you for services like PCI-compliance, cancellation, set-up, or application fees.

- Seamless checkout process. Through Authorize.net, you can add “Buy Now” or “Donate Now” buttons to your website that will automatically redirect your customers to the checkout page.

- Quick approvals. ProMerchant’s application process is very fast. Approval can take anywhere from 2 hours to one business day and you can start accepting e-commerce payments right away.

- High-risk merchant assistance. Not only does ProMerchant offer high-risk merchants the same features as low-risk merchants, but it also offers advanced fraud protection that can help reduce chargebacks.

| Payment gateway | Authorize.net |

| Security features | PCI compliant, end-to-end encryption, advanced fraud detection and prevention, tokenization, payer verification |

| Accepted payment methods | Credit and debit cards, ACH, digital wallets, bank transfers |

| Transaction fees on cheapest plan | 3% + 10¢ (credit) |

| Monthly fee on cheapest plan | $7.95 |

Unsure which processor is best for your business?

Take this short quiz and get a tailor-made recommendation in seconds

Our Score

Our Score

Save Up to 40% on Credit Card Processing Fees

Monthly Fee:

From $99

Transaction Fee:

From 8¢ + Interchange

Pricing Model:

Subscription

Subscription

With subscription-style pricing, you’ll pay a fixed monthly fee instead of a percentage-based markup on each credit and debit card transaction. While this will considerably reduce your per-transaction fees, you’ll typically still pay a small flat fee on each transaction. This amount is unaffected by the variable interchange fees charged by the different card networks (e.g. Visa, Mastercard), helping to keep your payment processing fees more predictable.

Features and Benefits

- Text2Pay. This feature allows your customers to make payments through mobile text messages, streamlining payment transactions and making them convenient.

- One-click payment. Stax allows your customers to make payments with just a click. You can create custom QR codes or Pay Now buttons for each invoice to provide your customers with an additional way to pay.

- Stax mobile app. Stax’s mobile app is ideal for e-commerce businesses that also engage in occasional in-person events. The app supports on-the-go payment transactions, including swiped, keyed, or tapped payments.

- Multiple e-commerce integrations. Stax can integrate with a wide range of e-commerce platforms, including Shopify, BigCommerce, WooCommerce, Magento, and HubSpot. Its integration with Zapier allows you to further automate your workflows.

| Payment gateway | Authorize.net, NMI, Stax API, and others |

| Security features | Level 1 PCI-compliant, multi-factor authentication, end-to-end encryption, tokenization, advanced fraud detection and prevention, payer verification |

| Accepted payment methods | Credit and debit cards, selected digital wallets, ACH, bank transfers |

| Transaction fees on cheapest plan | 15¢ + interchange (online) |

| Monthly fee on cheapest plan | $99.00 |

Our Score

Our Score

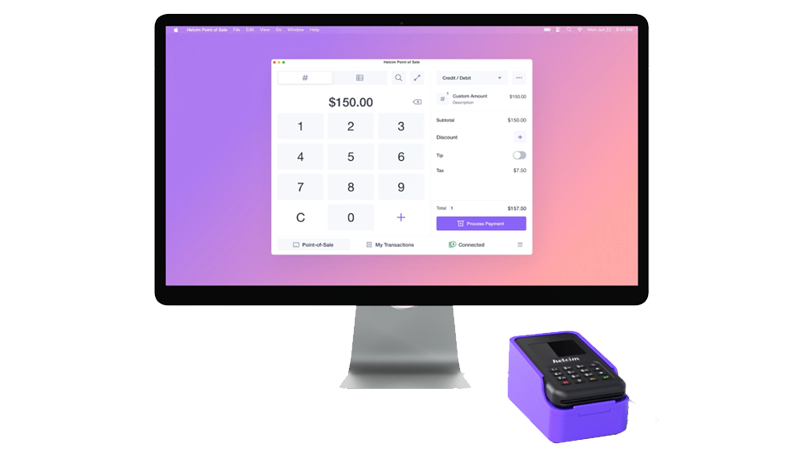

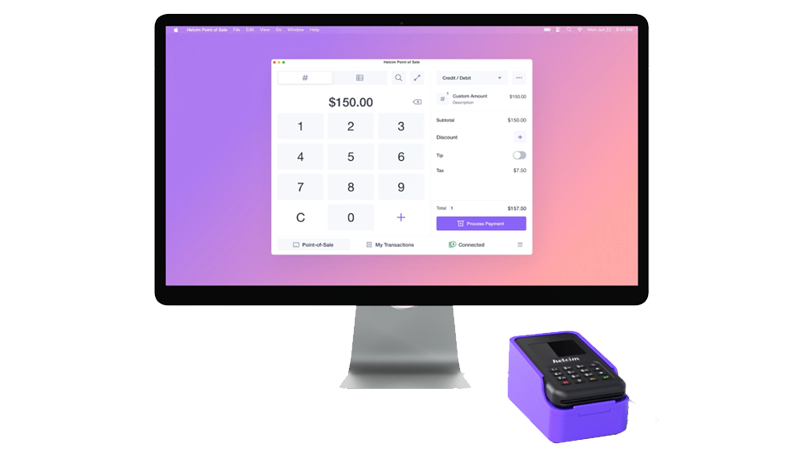

Budget-Friendly Credit Card Processing Ideal for New or Low-Volume Businesses

Monthly Fee:

None

Transaction Fee:

From 0.30% + 8¢

Pricing Model:

Interchange plus

Interchange plus

Interchange-plus pricing involves two fees for each credit or debit card transaction. The first is the interchange fee, a variable amount set by the card network (e.g. Visa, Mastercard). The second is a markup fee charged by the payment processor, typically a percentage of the transaction amount plus a small flat transaction fee. This allows you to see exactly how much of what you pay goes to the card networks and how much to the payment processor.

Features and Benefits

- PCI compliance support. Helcim is a Level 1 PCI-compliant service provider, and it provides you with free PCI compliance support through a video tutorial and written guide.

- E-commerce for restaurants. Helcim has an online food ordering system that restaurants and other related businesses can use in place of third-party food delivery apps, which typically charge a high fee for commissions. The system allows you to set up an online store and add a quick order menu with all your products.

- Fraud Defender. This tool helps to detect and prevent fraudulent transactions by analyzing 7 transaction factors (CVV security code, address verification, transaction size, billing & shipping, shipping location, bank bin, and IP address location) and providing an estimation of risk.

- Inventory manager. Helcim’s product and inventory manager offers real-time alerts for low inventory levels. It also generates detailed reports to identify your most and least popular products.

| Payment gateway | Proprietary |

| Security features | Level 1 PCI compliant, NIST compliant, tokenization, advanced fraud detection and prevention |

| Accepted payment methods | Credit and debit cards, ACH, digital wallets, bank transfers |

| Transaction fees on cheapest plan | 15¢ + interchange (online) |

| Monthly fee on cheapest plan | N/A |

5. CreditCardProcessing.com: Best Payment Gateway for Subscription-Based E-Commerce Businesses

Our Score

Our Score

Competitive Credit Card Processing Fees for High-Volume Businesses

Monthly Fee:

From $15

Transaction Fee:

From 0% + 0.05¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- Free training. CreditCardProcessing.com offers free training for its e-commerce features to anyone who’s new to accepting payments online.

- Breach security. CreditCardProcessing.com includes data breach insurance in every plan. With coverage up to $100,000, this feature isn’t just a safety net — it’s a robust shield against financial losses from breaches.

- Account updater. Through Authorize.net, CreditCardProcessing.com provides an account updater service to keep card information current, maintain uninterrupted service, and prevent lost sales.

- PCI-compliant checkout. CreditCardProcessing.com provides a PCI-compliant checkout system that supports all major payment methods and is customizable to fit your e-commerce brand.

| Payment gateway | Authorize.net |

| Security features | Level 1 PCI compliant, end-to-end-encryption, data breach insurance, tokenization, advanced fraud detection and prevention, payer verification |

| Accepted payment methods | Credit and debit cards, digital wallets, ACH, bank transfers |

| Transaction fees on cheapest plan | 0% + 30¢ (Starter) |

| Monthly fee on cheapest plan | $15.00 |

6. Paysafe: Best for International E-Commerce Businesses

Our Score

Our Score

Top Global Payment Processor With Industry-Specific Merchant Accounts

Monthly Fee:

$7.95

Transaction Fee:

From 0.50% + $0.10

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- Pay with cash online. Paysafe is one of the few credit card processors that allows you to accept cash payments on your e-commerce website. Using Paysafecash as a checkout payment method, your customers can generate a QR code and present this at their nearest in-store payment point, where they complete the transaction by paying in cash.

- Online dashboard. You can track and monitor all your payment transactions, process refunds, and generate reports — all within Paysafe’s user-friendly, centralized dashboard.

- Risk management team. Paysafe provides you with a dedicated risk management team that ensures all your transactions are secure. You’ll also be able to set up custom fraud rules and alerts for your e-commerce transactions.

- MobilePay app. Paysafe’s mobile app allows you to manually key in card information, prepare receipts, and send digital invoices – all from your phone.

| Payment gateway | Authorize.net, Paysafe Payments API |

| Security features | Level 1 PCI-compliant, tokenization, end-to-end encryption, address verification, GDPR, advanced fraud detection |

| Accepted payment methods | Credit and debit, digital wallets, ACH, EFT, bank transfers, Skrill, Venmo, cryptocurrency |

| Transaction fees on cheapest plan | 0.99% + 25¢ (debit cards) |

| Monthly fee on cheapest plan | $16.00 |

Other Notable Payment Gateways for E-Commerce

7. Flagship Merchant Services

Our Score

Our Score

Fast Onboarding & Quick Payouts With Same-Day Funding

Monthly Fee:

From $15

Transaction Fee:

From 1.58% + 19¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

8. Chase Payment Solutions

Our Score

Our Score

Favorable Flat Rate Pricing & E-Commerce Features for SMEs

Monthly Fee:

$0

Transaction Fee:

From 2.6% + 10¢

Pricing Model:

Flat rate

Flat rate

Flat rate pricing simplifies your payment processing bill by charging the same percentage markup on every credit or debit card transaction you receive. The payment processor still pays the variable interchange fee set by the card network (e.g. Visa, Mastercard) on each transaction, but you always pay the same fixed rate regardless.

9. Square

Our Score

Our Score

Advanced E-Commerce and Security Solutions for Start-Ups

Monthly Fee:

From $0

Transaction Fee:

From 2.5% + 10¢

Pricing Model:

Flat rate

Flat rate

Flat rate pricing simplifies your payment processing bill by charging the same percentage markup on every credit or debit card transaction you receive. The payment processor still pays the variable interchange fee set by the card network (e.g. Visa, Mastercard) on each transaction, but you always pay the same fixed rate regardless.

Pick the Best Payment Gateway for Your E-Commerce Business

Every e-commerce business has unique needs, but some payment gateways are better suited than others, especially when combined with a reliable credit card processor.

If you prioritize low fees and high approval rates, Leaders Merchant Services (LMS) is a great choice. It seamlessly integrates with Authorize.net and CartManager, a beginner-friendly shopping cart solution that’s compatible with all hosting platforms and provides advanced features like real-time shipping calculations and SSL security.

If you operate a retail business or a restaurant with an online presence, go with ProMerchant. Its zero-cost processing program shifts processing fees to customers, minimizing your costs. Plus, it streamlines your transactions with features like automatic recurring billing and digital invoicing via Authorize.net.

Or if your e-commerce business processes over $8,000/month, then I highly recommend Stax. Its subscription-style pricing model includes no markup fee and allows you to save up to 40%. Stax also provides multiple payment gateway integrations, including Authorize.net and NMI.

Check out this quick comparison of the best payment gateways for e-commerce.

| Best Feature | Best For | Monthly fee on cheapest plan | Transaction fees on cheapest plan | ||

| Leaders Merchant Services | Negotiable rates for e-commerce businesses | Budget-conscious e-commerce businesses that need a reliable payment gateway | $9.00 | ~0.15% + $0 | |

| ProMerchant | Zero-cost processing program for retail businesses and restaurants | Retail businesses and restaurants with an e-commerce website | $7.95 | $7.95 | |

| Stax | Advanced e-commerce solutions and several payment gateway integrations | High-volume e-commerce businesses processing over $8,000/month | $99.00 | 15¢ + interchange (online) | |

| Helcim | Free payment gateway and online store builder | New e-commerce businesses looking for an easy and fast launch | N/A | 0.30% + 8¢ (in-person) | |

| CreditCardProcessing.com | Access to the Vindicia subscription management platform | E-commerce businesses with a subscription or membership payment model | $15.00 | 0% + 30¢ (Starter) | |

| Paysafe | Accepts 40+ currencies and supports 250+ payment methods | Best for e-commerce businesses with an international customer base | $16.00 | 0.99% + 25¢ (debit cards) |