Inside this Article

What We Look For in the Best Merchant Services1. Leaders Merchant Services: Industry-Low Rates and Negotiable Pricing for SMBs2. Paysafe: Zero-Cost Processing for Small Physical Businesses3. Payment Depot: No Markups for SMEs on Its Interchange+ Plan4. Chase Payment Solutions: No Hidden Fees With Its Simplified Flat Rate Plan5. Sekure Payment Experts: Free Hardware and Same-Day Funding for Startup SMEs6. Square: Instant Payouts With a Square Checking AccountOther Notable Merchant Services for Small BusinessesThese Are the Best Merchant Services for Small BusinessesFAQ

Short on Time? These Are the Best Merchant Services for Small Businesses in 2025

- Leaders Merchant Services – Industry-low rates, negotiable pricing, and free hardware for cost-conscious SMBs.

- Paysafe – Zero-cost processing and a dedicated risk management team help cut merchant account fees.

- Payment Depot – No markups and a competitive interchange+ plan save SMBs on processing fees.

What We Look For in the Best Merchant Services

When choosing the best merchant services for small businesses, it’s essential to focus on features that maximize efficiency and minimize costs. Here’s what to look for:- Low and negotiable rates. Finding a payment processor that offers low and negotiable rates helps to keep operating costs down. Plus, as your business grows, inadequate rates could take a greater bite out of your profits.

- Zero-cost and interchange-plus pricing. You need to have options that minimize transaction fees. Zero-cost processing can offset 100% of your fees, while interchange-plus offers transparency and potentially lower costs for high-volume SMEs.

- Limited account or hidden fees. Merchant services with numerous hidden fees can increase your costs, especially if you operate in a high-risk industry. You need to know exactly how much you’re paying and where you can cut costs if required.

- No long-term contracts. Opting for a service without long-term contracts means you can change providers if your needs evolve without facing hefty cancellation fees.

- Free or discounted equipment. Merchant services that offer free or discounted equipment are essential for startups and recently established SMEs, allowing you to start taking payments without a significant upfront investment.

Our Score

Our Score

Negotiable Low Credit Card Processing Rates

Monthly Fee:

$9

Transaction Fee:

From 0.15% + $0

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- Dedicated account manager. By assigning a personal account manager to every merchant, LMS ensures personalized support tailored to your small business needs.

- $200 Meet or Beat policy. LMS promises that it can make an offer that meets or beats your current rates. If LMS’ promise isn’t met, you’ll receive $200.

- Merchant cash advances. If your small business requires capital but doesn’t have the resources to put up collateral, you can get a cash advance from LMS and pay it back through a small commission on future sales.

- 98% approval rate. Regardless of your credit score, transaction history, industry, or perceived risk, LMS’ high approval rate ensures that nearly any small business can access merchant services. Better yet, you can get accepted in under 24 hours.

| High approval rate | ✔ |

| Accepts in-person & online payments |

✔ |

| Quick payouts | ✔ |

| Transaction fees on cheapest plan |

~0.15% + $0 |

| Monthly fee on cheapest plan |

$9.00 |

Our Score

Our Score

Top Global Payment Processor With Industry-Specific Merchant Accounts

Monthly Fee:

$7.95

Transaction Fee:

From 0.50% + $0.10

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- 260 payment methods. Paysafe supports an extensive range of over 260 payment methods, allowing your small business to cater to all customers, regardless of their preferred payment method. This is also great if you have online customers from other countries.

- Enhanced security package. In addition to its built-in advanced security features, like BIN/IP checking, Paysafe allows you to purchase an insurance policy that protects you against the financial losses of a potential data breach.

- All-in-one dashboard. It lets you take orders through a virtual terminal, view your transaction history, generate reports, process refunds, and access real-time insights.

- MobilePay. Paysafe’s mobile app allows you to use your phone or tablet to easily accept credit and debit card payments, which is great if you want to save on the cost of paying for hardware.

| High approval rate | ✔ |

| Accepts in-person & online payments |

✔ |

| Quick payouts | ✔ |

| Transaction fees on cheapest plan |

$0 (1%-4% surcharge to customers) |

| Monthly fee on cheapest plan |

$16.00 |

Unsure which processor is best for your business?

Take this short quiz and get a tailor-made recommendation in seconds

Our Score

Our Score

Excellent Customer Service Backed by a Dedicated Risk Monitoring Team

Monthly Fee:

$0

Transaction Fee:

From 0% + 10¢

Pricing Model:

Subscription

Subscription

With subscription-style pricing, you’ll pay a fixed monthly fee instead of a percentage-based markup on each credit and debit card transaction. While this will considerably reduce your per-transaction fees, you’ll typically still pay a small flat fee on each transaction. This amount is unaffected by the variable interchange fees charged by the different card networks (e.g. Visa, Mastercard), helping to keep your payment processing fees more predictable.

Features and Benefits

- 24/7 support. Round-the-clock customer support ensures that any issues you encounter are quickly resolved. You can contact Payment Depot’s technical support team via phone or ticket.

- Next-day funding. With next-day funding included free of charge, your small business enjoys faster access to capital and improved cash flow. Most other merchant services charge extra for next-day funding.

- Free equipment. Every merchant receives a free Dejavoo terminal or mobile card reader, allowing you to start processing payments as quickly as possible. Better yet, you can negotiate multiple free terminals if required.

- Risk monitoring team. A dedicated risk monitoring team is there 24/7 to actively safeguard your transactions, helping to prevent fraud and the likelihood of chargebacks.

| High approval rate | ✔ |

| Accepts in-person & online payments |

✔ |

| Quick payouts | ✔ |

| Transaction fees on cheapest plan |

0.2%-1.95% |

| Monthly fee on cheapest plan |

$0 |

Our Score

Our Score

Favorable Flat Rate Pricing & E-Commerce Features for SMEs

Monthly Fee:

$0

Transaction Fee:

From 2.6% + 10¢

Pricing Model:

Flat rate

Flat rate

Flat rate pricing simplifies your payment processing bill by charging the same percentage markup on every credit or debit card transaction you receive. The payment processor still pays the variable interchange fee set by the card network (e.g. Visa, Mastercard) on each transaction, but you always pay the same fixed rate regardless.

Features and Benefits

- E-commerce integrations. Chase offers robust e-commerce integrations with platforms like BigCommerce, making it easier to streamline payment processing and enhance your customer’s experience.

- Chase Customer Insights. Chase provides valuable analytics into your card sales and customer behavior. It will even help you understand how your target customers shop at competing businesses.

- Chase Business Bank Account. Opening a Chase bank account allows you to get same-day funding for free. Although the account requires a monthly fee, you can waive the fee by meeting a minimum balance. Having this account also lets you take payments via your iPhone.

- Payment gateway. Chase allows you to use Authorize.Net, a trusted payment gateway for online payments. It includes access to 13 configurable fraud detection and monitoring filters that cover categories like location and payer verification.

| High approval rate | ✔ |

| Accepts in-person & online payments |

✔ |

| Quick payouts | ✔ |

| Transaction fees on cheapest plan |

2.6% + 10¢ |

| Monthly fee on cheapest plan |

N/A |

5. Sekure Payment Experts: Free Hardware and Same-Day Funding for Startup SMEs

Our Score

Our Score

Save up to 100% on Your Processing Costs With the Edge Program

Monthly Fee:

From $0

Transaction Fee:

From 0%

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- Personalized savings analysis. Before opening a merchant account, Sekure can analyze one of your monthly statements to help identify overpayments and reduce costs.

- Comprehensive onboarding. An in-depth walkthrough of its features and tools ensures you understand how to utilize Sekure’s services from day one.

- Breach forgiveness. If you are part of the PCI Plus program and your business is classified as PCI Level 3 or 4, Sekure will reimburse any breach-related costs up to $100,000.

- Dedicated chargeback team. Sekure’s chargeback team is dedicated to resolving disputes and reducing the potential impact of chargebacks.

| High approval rate | ✔ |

| Accepts in-person & online payments |

✔ |

| Quick payouts | ✔ |

| Transaction fees on cheapest plan |

0% (4% passed to customer) |

| Monthly fee on cheapest plan |

$39.95 |

6. Square: Instant Payouts With a Square Checking Account

Our Score

Our Score

Advanced E-Commerce and Security Solutions for Start-Ups

Monthly Fee:

From $0

Transaction Fee:

From 2.5% + 10¢

Pricing Model:

Flat rate

Flat rate

Flat rate pricing simplifies your payment processing bill by charging the same percentage markup on every credit or debit card transaction you receive. The payment processor still pays the variable interchange fee set by the card network (e.g. Visa, Mastercard) on each transaction, but you always pay the same fixed rate regardless.

Features and Benefits

- Same-day approval. Your merchant account will be approved within 24 hours, meaning you can start processing payments and generating revenue almost immediately.

- Advanced business software. Square’s app marketplace allows you to integrate with many common platforms, such as the website builders Wix and GoDaddy or the account software tools Xero and KashFlow.

- Numerous payment methods. You can accept various payment methods, including any US-issued and most internationally-issued magstripe or chip cards, PayPal, Apple Pay, Google Pay, After Pay, and more.

- E-commerce tools. Square lets you sell products without a website using QR codes and buy buttons or create and launch an online store for free using Square Online.

| High approval rate | ✔ |

| Accepts in-person & online payments |

✔ |

| Quick payouts | ✔ |

| Transaction fees on cheapest plan |

2.5% + 10¢ |

| Monthly fee on cheapest plan |

$89.00 |

Other Notable Merchant Services for Small Businesses

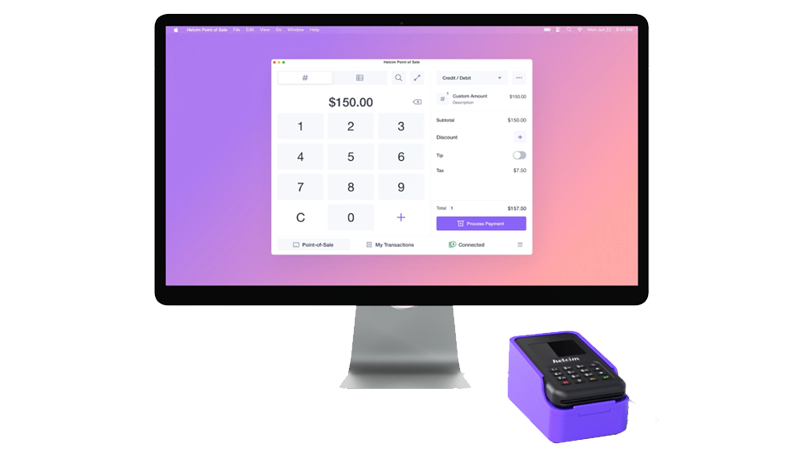

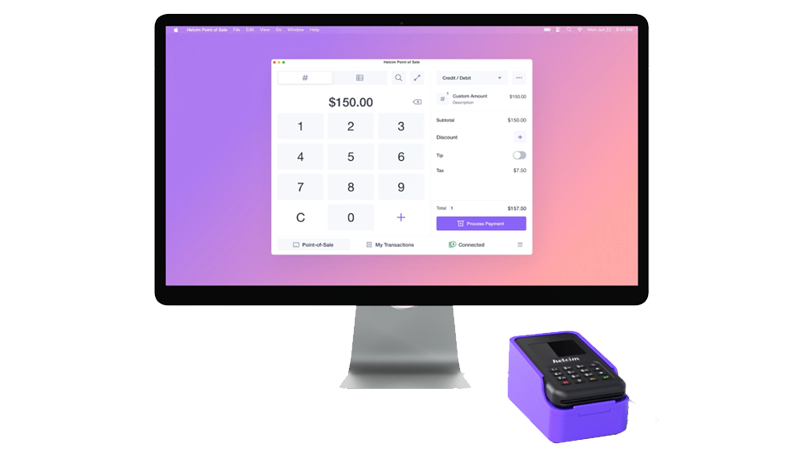

7. Helcim

Our Score

Our Score

Budget-Friendly Credit Card Processing Ideal for New or Low-Volume Businesses

Monthly Fee:

None

Transaction Fee:

From 0.30% + 8¢

Pricing Model:

Interchange plus

Interchange plus

Interchange-plus pricing involves two fees for each credit or debit card transaction. The first is the interchange fee, a variable amount set by the card network (e.g. Visa, Mastercard). The second is a markup fee charged by the payment processor, typically a percentage of the transaction amount plus a small flat transaction fee. This allows you to see exactly how much of what you pay goes to the card networks and how much to the payment processor.

8. POS Pros

Our Score

Our Score

Specialized Point-of-Sale Solutions for In-Person and Online Sales

Monthly Fee:

From $5

Transaction Fee:

From 0.30% + 10¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

9. PaymentCloud

Our Score

Our Score

Affordable Rates & Advanced Security Features for High-Risk Businesses

Monthly Fee:

$14

Transaction Fee:

From 2.1% + 15¢

Pricing Model:

Interchange plus

Interchange plus

Interchange-plus pricing involves two fees for each credit or debit card transaction. The first is the interchange fee, a variable amount set by the card network (e.g. Visa, Mastercard). The second is a markup fee charged by the payment processor, typically a percentage of the transaction amount plus a small flat transaction fee. This allows you to see exactly how much of what you pay goes to the card networks and how much to the payment processor.

10. Stax

Our Score

Our Score

Save Up to 40% on Credit Card Processing Fees

Monthly Fee:

From $99

Transaction Fee:

From 8¢ + Interchange

Pricing Model:

Subscription

Subscription

With subscription-style pricing, you’ll pay a fixed monthly fee instead of a percentage-based markup on each credit and debit card transaction. While this will considerably reduce your per-transaction fees, you’ll typically still pay a small flat fee on each transaction. This amount is unaffected by the variable interchange fees charged by the different card networks (e.g. Visa, Mastercard), helping to keep your payment processing fees more predictable.

These Are the Best Merchant Services for Small Businesses

Every small business has unique needs, making it essential to find a merchant service that aligns with your specific requirements. Whether you prioritize transparency, free hardware, or specialized services, there’s a solution tailored for you. Leaders Merchant Services is my top recommendation if you’re an SMB looking for industry-low rates and negotiable pricing. It also gives you complimentary equipment and a dedicated account manager to help you make the most of its payment processing services. For small businesses processing primarily in-person transactions, Paysafe is great due to its zero-cost plan. In addition, you get access to a dedicated risk management team that can help reduce the risk of fraud and chargebacks. Or, if your small business processes less than $150,000 a year, Payment Depot is the best option. It offers transaction fees with no markups and online payer verification, so you don’t have to worry about fraudulent activity.Here’s a quick comparison of my top merchant service picks for small businesses:

| Best Feature | Best For | Monthly fee on cheapest plan |

Transaction fees on cheapest plan |

||

| Leaders Merchant Services |

Industry-low rates and negotiable pricing |

Recently established SMEs on a budget |

$9.00 | ~0.15% + $0 | |

| Paysafe | Zero-cost processing plan and a dedicated risk management team |

Small brick-and-mortar businesses processing cash transactions |

$16.00 | $0 (1%-4% surcharge to customers) | |

| Payment Depot |

No markups or monthly fees |

Small businesses processing less than $150,000/year |

$0 | 0.2%-1.95% | |

| Chase Payment Solutions |

No hidden fees on its simplified flat-rate plan |

SMEs prioritizing transparent pricing |

N/A | 2.6% + 10¢ | |

| Sekure Payment Experts |

Free hardware, virtual terminal, and same-day funding |

Startup SMEs looking for free PCI-compliant equipment |

$39.95 | 0% (4% passed to customer) | |

| Square | Instant payouts through its checking account |

Low-volume small businesses with limited access to capital |

$89.00 | 2.5% + 10¢ |