Inside this Article

What We Look For in the Best Flat Rate Credit Card Processing Companies1. Stax: Flat-Rate Monthly Subscription Pricing for High-Volume Businesses2. Payment Depot: Simplified Pricing for Medium-Sized Businesses3. Leaders Merchant Services: Most Affordable Non-Flat Rate Option4. Chase Payment Solutions: Best Flat-Rate Payment Processor for Fast Payouts5. Square: Best for New Online Businesses6. Helcim: Budget-Friendly Processor for E-Commerce BusinessesEnjoy Consistent Rates With the Best Flat-Rate Credit Card ProcessorsFAQ

Short on Time? These Are the Best Flat Rate Credit Card Processors in 2025

- Stax – Simplified monthly subscription plan for high-volume businesses.

- Payment Depot – Best flat-rate credit card processor for small to medium-sized businesses.

- Leaders Merchant Services – Best payment processor to bargain a better deal with.

What We Look For in the Best Flat Rate Credit Card Processing Companies

In my investigation of flat-rate credit card processors, I sought specific features and benefits that directly influence your operations and cost management.- Transparent fees. Transparency in fee structure is crucial as it prevents unexpected costs. I looked for processors that clearly outline their fees, helping you avoid hidden charges and understand precisely what you’re paying for.

- Flexible contract terms. Flexibility in contract terms can significantly impact your ability to adapt and manage costs. Most of my recommended vendors offer month-to-month agreements with no cancellation fees, allowing you to switch if your needs change.

- Reliable security. Security is paramount, as it protects your financial data and your customers’ information. I prioritized processors that offer advanced encryption and comply with PCI standards to ensure your transactions are secure from fraud.

- Fast payouts. I looked for payment processors that offer either next-day or same-day funding, whether for a price or as a standard feature. This ensures you have a steady cash flow to run your business effectively.

Our Score

Our Score

Save Up to 40% on Credit Card Processing Fees

Monthly Fee:

From $99

Transaction Fee:

From 8¢ + Interchange

Pricing Model:

Subscription

Subscription

With subscription-style pricing, you’ll pay a fixed monthly fee instead of a percentage-based markup on each credit and debit card transaction. While this will considerably reduce your per-transaction fees, you’ll typically still pay a small flat fee on each transaction. This amount is unaffected by the variable interchange fees charged by the different card networks (e.g. Visa, Mastercard), helping to keep your payment processing fees more predictable.

Features and Benefits

- Same-day payouts. For an extra fee, Stax will send your funds to your bank account the same day you process them.

- QuickBooks integration. You can connect your Stax account to your QuickBooks account and automate your accounting process. This will help you save time, as your payments, invoices, customers, products, and services are automatically shared between Stax and QuickBooks.

- Stax Pay. Stax Pay is a versatile payment platform that you can use to create and schedule payments, explore your sales data, view customer information, and more.

- Stax mobile app. You can download Stax’s mobile app on your phone or tablet and use your device as a Point of Sale (POS) system. This way, you can quickly receive payments on the go during informal in-person events, for example.

| Flat rate structure | Flat rate per transaction and monthly fee |

| Contract length | Monthly (no cancellation fees) |

| Security | Level 1 PCI-compliant, end-to-end encryption, tokenization, multi-factor authentication, payer verification, advanced fraud detection and prevention |

| Transaction fees on cheapest plan |

15¢ + interchange (online) |

| Monthly fee on cheapest plan |

$99.00 |

Our Score

Our Score

Excellent Customer Service Backed by a Dedicated Risk Monitoring Team

Monthly Fee:

From $79

Transaction Fee:

From 0% + 10¢

Pricing Model:

Subscription

Subscription

With subscription-style pricing, you’ll pay a fixed monthly fee instead of a percentage-based markup on each credit and debit card transaction. While this will considerably reduce your per-transaction fees, you’ll typically still pay a small flat fee on each transaction. This amount is unaffected by the variable interchange fees charged by the different card networks (e.g. Visa, Mastercard), helping to keep your payment processing fees more predictable.

Features and Benefits

- Free Dejavoo Z11 terminal. As a Payment Depot merchant, you get a free Dejavoo Z11 terminal. The EMV-enabled tool accepts contactless payments and can capture signatures via the touch screen.

- Chargeback management. Payment Depot employs a 24/7 risk monitoring team to minimize chargebacks and fraud. You can also dispute chargebacks directly from your merchant account.

- Comprehensive payment dashboard. Payment Depot has an all-in-one payment dashboard where you can create and send branded invoices, generate payment links, input payments manually, run promotions, and monitor sales performance.

- Fast onboarding process. You can start taking payments with Payment Depot in as little as 24 hours. Ensure you provide the required documentation and information on time, and the sales team will help you get started as soon as possible.

| Flat rate structure | Flat rate per transaction and monthly fee |

| Contract length | Monthly (no cancellation fees) |

| Security | Level 1 PCI-compliant, end-to-end encryption, tokenization, payer authentication, 24/7 fraud risk monitoring |

| Transaction fees on cheapest plan |

0.2%-1.95% |

| Monthly fee on cheapest plan |

$0 |

Unsure which processor is best for your business?

Take this short quiz and get a tailor-made recommendation in seconds

3. Leaders Merchant Services: Most Affordable Non-Flat Rate Option

Our Score

Our Score

Negotiable Low Credit Card Processing Rates

Monthly Fee:

$9

Transaction Fee:

From 0.15% + $0

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- Shopping cart integration. LMS integrates with CartManager, a shopping cart tool you can add to your website. This tool has several features, including real-time shipping, sales tax calculation, custom languages, and more.

- High approval rate. LMS has one of the highest approval rates in the industry. It approves 98% of merchant applications, so it’s a great option if you’re in a high-risk industry or have a limited credit history.

- Chargeback and fraud department. There’s an entire department dedicated to resolving any chargeback issues you may encounter while using LMS. It’s one of the largest such departments in the industry.

- Same-day onboarding. After LMS approves your merchant application, it will set up your account in as little as 24 hours so you can start processing payments immediately.

| Flat rate structure | N/A |

| Contract length | 3 years average (no cancellation fee) |

| Security | PCI-compliant, end-to-end encryption, advanced fraud detection and prevention, tokenization |

| Transaction fees on cheapest plan |

~0.15% + $0 |

| Monthly fee on cheapest plan |

$9.00 |

Our Score

Our Score

Favorable Flat Rate Pricing & E-Commerce Features for SMEs

Monthly Fee:

$0

Transaction Fee:

From 2.6% + 10¢

Pricing Model:

Flat rate

Flat rate

Flat rate pricing simplifies your payment processing bill by charging the same percentage markup on every credit or debit card transaction you receive. The payment processor still pays the variable interchange fee set by the card network (e.g. Visa, Mastercard) on each transaction, but you always pay the same fixed rate regardless.

Features and Benefits

- Card-not-present options. Chase gives you access to two options for handling card-not-present transactions: the Orbital virtual terminal and the Authorize.net payment gateway.

- Specialized payment software. As a Chase merchant, you can access 10 free and premium payment software tools for different industries. These include EventZilla for event registrations, FuseBill for subscriptions, and PayRent for rent.

- Chase Mobile. Chase provides an intuitive mobile app that is available on iOS and Android. You can use the app to manage business accounts, create and send payment links, accept payments, manage disputes, and more.

- Developer toolkit. With Chase’s developer toolkit, you can build your own software solution, test it in real time, and integrate it within your own development environment.

| Flat rate structure | Flat rate per transaction and monthly fee |

| Contract length | Monthly (no cancellation fees) or variable (cancellation fees may apply) |

| Security | PCI-compliant, end-to-end encryption, tokenization, advanced fraud detection and prevention, payer verification |

| Transaction fees on cheapest plan |

2.6% + 10¢ |

| Monthly fee on cheapest plan |

N/A |

5. Square: Best for New Online Businesses

Our Score

Our Score

Advanced E-Commerce and Security Solutions for Start-Ups

Monthly Fee:

From $0

Transaction Fee:

From 2.5% + 10¢

Pricing Model:

Flat rate

Flat rate

Flat rate pricing simplifies your payment processing bill by charging the same percentage markup on every credit or debit card transaction you receive. The payment processor still pays the variable interchange fee set by the card network (e.g. Visa, Mastercard) on each transaction, but you always pay the same fixed rate regardless.

Features and Benefits

- Afterpay. Square partners with Afterpay to provide customers with a buy now, pay later option. They can pay for orders in four interest-free installments over 6 weeks or monthly over 6 or 12 months for larger online purchases, but with interest. You still get paid the full amount upfront.

- Super fast onboarding. Creating an account with Square is free and straightforward. You don’t need any approval – just provide some basic information about your business, and you can start accepting payments immediately.

- Analytics and reporting tool. Square’s reports and analytics tool provides real-time data about your sales, a general overview of your sales within a specific timeframe, a list of the top used discounts, updates on any disputes you may have received, customer insights, and much more.

- Multiple software integrations. Square integrates with multiple e-commerce platforms, such as Shopify, WooCommerce, Ecwid, WordPress, and more. It also syncs seamlessly with other software, such as QuickBooks and Mailchimp.

| Flat rate structure | Flat rate per transaction with or without a monthly fee |

| Contract length | Monthly (no cancellation fees) |

| Security | PCI-compliant, end-to-end encryption, tokenization, two-factor authentication, handles PCI compliance for you |

| Transaction fees on cheapest plan |

2.5% + 10¢ |

| Monthly fee on cheapest plan |

$0 |

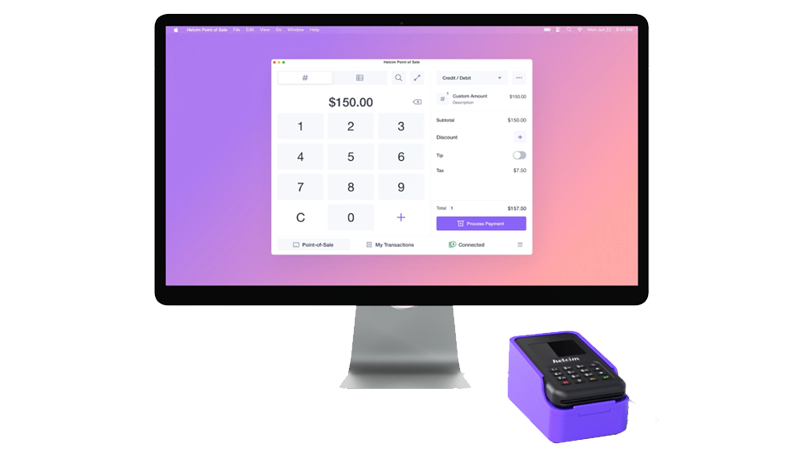

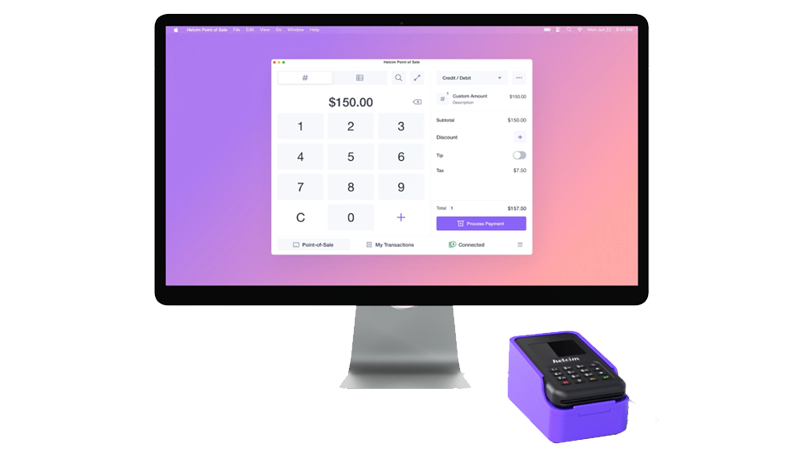

6. Helcim: Budget-Friendly Processor for E-Commerce Businesses

Our Score

Our Score

Budget-Friendly Credit Card Processing Ideal for New or Low-Volume Businesses

Monthly Fee:

None

Transaction Fee:

From 0.30% + 8¢

Pricing Model:

Interchange plus

Interchange plus

Interchange-plus pricing involves two fees for each credit or debit card transaction. The first is the interchange fee, a variable amount set by the card network (e.g. Visa, Mastercard). The second is a markup fee charged by the payment processor, typically a percentage of the transaction amount plus a small flat transaction fee. This allows you to see exactly how much of what you pay goes to the card networks and how much to the payment processor.

Features and Benefits

- Customer portal. Helcim’s online store builder lets you add a customer portal. Here, customers can manage their invoices, payment methods, subscriptions, and addresses without contacting you all the time.

- Online food ordering system. If you own a small restaurant, Helcim provides an online food ordering system that can help you save money on food delivery app commissions. With this system, you can create an online menu, manage tax calculations, and even create discount codes.

- Custom integrations. While Helcim has limited pre-built e-commerce integrations, you can use its API to build custom integrations if you want to connect to other e-commerce platforms outside of what Helcim provides.

- Built-in CRM. Helcim has a cloud-based customer relationship management tool that allows you to securely store customer information, update customer data, send invoices and emails, and track orders.

| Flat rate structure | Flat rate per transaction with or without a monthly fee |

| Contract length | Monthly (no cancellation fees) |

| Security | Level 1 PCI-compliant, voluntarily NIST compliant, advanced fraud detection and prevention |

| Transaction fees on cheapest plan |

0.30% + 8¢ (in-person) |

| Monthly fee on cheapest plan |

N/A |

Enjoy Consistent Rates With the Best Flat-Rate Credit Card Processors

Not everyone is a fan of varied costs, especially when the present month’s charge is higher than the previous month’s. This is where flat rate pricing comes in, ensuring you pay the exact same rate every time. Stax is the best choice if you process a high volume of transactions every month. It features a subscription-style plan that includes a flat monthly fee and a small transaction fee with zero markup on interchange fees. If you handle $8,000+ per month in credit card transactions, you can save up to 40% with Stax. If you’re looking for a processor that offers simplified subscription-based pricing suitable for small to mid-sized businesses, I recommend Payment Depot. It offers a slightly cheaper monthly fee than Stax and one of the best customer support teams in the industry. If you want the most affordable payment processor, go with Leaders Merchant Services. Not only is LMS cheap, but it’s open to negotiating rates with you. In fact, it will give you $200 if it can’t meet or beat the pricing of your current credit card processor.Below is a brief comparison of the best flat-rate credit card processors.

| Best Feature | Best For | Monthly fee on cheapest plan |

Transaction fees on cheapest plan |

||

| Stax | Simple pricing without markups on interchange rates | High-volume businesses looking for flat-rate pricing | $99.00 | 15¢ + interchange (online) | |

| Payment Depot | Simplified subscription-based pricing plan with zero monthly fees | Small to mid-sized enterprises looking for flat-rate pricing | $0 | 0.2%-1.95% | |

| Leaders Merchant Services | Affordable rates and negotiable fees |

Businesses that want to negotiate pricing | $9.00 | ~0.15% + $0 | |

| Chase Payment Solutions | Same-day funding |

Companies that need fast access to their funds | N/A | 2.6% + 10¢ | |

| Square | Free account and credit card reader | New, online-first businesses | $89.00 | 2.5% + 10¢ | |

| Helcim | Fully hosted online store builder |

E-commerce businesses with a tight budget | N/A | 0.30% + 8¢ (in-person) |