Inside this Article

What We Look For in the Best Credit Card Processors for Small Businesses1. Leaders Merchant Services: Low, Negotiable Fees for Small Businesses2. PAYARC – Best for Growth-Focused Businesses Selling Internationally3. ProMerchant: Best for Small Retail and Restaurant Businesses4. Flagship Merchant Services: For New Small Businesses5. POS Pros: Best for Small Brick-And-Mortar Businesses6. CreditCardProcessing.com: For Advanced Small Business SolutionsOther Notable Credit Card Processing Companies for Small BusinessesFinding the Best Credit Card Processing for Small BusinessesFAQ

Short on Time? These Are the Best Credit Card Processors for Small Businesses in 2025

- Leaders Merchant Services – Low fees and custom small business plans with free high-quality Clover POS hardware.

- PAYARC – Best international payment processing and top invoicing tools for growing businesses.

- ProMerchant – Best for small restaurant and retail businesses looking to minimize processing costs.

What We Look For in the Best Credit Card Processors for Small Businesses

While I was researching credit card processing companies for this list, I focused on certain features that would directly benefit small businesses.- Free or discounted terminals. Getting a free or discounted terminal means there’s more money in the budget to invest in your business. Every card processor on this list helps you start selling in person for little to no extra cost.

- Quick approvals. These credit card processors have a quick application process and aim to approve every eligible application within 48 hours. This means you’re not waiting around and potentially losing business.

- E-commerce support. With many small businesses selling both in-person and online, you’ll need a payment processor that offers e-commerce support. Whether that’s integration with popular e-commerce platforms or virtual terminals, these features make sure you never miss a sale.

- No or low monthly minimums. Given how volatile small business incomes can be, I’ve avoided including payment processors on my list that charge a high minimum monthly processing fee.

Free Card Reader

Our Score

Our Score

Best Credit Card Processor in 2025

Negotiable Low Credit Card Processing Rates

Monthly Fee:

$9

Transaction Fee:

From 0.15% + $0

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- 98% approval rate. There’s a good chance LMS will approve your application regardless of your industry or financial history. It only takes a few minutes to apply, and the approval process can take as little as 24 hours.

- Customized services. Depending on your business and industry, you’ll be able to access additional services like subscription tools, loyalty programs, gift cards, online menus, and more.

- 24/7 phone support. Unlike other providers, LMS provides round-the-clock customer service to solve any payment processing issues that might arise.

- Cash discount. LMS’s affordably priced cash discount plan lets you pass the processing fees onto your credit card paying customers while granting a 4% discount to clients who pay in cash.

| Free terminal | ✔ (depending on contract length) |

| E-commerce features |

|

| Contract length | 3 years average (open to negotiation) |

| Transaction fees on cheapest plan | ~0.15% + $0 |

| Monthly subscription on cheapest plan | $9.00 |

Our Score

Our Score

Custom Payment Processing Plans With No Hidden Costs

Monthly Fee:

From $69

Transaction Fee:

From 0% + 15¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- Business management platform. Once you sign up, you can access PAYARC’s robust dashboard. You’ll be able to monitor your payment data, issue invoices, and get reports, among other things.

- Free mobile app. You can use the app to take payments on the go or turn your phone into an additional POS device to save on equipment. You can also access PAYARC’s dashboard through the mobile app.

- Advanced security features. PAYARC has a robust set of security features to help small businesses keep fraud at bay. You can set velocity filters to limit the number of attempts made by a customer, IP address, or other criteria. You can also limit transactions from specific regions, countries, and IP addresses.

- E-commerce integrations. PAYARC seamlessly integrates with popular e-commerce platforms WooCommerce and Magento. You can also integrate its payment solutions into any e-commerce website with very little programming. You’ll receive detailed instructions so you won’t need to hire outside help.

| Free terminal | ✔ (with some plans) |

| E-commerce features |

|

| Contract length | 3 years |

| Transaction fees on cheapest plan | 2.49% + 30¢ (in-person) |

| Monthly subscription on cheapest plan | N/A |

Unsure which processor is best for your business?

Take this short quiz and get a tailor-made recommendation in seconds

Our Score

Our Score

Interchange-Plus & Zero Cost Processing Plans Ideal for Restaurants and Retail

Monthly Fee:

$7.95

Transaction Fee:

From 3% + 10¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- High-risk merchant accounts. ProMerchant boasts high approval rates and offers fair pricing and advanced security, regardless of your industry or credit history.

- Next-day funding. Small businesses will benefit from ProMerchant’s standard next-day funding at no additional cost. Funds from transactions processed and settled by 8:30 pm EST will be available the following day.

- Free mobile payment solution. ProMerchant offers the Payanywhere app and Bluetooth card reader enabled for card dipping and swiping payment processing. The smartphone app lets you view up to 3 years of transaction history, send text and email receipts, and accept tips.

- Free virtual terminal. Small retail businesses that don’t need a complete POS system can use the Payments Hub virtual terminal to receive payments. It’s also suitable for catering businesses getting paid through invoices or restaurants handling remote takeout orders like curbside pickup and delivery.

| Free terminal | ✔ |

| E-commerce features |

|

| Contract length | Monthly (no cancellation fees) |

| Transaction fees on cheapest plan | Custom |

| Monthly subscription on cheapest plan | $7.95 |

Our Score

Our Score

Fast Onboarding & Quick Payouts With Same-Day Funding

Monthly Fee:

From $15

Transaction Fee:

From 1.58% + 19¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- Same-day funding. Flagship can help keep your business afloat with its same-day funding option. There’s no information about how much this service costs, so you’ll need to contact a sales representative for a custom quote.

- iAccess Business Management Portal. You can keep an eye on all aspects of your business with this software suite. Use it to see sales summaries, generate financial statements, analyze your business’s growth, and more.

- 24/7 support. In addition to a dedicated account manager that operates during business hours, you’ll get 24/7 phone support for time-sensitive technical issues.

- Custom merchant account solutions. With Flagship, you only have to pay for the card processing features you actually need. By negotiating rates, features, and pricing structures with your sales agent, you can make sure everything is set up in a way that benefits your business.

| Free terminal | ✔ |

| E-commerce features |

|

| Contract length | Monthly |

| Transaction fees on cheapest plan | 1.58% + 19¢ (in person) |

| Monthly subscription on cheapest plan | $7.95 |

5. POS Pros: Best for Small Brick-And-Mortar Businesses

Our Score

Our Score

Specialized Point-of-Sale Solutions for In-Person and Online Sales

Monthly Fee:

From $5

Transaction Fee:

From 0.30% + 10¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- Cash discount. Reduce processing costs with POS Pros’s cash discount program, which incentivises customers to pay with cash to receive a discount.

- 24/7 POS help desk. If you purchase POS equipment from POS Pros, you’ll gain access to knowledgeable 24/7 technical support. This means you won’t lose business, even if your POS device malfunctions on a Sunday morning.

- Cash advances. You can secure up to $500,000 in capital for new equipment, staff hiring, and business expansion. POS Pros will evaluate your application in just 10 minutes to determine whether you qualify and how much you can borrow.

- Flexible contracts. You can use POS Pros’s services on a monthly basis without any cancellation fees. This flexible approach is crucial for small businesses focused on stabilization and growth.

| Free terminal | ✔ |

| E-commerce features |

|

| Contract length | Monthly (no cancellation fees) |

| Transaction fees on cheapest plan | 0.30% + 10¢ (in-person) |

| Monthly subscription on cheapest plan | $5.00 |

6. CreditCardProcessing.com: For Advanced Small Business Solutions

Our Score

Our Score

Competitive Credit Card Processing Fees for High-Volume Businesses

Monthly Fee:

From $15

Transaction Fee:

From 0% + 0.05¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- Free terminal. If you commit to a 1-year contract, you can receive a free Pax A920 terminal. Alternatively, signing up for the High Volume plan will get you a free Clover Mini. Just keep in mind that there is an additional cost for using Clover’s software.

- High approval rate. CreditCardProcessing.com is happy to accept businesses with low credit scores and boasts the highest approval rate of any US credit card processor.

- Free training. If you’re not sure how to use your included POS terminal or e-commerce solutions, CreditCardProcessing.com offers free training to help get you up and running.

- Data breach protection. If you suffer financial losses because of a data breach on CreditCardProcessing.com’s servers, you’re insured for up to $100,000.

| Free terminal | ✔ (depending on contract length/plan) |

| E-commerce features |

|

| Contract length | Variable |

| Transaction fees on cheapest plan | 0% + 30¢ (Starter) |

| Monthly subscription on cheapest plan | $15.00 |

Other Notable Credit Card Processing Companies for Small Businesses

7. Chase Payment Solutions

Our Score

Our Score

Favorable Flat Rate Pricing & E-Commerce Features for SMEs

Monthly Fee:

$0

Transaction Fee:

From 2.6% + 10¢

Pricing Model:

Flat rate

Flat rate

Flat rate pricing simplifies your payment processing bill by charging the same percentage markup on every credit or debit card transaction you receive. The payment processor still pays the variable interchange fee set by the card network (e.g. Visa, Mastercard) on each transaction, but you always pay the same fixed rate regardless.

8. Square

Our Score

Our Score

Advanced E-Commerce and Security Solutions for Start-Ups

Monthly Fee:

From $0

Transaction Fee:

From 2.5% + 10¢

Pricing Model:

Flat rate

Flat rate

Flat rate pricing simplifies your payment processing bill by charging the same percentage markup on every credit or debit card transaction you receive. The payment processor still pays the variable interchange fee set by the card network (e.g. Visa, Mastercard) on each transaction, but you always pay the same fixed rate regardless.

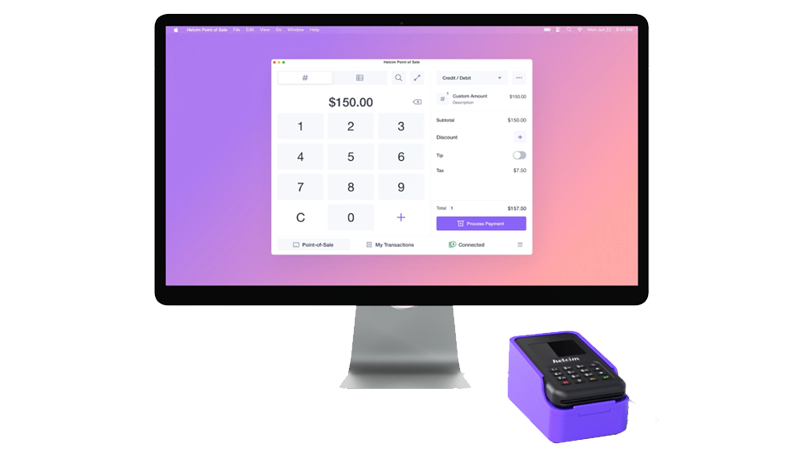

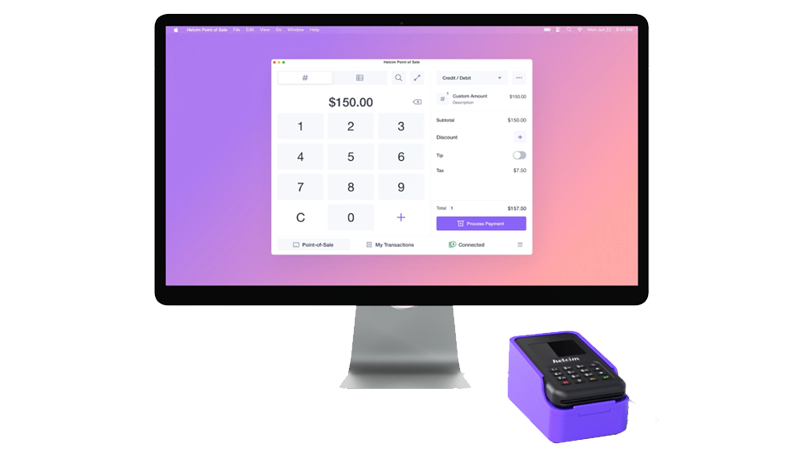

9. Helcim

Our Score

Our Score

Budget-Friendly Credit Card Processing Ideal for New or Low-Volume Businesses

Monthly Fee:

None

Transaction Fee:

From 0.30% + 8¢

Pricing Model:

Interchange plus

Interchange plus

Interchange-plus pricing involves two fees for each credit or debit card transaction. The first is the interchange fee, a variable amount set by the card network (e.g. Visa, Mastercard). The second is a markup fee charged by the payment processor, typically a percentage of the transaction amount plus a small flat transaction fee. This allows you to see exactly how much of what you pay goes to the card networks and how much to the payment processor.

10. Luminous Payments

Our Score

Our Score

Multiple Pricing Models to Fit Every Business

Monthly Fee:

From $10

Transaction Fee:

From 0.59% + 5¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Finding the Best Credit Card Processing for Small Businesses

Naming a definitive best credit card processing service for small businesses proves challenging due to the unique needs of each small business. Nevertheless, certain credit card companies outshine others in terms of what they have to offer.

To minimize processing expenses without compromising quality, consider Leaders Merchant Services. LMS provides low negotiable fees and custom plans for small businesses, as well as a complimentary Clover device for qualified candidates.

If your small business plans to go international, PAYARC offers the ideal solution. It supports global payments with a range of payment gateways and international e-commerce integrations. It also offers a comprehensive range of invoicing tools for professionally branded invoices and recurring billing.

Finally, if you run a small restaurant or retail business and are looking for niche plans, ProMerchant stands out as the best processor. Its affordable zero-cost processing program will keep your monthly costs low. You can also select complimentary equipment that aligns perfectly with your operational needs.

Here’s a quick comparison of my top credit card processing companies for small businesses.

| Best Feature | Best For | Monthly fee on cheapest plan | Transaction fees on cheapest plan | ||

| Leaders Merchant Services | Low, negotiable fees and free Clover POS hardware (depending on contract length) | Growth-focused small businesses looking to save on payment processing without compromising features and quality | $9.00 | ~0.15% + $0 | |

| PAYARC | Robust support for international payment processing and free advanced invoicing tools | Tech-forward small businesses that want to sell internationally | N/A | 2.49% + 30¢ (in-person) | |

| ProMerchant | Affordable zero-cost processing program with a choice of free hardware | Small restaurant and retail businesses | $7.95 | Custom | |

| Flagship Merchant Services | Simple application process with high approval rates | New small businesses that don’t have a lot of documentation | $7.95 | 1.58% + 19¢ (in person) | |

| POS Pros | Over 25 custom POS solutions for small businesses | Small brick-and-mortar operations looking for bespoke hardware solutions | $5.00 | 0.30% + 10¢ (in-person) | |

| CreditCardProcessing.com | Flat-rate pricing with low transaction fees and advanced software to manage subscriptions and recover lost payments | Small businesses with high processing volume | $15.00 | 0% + 30¢ (Starter) |