Inside this Article

What We Look For in the Best Credit Card Processing Companies for Nonprofits1. PAYARC: Discounted Rates & Impressive Features for Nonprofits2. Leaders Merchant Services: Funding and Low-Cost Processing for Charities3. ProMerchant: Low-Cost Credit Card Processing for Higher-Risk Nonprofits4. Flagship Merchant Services: Quick and Easy Processing5. CreditCardProcessing.com: Optimize Recurring Donations6. Stax: Best For Established, High-Volume NonprofitsOther Notable Credit Card Processors for NonProfitsThe Best Credit Card Processing for Nonprofits Can Maximize DonationsFAQ

Short on Time? These Are the Best Credit Card Processors for Nonprofits in 2025

- PAYARC – All-in-one payment platform offering nonprofits discounts and robust fundraising tools.

- Leaders Merchant Services – Industry-low rates, free equipment, and cash advances to support your nonprofit.

- ProMerchant – Affordable processing for charities, including those considered high risk.

What We Look For in the Best Credit Card Processing Companies for Nonprofits

Nonprofits have specific needs from payment processors. I focused on the following features when researching different services for this article:- Discounted or budget-friendly rates. When most of your funding comes from donations, you can’t afford to lose a significant chunk of your income to your payment processor. Every vendor on this list has highly competitive rates or offers nonprofits a discounted rates.

- E-commerce software. Whether it’s built-in or integrated, every credit card processor on this list has e-commerce software that makes it simple to take donations online.

- Fundraising tools. The processors on this list offer plenty of tools to boost donations, including integration with digital marketing tools, Customer Relationship Management (CRM) software and email marketing services. This will enable you to create a powerful donation pipeline with only a few clicks.

- Free Point of Sale (POS) hardware. Whether you already take in-person donations or you want to start doing so, a free terminal helps to reduce your costs while making it easy for donors to contribute. These processors offer POS systems, mobile POS devices, and apps you can use with a tablet or smartphone so you can accept donations on site and at events/fundraisers.

- Zero-fee processing. Surcharging allows you to pass the per-transaction costs of credit card processing onto your donors, which can significantly reduce your payment processing bill.

A Note on Nonprofit Merchant Accounts

While many payment processors will classify your nonprofit as high-risk and charge you higher-than-average fees, some processors actually offer discounted fees for nonprofits. If you are offered a discounted rate, make sure you get this confirmed in writing and check your contract carefully for any hidden fees.

You also need to ensure that your merchant account is set up with the right merchant category code. This is because some credit card providers charge lower interchange rates to charitable organizations, helping to reduce your overall processing costs.

Our Score

Our Score

Custom Payment Processing Plans With No Hidden Costs

Monthly Fee:

From $69

Transaction Fee:

From 0% + 15¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- 24/7 risk monitoring. PAYARC has a team of fraud prevention experts who will continually monitor your account to help you reduce the risk of fraud and chargebacks. It will even design a personalized fraud mitigation plan for your nonprofit free of charge.

- Useful integrations. PAYARC integrates with popular software, including e-commerce platforms like WooCommerce, Magento, and Chargezoom. If you accept international donations, you can also integrate one of several secure global payment gateways (Planet Payment, Speedy, RS2, TSYS) and accept donations in over 150 currencies.

- Fundraising/donor management. Your PAYARC dashboard gives you access to in-depth data for donations and sales, securely stores donor information, and pulls reports to gain insights into your fundraising performance. This can help you increase donations and further your mission.

- Full-featured mobile app. In addition to its impressive POS and e-commerce tools, PAYARC offers a free mobile app that allows you to manage all aspects of your nonprofit remotely. You can manually key in donations, email or text receipts, and access your dashboard.

| Pricing model | Subscription-style, flat rate, and zero cost cash discount |

| Free hardware | ✔ (PAX A920 and Z1 mobile card reader free with some plans) |

| Software integrations | 10+ including, QuickBooks, WooCommerce, Magento, Chargezoom, and more |

| Transaction fees on cheapest plan | 2.49% + 30¢ (in-person) |

| Monthly fee on cheapest plan | N/A |

2. Leaders Merchant Services: Funding and Low-Cost Processing for Charities

Free Card Reader

Our Score

Our Score

Negotiable Low Credit Card Processing Rates

Monthly Fee:

$9

Transaction Fee:

From 0.15% + $0

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- High approval rate. LMS boasts a 98% approval rate, and in many cases offers same-day approvals. If you’ve struggled to open a merchant account for your nonprofit in the past, there’s a good chance you’ll be accepted by LMS.

- Free hardware. LMS will provide a free Clover or SwipeSimple terminal (POS or mPOS) or free mobile card reader. This hardware comes with useful tools such as Clover Connect’s nonprofit payment solutions and its donor-facing Clover Donate interface to help you optimize donations.

- Authorize.net integration. This popular payment gateway and virtual terminal allows you to accept payments online and over the phone. It also comes with advanced fraud protection measures and its own customer support channels. You will need to pay an additional monthly fee to use this software suite, however.

- Recurring payments. LMS offers subscription tools that will let you set up and manage recurring payments. This ability may come at an additional monthly fee, but it’s a great feature for securing ongoing donations.

| Pricing model | Interchange-plus, tiered pricing |

| Free hardware | ✔ (Clover hardware free depending on processing volume) |

| Software integrations | Authorize.net, QuickBooks, CartManager, Clover and SwipeSimple apps |

| Transaction fees on cheapest plan | ~0.15% + $0 |

| Monthly fee on cheapest plan | $9.00 |

Unsure which processor is best for your business?

Take this short quiz and get a tailor-made recommendation in seconds

3. ProMerchant: Low-Cost Credit Card Processing for Higher-Risk Nonprofits

Our Score

Our Score

Interchange-Plus & Zero Cost Processing Plans Ideal for Restaurants and Retail

Monthly Fee:

$7.95

Transaction Fee:

From 3% + 10¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- Fundraising add-ons. Several integrations, such as DonorBox, Fundly, Qgiv, and Classy, offer additional features for fundraising. These include donor forms, social media fundraising, crowdfunding, and event management.

- Inventory management. If your nonprofit sells merchandise to support its goals, you can add third-party integrations like Orderbot, TradeGecko, Cin7, and inFlow Inventory to manage your inventory and ensure popular items are never out of stock.

- Payanywhere App. Charitable organizations can use the app and free mobile card reader to accept EMV chip and swiped card donations, digital wallets (Apple Pay, Google Pay, Samsung Pay) at events, fundraisers, and in the field. You can also email/text receipts, set up recurring donations, and view real time reports.

- Next-day funding. Nonprofits on tight budgets will appreciate ProMerchant’s fast payout for processed donations – next day as standard for all accounts. Many processors charge extra for this feature, but ProMerchant offers it for free.

| Pricing model | Interchange-plus, zero-cost processing |

| Free hardware | ✔ (Verifone, PayAnywhere, PAX, or Ingenico terminal) |

| Software integrations | QuickBooks, Authorize.net (additional software integrations), Clover app market, ProMerchant API (shopping cart integration) |

| Transaction fees on cheapest plan | 3% + 10¢ (credit) |

| Monthly fee on cheapest plan | $7.95 |

Our Score

Our Score

Fast Onboarding & Quick Payouts With Same-Day Funding

Monthly Fee:

From $15

Transaction Fee:

From 1.58% + 19¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- “Free” terminal. Once you sign up with Flagship, you’ll be eligible to receive a free Clover Mini or Verifone terminal. You’ll have to pay a small monthly fee for terminal insurance and maintenance, plus an extra monthly fee for Clover’s software – but not many other payment processors offer this sophisticated hardware for free.

- iAccess 3.0 business portal. This business management portal is included with your monthly fee and provides you with sales summaries, expense reports, and account activity. It can also analyze customer reviews and industry statistics to show you where your nonprofit needs to focus its marketing efforts.

- Recurring payments. You can set up subscriptions and recurring donations through Flagship’s virtual terminal. You will have to pay an additional monthly fee to use the terminal, but it’s well worth it if you regularly handle recurring donations.

- Meet or Beat Guarantee. If Flagship can’t save you money on your current processing costs (or match it), it’ll give you a $200 AMEX gift card. Even if you think you’ve got a good deal with your current processor, it’s worth getting a quote from Flagship to see if they can match or beat your existing rates.

| Pricing model | Interchange-plus |

| Free hardware | ✔ (with small monthly insurance and maintenance fee) |

| Software integrations | Authorize.net, iAccess, MobilePay, Pirq |

| Transaction fees on cheapest plan | 1.58% + 19¢ (in person) |

| Monthly fee on cheapest plan | $7.95 |

5. CreditCardProcessing.com: Optimize Recurring Donations

Our Score

Our Score

Competitive Credit Card Processing Fees for High-Volume Businesses

Monthly Fee:

From $15

Transaction Fee:

From 0% + 0.05¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- High approval rate. CreditCardProcessing.com often overlooks low credit scores and doesn’t charge higher fees to high-risk merchants, which is good news for nonprofits.

- Free terminal. Depending on the plan you select, you will receive either a free Pax or Clover Mini terminal. Acquiring one of these devices for free is a valuable bonus, especially if you accept in-person donations, as neither device comes at a low upfront cost.

- 24/7 multi-channel support. CreditCardProcessing.com offers 24/7 support via email or phone, so you’re covered if something goes wrong outside of working hours.

- Data breach insurance. If CreditCardProcessing.com suffers a data breach and you suffer any financial losses as a result, you’re covered for up to $100,000 worth of damages.

| Pricing model | Subscription-style |

| Free hardware | ✔ (depending on your plan) |

| Software integrations | Vindicia, iAccess, Authorize.net |

| Transaction fees on cheapest plan | 0% + 30¢ (Starter) |

| Monthly subscription on cheapest plan | $15.00 |

Our Score

Our Score

Save Up to 40% on Credit Card Processing Fees

Monthly Fee:

From $99

Transaction Fee:

From 8¢ + Interchange

Pricing Model:

Subscription

Subscription

With subscription-style pricing, you’ll pay a fixed monthly fee instead of a percentage-based markup on each credit and debit card transaction. While this will considerably reduce your per-transaction fees, you’ll typically still pay a small flat fee on each transaction. This amount is unaffected by the variable interchange fees charged by the different card networks (e.g. Visa, Mastercard), helping to keep your payment processing fees more predictable.

Features and Benefits

- Reporting and analytics software. Keep an eye on your nonprofit’s financial health thanks to Stax’s fantastic reporting and analytics software. You’ll be able to track your sales over time, manage your staff (or volunteers), track donation habits by donor, and more.

- Thousands of software integrations. While Stax only has a few integrations built in, you can connect to thousands of applications through its integration with Zapier. This makes it easy to connect Stax to your workflow and create seamless online donation pipelines.

- Fraud protection. In addition to helping your nonprofit become PCI compliant, Stax will put risk holds on customer accounts that need additional verification.

- Credit card surcharging. For an extra fee, you can pass on the per-transaction cost of processing donations to your donors. While you’ll still have to pay the monthly fee, this can help to significantly lower your processing costs.

| Pricing model | Subscription-style |

| Free hardware | ✔ |

| Software integrations | 15+, including Zapier, Facebook Ads, Mailchimp, QuickBooks, and more |

| Transaction fees on cheapest plan | 8¢ + interchange (in-person) |

| Monthly fee on cheapest plan | $99.00 |

Other Notable Credit Card Processors for NonProfits

7. Square

Our Score

Our Score

Advanced E-Commerce and Security Solutions for Start-Ups

Monthly Fee:

From $0

Transaction Fee:

From 2.5% + 10¢

Pricing Model:

Flat rate

Flat rate

Flat rate pricing simplifies your payment processing bill by charging the same percentage markup on every credit or debit card transaction you receive. The payment processor still pays the variable interchange fee set by the card network (e.g. Visa, Mastercard) on each transaction, but you always pay the same fixed rate regardless.

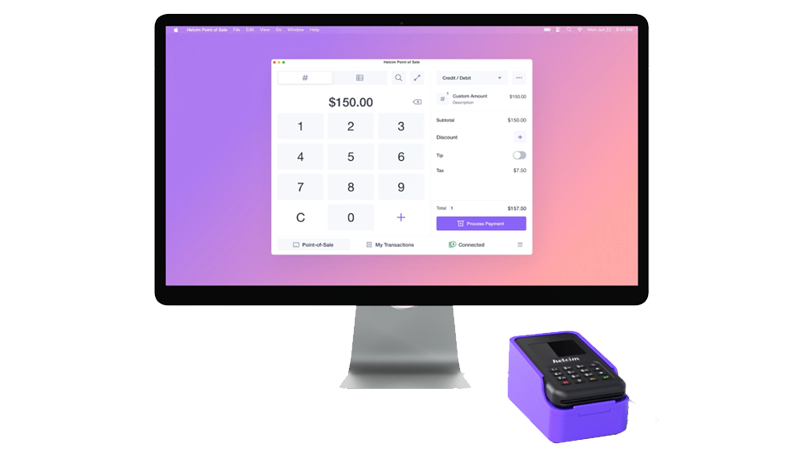

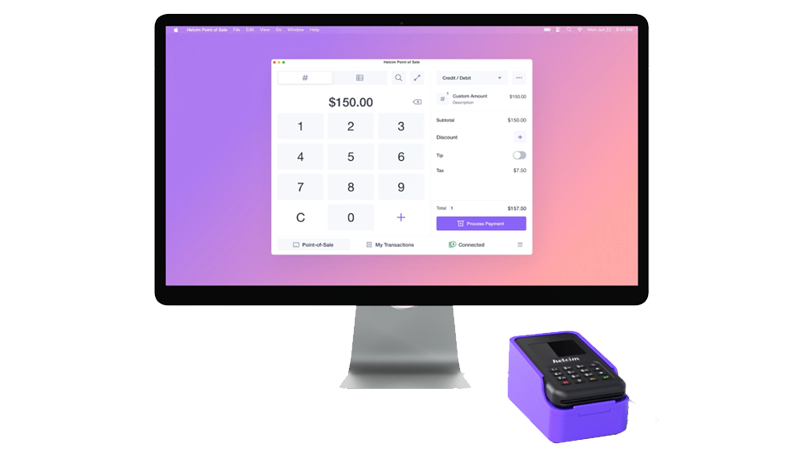

8. Helcim

Our Score

Our Score

Budget-Friendly Credit Card Processing Ideal for New or Low-Volume Businesses

Monthly Fee:

None

Transaction Fee:

From 0.30% + 8¢

Pricing Model:

Interchange plus

Interchange plus

Interchange-plus pricing involves two fees for each credit or debit card transaction. The first is the interchange fee, a variable amount set by the card network (e.g. Visa, Mastercard). The second is a markup fee charged by the payment processor, typically a percentage of the transaction amount plus a small flat transaction fee. This allows you to see exactly how much of what you pay goes to the card networks and how much to the payment processor.

9. POS Pros

Our Score

Our Score

Specialized Point-of-Sale Solutions for In-Person and Online Sales

Monthly Fee:

From $5

Transaction Fee:

From 0.30% + 10¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

10. Chase Payment Solutions

Our Score

Our Score

Favorable Flat Rate Pricing & E-Commerce Features for SMEs

Monthly Fee:

$0

Transaction Fee:

From 2.6% + 10¢

Pricing Model:

Flat rate

Flat rate

Flat rate pricing simplifies your payment processing bill by charging the same percentage markup on every credit or debit card transaction you receive. The payment processor still pays the variable interchange fee set by the card network (e.g. Visa, Mastercard) on each transaction, but you always pay the same fixed rate regardless.

The Best Credit Card Processing for Nonprofits Can Maximize Donations

Because you’ll always have to pay a fee on each incoming donation (unless you’re using surcharging), it makes sense to find the cheapest credit card processing service for your nonprofit. However, you’ll want to be sure your processors also includes powerful business software in its standard payment packages – or cheaper won’t be better. If your nonprofit goal is to both save on processing fees and get business management software, then I recommend PAYARC. You’ll get technology-driven e-commerce solutions, analytics tools, fundraising/donor management features, and discounted or at-cost rates. On the other hand, smaller nonprofits may benefit from Leaders Merchant Services’ industry-low rates and flexible funding options. LMS also helps nonprofits looking to switch processors make the most of their incoming donations. However, if your nonprofit is considered high risk, I’d suggest you take a look at ProMerchant. You’ll get free hardware for in-person donations, plenty of great e-commerce features, and fair pricing.If you’re still struggling to decide, here’s a quick comparison of our top merchant services for nonprofits.

| Best Feature | Best For | Monthly fee on cheapest plan | Transaction fees on cheapest plan | ||

|---|---|---|---|---|---|

| PAYARC | Discounted rates and impressive features that help nonprofits prosper | Nonprofits looking for lower rates and the latest fundraising technology | N/A | 2.49% + 30¢ (in-person) | |

| Leaders Merchant Services | Merchant cash advances for flexible funding | Budget-conscious nonprofits that need the safety net of advance funding | $9.00 | ~0.15% + $0 | |

| ProMerchant | Affordable and transparent processing for nonprofits considered higher risk | Nonprofits considered riskier by other processors | $7.95 | 3% + 10¢ (credit) | |

| Flagship Merchant Services | Quick application and onboarding process | New nonprofits that need to start taking donations quickly | $7.95 | 1.58% + 19¢ (in person) | |

| CreditCardProcessing.com | Recurring donation management and optimization | Nonprofits that rely on regular donations for a steady cash flow | $15.00 | 0% + 30¢ (Starter) | |

| Stax | All-in-one payment platform offering powerful business software | Modern nonprofits that process most of their donations online | $99.00 | 8¢ + interchange (in-person) |