Inside this Article

What We Look For in the Best Credit Card Processing for Large Transactions1. Paysafe: Best for Processing Large Transactions Globally2. Stax: Best for Processing a High Volume of Transactions3. Leaders Merchant Services: Best for High-Risk Businesses With Large Transactions4. Payment Depot: Best for Businesses With High and Low Seasons5. Helcim: Best for Processing Large Card-Not-Present Transactions6. POS Pros: Best for Brick-And-Mortar Stores That Process Large TransactionsSelect the Best Credit Card Processing Payment Processor for Large TransactionsFAQ

Short on Time? These Are the Best Credit Card Processors for Large Transactions in 2025

- Paysafe – Low fees, 250+ payment methods, and support for international sales.

- Stax – A subscription-based pricing model with low, flat transaction fees.

- Leaders Merchant Services – Plans customized to your needs, focusing on low interchange-plus fees.

What We Look For in the Best Credit Card Processing for Large Transactions

Assessing credit card processors for businesses handling large-volume or high-ticket transactions, I prioritized these features:- In-person and online support. Whether your business is physical, online, or a blend, the recommended processors provide robust support for all sales channels. I also considered processors with advanced tools for managing subscriptions.

- Low transaction fees. With high-volume transactions, even slightly lower fees can significantly reduce costs. All processors listed offer competitive rates.

- Advanced security. Processing high volumes of transactions and large payments increases vulnerability to cybersecurity attacks and fraud. I selected processors using cutting-edge security measures.

- Chargeback/fraud management. I identified processors that efficiently handle chargebacks and fraud. Some have entire teams dedicated to reducing the losses and hassle associated with chargebacks.

- Extensive API. I featured processors that offer an extensive Application Programming Interface (API). This allows for the seamless integration of your processor/payment gateway and online storefronts as well as advanced customization options to enhance functionality and branding.

Our Score

Our Score

Top Global Payment Processor With Industry-Specific Merchant Accounts

Monthly Fee:

$7.95

Transaction Fee:

From 0.50% + $0.10

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- 250+ payment methods. With over 250 payment options, including digital wallets, local card schemes, and even cryptocurrency, Paysafe ensures you can cater to both domestic and international clients.

- Low fees for online transactions. Although card-not-present transactions are often associated with higher processing fees, Paysafe charges below-average fees for online payments. Its online transaction fees start at 0.99% + 25¢ (debit cards) and monthly fees at around $16.00.

- Extensive API. You can customize and personalize your payment gateway using Paysafe’s API, which supports white labeling. Using its API, you can integrate mobile wallets, shopping carts, and hosted payment pages, among other capabilities.

- Solutions for high-risk industries. Paysafe offers personalized, highly secure solutions for high-risk industries – including igaming, video games, forex, and crypto. These businesses often struggle to access merchant services, but Paysafe offers robust support at fair prices.

| Accepted payment methods |

Credit and debit, ACH, EFT, digital wallets, bank transfers, Skrill, and Venmo among 250+ options |

| Security features | Level 1 PCI-compliant, end-to-end encryption, tokenization, GDPR compliance, and more |

| Customer support | 24/7 technical support line for customers – other phone and email support available Monday to Friday |

| Transaction fees on cheapest plan |

0.50% + $0.10 |

| Monthly fee on cheapest plan |

$7.95 |

Our Score

Our Score

Save Up to 40% on Credit Card Processing Fees

Monthly Fee:

From $99

Transaction Fee:

From 8¢ + Interchange

Pricing Model:

Subscription

Subscription

With subscription-style pricing, you’ll pay a fixed monthly fee instead of a percentage-based markup on each credit and debit card transaction. While this will considerably reduce your per-transaction fees, you’ll typically still pay a small flat fee on each transaction. This amount is unaffected by the variable interchange fees charged by the different card networks (e.g. Visa, Mastercard), helping to keep your payment processing fees more predictable.

Features and Benefits

- Brand customization tools. Stax provides tools to tailor every aspect of your transactional interfaces – from invoices and receipts to website payments – enhancing brand consistency and customer trust.

- Comprehensive reporting. Stax’s comprehensive reporting tools can help you gain valuable insights. You can access daily reports, in-depth analysis, and multi-location overviews to optimize your financial strategies and make better business decisions.

- More ways to sell. You can expand your payment options with Stax using convenient methods like payment links, buy-now buttons, QR codes, and Text2Pay mobile payments.

- SaaS payment solution. Stax Connect is a payment solution for SaaS (Software as a Service) companies and ISVs (Independent Software Vendors). It lets you create a branded payment experience and manage user onboarding, underwriting, and payment transactions without the complexities of becoming a direct payment facilitator yourself.

| Accepted payment methods |

Credit and debit cards, digital wallets, ACH, bank transfers |

| Security features | Level 1 PCI-compliant, multi-factor authentication, tokenization, end-to-end encryption, payer verification, advanced fraud detection and prevention |

| Customer support | Live chat, email, ticket, and phone support |

| Transaction fees on cheapest plan |

8¢ + interchange (in-person) |

| Monthly fee on cheapest plan |

$99.00 |

Unsure which processor is best for your business?

Take this short quiz and get a tailor-made recommendation in seconds

Our Score

Our Score

Negotiable Low Credit Card Processing Rates

Monthly Fee:

$9

Transaction Fee:

From 0.15% + $0

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- Pre-built shopping cart. LMS integrates seamlessly with the CartManager shopping cart. This pre-built solution allows you to customize the order form and checkout pages with your logo, desired colors, background images, buttons, text, and fonts.

- Payment links and buttons. Customizable payment links and buttons simplify how you accept payments and give customers a direct and secure way to complete purchases.

- Free equipment. If you commit to a long-term contract, you can benefit from free high-quality POS equipment, which can be a significant cost saver for your business.

- 24/7 merchant support. LMS provides 24/7 support to keep your payment systems operational, minimize downtime, and boost customer satisfaction.

| Accepted payment methods |

Credit and debit cards, digital wallets, ACH, bank transfers |

| Security features | PCI-compliant, end-to-end encryption, tokenization, advanced fraud detection and prevention |

| Customer support | 24/7 phone support |

| Transaction fees on cheapest plan |

~0.15% + $0 |

| Monthly fee on cheapest plan |

$9.00 |

Our Score

Our Score

Excellent Customer Service Backed by a Dedicated Risk Monitoring Team

Monthly Fee:

From $79

Transaction Fee:

From 0% + 10¢

Pricing Model:

Subscription

Subscription

With subscription-style pricing, you’ll pay a fixed monthly fee instead of a percentage-based markup on each credit and debit card transaction. While this will considerably reduce your per-transaction fees, you’ll typically still pay a small flat fee on each transaction. This amount is unaffected by the variable interchange fees charged by the different card networks (e.g. Visa, Mastercard), helping to keep your payment processing fees more predictable.

Features and Benefits

- 24/7 risk monitoring team. Payment Depot’s 24/7 risk monitoring team ensures maximum security by monitoring transactions constantly. It also provides data breach protection and strong chargeback management support.

- Shopping cart integrations. You can choose between popular solutions like 3DCart, ZenCart, and OpenCart or build your own using Payment Depot’s API.

- E-commerce integrations. Payment Depot offers direct integrations with major e-commerce platforms like BigCommerce, PrestaShop, Magento, and WooCommerce, streamlining online transactions for businesses with high volumes.

- Accounting tools. Payment Depot also integrates with well-known accounting software like QuickBooks and Sage, simplifying financial management.

| Accepted payment methods |

Credit and debit cards, digital wallets, ACH, bank transfers |

| Security features | Level 1 PCI-compliant, payer authentication, tokenization, end-to-end encryption, 24/7 fraud risk monitoring |

| Customer support | 24/7 technical support line (phone and ticket), sales support 8:30 am – 7:30 pm EST/PST |

| Transaction fees on cheapest plan |

0.2%-1.95% |

| Monthly fee on cheapest plan |

$0 |

Our Score

Our Score

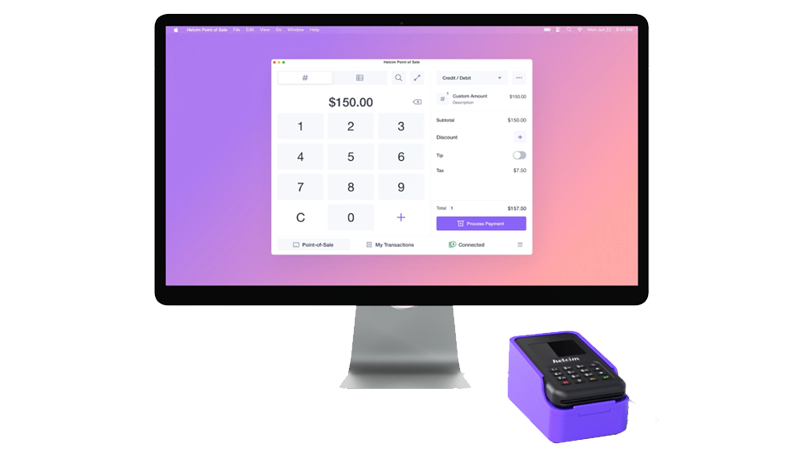

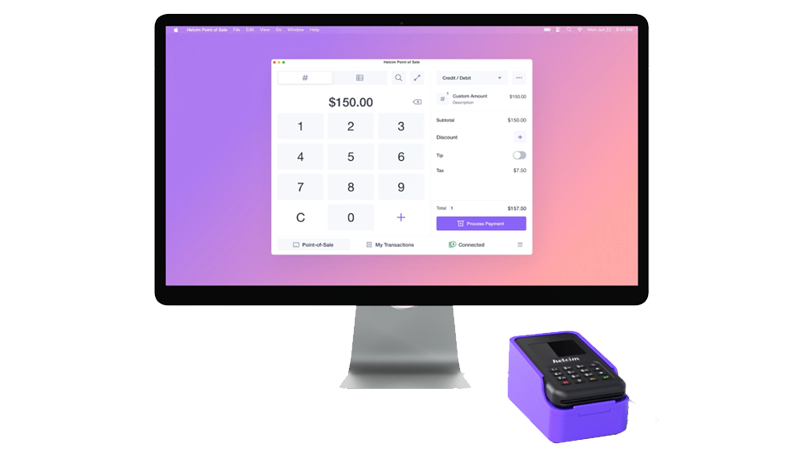

Budget-Friendly Credit Card Processing Ideal for New or Low-Volume Businesses

Monthly Fee:

None

Transaction Fee:

From 0.30% + 8¢

Pricing Model:

Interchange plus

Interchange plus

Interchange-plus pricing involves two fees for each credit or debit card transaction. The first is the interchange fee, a variable amount set by the card network (e.g. Visa, Mastercard). The second is a markup fee charged by the payment processor, typically a percentage of the transaction amount plus a small flat transaction fee. This allows you to see exactly how much of what you pay goes to the card networks and how much to the payment processor.

Features and Benefits

- Business tools. Helcim’s Customer Manager makes it easy to track customer information. Additionally, the Product & Inventory Manager automatically syncs inventory data across all sales channels, sends you alerts when stock is low, and prepares insightful reports.

- Free online store. Every Helcim customer gets a fully hosted online store. You can set it up in minutes – no technical knowledge is needed.

- Subscription manager. Helcim’s subscription-management tools make recurring billing easy. You can create custom subscription plans and automatically collect payments via credit card and ACH.

- International payments. With Helcim, you can easily process international payments, expanding your business reach. Your customers will be charged in your local currency based on the exchange rate on the purchase day. You will also receive the money in your currency without conversions.

| Accepted payment methods |

Credit and debit cards, digital wallets, ACH, bank transfers |

| Security features | Level 1 PCI-compliant, NIST-compliant, advanced fraud detection and prevention |

| Customer support | Phone, email, and ticket support available 7 days a week |

| Transaction fees on cheapest plan |

0.30% + 8¢ (in-person) |

| Monthly fee on cheapest plan |

N/A |

6. POS Pros: Best for Brick-And-Mortar Stores That Process Large Transactions

Our Score

Our Score

Specialized Point-of-Sale Solutions for In-Person and Online Sales

Monthly Fee:

From $5

Transaction Fee:

From 0.30% + 10¢

Pricing Model:

Multiple options

Multiple options

This payment processor allows you to choose from two or more different pricing models for paying credit card processing fees. Each model will come with its own advantages and disadvantages, so make sure to consider your options carefully before deciding which is right for your business.

Features and Benefits

- Consultation with a specialist. POS Pros offers personalized consultations to help you select the right equipment for handling large transactions in your industry.

- Free hardware. POS Pros offers free credit card readers and system demos, helping you reduce upfront costs.

- Industry-specific reporting and analytics. Depending on the POS software chosen, POS Pros provides tailored reporting and analytics with insights from your industry that support your decision-making process and growth.

- Strong anti-fraud features. POS Pros employs enhanced security measures against fraud, making it a reliable choice for processing large transactions.

| Accepted payment methods |

Credit and debit cards, digital wallets, ACH, bank transfers |

| Security features | Level 1 PCI compliant, fraud prevention, chargeback management, and tokenization |

| Customer support | 24/7 support and POS technical help desk for customers, phone and email sales support (Monday to Friday 6:00 AM – 9:00 PM (CT)) |

| Transaction fees on cheapest plan |

0.30% + 10¢ (in-person) |

| Monthly fee on cheapest plan |

$5.00 |

Select the Best Credit Card Processing Payment Processor for Large Transactions

Choosing the right payment processor is critical if your business deals with high volumes or large-ticket transactions. You need a processor that charges low transaction fees and prioritizes security, among other benefits. Paysafe specializes in high-ticket processing with relatively low transaction fees, enhanced security measures, and 250+ payment methods. It offers solutions for different business models, including subscription-based businesses. It also supports international processing, making it easy and cheap to serve global customers. Stax is ideal for high-volume businesses that prioritize transparent pricing. Its subscription-based pricing model removes unpredictability and can yield significant savings. With its wide range of e-commerce tools and rich API, Stax is also ideal for customizing payment processes. Leaders Merchant Services lets you negotiate your fees and customize your plan if you need flexibility. In addition to its excellent customer service and 24/7 risk management team, it provides tailored setups for complex, high-volume processing needs.Here’s a quick comparison of my top choices for payment processors handling large transactions.

| Best Feature | Best For | Monthly fee on cheapest plan |

Transaction fees on cheapest plan |

||

| Paysafe | Low fees and international processing |

Businesses processing large transactions globally or on a recurring basis |

$7.95 | 0.50% + $0.10 | |

| Stax | Cheap subscription pricing and a range of e-commerce features |

Established high-volume businesses processing over $8,000/month |

$99.00 | 8¢ + interchange (in-person) | |

| Leaders Merchant Services |

Low, negotiable fees and custom plans |

New/high-risk businesses processing large transactions |

$9.00 | ~0.15% + $0 | |

| Payment Depot |

Versatile pricing models, reliable support, and monthly contracts |

Businesses with high and low seasons |

$0 | 0.2%-1.95% | |

| Helcim | Free online store and volume discounts |

Businesses processing a high-volume of card-not-present transactions |

N/A | 0.30% + 8¢ (in-person) | |

| POS Pros | Industry-specific POS selection featuring 25+ brands |

High-volume/ high-ticket brick-and-mortar businesses |

$5.00 | 0.30% + 10¢ (in-person) |